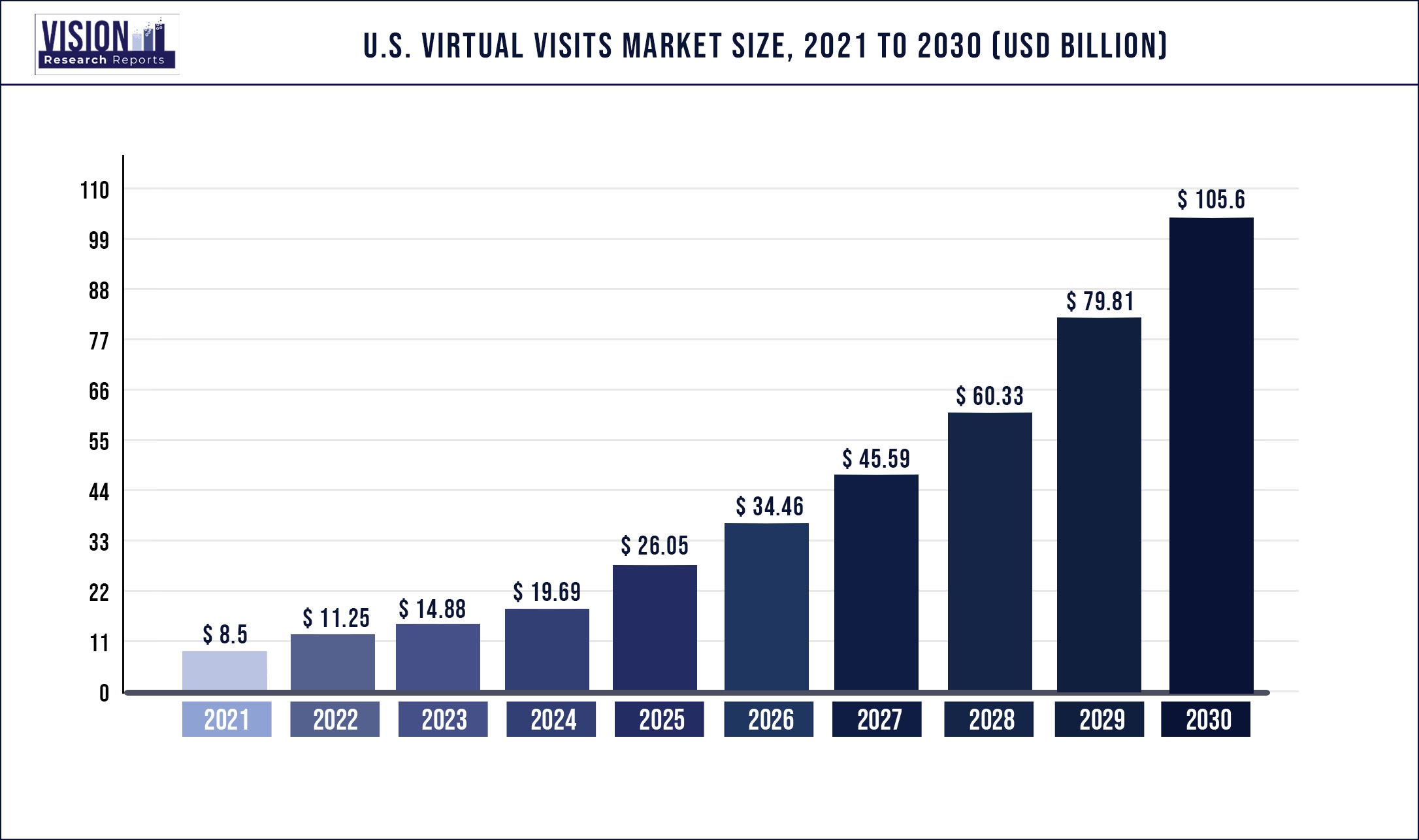

The U.S. virtual visits market was estimated at USD 8.5 billion in 2021 and it is expected to surpass around USD 105.6 billion by 2030, poised to grow at a CAGR of 32.31% from 2022 to 2030.

