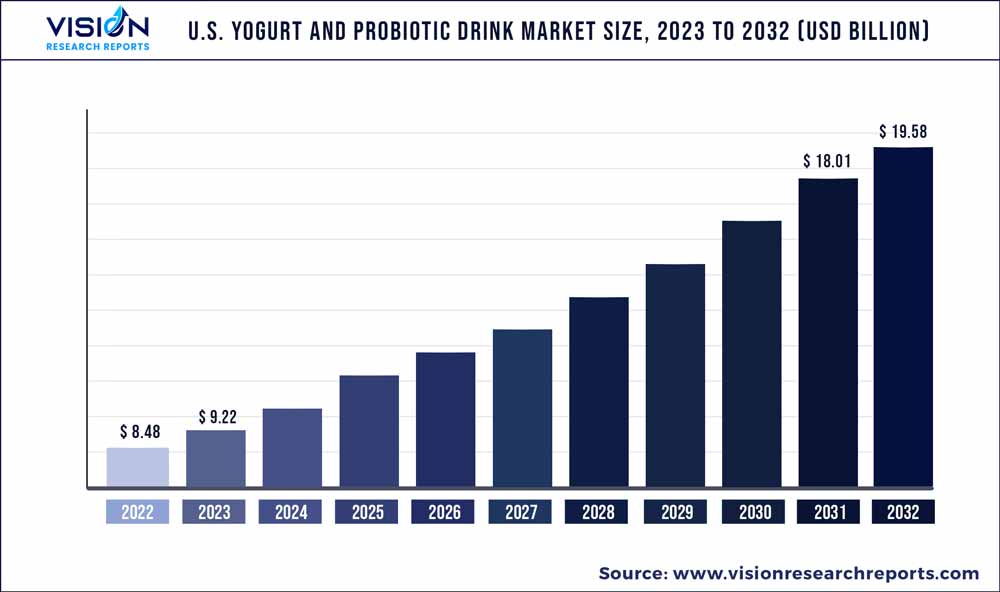

The U.S. yogurt and probiotic drink market was surpassed at USD 8.48 billion in 2022 and is expected to hit around USD 19.58 billion by 2032, growing at a CAGR of 8.73% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Yogurt And Probiotic Drink Market

| Report Coverage | Details |

| Market Size in 2022 | USD 8.48 billion |

| Revenue Forecast by 2032 | USD 19.58 billion |

| Growth rate from 2023 to 2032 | CAGR of 8.73% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Yakult Honsha Co. Ltd.; Chobani LLC; Danone; Grupo Lala; Califia Farms LLC; Bio K+ Kerry Company; Harmless Harvest; Goodbelly Probiotics; KeVita; Lifeway Foods Inc |

Increasing consumer awareness and understanding of the importance of maintaining a healthy gut are fueling the growth of the market. Consumers are becoming more conscious of the role of gut health in overall well-being and actively seek products that promote digestive health and improve gut flora. Factors, such as growing awareness about following a healthy lifestyle have driven the market growth in recent years. The increased demand for probiotics is driven by the growing consumer awareness about the importance of gut health and its impact on overall well-being. Beneficial probiotics are known to promote a healthy balance of microorganisms in the gut, thereby improving digestion, immunity, and overall health.

In addition, lifestyle changes and dietary preferences have also played a role in driving market growth. With the growing consumption of processed and unhealthy food products, many individuals are seeking ways to improve their diet and incorporate more natural and beneficial ingredients. Probiotics offer a convenient and accessible solution, as they can be consumed through supplements, fermented foods like yogurt and kefir, or even functional beverages. Furthermore, the expanding range of probiotic products available in the market has contributed to its growth. Manufacturers have introduced a variety of innovative and convenient formats, including capsules, tablets, powders, and even gummies, catering to different consumer preferences.

This diversification has made probiotics more appealing and accessible to a wider audience. In April 2022, the International Food Information Council (IFIC) conducted a study titled "Consumer Insights on Gut Health and Probiotics," which revealed a notable increase in Americans' curiosity regarding prebiotics, probiotics, postbiotics, and the gut microbiome. This study highlights a growing interest among the population in understanding the importance of these elements for maintaining a healthy gut and overall well-being. Approximately 32% of individuals actively make an effort to consume probiotics, with 60% of them aiming to consume probiotics once a day and 24% attempting to consume them multiple times daily.

