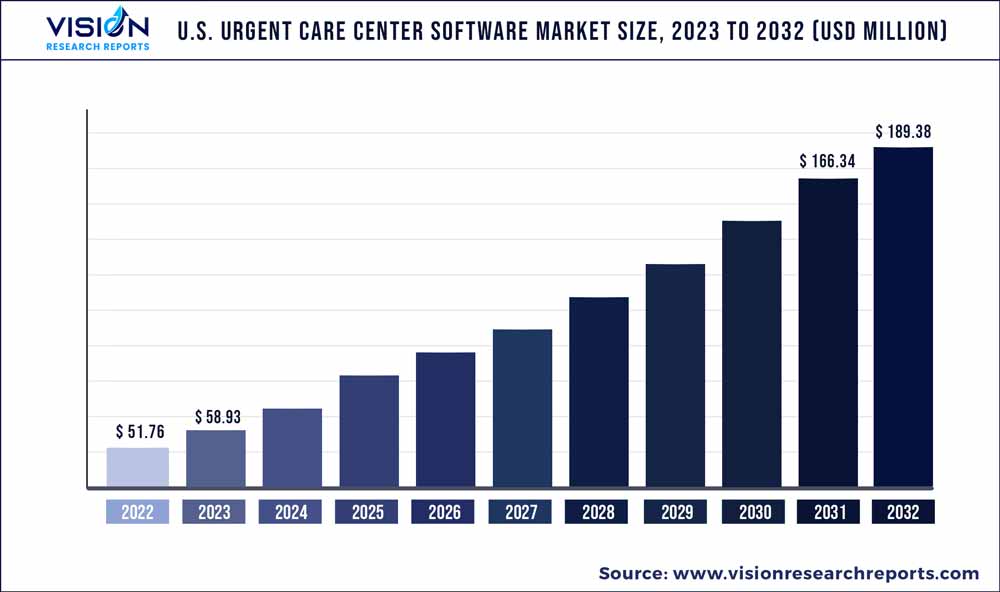

The U.S. urgent care center software market size was estimated at around USD 51.76 million in 2022 and it is projected to hit around USD 189.38 million by 2032, growing at a CAGR of 13.85% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Urgent Care Center Software Market

| Report Coverage | Details |

| Market Size in 2022 | USD 51.76 million |

| Revenue Forecast by 2032 | USD 189.38 million |

| Growth rate from 2023 to 2032 | CAGR of 13.85% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Experity, Inc.; NXGN Management, LLC; Veradigm LLC; DrChrono Inc.; CareCloud, Inc.; AdvancedMD, Inc.; eClinicalWorks; MicroFour, Inc.; PrognoCIS EHR (Bizmatics, Inc.); Medsphere Systems Corp.; AthenaHealth; 1st Provider's Choice |

The growth can be attributed to the rising number of urgent care centers and increased visits to the centers. The volume of patient visits to urgent care centers in the U.S. is constantly rising, which has created a lot of strain on the clinics. According to the Experity Urgent Care Quarterly report of 2021, the urgent care clinics have reported an average of around 45 patients per dayin 2021, a 12.5% increase from 2020 visits and around 32% rise since 2016. Urgent care centers provide convenient and immediate medical care for non-life-threatening conditions.

With the growing need for prompt healthcare services, there is rising demand for software that can streamline operations, enhance patient experience, and improve overall efficiency in these centers. Hence, many organizations are implementing these solutions to streamline the workflow. For instance, in December 2021, Next Level Urgent Care, a Texas-based organization, deployed Allscripts Professional EHR Software solution to streamline operations at 20 different locations in Houston. In addition, FolloMyHealth, a patient engagement solution, was deployed to improve the population's health.Since urgent care centers receive large patient volumes quickly, there is always a huge demand to simplify workflow and manage the billing process.

Efficiently managing patient volumes is often a challenge for many centers; hence, these centers are shifting toward integrated software. For instance, STAT-MD Urgent Care and Family Medicine Practice in Utah deployed athenaOne software, improving patient pay by around 98% and decreasing accounts receivable time to around 24.6 days.Moreover, urgent care centers' regulations and compliance standards are constantly evolving, and these centers need to adhere to these regulations. Software solutions comprising these features per the compliance features including HIPAA compliance, are expected to drive the market's growth over the forecast period. For instance, American Medical Compliance offers Urgent Care Compliance Solutions with dynamic HR and LMS platforms to maintain compliance with federal and state-mandated regulations, such as HIPAA & OSHA policies.

The COVID-19 pandemic slightly impacted the market growth as the maximum patient penetration was related to COVID-19 testing and related services. Hence, the new adoption of software was very low. Moreover, very few new urgent care centers were launched during the period, whichdecreased the adoption of software during the pandemic. This affected the market growth. However, post-pandemic, urgent care center software became imperative due to the growing demand for these centers in the U.S. Implementing these solutions decreased the staff's burden, speeding up the diagnostic process and reducing the errors that cost huge amounts of money to these centers.

Mode Of Deployment Insights

Based on the mode of deployment, the market is divided into cloud-based and on-premise. The cloud-based segment held the largest market share of 66% in 2022. Cloud-based technology enables to host platforms or services from a remote location that can be accessed over the internet. The adoption of cloud-based software is constantly rising owing to its cost-effectiveness, ease of use, and scalability. The old-generation on-premise systems incur a high cost of managing servers and operating system updates; hence, many organizations are shifting to cloud-based technologies.

