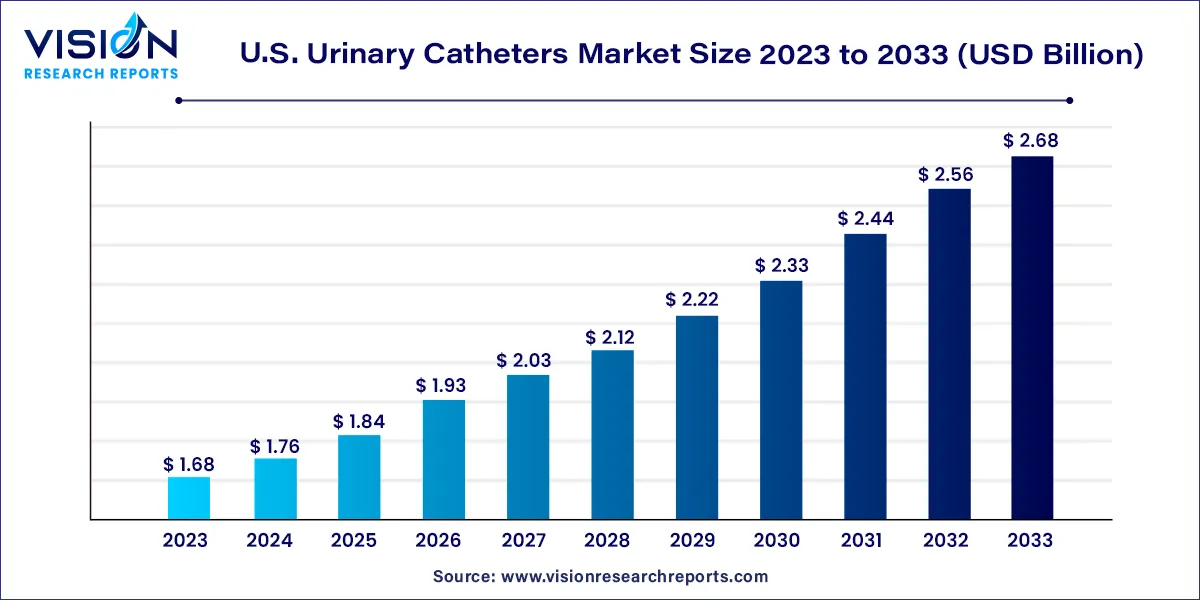

The U.S. urinary catheters market size was estimated at around USD 1.68 billion in 2023 and it is projected to hit around USD 2.68 billion by 2033, growing at a CAGR of 4.79% from 2024 to 2033.

The U.S. urinary catheters market is a critical segment within the medical device industry, catering to the needs of millions of patients suffering from various urological conditions. Urinary catheters play a pivotal role in managing urinary retention, incontinence, and facilitating urine drainage, thereby improving patients' quality of life.

The growth of the U.S. urinary catheters market is propelled by several key factors. Firstly, the increasing prevalence of urological disorders, particularly among the aging population, drives the demand for urinary catheters. Technological advancements, such as the development of catheters with enhanced comfort and reduced infection risk, also contribute significantly to market growth. Moreover, the rising healthcare expenditure in the U.S. enables patients to access advanced medical treatments, including urinary catheterization. Regulatory standards play a crucial role in maintaining product quality and safety, fostering consumer trust and market expansion. Additionally, the growing adoption of urinary catheters across various healthcare settings, including hospitals, clinics, and home care, further stimulates market growth. Overall, a combination of demographic trends, technological innovation, regulatory compliance, and healthcare infrastructure development sustains the upward trajectory of the U.S. urinary catheters market.

