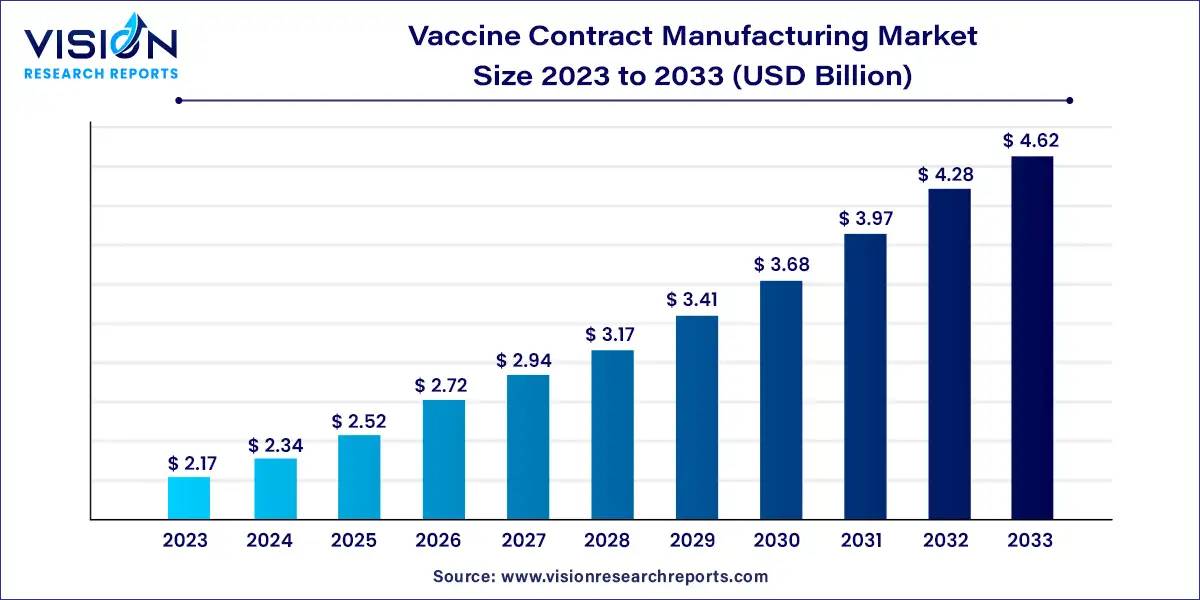

The global vaccine contract manufacturing market size was valued at USD 2.17 billion in 2023 and it is predicted to surpass around USD 4.62 billion by 2033 with a CAGR of 7.85% from 2024 to 2033.

The growth of the vaccine contract manufacturing market is propelled an increasing prevalence of infectious diseases worldwide drives the demand for vaccines, necessitating efficient manufacturing solutions. Secondly, rising investments in vaccine research and development initiatives contribute to the expansion of contract manufacturing services. Additionally, the emergence of novel vaccine technologies, such as mRNA vaccines, stimulates demand for specialized manufacturing capabilities offered by contract manufacturing organizations (CMOs). Moreover, the COVID-19 pandemic has underscored the importance of resilient vaccine manufacturing capacities, leading to heightened focus and investments in contract manufacturing services.

In 2023, the attenuated vaccines segment took the lead in the market, boasting the largest revenue share at 30%. These vaccines are relatively simple to develop for certain viruses, thus as cases of viral illnesses rise, this segment is projected to experience a notable Compound Annual Growth Rate (CAGR) during the forecast period. Moreover, due to advancements in manufacturing technology, the risk of attenuated vaccines reverting to a disease-producing state is exceedingly low or non-existent, further bolstering this segment's dominance.

On the other hand, the DNA vaccines segment is poised to witness the swiftest CAGR of 9.53% over the forecast period. DNA vaccines hold promise for lucrative growth prospects in the future, with various types currently undergoing human testing. Ongoing experiments and investigations to assess the effectiveness and safety of these vaccines are anticipated to propel market growth. The advent of DNA vaccines is expected to bring about a revolution in immunization practices.

