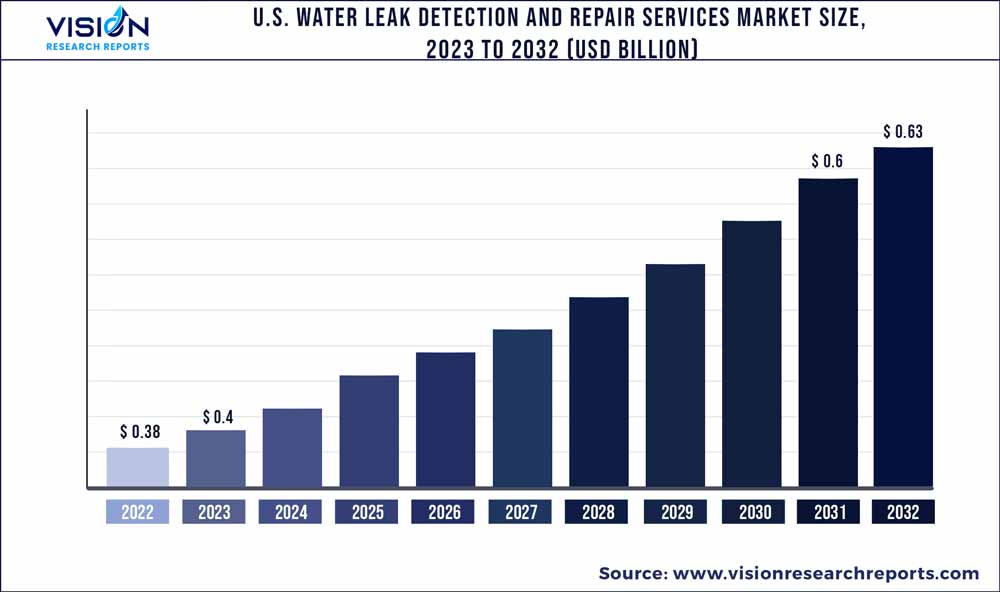

The U.S. water leak detection and repair services market was surpassed at USD 0.38 billion in 2022 and is expected to hit around USD 0.63 billion by 2032, growing at a CAGR of 5.24% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Water Leak Detection And Repair Services Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.38 billion |

| Revenue Forecast by 2032 | USD 0.63 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.24% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Five Star Leak Detection; American Leak Detection; ADU; Ground Penetrating Radar Systems, LLC; Calfo Home Services; Underground Surveying; EZ Plumbing; Sleuth, Inc.; Leak Master; ABE’s Complete Plumbing Service |

The increasing concern for water conservation and sustainability is a major driver of market growth in the U.S. With rising water scarcity and the need to optimize water resources; there is an increasing demand for efficient leak detection and repair services to minimize water loss. Moreover, the demand for water leak detection & repair services is increasing to ensure efficient water use in residential, commercial, and industrial settings. Stringent policies and regulations regarding water conservation and environmental protection drive the need for effective leak detection and repair services.

Government agencies and water utilities impose strict guidelines and standards to effectively prevent water wastage and address water infrastructure issues. This creates a favorable market environment for businesses offering leak detection and repair services. They help clients comply with regulations and maintain sustainable water management practices.

The market is also driven by the aging water infrastructure in the U.S. Numerous water supply systems consist of old and deteriorating pipelines, leading to a greater risk of leaks and water loss. As a result, there is a rising demand for professional leak detection and repair services to effectively identify and address these infrastructure vulnerabilities. Moreover, the need for regular inspection, maintenance, and repair of water distribution networks drives the demand for specialized services in the U.S. market.

Furthermore, the increasing adoption of advanced technologies such as the Internet of Things (IoT) and Artificial Intelligence (AI) is driving market growth in water leak detection & repair services. IoT sensors and monitoring systems play an important role in providing real-time data on water pressure, usage, and flow. This enables proactive leak detection and timely repairs, reducing water loss and damage. Furthermore, AI algorithms can analyze large datasets and detect patterns indicative of leaks, thereby facilitating efficient detection and prioritization of repair activities.

