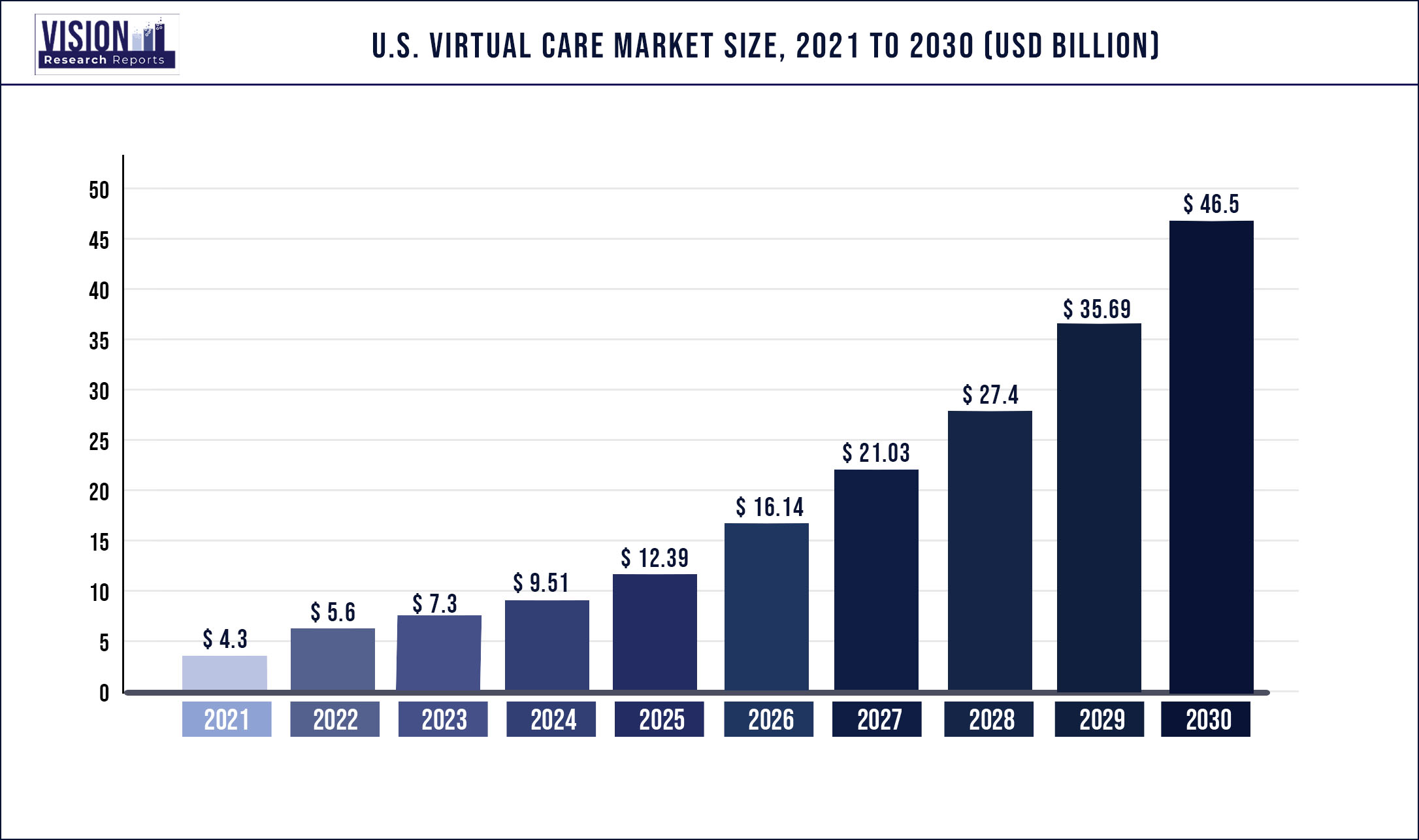

The U.S. virtual care market was estimated at USD 4.3 billion in 2021 and it is expected to surpass around USD 46.5 billion by 2030, poised to grow at a CAGR of 30.28% from 2022 to 2030.

Virtual care is an umbrella term encompassing all remote patient interactions with healthcare providers. High waiting times for physician appointments and the shift toward convenient and patient-focused care are boosting the market growth. In recent years, the inclination toward digital platforms from conventional care settings is increasing, which is propelling the market growth.

Rising healthcare expenses, advancements in telecommunication technologies, and the prevalence of chronic diseases are the primary factors driving the growth of the market. The cost of healthcare in the United States is gradually increasing. According to the National Health Expenditure Projections 2018-2027, national health spending in the United States is predicted to increase by an average of 5.5% per year between 2018 and 2027, reaching over USD 6.0 trillion by 2027.