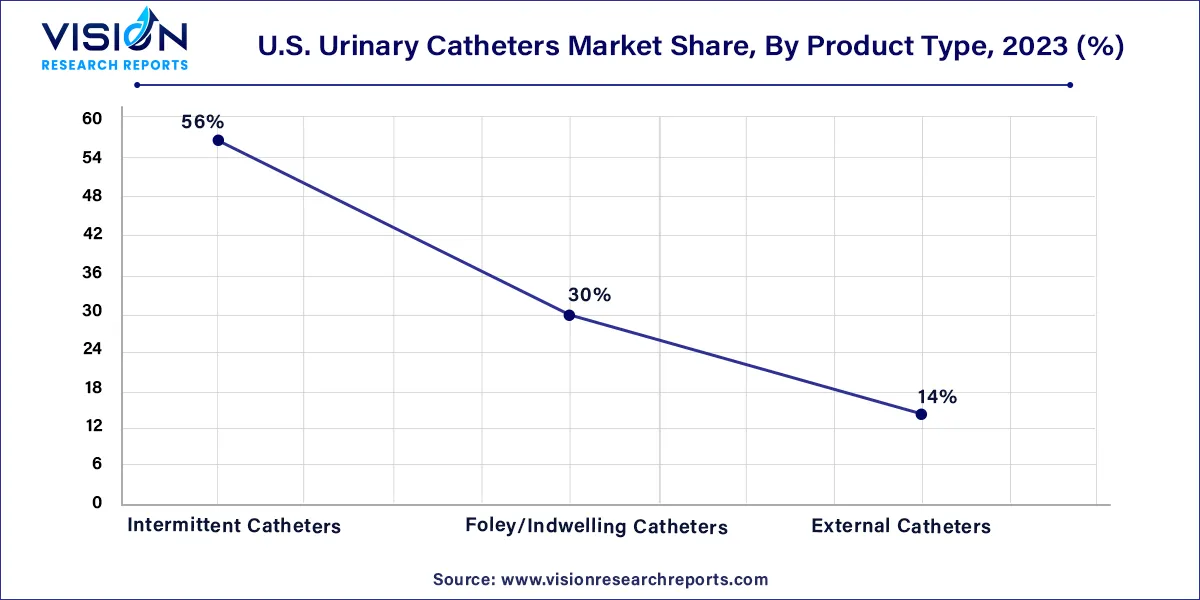

In 2023, intermittent catheters emerged as the dominant segment, commanding over 56% of the market revenue. This trend is attributed to the lesser risk of urinary tract infections associated with intermittent catheterization compared to indwelling catheters, which are less commonly utilized due to their higher susceptibility to causing UTIs. Additionally, the widespread adoption of intermittent catheters is bolstered by their eligibility for reimbursement through Medicaid and Medicare programs, further driving their popularity in the market.

Looking ahead, external catheters are projected to experience the most rapid growth from 2024 to 2033. These catheters, worn externally, pose a reduced risk of urethral damage compared to intermittent catheters, making them increasingly favored. The escalating prevalence of urinary incontinence contributes to the segment's expansion, as external catheters are widely applicable in addressing such conditions. Furthermore, their noninvasive nature distinguishes them from other catheter types, further fueling their growth within the market.

In 2023, urinary incontinence emerged as the primary application for urinary catheters, representing nearly 39% of the total revenue generated. According to the National Association for Continence, approximately 25 million individuals in the U.S. suffer from some form of incontinence, with 75% to 80% of them being female. The prevalence of this condition has increased due to sedentary lifestyles and the aging population, resulting in a growing demand for urinary catheters to assist affected patients.

Benign prostatic hyperplasia (BPH) is another significant application driving the urinary catheters market, expected to experience the fastest growth in the forecast period. BPH, a common condition among older individuals, causes urinary retention primarily in men over the age of 50. Catheterization is utilized to alleviate bladder emptying difficulties associated with BPH. In severe cases, transurethral methods are employed, with approximately 150,000 men in the U.S. undergoing surgeries annually. The rising prevalence of BPH, coupled with the increasing demand for urinary retention treatment and growing awareness of its impact on quality of life, contribute to the expansion of the urinary catheters market.

By Product Type

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Urinary Catheters Market

5.1. COVID-19 Landscape: U.S. Urinary Catheters Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Urinary Catheters Market, By Product Type

8.1. U.S. Urinary Catheters Market, by Product Type, 2024-2033

8.1.1. Intermittent Catheters

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Foley/Indwelling Catheters

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. External Catheters

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Urinary Catheters Market, By Application

9.1. U.S. Urinary Catheters Market, by Application, 2024-2033

9.1.1. Benign Prostate Hyperplasia

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Urinary Incontinence

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Spinal Cord Injury

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Urinary Catheters Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Hollister, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Medtronic PLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Boston Scientific Corp.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. BD (C.R. Bard, Inc.)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Cook Medical

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ConvaTec, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Teleflex, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Coloplast

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. B. Braun Melsungen AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Medline Industries, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others