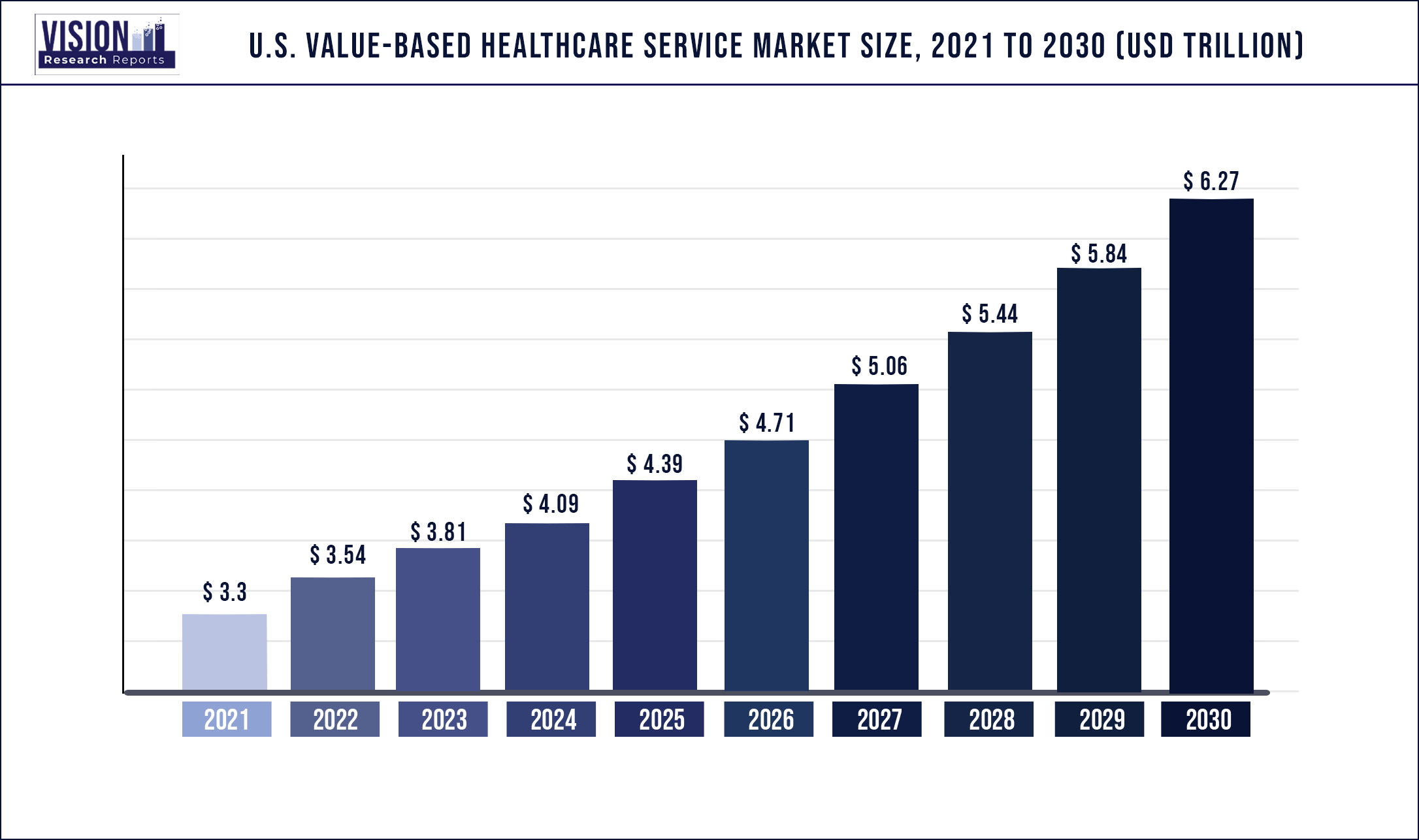

The U.S. value-based healthcare service market was surpassed at USD 3.3 trillion in 2021 and is expected to hit around USD 6.27 trillion by 2030, growing at a CAGR of 7.39% from 2022 to 2030.