Digestive health was considered the most crucial aspect of overall health by 24% of survey respondents. The survey also revealed that more individuals were actively trying to incorporate probiotics and prebiotics into their diets in 2021 compared to the previous year. These statistics indicate a growing preference for gut-healthy yogurt and probiotic beverages. Yogurt and probiotic beverages contain active bacteria that improve intestinal health and support healthy digestion. Probiotic drinks are currently experiencing rapid growth in the U.S. market.

The increasing awareness among consumers has led food system manufacturers to adopt a new approach to food production, wherein they incorporate or enhance the health benefits of yogurt and probiotic beverages to make them more beneficial and effective. Yogurt and probiotics-based foods and beverages are becoming increasingly popular and accepted among consumers as emerging functional foods. Traditional fermented beverages and functional drinks have long been recognized for including probiotic microorganisms. Among these options, fermented dairy products such as yogurt, cheese, acidified milk, and drinkable yogurt have gained significant acceptance as effective carriers of probiotics.

Product Insights

The yogurt drinks are the leading product segment, which accounted for a revenue share of 72% in 2022. The segment growth is being driven by the increasing preference of consumers for healthier food products and enhanced nutrition. Yogurt drinks provide the convenience of a ready-to-drink option while offering low-fat yogurt, which is rich in beneficial components like lean protein, branched-chain amino acids, calcium, and vitamin D. Research conducted by the Grande Cheese Company reveals that yogurt consumption can lead to a significant reduction in the risk of high blood pressure, potentially lowering it by up to 50%. This reduction in blood pressure is particularly important as it addresses a significant factor contributing to the development of heart disease.

Furthermore, it helps improve digestion, control appetite, and results in weight loss. According to a report published by International Dairy Foods Association in 2021, the upward surge in dairy consumption persisted in the U.S. owing to the growth in yogurt, butter, and cream consumption. In the yogurt drink segment, dairy-based yogurt drinks accounted for a prominent market share of 95.0% in 2022. However, the vegan yogurt drinks segment is expected to witness a lucrative growth rate of 10.64% during the forecast period of 2023 to 2032. The increasing adoption of vegan diets among consumers is a primary driver of growth in this segment.

A report titled "2021 Trend Insight: The Opportunity in Plant" by FONA International Inc. in April 2021 revealed that a significant portion, 39%, of consumers in the U.S. expressed interest in transitioning to a vegan lifestyle after the pandemic. Among those surveyed, 20% attributed health concerns as the main motivation behind their decision. These factors are expected to positively impact the growth of this segment. Probiotic drinks is the most lucrative product segment, which is projected to accelerate at a CAGR of 10.0% during the forecast period. Functional beverages containing probiotics are gaining traction among consumers owing to rising awareness about gut health and wellness.

The introduction of novel and exotic-flavored probiotic beverages with useful qualities is anticipated to open up lucrative chances in the market. In 2022, the water-based probiotic drink segment accounted for the dominant share of 57% of the probiotic drink segment. However, the vegan probiotic drink segment is projected to grow at a prominent growth rate of 12.7% during the forecast period. Vegan probiotic drinks have gained considerable popularity in recent years as more individuals adopt plant-based diets and seek alternatives to traditional dairy-based probiotic products. These drinks offer a nutritious and cruelty-free option for those looking to improve their gut health while adhering to a vegan lifestyle.

Type Insights

In the yogurt drink segment, drinks with probiotics are estimated to be the leading market. Yogurt drinks with probiotics held the dominant share of 55% in 2022. The main growth driver of the category is the growing customer interest in food and beverages with probiotics. A significant share of consumers in the U.S. are including probiotics in their daily diet, through breakfast, dinner, lunch, and snacks. This scenario is favorable for the segment's expansion. Kombucha dominated the probiotic drink market and accounted for a revenue share of 47% in 2022. Kombucha is a fermented probiotic drink that has gained significant popularity in recent years.

It is made by fermenting sweetened tea with a culture of bacteria and yeast, often referred to as a Symbiotic Culture of Bacteria and Yeast (SCOBY). In probiotic drinks, probiotic water is projected to witness a significant growth rate of 13.3% over the forecast period of 2023 to 2032.Probiotic waters, also known as probiotic-infused waters, have gained popularity as a convenient and refreshing way to incorporate probiotics into one's daily routine. Unlike traditional probiotic drinks that are dairy-based, or yogurt-based, probiotic waters are typically made by infusing water with specific strains of beneficial bacteria.

