The global vanillic acid market was surpassed at USD 20.14 billion in 2022 and is expected to hit around USD 25.09 billion by 2032, growing at a CAGR of 2.22% from 2023 to 2032. The vanillic acid market in the United States was accounted for USD 3.62 billion in 2022.

Key Pointers

Report Scope of the Vanillic Acid Market

| Report Coverage | Details |

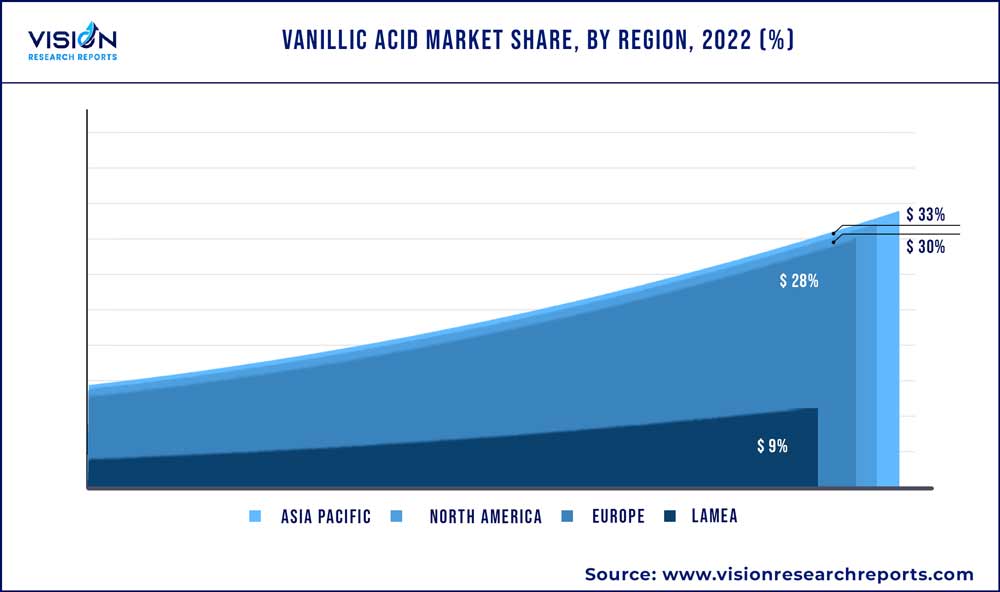

| Revenue Share of Asia Pacific in 2022 | 33% |

| Revenue Forecast by 2032 | USD 25.09 billion |

| Growth Rate from 2023 to 2032 | CAGR of 2.22% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Solvay; Donglian Nankai FlavorDlflavor; Quzhou Mingfeng Chemical; The Good Scents Company; Parchem Fine & Specialty Chemicals; Otto Chemie Pvt. Ltd.; Lanxess |

The rising demand for natural and organic goods in the food and cosmetic industries is one of the key drivers positively influencing market growth across regions. The product can be utilized as a flavoring agent and in the formulation of perfumes as well as medicinal intermediates. Vanillic acid is a naturally occurring substance that is obtained from plants, making it a preferred option for businesses trying to create natural and organic products.

Vanillic acid is a derivative of benzoic acid that is utilized for flavoring. It is an oxidized form of vanillin that is created when vanillin is transformed into ferulic acid.Several food producers use vanillic acid as a flavoring agent on account of its antioxidant, antibacterial, anti-inflammatory, anti-cancer, and anti-obesity properties. It is often used as a flavoring additive in confectionery, beverages, and baked goods. Furthermore, its vanilla flavor is greatly desired by customers, especially in the natural and organic food sector. Therefore, the growing food industry coupled with the adoption of vanillic acid is anticipated to fuel the market demand over the forecast period.

Vanillic acid is found in a few natural applications, such as vanilla beans, but the yield from these applications is relatively low. This limited availability of natural applications may lead to supply constraints and higher prices further, thus, limiting market growth. Furthermore, some studies suggest that a high intake of vanillic acid may have negative effects, such as an increased risk of liver and kidney failure or damage.

Moreover, purity is subject to regulations related to its usage in the food, beverages, and pharmaceutical industries. Thus, any changes in regulation or restriction on the usage of vanillic acid in certain applications can directly affect the demand for the compound in the forecast period.

Purity Insights

The 98% purity segment dominated the market with a share of over 55% in 2022. This is attributed to rising utilization in the food & beverage and personal care industry. It acts as an intermediary in the purification process of vanillin from ferulic acid. In the food industry, it is widely used as a flavoring agent. It is also used for anti-aging skin treatments. Owing to several factors such as changing lifestyles, increasing age, diet, and certain environmental factors such as sunlight, and pollution, the demand for skin treatments continues to rise.

The 99% purity vanillic acid is gaining popularity on account of its rising demand in the food & beverage industry, especially for wine and vinegar. It is non-toxic to HT22 cells at all three concentrations (50, 100, and 200 μM); Vanillic acid co-treatment with Aβ1-42 significantly increases (1.5-, 1.9- and 2-fold respectively) cell viability. They are soluble in water, ether, and alcohol, making them a preferred purity standard of vanillic acid.