Increased adoption of value-based care beyond primary care, increase in healthcare spending as a percentage of GDP, and Continued growth in home and virtual-based models, are the major growth drivers for the industry.

The Centers for Medicare & Medicaid Services' objective is to transition all Medicare providers to two-sided risk arrangements and half of its commercial and Medicaid contracts to value-based models by 2025; currently, fewer than 20% of Medicare expenditure is value-based. The increase of consumerism in health care, the development of new technology, the need to fulfilling the Quadruple Aim, and prioritizing preventative care while decreasing unsustainable health care expenditures are the primary drivers of the shift to value-based care.

Healthcare reform in recent years has highlighted the need for electronic health information, which has raised interest in digital solutions. Furthermore, the COVID-19 pandemic has accelerated business expansion by highlighting the benefits of using electronic health information to help improve patient care and scheduling. Several countries are implementing value-based care systems. This increases the demand for high-acuity IT solutions that boost clinical efficacy and workflow, thus supporting market growth.

The rapid evolution of value-based healthcare services is one of the factors driving this market's rapid growth. Due to value-based healthcare services, the healthcare cost curve and excessive health spending have decreased. According to "UnitedHealth Group," a US-based health insurance firm that delivers value-based payments to healthcare providers, this industry's development increased by more than 15% in 2019. It supports the delivery of high-quality treatment while improving the efficient use of healthcare resources.

Furthermore, "Cigna" acquired Bright Health, in December 2021, bringing additional skills and resources to continue their development toward a value-based healthcare setting. Collaborations in value-based care are becoming increasingly popular among providers because they enable partners such as medical device makers, payers, and provider groups to build programs, solutions, and initiatives that benefit both patients and healthcare systems. For instance, in June 2021, “Humana’’ acquired League, a digital health company to create a new digital platform for Humana employer group and specialty insurance members.

To take advantage of the various types of services and technology capabilities required for future success, forward-thinking payers are broadening their options and moving beyond traditional providers. These firms have employed several techniques to increase their position in the value-based healthcare services industry in the U.S., including partnerships, collaborations, joint ventures, and mergers and acquisitions. For instance, In February 2021, Optum, a healthcare provider, completed the acquisition of Leadmark Health, a home healthcare company. It will create the first of its home-based care health system and it would accelerate home health care’s move toward value-based care.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 3.3 trillion |

| Revenue Forecast by 2030 | USD 6.27 trillion |

| Growth rate from 2022 to 2030 | CAGR of 7.39% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Models, payers, providers utilization category |

| Companies Covered |

Baker Tilly US, LLP; Deloitte; Siemens Medical Solutions USA, Inc.; Boston Consulting Group Change Healthcare; Athena Healthcare; Veritas Capital Fund Management, L.L.C.; UnitedHealth Group; NXGN Management, LLC.; McKesson Corporation; Genpact; Unlimited Technology Systems, LLC; ForeSee Medical, Inc.; Signify Health, Inc. (Sentara Healthcare); Curation Health; Koninklijke Philips N.V. |

Models Insights

Pay for performance accounted for the largest market share revenue of over 28.14% in 2021 due to the rising shift from traditional fee-for-service toward payment for value-based healthcare programs. Furthermore, to reduce costs and improve healthcare for patients and society, the government has provided incentives that have driven payers to establish value-based pay-for-performance programs.

For instance, the Affordable Care Act has encouraged the Center for Medicare and Medicaid Services (CMS) to take the lead in value-based care by implementing a range of payment methods, such as several pay-for-performance programs. The Hospital Readmissions Reduction Program (HRRP), the Hospital Value-Based Purchasing Program (VBP), and the Hospital-Acquired Condition (HAC) Reduction Program are three Pay for Performance initiatives that have an impact on hospital reimbursement through Medicare. These programs accounted for nearly 40% of total spending, and CMS has established them as the primary means of financing healthcare.