Distribution Channel Insights

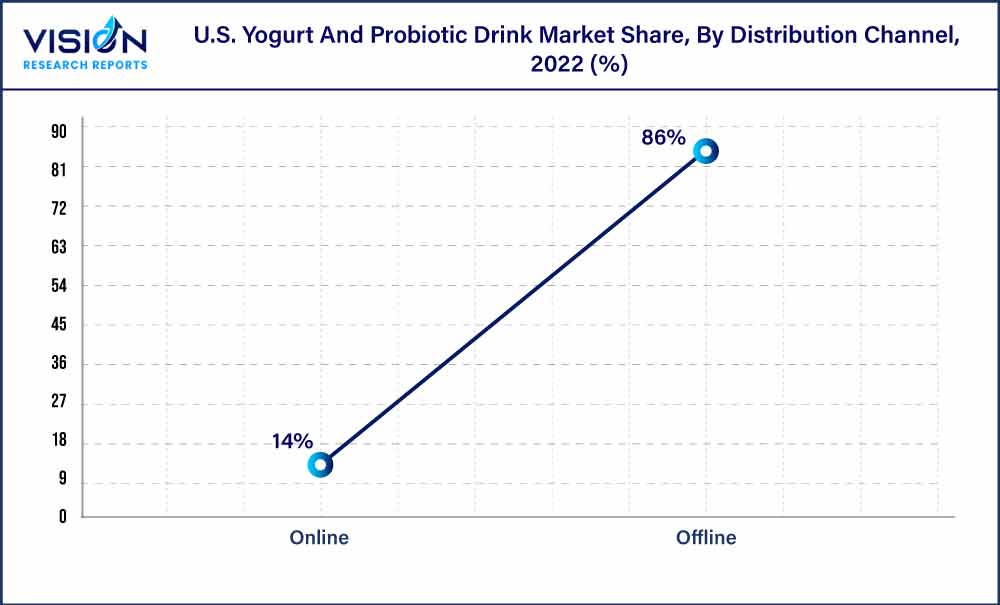

The product sales through offline distribution channels accounted for the largest revenue share of 86% in 2022. Offline distribution channels, which include hypermarkets, supermarkets, and convenience stores, play an important role in product distribution in the U.S. These channels offer consumers the opportunity to compare products from different brands along with their prices, leading to a rational decision to purchase the product. Offline distribution channels provide consumers with the option of immediate purchase, eliminating the need to wait for delivery.

Offline channels also allow manufacturers to establish secure relationships, leading to long-term partnerships and increased brand recognition. The online distribution channel is expected to register the fastest CAGR of 12.24% from 2023 to 2032. Recent consumption patterns and shifting shopper sentiments indicate that the online segment is poised for robust growth. The emergence of online shopping and the benefits of at-home delivery have persuaded consumers to shop for yogurt and probiotic drinks through online portals.

U.S. Yogurt And Probiotic Drink Market Segmentations:

By Product

By Type

By Distribution Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Yogurt And Probiotic Drink Market

5.1. COVID-19 Landscape: U.S. Yogurt And Probiotic Drink Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Yogurt And Probiotic Drink Market, By Product

8.1. U.S. Yogurt And Probiotic Drink Market, by Product, 2023-2032

8.1.1 Yogurt Drink

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Probiotic Drink

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Yogurt And Probiotic Drink Market, By Type

9.1. U.S. Yogurt And Probiotic Drink Market, by Type, 2023-2032

9.1.1. Yogurt Drink

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Probiotic Drink

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Yogurt And Probiotic Drink Market, By Distribution Channel

10.1. U.S. Yogurt And Probiotic Drink Market, by Distribution Channel, 2023-2032

10.1.1. Online

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Offline

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Yogurt And Probiotic Drink Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Product (2020-2032)

11.1.2. Market Revenue and Forecast, by Type (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 12. Company Profiles

12.1. Yakult Honsha Co. Ltd.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Chobani LLC.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Danone.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Grupo Lala

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Califia Farms LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Bio K+ Kerry Company

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Harmless Harvest

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Goodbelly Probiotics

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. KeVita.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Lifeway Foods Inc

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others