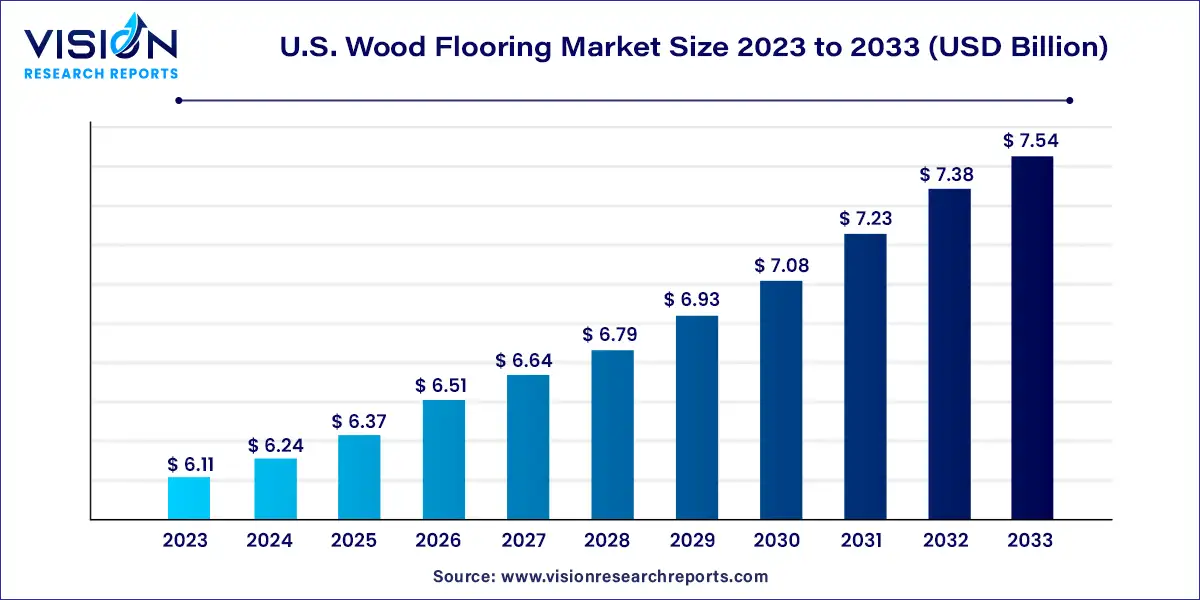

The U.S. wood flooring market was surpassed at USD 6.11 billion in 2023 and is expected to hit around USD 7.54 billion by 2033, growing at a CAGR of 2.13% from 2024 to 2033.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.11 billion |

| Revenue Forecast by 2033 | USD 7.54 billion |

| Growth rate from 2024 to 2033 | CAGR of 2.13% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of product, the engineered wood segment dominated the market with a revenue share of 54% in 2023. Over the years, engineered wood flooring has emerged as a comparatively low-cost alternative to solid wood flooring. This is because engineered wood is relatively less susceptible to moisture and temperature changes. Moreover, engineered wood floor coverings can be installed on any type of subfloor available in the form of concrete slabs, radiant heating systems, etc. using various installation methods including nailing, stapling, gluing, or floating. It reduces the installation time of this flooring. This is expected to surge the usage of engineered wood flooring in projects with time constraints.

The solid wood segment is anticipated to grow at the fastest CAGR of 2.64% over the forecast period. High durability and easy installation are the characteristic attributes of solid wood flooring. This flooring has a narrow plank size with a few seams between boards of wood. Solid wood flooring is highly preferred in residential and commercial applications in the U.S. owing to its durability and longevity. Moreover, this flooring can be developed from a wide variety of dent- and scratch-resistant wood.

In addition, solid wood flooring is stain-free and can be polished. This flooring can be sanded and re-finished multiple times over its lifetime, owing to its top-to-bottom solid core. Hardwood flooring provides a solid feel while walking as it is permanently installed by nailing it to subfloors. Solid wood flooring is highly durable and low maintenance. However, susceptibility to expansion owing to moisture is one of the major drawbacks associated with solid wood flooring.