Virtual care solutions have been shown to improve health outcomes and cut expenses. Compared to traditional approaches, it saves money for patients, providers, and payers. Virtual care has decreased the cost of healthcare while increasing its efficiency through better management of chronic diseases, shorter travel times, shared staffing of health professionals, and fewer and shorter hospital stays. The aforementioned factors are expected to fuel the growth of the market.

The adoption of telemedicine and online consultations has enhanced care management, elevated patients’ quality of life, and decreased healthcare expenditure. During the COVID-19 outbreak, the U.S. healthcare system witnessed favorable trends due to the emergence of telemedicine encouraging people’s participation in personal health management. Smartphones and mobile technologies enable the use of clinical and lifestyle applications to support, educate, and modify healthy behavior.

Moreover, the industry is witnessing an increase in the number of investments, mergers & acquisitions, and entry of new and large-scale companies. This is anticipated to intensify the competition over the next several years. For example, in March 2021, Amazon.com, Inc. expanded access to its virtual visits and healthcare platform, Amazon Care, to Washington-based businesses. Earlier, Amazon Care was exclusively offered to the company's workers and their families in the state of Washington. In addition, the company intends to expand its virtual care product and services to its employees and other businesses in all 50 U.S. states.

The COVID-19 pandemic boosted the demand for telemedicine services and online consultations. Key market players reported high growth in the number of users and revenue. For instance, the overall revenue of Teladoc Health Inc. increased 97.7% in 2020 when compared to 2019. The number of visits increased by 156% to nearly 10.6 million in 2020. Similarly, American Well Corporation witness a growth of 83.4% in revenue in 2020. Easy access to physicians through online platforms, travel restrictions, and measures to decrease the patient volume in hospitals positively impacted the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 4.3 billion |

| Revenue Forecast by 2030 | USD 46.5 billion |

| Growth rate from 2022 to 2030 | CAGR of 30.28% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, consultation mode |

| Companies Covered | Teladoc Health, Inc.; American Well Corporation; MDLIVE; Doctor on Demand, Inc.; Virtuwell; CVS health; MeMD; HealthTap, Inc.; iCliniq; Sesame, Inc. |

Consultation Mode Insights

The audio segment accounted for the largest market share of 45.9% in 2021. Easy access and a higher preference for phone calls are factors driving the growth of the market. Moreover, many people reside on the side of the digital divide where access to technology and high-speed internet service is limited. More than 21 million Americans live in "digital deserts" according to the 2020 Broadband Deployment Report. Both rural and urban residents are affected by this issue.

The Pew Research Center discovered that less than 65% of rural individuals have a broadband internet connection in their homes, while more than 40% of low-income Americans do not have broadband connectivity in their homes. For these individuals, audio-only visits have proven to be a successful means of overcoming barriers to care such as mobility issues, lack of transportation, and lack of nearby providers. Moreover, audio-only consultations have expanded access to crucially needed behavioral health services.

The video segment is likely to witness remarkable growth over the forecast period. This growth is related to COVID-19. In April 2020, 43.5% of all Medicare primary care visits were conducted via telehealth; before the pandemic, this percentage was only 0.1%. While virtual care also encompasses phone and message consultations, the frequency of appointments conducted by video has risen dramatically. Video appointments via the Department of Veterans Affairs Video Connect System, for instance, increased to 120,000 per week in May of 2020 from 10,000 per week in February 2020.

Application Insights

In 2021, the family medicine segment dominated the U.S. virtual care market with a share of 29.4%. A high number of online consultations for acute and primary care is the main factor for the dominant share of the segment. The American Academy of Family Physicians (AAFP) recommends expanding the use of telemedicine as an efficient and appropriate means of enhancing health when handled by adequate standards of care.

During the pandemic, more than 80% of family physicians began delivering online appointments, according to a recent AAFP poll. In addition, almost 70% of respondents would prefer to deliver health services virtually in the future. Thus, increasing adoption of virtual care by family physicians is expected to fuel the growth of the segment.

Moreover, the internal medicine segment held a significant portion of the market in 2021. According to a survey conducted by the American College of Physicians (ACP), internal medicine physicians and subspecialists would like to use virtual care technologies more than they do currently. The survey revealed that more than half of the respondents are interested in learning more about connected care technologies.

Also, one-third of telemedicine users use e-consults to collaborate with specialists at least once a week. The technology is used by around one-quarter of telehealth users to communicate with patients and manage care outside the clinic. Nearly 18% of telehealth/telemedicine users conduct video visits with patients, and 19% use the platform at least once a week. The aforementioned factors are expected to drive the segment growth.