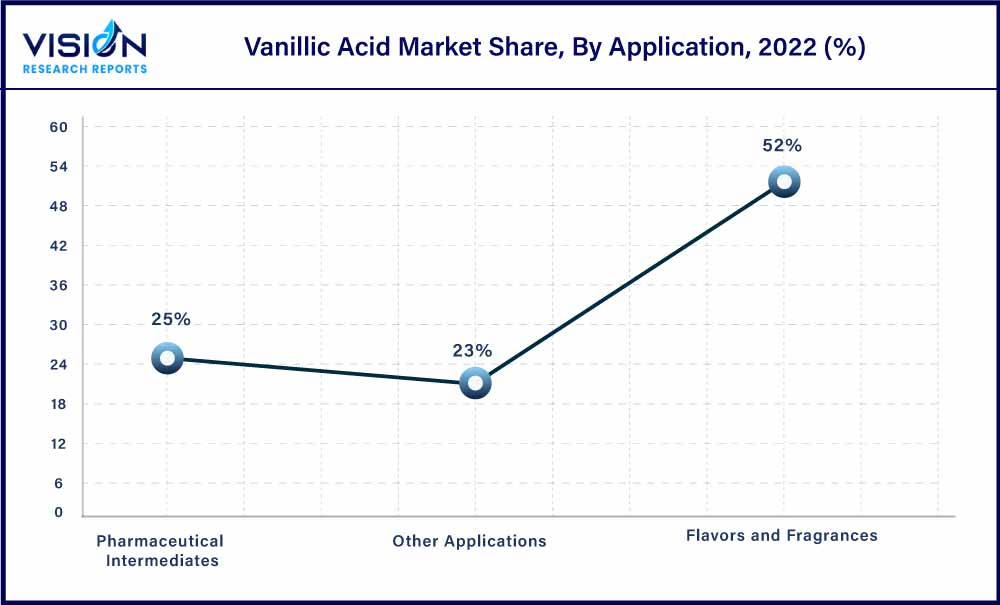

Application Insights

The flavors & fragrances segment dominated the market with a revenue share of over 55% in 2022. This is attributed to growing awareness regarding environment-friendly and natural perfumes, skin-friendly deodorants, and other aromatic purifiers. It is used as a key aroma ingredient in making various fragrances and perfumeries such as aromatic candles, essential oils, sweet-flavored perfumes, organic perfumes, and deodorants. In addition, increasing consumer demand in applications such as aromatherapy, toiletry, and car fresheners is expected to boost the demand in the future.

In cosmetic and personal care, vanillic acid is used as an antioxidant and skin conditioning agent. The growing demand for natural and organic cosmetics and personal care is expected to drive the demand for market growth. Furthermore, the food & beverage industry has been experiencing a change in the consumption pattern on account of rising disposable income. Furthermore, changing food consumption patterns of the population due to a hectic lifestyle also aid market growth. Superior economic growth coupled with the growing demand for ready-to-eat and processed foods is boosting the use of vanillin in this industry.

In the pharmaceutical industry, vanillic acid is used as an intermediary to produce various drugs. It has been shown to have anti-inflammatory and anti-cancer properties, making it a potentially valuable compound for the development of new drugs. It is used for tablet masking, minimizing bitter taste in medicines, oral medicine processing, topical medicated lotions, and other pharmaceutical products. Thus, the demand for vanillic acid is likely to grow over the upcoming years driven by the increasing application in end-use industries such as the food, cosmetics, and pharmaceutical industries.

Regional Insights

The Asia Pacific regional segment dominated the market with a revenue share of over 33% in 2022. This is attributed to the presence of increasing demand in major countries such as China, India, Japan, and Germany. The food & beverage industry in these countries has been experiencing significant growth, which in turn is increasing the demand for vanillic acid over the past few years.

Factors such as rapid urbanization, increasing spending power, high household income, industrialization, and changing consumer food preferences are responsible for growth in the food industry in the North America region. According to the Centre for Sustainable Systems, University of Michigan, U.S., around 83% of the U.S. population lives in urban cities, which is expected to reach 89% by 2050. The growing urban population has influenced food preferences, which, in turn, is favoring the processing & food industry. This is expected to positively impact the vanillic acid industry over the forecast period.

The steady growth of the pharmaceutical industry in the European region is expected to boost the demand for vanillic acid over the forecast period. A more collaborative environment between the European regulatory bodies and pharma manufacturers is expected to enable the launch of several initiatives in the region. For instance, Priority Medicine (PRIME) scheme was launched to strengthen the support for the development of medicines that target unmet medical needs.

Vanillic Acid Market Segmentations:

By Purity

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Vanillic Acid Market

5.1. COVID-19 Landscape: Vanillic Acid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Vanillic Acid Market, By Purity

8.1. Vanillic Acid Market, by Purity, 2023-2032

8.1.1. Purity 99%

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Purity 98%

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Vanillic Acid Market, By Application

9.1. Vanillic Acid Market, by Application, 2023-2032

9.1.1. Pharmaceutical Intermediates

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Flavors and Fragrances

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Other Applications

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Vanillic Acid Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Purity (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Purity (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Purity (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Purity (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Purity (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Purity (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Purity (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Purity (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Purity (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Purity (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Purity (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Purity (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Purity (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Purity (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Purity (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Purity (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Purity (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Purity (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Purity (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Purity (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Purity (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Solvay

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Donglian Nankai FlavorDlflavor

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Quzhou Mingfeng Chemical

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. The Good Scents Company

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Parchem Fine & Specialty Chemicals

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Otto Chemie Pvt. Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Lanxess

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others