However, the market growth could be more restrained by the high cost associated with conducting repair activities and implementing advanced leak detection technologies. Furthermore, installing and maintaining data analytics systems, IoT sensors, and other sophisticated equipment require significant financial investment. In addition, the specialized skills and expertise needed to operate and interpret the data from these technologies effectively can also pose a challenge. Vendors can explore collaborations and partnerships with technology providers to overcome this restraint to access cost-effective solutions. They can also spend on training and development programs to enhance the skill sets of their workforce, ensuring efficient utilization of advanced technologies.

Technique Insights

The acoustic leak detection segment dominated the market in 2022 and accounted for a revenue share of more than 31%. Acoustic leak detection is a proven and reliable method for identifying leaks in water distribution systems. It utilizes sensitive microphones and advanced algorithms to detect the unique sound patterns created by escaping water, enabling accurate and precise leak detection. This technique is highly effective in identifying leaks, even in challenging environments or underground pipelines.

The leak noise correlators segment is anticipated to register significant growth over the forecast period. The leak noise correlator devices use advanced algorithms to analyze the acoustic signals produced by leaks and correlate them with the physical location of the leaks. This enables precise identification and localization of leaks, minimizing the time and effort required for repair. Moreover, leak noise correlators are non-intrusive and non-destructive, allowing for leak detection without excavation or disruption to the existing infrastructure. This reduces the cost, time, and inconvenience associated with traditional leak detection methods.

Application Insights

The water distribution systems segment dominated the market in 2022 and accounted for a revenue share of more than 33%. Water distribution systems play a critical role in delivering clean and safe water to residential, commercial, and industrial areas. As these systems age, they are more prone to leaks and water loss, necessitating effective leak detection and repair services. Water distribution systems cover a vast network of pipes, valves, and infrastructure, making them a key focus of leak detection efforts.

The plumbing leaks segment is anticipated to register significant growth over the forecast period. Plumbing systems are an integral part of residential, commercial, and industrial buildings, and they are susceptible to leaks due to aging infrastructure, pipe corrosion, and faulty connections. Plumbing leaks can lead to water damage, property loss, and increased water bills, making prompt detection and repair crucial. Moreover, the increasing awareness among property owners about the importance of water conservation and the need to prevent water wastage has driven the demand for effective leak detection and repair services in plumbing systems.

End-user Insights

The commercial segment dominated the market in 2022 and accounted for a revenue share of over 61%. Commercial properties, such as office buildings, hotels, hospitals, and retail spaces, often have extensive plumbing systems prone to leaks. These leaks can result in significant water damage, disrupt business operations, and incur substantial financial losses. As a result, commercial property owners and managers are increasingly recognizing the importance of proactive leak detection and repair to minimize risks and protect their investments.

The residential segment is anticipated to register significant growth over the forecast period. Residential properties, including houses, apartments, and condominiums, account for a substantial portion of the overall water consumption. With the increasing focus on water conservation and efficiency, homeowners are becoming more aware of the potential risks associated with water leaks and the need to address them promptly. As a result, there is a growing demand for professional leak detection and repair services in residential settings to prevent water wastage and minimize damage to the property.

U.S. Water Leak Detection And Repair Services Market Segmentations:

By Technique

By Application

By End-user

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Technique Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Water Leak Detection And Repair Services Market

5.1. COVID-19 Landscape: U.S. Water Leak Detection And Repair Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Water Leak Detection And Repair Services Market, By Technique

8.1. U.S. Water Leak Detection And Repair Services Market, by Technique, 2023-2032

8.1.1 Acoustic Leak Detection

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Leak Noise Correlators

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Manual Inspection

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Water Leak Detection And Repair Services Market, By Application

9.1. U.S. Water Leak Detection And Repair Services Market, by Application, 2023-2032

9.1.1. Pool & Spa

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Water Distribution Systems

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Plumbing Leaks

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Water Leak Detection And Repair Services Market, By End-user

10.1. U.S. Water Leak Detection And Repair Services Market, by End-user, 2023-2032

10.1.1. Commercial

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Residential

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Water Leak Detection And Repair Services Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Technique (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by End-user (2020-2032)

Chapter 12. Company Profiles

12.1. Five Star Leak Detection

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. American Leak Detection.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. ADU

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Ground Penetrating Radar Systems, LLC.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Calfo Home Services

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Underground Surveying

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. EZ Plumbing.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Sleuth, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Leak Master

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. ABE’s Complete Plumbing Service

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others