Key Players

Market Segmentation

Chapter 1.Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2.Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3.Executive Summary

3.1.Market Snapshot

Chapter 4.Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1.Raw Material Procurement Analysis

4.3.2.Sales and Distribution Channel Analysis

4.3.3.Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on U.S. Virtual Care Market

5.1.COVID-19 Landscape: U.S. Virtual Care Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6.Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1.Market Drivers

6.1.2.Market Restraints

6.1.3.Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1.Bargaining power of suppliers

6.2.2.Bargaining power of buyers

6.2.3.Threat of substitute

6.2.4.Threat of new entrants

6.2.5.Degree of competition

Chapter 7.Competitive Landscape

7.1.1.Company Market Share/Positioning Analysis

7.1.2.Key Strategies Adopted by Players

7.1.3.Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8.Global U.S. Virtual Care Market, By Consultation Mode

8.1.U.S. Virtual Care Market, by Consultation Mode Type, 2022-2030

8.1.1.Video

8.1.1.1.Market Revenue and Forecast (2017-2030)

8.1.2.Audio

8.1.2.1.Market Revenue and Forecast (2017-2030)

8.1.3.Messaging

8.1.3.1.Market Revenue and Forecast (2017-2030)

Chapter 9.Global U.S. Virtual Care Market, By Application

9.1.U.S. Virtual Care Market, by Application, 2022-2030

9.1.1.Family Medicine

9.1.1.1.Market Revenue and Forecast (2017-2030)

9.1.2.Internal Medicine

9.1.2.1.Market Revenue and Forecast (2017-2030)

9.1.3.Cardiology

9.1.3.1.Market Revenue and Forecast (2017-2030)

9.1.4.Pediatrics

9.1.4.1.Market Revenue and Forecast (2017-2030)

9.1.5.Endocrinology

9.1.5.1.Market Revenue and Forecast (2017-2030)

9.1.6.Rheumatology

9.1.6.1.Market Revenue and Forecast (2017-2030)

9.1.7.Pulmonology

9.1.7.1.Market Revenue and Forecast (2017-2030)

9.1.8.Others

9.1.8.1.Market Revenue and Forecast (2017-2030)

Chapter 10.Global U.S. Virtual Care Market, Regional Estimates and Trend Forecast

10.1.North America

10.1.1.Market Revenue and Forecast, by Consultation Mode (2017-2030)

10.1.2.Market Revenue and Forecast, by Application (2017-2030)

10.1.3.U.S.

10.1.3.1.Market Revenue and Forecast, by Consultation Mode (2017-2030)

10.1.3.2.Market Revenue and Forecast, by Application (2017-2030)

10.1.4.Rest of North America

10.1.4.1.Market Revenue and Forecast, by Consultation Mode (2017-2030)

10.1.4.2.Market Revenue and Forecast, by Application (2017-2030)

Chapter 11.Company Profiles

11.1.Teladoc Health, Inc.

11.1.1.Company Overview

11.1.2.Product Offerings

11.1.3.Financial Performance

11.1.4.Recent Initiatives

11.2.American Well Corporation

11.2.1.Company Overview

11.2.2.Product Offerings

11.2.3.Financial Performance

11.2.4.Recent Initiatives

11.3.MDLIVE

11.3.1.Company Overview

11.3.2.Product Offerings

11.3.3.Financial Performance

11.3.4.Recent Initiatives

11.4.Doctor on Demand, Inc.

11.4.1.Company Overview

11.4.2.Product Offerings

11.4.3.Financial Performance

11.4.4.Recent Initiatives

11.5.Virtuwell

11.5.1.Company Overview

11.5.2.Product Offerings

11.5.3.Financial Performance

11.5.4.Recent Initiatives

11.6.CVS health

11.6.1.Company Overview

11.6.2.Product Offerings

11.6.3.Financial Performance

11.6.4.Recent Initiatives

11.7.MeMD

11.7.1.Company Overview

11.7.2.Product Offerings

11.7.3.Financial Performance

11.7.4.Recent Initiatives

11.8.HealthTap, Inc.

11.8.1.Company Overview

11.8.2.Product Offerings

11.8.3.Financial Performance

11.8.4.Recent Initiatives

11.9.iCliniq

11.9.1.Company Overview

11.9.2.Product Offerings

11.9.3.Financial Performance

11.9.4.Recent Initiatives

11.10.Sesame, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12.Research Methodology

12.1.Primary Research

12.2.Secondary Research

12.3.Assumptions

Chapter 13.Appendix

13.1.About Us

13.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others