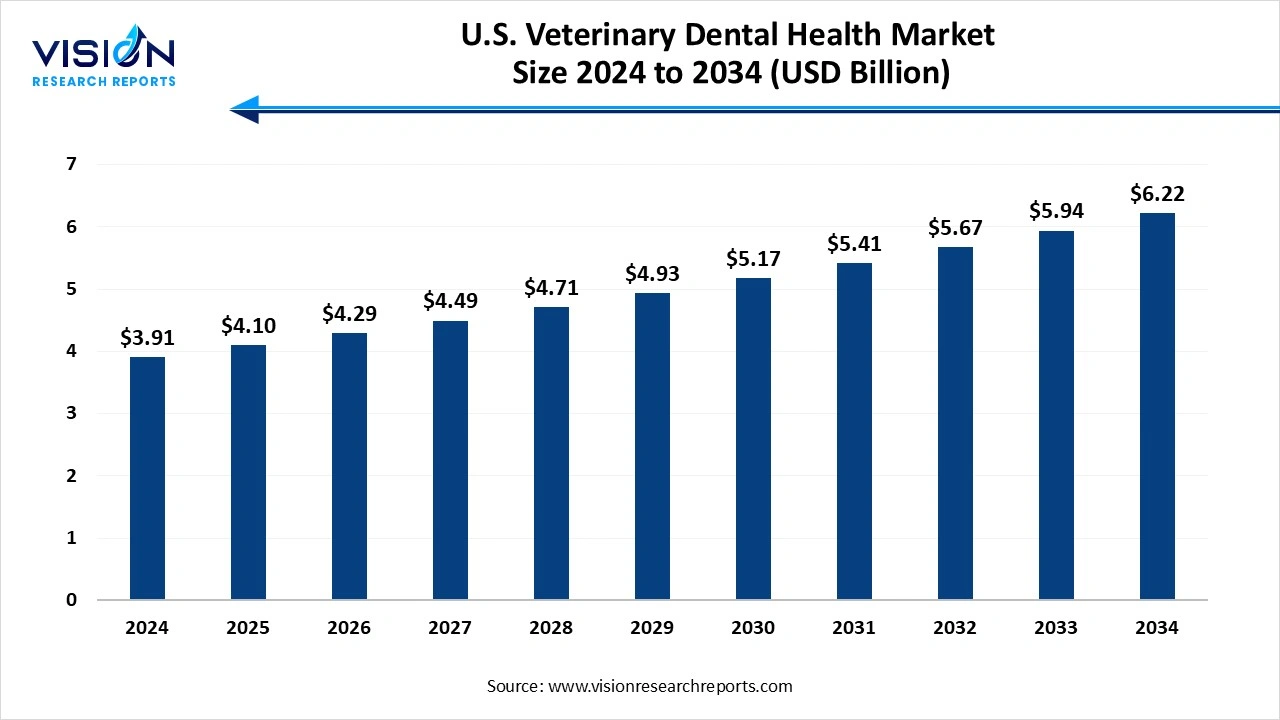

The U.S. veterinary dental health market size was exhibited at around USD 19.88 billion in 2024 and it is projected to hit around USD 5.70 billion by 2034, growing at a CAGR of 6.24% from 2025 to 2034.

The U.S. veterinary dental health market is experiencing notable growth, driven by increasing awareness among pet owners regarding the importance of oral hygiene in animals. Dental diseases are among the most common health issues affecting companion animals, especially dogs and cats. As a result, veterinarians are placing greater emphasis on preventive dental care, leading to increased demand for advanced diagnostic tools, professional cleanings, and dental products such as oral rinses, chews, and specialized diets.

One of the primary growth factors driving the U.S. veterinary dental health market is the increasing awareness among pet owners regarding the significance of oral care in maintaining overall pet health. Dental diseases such as periodontal disease, gingivitis, and tooth resorption are highly prevalent in aging pets, especially dogs and cats. As owners become more informed through veterinary guidance and educational campaigns, the demand for preventive and therapeutic dental services has surged. This includes routine dental cleanings, oral exams, and the use of specialized dental products, which contribute to a broader expansion of the market.

Another key driver is the technological advancement in veterinary dental procedures and equipment. Innovations such as digital dental radiography, ultrasonic scalers, and advanced anesthesia techniques have enhanced the safety, efficiency, and accuracy of dental diagnostics and treatments. Additionally, the increase in pet insurance coverage for dental services and the expansion of veterinary dental training programs are enabling more clinics to offer comprehensive dental care.

