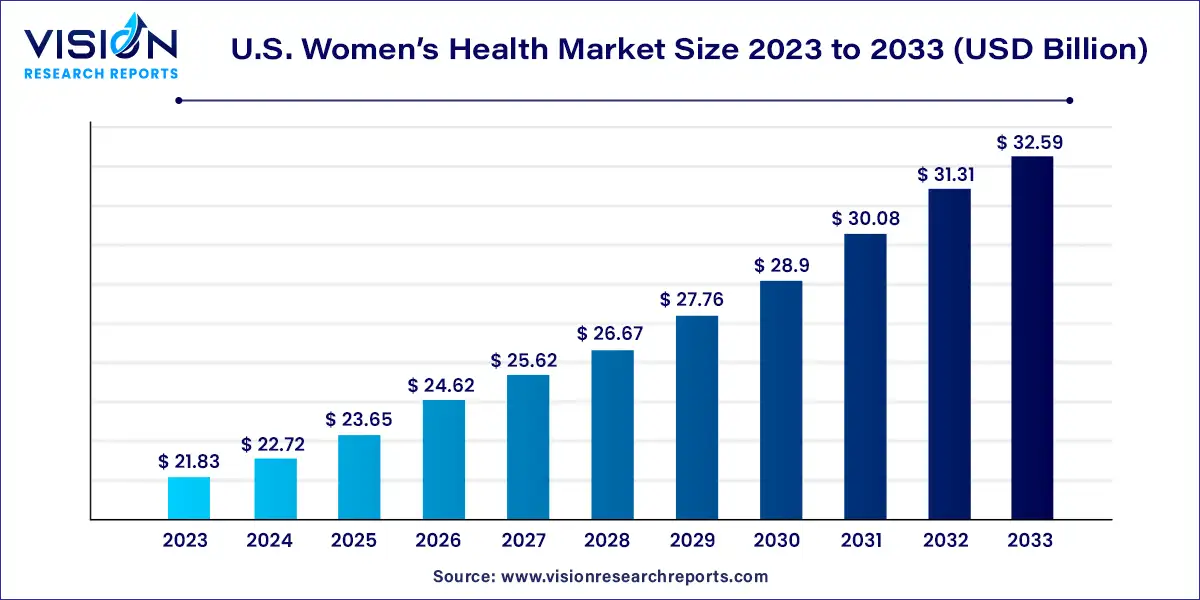

The U.S. women’s health market size was estimated at around USD 21.83 billion in 2023 and it is projected to hit around USD 32.59 billion by 2033, growing at a CAGR of 4.09% from 2024 to 2033.

The U.S. women's health market encompasses a broad spectrum of healthcare services, products, and initiatives designed to address the unique health needs and concerns of women across various life stages. This market segment encompasses a wide range of issues, including reproductive health, maternal health, gynecological conditions, menopause management, and preventive care. With growing awareness and advocacy surrounding women's health issues, there has been an increasing focus on research, innovation, and access to quality healthcare services tailored specifically to women. From pharmaceuticals and medical devices to wellness programs and digital health solutions, the U.S. women's health market continues to evolve to meet the evolving needs of women and improve their overall health outcomes.

The growth of the U.S. women's health market is driven by an advancements in medical technology and research have led to the development of innovative treatments and interventions for various women's health conditions, driving demand for specialized healthcare services and products. Secondly, increasing awareness and advocacy surrounding women's health issues have prompted greater investment in preventive care and wellness initiatives, promoting early detection and disease prevention. Additionally, demographic trends such as an aging population and shifting societal attitudes towards women's health have contributed to the expansion of the market. Moreover, government initiatives and healthcare reforms aimed at improving access to women's healthcare services have played a significant role in driving market growth. Lastly, the rise of digital health solutions and telemedicine has facilitated greater convenience and accessibility to healthcare services, particularly for underserved populations, further driving market expansion.

| Report Coverage | Details |

| Market Size in 2023 | USD 21.83 billion |

| Revenue Forecast by 2033 | USD 32.59 billion |

| Growth rate from 2024 to 2033 | CAGR of 4.09% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The Prolia segment held the largest market share of 17% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Prolia is a medication used in the field of women's health for the treatment and prevention of osteoporosis in postmenopausal women. The generic name for Prolia is denosumab. Prolia is a monoclonal antibody that works by inhibiting a protein called RANK ligand, which plays a key role in the process of bone resorption. By blocking the RANK ligand, Prolia helps reduce bone loss, increase bone density, and decrease the risk of fractures in postmenopausal women with osteoporosis. It is typically administered as an injection every six months by a healthcare professional.

The Minastrin 24 Fe segment is expected to showcase a lucrative CAGR over the forecast period. Minastrin 24 Fe is a brand name for a combination birth control pill used in women's health. It contains two hormones, norethindrone acetate (a progestin) and ethinyl estradiol (an estrogen), and is primarily prescribed as an oral contraceptive to prevent pregnancy. Minastrin 24 Fe works by preventing ovulation (the release of an egg from the ovary), thickening the cervical mucus to inhibit sperm movement, and affecting the lining of the uterus to make it less receptive to implantation.