In terms of wood type, the red oak segment is expected to grow at the fastest CAGR of 2.16% over the forecast period. Red oak or the Quercus rubra is a hardwood tree species native to the U.S. that can grow up to 5–6 meters in 10 years under optimal conditions and full sun. It is economically one of the most important timber species grown in North America. Red oak is widely used in the production of lumber and veneer used for developing flooring and furniture.

Red oak flooring is not preferred for use in kitchens and bathrooms owing to its susceptibility to movement under varying moisture conditions. However, this product is more porous than white oak flooring which makes the former stain well. As such, red oak wood can be used for developing bleached flooring. Thus, red oak wood flooring is highly preferred in households with pets and children.

The white oak segment held a revenue share of 31% in 2023. White oak wood is highly durable with a Janka value of 1360. It is widely used in the construction industry as structural timber owing to its low stiffness and overall good strength. Moreover, this wood is also utilized in shipbuilding & boat building, architectural joinery, exterior joinery, flooring, and railway sleeper manufacturing applications.

In terms of application, the residential segment dominated the market in 2023 with a revenue share of 79% and it is further expected to grow at the fastest CAGR of 2.27% over the forecast period. The growing rate of domestic and international migration and the ongoing urbanization are expected to drive the demand for residential buildings in the U.S. in the coming years. It is anticipated that it will lead to increased construction of residential buildings, thereby resulting in a rise in demand for wooden floor coverings used in these buildings in the country over the forecast period.

In addition, the rising number of single-family houses in the U.S. owing to the high disposable income of consumers is further projected to drive the demand for wood flooring in the residential segment. Engineered wood flooring is increasingly replacing traditional solid wood in residential buildings owing to its cost-effectiveness, ease of installation, and superior moisture resistance.

The commercial segment of the market in the U.S. includes commercial buildings, hotels, restaurants, cafes, retail stores, offices, gymnasiums, basketball courts, hospitals, etc. Wood flooring is widely used in commercial applications owing to its long lifecycle. Growing demand for sustainable building materials for use in commercial construction activities in the U.S. is expected to surge the demand for the product from 2024 to 2033.

In terms of end-use, the new construction segment is projected to grow at a CAGR of 1.85% from 2024 to 2033. The growth of this segment of the market can be attributed to the increasing construction activities related to new residential units and commercial spaces in the country.

According to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, the country had approximately 1,342,000 building permits, along with 1,427,000 housing projects that are ongoing, and approximately 1,490,000 housing projects that are nearing completion as of 2022. The increasing construction activities for developing new residential projects in the country are fueling the growth of the new construction segment of the market.

The replacement segment dominated the market in 2023 with a revenue share of 55%, and it is further expected to grow at the fastest CAGR of 2.35% over the forecast period. Wood flooring is highly durable and can last for a longer period than other types of floor coverings without losing its original quality. In addition, wood flooring can be refinished when dented or scratched.

These factors are leading to the large-scale adoption of wood flooring, which is replacing other floors such as LVT (luxury vinyl tiles) and terrazzo in existing buildings. In addition, continued investments in the repair and renovation of existing housing structures in the U.S. are driving the growth of the replacement segment.

By Product

By Wood Type

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Wood Flooring Market

5.1. COVID-19 Landscape: U.S. Wood Flooring Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Wood Flooring Market, By Product

8.1. U.S. Wood Flooring Market, by Product, 2024-2033

8.1.1. Solid Wood

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Engineered Wood

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Wood Flooring Market, By Wood Type

9.1. U.S. Wood Flooring Market, by Wood Type, 2024-2033

9.1.1. Red Oak

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. White Oak

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Maple

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Wood Flooring Market, By Application

10.1. U.S. Wood Flooring Market, by Application, 2024-2033

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Wood Flooring Market, By End-use

11.1. U.S. Wood Flooring Market, by End-use, 2024-2033

11.1.1. New Construction

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Replacement

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Wood Flooring Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Wood Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Mohawk Industries, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. EGGER Group

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Goodfellow, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Flooring Innovations

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Somerset Hardwood Flooring, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Shaw Industries Group, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Mannington Mills, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Home Legend, LLC

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Provenza Floors, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. DuChateau

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others