A prominent trend in the U.S. veterinary dental health market is the increasing integration of advanced technologies into dental practices. Tools such as digital dental radiography, intraoral cameras, and laser dentistry are becoming standard in many veterinary clinics, enhancing diagnostic precision and treatment planning. These technologies not only improve patient outcomes but also help in early detection of complex dental issues, thus promoting preventive care. Additionally

Another key trend is the rising consumer preference for natural and specialized pet dental products. Pet owners are increasingly seeking dental chews, water additives, and oral gels formulated with natural or organic ingredients to reduce plaque and tartar without synthetic chemicals. Veterinary clinics and pet product retailers are expanding their offerings to meet this demand, and product innovation in this space continues to grow.

One of the primary challenges facing the U.S. veterinary dental health market is the limited awareness and prioritization of dental care among some pet owners. Despite growing education efforts, many still perceive dental procedures as non-essential or only necessary when visible symptoms arise. This lack of routine dental check-ups often leads to late diagnoses of dental diseases, which can become more severe and costly to treat. Furthermore, the misconception that dental care is a luxury rather than a necessity hinders market growth, especially in price-sensitive segments.

Another significant challenge is the shortage of specialized veterinary dental professionals and trained staff. Dental procedures require a high level of skill, appropriate training, and adherence to anesthesia protocols to ensure safety and effectiveness. However, not all veterinary practices have access to certified veterinary dentists or adequately trained technicians. This limitation affects service quality and the ability of smaller or rural clinics to offer comprehensive dental care.

The small animal segment which includes dogs, cats, and other companion animals led the U.S. veterinary dental health market, capturing a revenue share of 92% in 2024. These companion animals are more likely to receive regular veterinary attention, including dental care, due to their close association with human households. Dental diseases such as plaque buildup, periodontal disease, and tooth decay are highly prevalent in small animals, especially as they age. This has led to a surge in demand for both preventive and therapeutic dental services, including cleanings, extractions, and dental radiographs.

The large animal segment, which includes horses, cattle, and other livestock, represents a smaller but steadily growing portion of the market. While routine dental care in large animals has traditionally received less attention compared to small animals, awareness is gradually increasing, especially in equine veterinary practices. Horses, in particular, require regular dental floating to prevent sharp enamel points and malocclusion, which can cause significant discomfort and feeding issues.

The services segment accounted for the highest revenue share, reaching 70% in 2024. Veterinary dental services encompass a broad range of procedures, from basic oral examinations and cleanings to complex interventions such as tooth extractions, root canals, and advanced periodontal treatments. These services are primarily offered in veterinary hospitals, clinics, and specialty dental centers that are equipped with specialized instruments and trained personnel. The rising incidence of dental disorders in companion animals, such as periodontal disease, gingivitis, and fractured teeth, has led to a significant increase in the demand for professional dental care.

The growth of this segment is further supported by the integration of advanced diagnostic tools and technologies, such as digital dental radiography, ultrasonic scalers, and anesthesia monitoring systems, which enhance the quality and safety of dental procedures. Many veterinary practices are now investing in continuing education and certifications to expand their dental service capabilities, responding to the growing expectations of pet owners.

The gum diseases segment held the largest market share of 38% in 2024, leading all indication segments. Periodontal disease, which affects the gums and supporting structures of the teeth, is highly prevalent among aging pets, especially dogs and cats. It typically begins with plaque buildup and, if left untreated, can progress to more severe stages involving inflammation, infection, and eventual tooth loss. The increasing awareness of the impact of gum disease on overall animal health has led to higher demand for early diagnosis and professional treatment.

The dental calculus, also known as tartar, is another significant indication in the U.S. veterinary dental health market. It develops when plaque on the tooth surface hardens due to the accumulation of minerals from saliva, creating a rough surface that promotes further bacterial growth. Dental calculus is not only a cosmetic concern but also a precursor to more serious dental issues such as gum inflammation, infection, and halitosis. As a result, veterinary professionals emphasize the importance of scaling and polishing procedures to remove calculus and restore oral health.

The veterinary hospitals and clinics segment led the distribution channel category, accounting for the largest revenue share of 40% in 2024. These facilities offer a comprehensive range of professional dental services, including routine cleanings, oral examinations, extractions, and periodontal treatments. Equipped with specialized diagnostic tools such as digital dental radiography and ultrasonic scalers, veterinary clinics are well-positioned to deliver high-quality dental care.

The conversely, the e-commerce segment is expected to witness the highest compound annual growth rate throughout the forecast period. Online platforms offer a wide selection of veterinary dental products, ranging from dental chews and water additives to professional-grade dental tools and supplements. Consumers are increasingly turning to e-commerce websites and pet-specific online retailers to purchase these products due to competitive pricing, subscription options, and home delivery services.

By Animal Type

By Type

By Indication

By Distribution Channel

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others