Furthermore, with the increasing demand for IT infrastructure and rapidly changing business demands, exchanging data with customers and stakeholders has become a priority requirement. This has led to increased uptake of this technology. The on-premise segment is expected to grow at a significant CAGR over the forecast period due to the benefits, including internal policies and protocols. Furthermore, compliance with data privacy has contributed to the high demand for on-premise software.

Application Insights

Based on the application, the market is segmented into EHR/EMR, practice management, revenue cycle management, patient engagement, and telehealth. The EHR/EMR segment dominated the market with the largest share of 38% in 2022 and is expected to witness the fastest growth over the forecast period. The rising adoption of EHR solutions by urgent care providers is driving the growth of the market. For instance, in March 2022, MedWise Urgent Care expanded its partnership with Athenahealth for its medical coding solution and athenaOne, a cloud-based EHR suite.

The company has used athenaOne since the first center was launched in 2020. The Revenue Cycle Management (RCM) segment is expected to witness the fastest growth over the forecast period owing to the challenges associated with the billing process, including coding problems, reimbursement rules, and regulations. Moreover, payer denials are currently the biggest challenge for urgent care centers in the U.S. and curtail profitability seriously. This puts an excessive strain on the staff to resolve the unpaid and unsettled claims. Hence, these centers are adopting RCM software to cater to the growing demand.

Type Insights

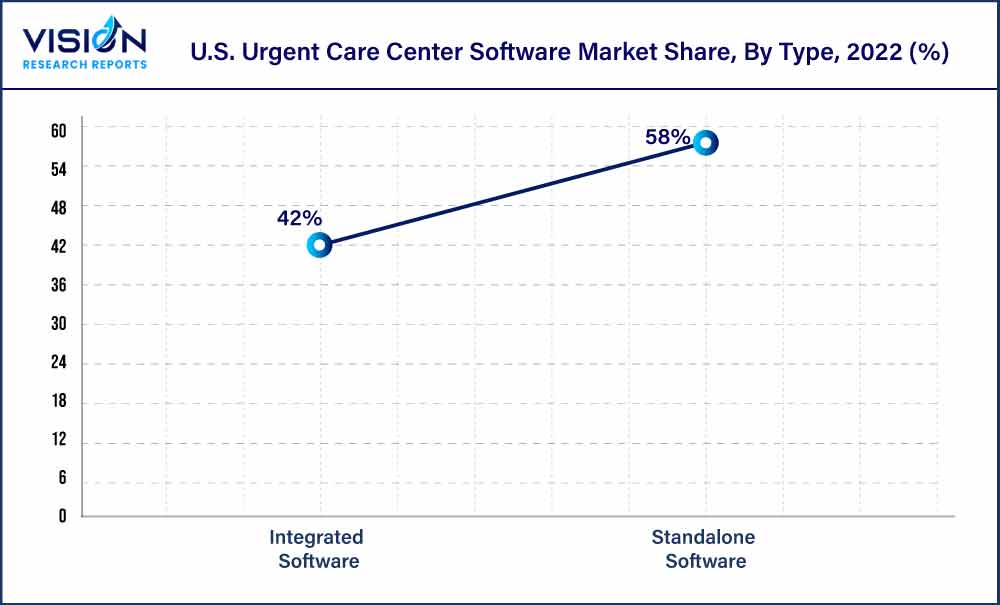

Based on the type, the market is divided into integrated and standalone. The standalone segment dominated the market with the largest share of 58% in 2022. This can be attributed to the lower cost and data privacy compliance associated with this software. This software offers customization functionalities and is suitable for small-scale operations, such as freestanding urgent care centers. Moreover, these solutions have simple operations and are scalable, increasing the adoption of this software.

However, integrated software is expected to witness the fastest growth rate over the forecast period. This can be attributed to the shift of centers toward integrated software owing to better performance, operation, and more monitoring and control. The companies are launching integrated software to cater to the growing market demand. For instance, in July 2022, Experity launched Experity Business Intelligence, an integrated software with practice management and EMR solution, for urgent care centers in the U.S.

U.S. Urgent Care Center Software Market Segmentations:

By Mode Of Deployment

By Application

By Type

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Mode Of Deployment Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Urgent Care Center Software Market

5.1. COVID-19 Landscape: U.S. Urgent Care Center Software Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Urgent Care Center Software Market, By Mode Of Deployment

8.1. U.S. Urgent Care Center Software Market, by Mode Of Deployment, 2023-2032

8.1.1 Cloud-based

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. On-premise

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Urgent Care Center Software Market, By Application

9.1. U.S. Urgent Care Center Software Market, by Application, 2023-2032

9.1.1. Electronic Health Records (EHR)/Electronic Medical Records (EMR)

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Practice Management

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Revenue Cycle Management

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Patient Engagement

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Telehealth

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Urgent Care Center Software Market, By Type

10.1. U.S. Urgent Care Center Software Market, by Type, 2023-2032

10.1.1. Integrated Software

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2 Standalone Software

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Urgent Care Center Software Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Mode Of Deployment (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Type (2020-2032)

Chapter 12. Company Profiles

12.1. Experity, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. NXGN Management, LLC.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Veradigm LLC.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. DrChrono Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. CareCloud, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. AdvancedMD, Inc.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. eClinicalWorks.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. MicroFour, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. PrognoCIS EHR (Bizmatics, Inc.).

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Medsphere Systems Corp.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others