On the other hand, patient-centered medical homes would register the highest market growth for value-based healthcare services over the forecast period. The ability of patient-centered medical home services to improve efficiency while providing medical assistance and reducing medical costs is one of the key factors influencing the market expansion. Additionally, this market would have significant support as healthcare providers at both the private and public levels restructure their operations to line with value-based reimbursement and patient-centered medical home care models. For instance, Pfizer has several patient-centered medical home models with which it collaborates on care management programs (PCMH).

Payer Insights

Medicare is gradually shifting away from fee-for-service compensation toward value-based models that promote cost-cutting and quality improvement, which is anticipated to drive market growth. The Medicare Advantage (MA) program, which enables Medicare beneficiaries to voluntarily join a commercial plan that provides health benefits, was established by the Balanced Budget Act (BBA) of 1997. In a related manner, the Centers for Medicare and Medicaid Services (CMS) and private insurers have enthusiastically endorsed a number of payment strategies for primary care doctors, specialists, and health systems in taking on financial risk for the individuals they treat.

These payment plans include, for instance, bundled payments, accountable care organizations, and the comprehensive primary care initiative. All of these models have been widely embraced in both traditional Medicare and Medicare Advantage, which is predicted to fuel market expansion. Some of these models were established by CMS through the Innovation Center, while others were produced by the private sector.

Providers Utilization Category Insights

The increasing healthcare expenditure in the U.S. is a key factor driving the adoption of services for Home Health Care settings during the forecast period. For instance, as per the American Journal of Managed Care (AJMC) in 2021, there was a 19% cost decrease in home healthcare management comparing patients treated in a hospital environment versus those treated in a hospital-at-home setting.

Medicare reimbursements in the U.S. are extremely advantageous in terms of providing value-based healthcare for better outcomes for patients at a low cost. For instance, through December 31, 2021, the Center for Medicare and Medicaid Innovation adopted the initial Home Health Value-Based Purchasing Model. The concept was created to help Medicare-certified Home Health Agencies across the country improve the quality and efficiency of their treatment.

On the other hand, the institutional care model for healthcare is anticipated to be the growth driver for this market throughout the forecast period due to increasing technology, operational problems, rising consumer expectations, and new health conditions. As a result, there has been a continuous shift toward healthcare services that are value-based and patient-centered. Due to profitability, the number of patients treated, and lower financial risk, value-based healthcare services are driven by a focus on establishing integrated practice units, which measure outcomes and cost at the patient level, bundle prices, geographic expansion, and information technology platforms.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Value-based Healthcare Service Market

5.1. COVID-19 Landscape: U.S. Value-based Healthcare Service Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Value-based Healthcare Service Market, By Models

8.1. U.S. Value-based Healthcare Service Market, by Models, 2022-2030

8.1.1 Pay for Performance

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Patient-centered Medical Home

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Shared Savings

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Shared Risk

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Bundled Payment

8.1.5.1. Market Revenue and Forecast (2017-2030)

8.1.6. Capitation Models

8.1.6.1. Market Revenue and Forecast (2017-2030)

Chapter 9. U.S. Value-based Healthcare Service Market, By Payer Category

9.1. U.S. Value-based Healthcare Service Market, by Payer Category, 2022-2030

9.1.1. Medicare and Medicare Advantage

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Medicaid

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Commercial

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. U.S. Value-based Healthcare Service Market, By Providers’ Utilization Category

10.1. U.S. Value-based Healthcare Service Market, by Providers’ Utilization Category, 2022-2030

10.1.1. Home Health Care

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Institutional Care

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Self-Care

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Hospital Therapy

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. U.S. Value-based Healthcare Service Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Models (2017-2030)

11.1.2. Market Revenue and Forecast, by Payer Category (2017-2030)

11.1.3. Market Revenue and Forecast, by Providers’ Utilization Category (2017-2030)

Chapter 12. Company Profiles

12.1. Baker Tilly US, LLP

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Deloitte

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Siemens Medical Solutions USA, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Boston Consulting Group

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Change Healthcare

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Athena Healthcare

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Veritas Capital Fund Management, L.L.C.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. UnitedHealth Group.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. NXGN Management, LLC.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. McKesson Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others