Increasing demand for telehealth and teleconsultation and introduction of new and advanced technologies has positively impacted the growth of the market in the U.S. Increasing penetration of smartphones and assisted technologies has also been a key factor for the fast growth of the market.

In the service segment, cold and flu management had the largest market share in 2021. The major factor behind the growth of the market is the growing demand for teleconsultations for patients for treatment of common conditions like cold and flu to reduce the chances of contracting additional illnesses due to hospital visits. The availability of specialists through telehealth and teleconsultations, even in remote areas has brought about a revolution in the virtual visits market, acting as a key factor for the growth of the market.

Based on age, the 18 to 34 years segment had the largest market share in 2021. The growth is a result of increasing smartphone penetration and increased internet usage by the consumers in this age group. The increase in the number of young adults suffering from mental health issues has also risen in the past few years and more so during COVID-19, resulting in a large market share.

Based on gender, women dominated the market with a revenue share of 65% in 2021. The increasing demand for telemedicine and telehealth had increased due to COVID-19 to reduce the chances of contracting additional infections, especially in pregnant females. The virtual visits made it easier for all to get access to specialists and better healthcare facilities within the comfort of their homes, proving to be a major factor for the growth of this segment and the market overall.

Based on the type of commercial plans, self-funded/ASO group plans had the largest revenue share. Growth in this segment has been a result of ASO groups proposing and encouraging virtual visits in their coverage plans to avoid regular visits to hospitals in avoidable conditions. During the pandemic, only non-emergency visits throughout the country were encouraged by healthcare providers to avoid the risk of infection. In wake of the pandemic, employers are increasingly preferring self-coverage plans and providing cost-effective healthcare services for their employees to diminish the exploding healthcare costs, which is further enhancing the growth of the market.

The COVID-19 pandemic created a massive growth spurt for the virtual visits market in the U.S. With the people needing healthcare solutions during the peak of the pandemic, teleconsultations were providing the necessary care that was needed. The huge jump in the uptake of virtual consultations was a result of government initiatives as well as fear of contracting the disease by physically visiting the hospitals. It came as a necessary relief for the healthcare providers as well, where they were less burdened due to the use of teleconsultations in case of non-emergency cases. The overall productivity of the healthcare system had also improved, proving the virtual visit market has been a great success and would be a way to consult in the future as well.

Scope of the Report

| Report Coverage | Details |

| Market Size in 2021 | USD 8.5 Billion |

| Revenue Forecast By 2030 | USD 105.6 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 32.31% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Companies Mentioned | Teladoc, Inc.; American Well Corporation; MDLive; Doctor on Demand, Inc.; Zipnosis; MeMD; HealthTap; Vidyo, Inc.; eVisit Telemedicine Solution; PlushCare |

Service Insights

The cold and flu management segment in the service type dominated the market and held a share of 29.8% in 2021. This can be attributed to the fact that the patients are increasingly preferring virtual visits to consult physicians regarding cold and flu symptoms. The majority of the patients in this category resorted to teleconsultations to avoid the spread of infection and contracting additional symptoms through physical visits to hospitals. An increase in the prevalence of influenza during the pandemic has also resulted in the growth of the segment. In 2020, there was a huge spike in the number of influenza cases that lead to the growth of this segment.

Behavioral health is the fastest-growing segment and is expected to grow at a significant rate during the forecast period. The onset of the pandemic made teleconsultations and virtual visits a norm, even in the behavioral health segment. The increasing demand for virtual visits for a number of conditions like depression, anxiety, LGBTQ counseling, and a wide array of mental health issues has resulted in the growth of this segment. The pandemic saw a massive increase in the number of patients suffering from depression and anxiety, also contributing to the growth of the behavioral health segment.

