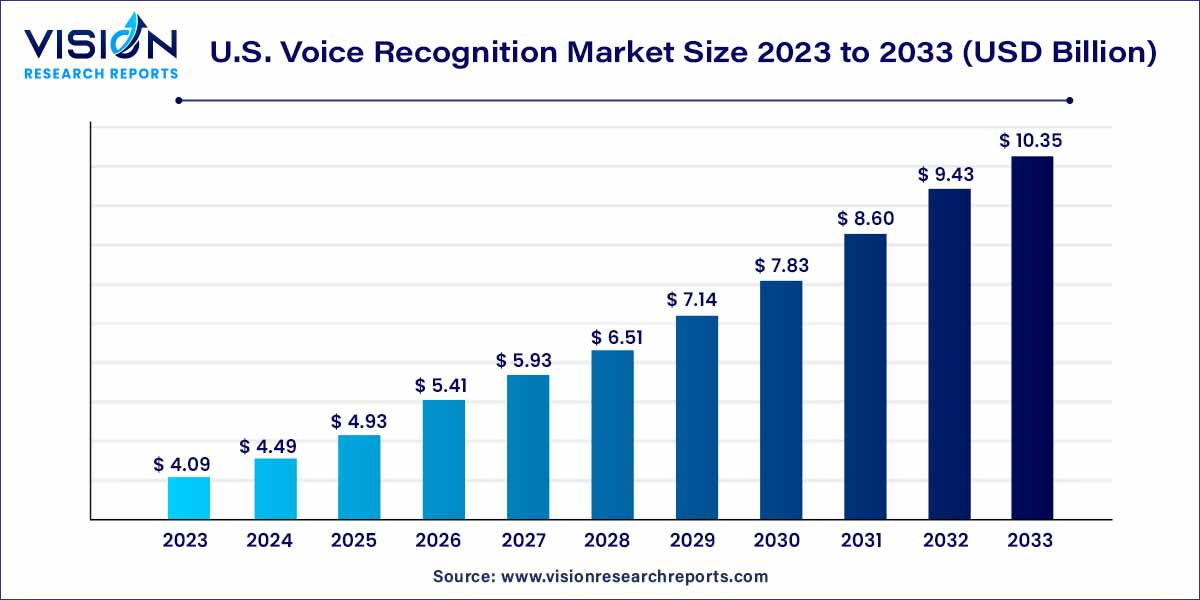

The U.S. voice recognition market size was estimated at around USD 4.09 billion in 2023 and it is projected to hit around USD 10.35 billion by 2033, growing at a CAGR of 9.73% from 2024 to 2033. Technological developments, the increasing usage of speech recognition in sophisticated computer-controlled electronics, and the expanding application of technology in biometric systems are expected to propel the market. For security reasons, voice-activated biometric systems assist in granting authorized users access to complete transactions.

The exponential growth of the U.S. Voice Recognition Market can be attributed to several key factors. Firstly, the increasing prevalence of smart devices and their integration with voice-activated virtual assistants has significantly expanded the user base. This surge in consumer adoption is further fueled by the convenience of hands-free interactions, driving the demand for voice recognition technology across various applications. Moreover, advancements in artificial intelligence and natural language processing have substantially improved the accuracy and responsiveness of voice recognition systems, enhancing user experiences. The technology's versatility is evident as it finds applications not only in consumer electronics but also across industries such as healthcare, automotive, and customer service. This broadening scope, coupled with ongoing research and development efforts to address challenges like privacy concerns, positions the U.S. voice recognition market for sustained and robust growth in the foreseeable future.

| Report Coverage | Details |

| Market Size in 2023 | USD billion |

| Revenue Forecast by 2033 | USD billion |

| Growth rate from 2024 to 2033 | CAGR of 9.73% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Based on vertical, the U.S. voice recognition market has been segmented into automotive, enterprise, consumer, BFSI, government, retail, healthcare, military, legal, education, and others. The healthcare segment held the largest revenue share of 23% in 2023, owing to the rising need for precise & efficient documentation and the growing demand for telemedicine services.

For instance, in 2022, Amazon unveiled a cutting-edge solution for hospitals that incorporates speech intelligence on a larger scale into healthcare facilities. The solution, known as Alexa Smart Properties, promises to make it much more convenient for hospitals and senior care centers to install and run Alexa-enabled devices throughout their premises, leading to improved healthcare services.

The banking, financial services, & insurance segment is expected to expand at the fastest CAGR of 13.23% over the forecast period. This growth is due to the rising need for enhanced and reliable security measures, improved customer experience, efficiency, cost-effectiveness, and integration of voice recognition with other technologies such as AI and Natural language processing (NLP). Additionally, the segment is anticipated to grow as voice-assisted digital payment technologies continue to advance.

For instance, ToneTag has been working with public sector organizations in India to offer UPI 123Pay options to its customers. Through this service, feature phone users can dial the relevant IVR number and conduct financial transactions using their voice as input. Customers can perform financial activities such as paying utility bills, checking account balances, recharging, and more, using this service.

The automotive segment is also expected to account for a significant share of the market in the U.S. over the forecast period. The increased use of voice recognition technology in a variety of automotive applications such as remote control, car navigation, and verbal commands for in-car infotainment systems is poised to drive strong segment growth. The United Services Automobile Association (USAA) uses this technology for authentication for users to access their USAA accounts on their mobile devices. Its biometric system offers three quick login options - fingerprint, face, or voice recognition.

Applications of voice recognition technology are also increasing in the field of home security and health monitoring. Advanced security and smart systems can monitor the surrounding conditions and interact with residents to process commands such as adjusting thermostats, turning on or turning off lights, identifying residents or employees, and reporting intruders, based on definite biological signs. These applications are expected to lead to new avenues of growth for the U.S. market over the forecast period.

By Vertical

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Voice Recognition Market

5.1. COVID-19 Landscape: U.S. Voice Recognition Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Voice Recognition Market, By Vertical

8.1.U.S. Voice Recognition Market, by Vertical Type, 2024-2033

8.1.1. Automotive

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Enterprise

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Consumer

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Banking, Financial Services & Insurance

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Government

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Retail

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Healthcare

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Military

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Legal

8.1.9.1. Market Revenue and Forecast (2021-2033)

8.1.10. Education

8.1.10.1. Market Revenue and Forecast (2021-2033)

8.1.11. Others

8.1.11.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Voice Recognition Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Vertical (2021-2033)

Chapter 10. Company Profiles

10.1. Advanced Voice Recognition Systems, Inc.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Nuance Communications Inc.

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Amazon.com, Inc.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Keda Xunfei Co., Ltd.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Apple Inc.

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Baidu, Inc.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Google LLC

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. International Business Machines Corporation

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. M2SYS Technology

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. LumenVox

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others