In 2023, the downstream segment asserted its dominance in the market, commanding the largest revenue share of 51%. This segment is anticipated to uphold its leading position throughout the forecast period. The production of vaccines necessitates skilled personnel for both upstream and downstream processing, and contract manufacturing organizations (CMOs) are playing a crucial role by offering expertise and cutting-edge technologies to streamline the entire production chain. Downstream processing, encompassing product recovery and purification steps, demands meticulous attention and significant capital investment. Consequently, the segment's growth has been propelled by the substantial need for advanced biotechnological tools, capital, and skilled personnel to ensure the successful recovery of the vaccine as the final product.

Meanwhile, the upstream segment is poised to witness the fastest Compound Annual Growth Rate (CAGR) of 8.04% over the forecast period. The upstream workflow involves developing scalable production processes and high-titer methods to express various target molecules utilizing cell culture systems, microbial fermentation, transgenic sources, and insect cells. This encompasses process transfer-in and development, supply and toxicology study supply batches, recovery of soluble or solid materials, cell disruption, and process monitoring. Ongoing advancements in recombinant technologies and process control strategies are anticipated to fuel growth within this segment.

In 2023, the human-use segment took the lead in the market, capturing the largest revenue share of 93%. According to a CDC report, vaccinations administered to young children and infants over the past two decades are projected to prevent 322 million illnesses and save 732,000 lives in the U.S. in the coming year. Various programs initiated by government bodies and healthcare agencies aim to meet the increasing demand for vaccines. The World Health Organization (WHO) collaborates with nations globally to emphasize the importance of vaccines and immunization, ensuring that governments receive essential guidance and technical assistance to establish high-quality immunization programs.

Moreover, vaccination plays a crucial role in enhancing veterinary health and preventing animal diseases. This is expected to drive significant utilization of contract manufacturing organizations (CMOs) for animal inoculation production. Vaccination reduces the reliance on antibiotics for treating animals. Additionally, with the expanding human population, the demand for animal-based food continues to rise. Consequently, the importance of vaccination in the meat-production industry is anticipated to grow as well. These factors are likely to fuel the growth of the segment.

The vaccine contract manufacturing market in North America holds the largest share, primarily due to extensive vaccine manufacturing activities in the region, alongside the increasing presence of numerous biopharmaceutical facilities. Regulations governing the development of vaccines and other biologics in North America, particularly in the U.S. and Canada, are expected to have a significant impact on the advancement of contract manufacturing organizations (CMOs) and contract research organizations (CROs) in the industry.

Meanwhile, the vaccine contract manufacturing market in Asia Pacific is projected to witness a lucrative compound annual growth rate (CAGR) over the forecast period. This growth can be attributed to favorable regulatory changes, improving infrastructure, and a large pool of potential study subjects.

By Vaccine Type

By Workflow

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Vaccine Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Vaccine Contract Manufacturing Market

5.1. COVID-19 Landscape: Vaccine Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Vaccine Contract Manufacturing Market, By Vaccine Type

8.1. Vaccine Contract Manufacturing Market, by Vaccine Type, 2024-2033

8.1.1 Attenuated

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Inactivated

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Subunit-based

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Toxoid-based

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. DNA-based

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Vaccine Contract Manufacturing Market, By Workflow

9.1. Vaccine Contract Manufacturing Market, by Workflow, 2024-2033

9.1.1. Downstream

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Upstream

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Vaccine Contract Manufacturing Market, By Application

10.1. Vaccine Contract Manufacturing Market, by Application, 2024-2033

10.1.1. Human Use

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Veterinary

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Vaccine Contract Manufacturing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.1.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Vaccine Type (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Lonza.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. FUJIFILM Diosynth Biotechnologies.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Ajinomoto Co., Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Merck KGaA.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Catalent, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. IDT Biologika GmbH

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Curia Global, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. ICON plc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Cytovance Biologics (Hepalink).

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Syngene International Limited

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others