Age Group Insights

Consumer groups aged between 18 – 34 years held the largest revenue share of 31.8% in 2021, in the regional market. An increase in penetration of smartphones in this age group, increasingly high internet usage, and a steady incline in the number of mental health issues have resulted in a large market share. The increase in the number of people reporting mental health issues and the increased rate of anxiety and depression among people is forecasted to propel growth in this segment.

Consumers of the age group 35 to 49 years are the fastest-growing age group of consumers, with the highest CAGR over the forecast period due to the increasing prevalence of chronic illnesses like diabetes, hypertension, various cardiovascular diseases, etc. in the age group. As per CDC’s statistical data, nearly 18.2 million adults aged 20 and above suffer from coronary artery disease; nearly half the adult population in the U.S. has hypertension, 47% population or 116 million people have hypertension in the U.S. The numerous advantages associated with virtual visits like lesser waiting time due to pre-scheduling decreased chances of contracting additional infections from hospitals, and ease of comfort of the process are all expected to propel the virtual visits market in the forecast period.

Commercial Plan Type Insights

Self-funded/ASO group plans in the commercial plans type had the largest revenue share of 34.3% as of 2021, in the regional market. This can be attributed to an increase in the prevalence of chronic diseases, skyrocketing healthcare costs, and an increase in demand for affordable healthcare solutions.

The fastest-growing segment was the small group commercial plan type, it is expected to expand at a significant CAGR over the forecast period. Demand for virtual care has been steadily increasing and more so due to the COVID-19 pandemic, several initiatives undertaken by both public and private entities for decreasing the burden of healthcare costs on small businesses and their employees have resulted in the growth of small group commercial plan type. Medicare and Medicaid do not cover all costs associated with telehealth and virtual consultations, to reduce that burden and to aid patients and caregivers, adoption of this type of plan has resulted in more access to healthcare, and more patient adherence resulting in the growth of this segment.

Gender Insights

The regional virtual visits market was dominated by the women segment in the gender type, with a revenue share of 65% in 2021. The pandemic brought to light the need to access healthcare facilities in a safe environment for pregnant women to avoid the risk of contracting the virus through hospital visits, which was the primary factor for the large revenue share for this segment. Virtual visits were the need of the hour and were increasingly adopted by women all over the country.

The men’s segment is the fastest-growing gender type, with the indication of a fast-paced growth during the forecast period. This can be attributed to the ease of use of teleconsultations for various conditions like increasing mental health issues, sexual health concerns like erectile dysfunction, STDs, etc. without visiting the doctor in person, stress management, and various other health conditions. Virtual visits have come a long way and are not just restricted to video calling, connected apps, and devices that made patient monitoring easier, the consumers are increasingly leaning towards this form of consultation to avoid wastage of time and resources by going to hospitals unless necessary, reduction of healthcare costs in an overall scenario, etc., all these factors are poised to propel the growth of the virtual visits market in the U.S.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2.Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3.Executive Summary

3.1.Market Snapshot

Chapter 4.Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1.Raw Material Procurement Analysis

4.3.2.Sales and Distribution Channel Analysis

4.3.3.Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on U.S. Virtual Visits Market

5.1.COVID-19 Landscape: U.S. Virtual Visits Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6.Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1.Market Drivers

6.1.2.Market Restraints

6.1.3.Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1.Bargaining power of suppliers

6.2.2.Bargaining power of buyers

6.2.3.Threat of substitute

6.2.4.Threat of new entrants

6.2.5.Degree of competition

Chapter 7.Competitive Landscape

7.1.1.Company Market Share/Positioning Analysis

7.1.2.Key Strategies Adopted by Players

7.1.3.Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8.Global U.S. Virtual Visits Market, By Service Type

8.1.U.S.Virtual Visits Market, by Service Type Type, 2022-2030

8.1.1.Cold & Flu management

8.1.1.1.Market Revenue and Forecast (2017-2030)

8.1.2.Allergies

8.1.2.1.Market Revenue and Forecast (2017-2030)

8.1.3.Urgent Care

8.1.3.1.Market Revenue and Forecast (2017-2030)