The contraceptive segment held the largest market share of 38% in 2023 due to rapid technological advancements in contraception and an increase in awareness about family planning. Favourable government regulations and increasing awareness about different contraceptive methods in the U.S. are likely to drive the adoption of contraceptives and contribute to the market’s growth. For instance, U.S. Federal law mandates that all female-controlled contraceptive methods are covered without out-of-pocket patient costs. Counselling and related services for female contraception are also mandatorily covered. Moreover, key players constantly focus on product launches to meet the rising demand for contraceptives. For instance, in July 2023, Perrigo Company plc announced that it had submitted an application for the first-ever OTC birth control pill to the U.S. FDA.

The endometriosis & uterine fibroids segment is expected to showcase the fastest CAGR over the projected period. The growth can be attributed to several factors, such as the high prevalence of uterine fibroids among women in the U.S., an increasing preference for less invasive procedures by patients, and the high adoption of advanced technologies. Uterine fibroids are characterized by symptoms such as extreme menstrual flow, infertility, pelvic pain, and frequent urination. They are benign tumour’s that develop in the smooth muscle cells of the uterus. Furthermore, the market is expected to grow due to the increasing preference for minimally invasive and non-invasive procedures for fibroid treatment.

The others segment including women aged less than 50 years held the largest market share of 61% in 2023 and is anticipated to grow the fastest during the forecast period. The growth of the segment is attributed to the rising prevalence of women’s health conditions in the age group. Women below 50 are mainly of reproductive age and women’s health concerns in this age group are more likely associated with fertility, such as endometriosis, hormonal infertility, and PCOS. According to World Bank, in 2020, globally, around 64.8% of women are aged between 15 and 49, which is around 1.9 billion out of 3.8 billion of the total women population.

The 50 years and above segment is expected to showcase a significant CAGR over the forecast period. Women aged 50 and above form the core demographic that undergoes menopause, and hence, demand & adoption of postmenopausal products are high in this segment. According to UN 2020 global estimates, 958 million women were aged 50 and above. By 2050, this demographic is expected to reach 1.65 billion. NAMS stated that every day an estimated 6,000 women in the U.S. reach menopause, which totals more than 2 million women undergoing menopause per year. An increase in life expectancy has led to a rise in the menopausal population worldwide. The post-menopause period is expected to account for one-third of women’s lives.

The hospital pharmacy segment led the U.S. women’s health market with the largest revenue share of 49% in 2023. It is expected to maintain a dominant share throughout the forecast period. Hospital pharmacies give better access to women’s health products for both inpatient and outpatient. Some patients admitted to hospitals for complicated surgeries also need to take medications, including estrogenic, progesterone, and other hormone treatment combination therapies. Additionally, for some eye-related disorders, these are effective for outpatients. Hospital stay duration, overall healthcare expenses, level of treatment, and emergency care are all positively impacted by the presence of these facilities.

The online pharmacy segment is estimated to showcase the fastest CAGR over the forecast period. The growth can be attributed to greater internet accessibility and more knowledge of over-the-counter medicines, online pharmacies are being rapidly adopted in the U.S. Additionally, the COVID-19 pandemic favourably impacted the market, driving it at an exponential pace due to constraints on migration. However, online pharmacies are seeing a fall in sales as the situation has generally de-escalated. E-prescriptions are another factor in this market's expansion, and as this trend gains traction, it may help the situation for online pharmacies.

By Drug

By Application

By Age

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Women’s Health Market

5.1. COVID-19 Landscape: U.S. Women’s Health Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Women’s Health Market, By Drug

8.1. U.S. Women’s Health Market, by Drug, 2024-2033

8.1.1. ACTONEL

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. YAZ,Yasmin,Yasminelle

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. FORTEO

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Minastrin 24 Fe

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Mirena

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. NuvaRing

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. ORTHO TRI-CY LO

8.1.7.1. Market Revenue and Forecast (2021-2033)

8.1.8. Premarin

8.1.8.1. Market Revenue and Forecast (2021-2033)

8.1.9. Prolia

8.1.9.1. Market Revenue and Forecast (2021-2033)

8.1.10. Reclast/Aclasta

8.1.10.1. Market Revenue and Forecast (2021-2033)

8.1.11. XGEVA

8.1.11.1. Market Revenue and Forecast (2021-2033)

8.1.12. Zometa

8.1.12.1. Market Revenue and Forecast (2021-2033)

8.1.13. Others

8.1.13.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Women’s Health Market, By Application

9.1. U.S. Women’s Health Market, by Application, 2024-2033

9.1.1. Hormonal Infertility

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Contraceptives

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Postmenopausal Osteoporosis

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Endometriosis & Uterine Fibroids

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Menopause

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Polycystic Ovary Syndrome (PCOS)

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Women’s Health Market, By Age

10.1. U.S. Women’s Health Market, by Age, 2024-2033

10.1.1. 50 years and above

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Others

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Women’s Health Market, By Distribution Channel

11.1. U.S. Women’s Health Market, by Distribution Channel, 2024-2033

11.1.1. Hospital Pharmacy

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Retail Pharmacy

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Online Pharmacy

11.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Women’s Health Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Drug (2021-2033)

12.1.2. Market Revenue and Forecast, by Application (2021-2033)

12.1.3. Market Revenue and Forecast, by Age (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. AbbVie Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Bayer AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Merck & Co., Inc. (ORGANON)

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Pfizer, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Teva Pharmaceutical Industries Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Agile Therapeutics, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Amgen, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Apothecus Pharmaceutical Corp.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Lilly (Eli Lilly)

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Ferring B.V

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others