8.1.4.Preventive Care

8.1.4.1.Market Revenue and Forecast (2017-2030)

8.1.5.Chronic Care Management

8.1.5.1.Market Revenue and Forecast (2017-2030)

8.1.6.Behavioral Health

8.1.6.1.Market Revenue and Forecast (2017-2030)

Chapter 9.Global U.S. Virtual Visits Market, By Age Group

9.1.U.S.Virtual Visits Market, by Age Group, 2022-2030

9.1.1.Age 18-34

9.1.1.1.Market Revenue and Forecast (2017-2030)

9.1.2.Age 35-49

9.1.2.1.Market Revenue and Forecast (2017-2030)

9.1.3.Age 50-64

9.1.3.1.Market Revenue and Forecast (2017-2030)

9.1.4.Age 65 and above

9.1.4.1.Market Revenue and Forecast (2017-2030)

Chapter 10.Global U.S. Virtual Visits Market, By Gender

10.1.U.S. Virtual Visits Market, by Gender, 2022-2030

10.1.1. Small Group

10.1.1.1.Market Revenue and Forecast (2017-2030)

10.1.2. Self-funded/ASO Group Plans

10.1.2.1.Market Revenue and Forecast (2017-2030)

10.1.3. Medicaid

10.1.3.1.Market Revenue and Forecast (2017-2030)

10.1.4. Medicare

10.1.4.1.Market Revenue and Forecast (2017-2030)

Chapter 11.Global U.S. Virtual Visits Market, By Gender

11.1.U.S. Virtual Visits Market, by Gender, 2022-2030

11.1.1. Male

11.1.1.1.Market Revenue and Forecast (2017-2030)

11.1.2. Female

11.1.2.1.Market Revenue and Forecast (2017-2030)

Chapter 12.U.S. Virtual Visits Market, Regional Estimates and Trend Forecast

12.1.U.S.

12.1.1.Market Revenue and Forecast, by Service Type (2017-2030)

12.1.2.Market Revenue and Forecast, by Gender (2017-2030)

Chapter 13.Company Profiles

13.1.American Well Corporation

13.1.1.Company Overview

13.1.2.Product Offerings

13.1.3.Financial Performance

13.1.4.Recent Initiatives

13.2.MDLive, Inc

13.2.1.Company Overview

13.2.2.Product Offerings

13.2.3.Financial Performance

13.2.4.Recent Initiatives

13.3.Doctor On Demand, Inc

13.3.1.Company Overview

13.3.2.Product Offerings

13.3.3.Financial Performance

13.3.4.Recent Initiatives

13.4.eVisit Telemedicine Solution

13.4.1.Company Overview

13.4.2.Product Offerings

13.4.3.Financial Performance

13.4.4.Recent Initiatives

13.5.Teladoc Health, Inc

13.5.1.Company Overview

13.5.2.Product Offerings

13.5.3.Financial Performance

13.5.4. Recent Initiatives

13.6.MeMD

13.6.1.Company Overview

13.6.2.Product Offerings

13.6.3.Financial Performance

13.6.4.Recent Initiatives

13.7.HealthTap, Inc

13.7.1.Company Overview

13.7.2.Product Offerings

13.7.3.Financial Performance

13.7.4.Recent Initiatives

13.8.Vidyo, Inc

13.8.1.Company Overview

13.8.2.Product Offerings

13.8.3.Financial Performance

13.8.4.Recent Initiatives

13.9.PlushCare, Inc

13.9.1.Company Overview

13.9.2.Product Offerings

13.9.3.Financial Performance

13.9.4.Recent Initiatives

13.10.Zipnosis

13.10.1.Company Overview

13.10.2.Product Offerings

13.10.3.Financial Performance

13.10.4.Recent Initiatives

Chapter 14.Research Methodology

14.1.Primary Research

14.2.Secondary Research

14.3.Assumptions

Chapter 15.Appendix

15.1.About Us

15.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others