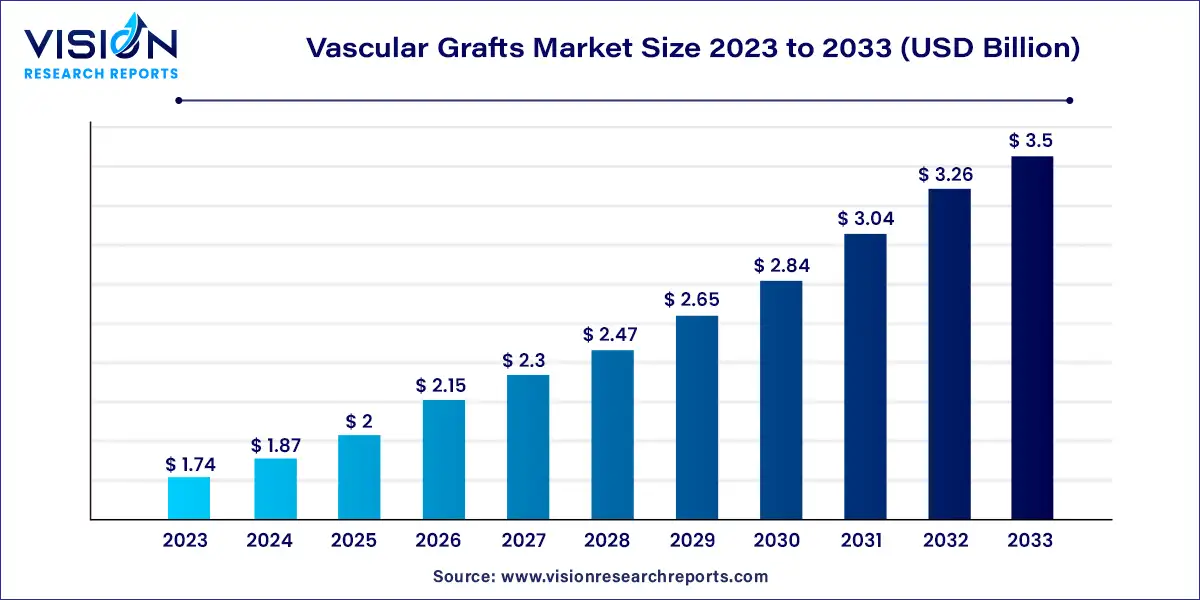

The global vascular graft market size was estimated at around USD 1.74 billion in 2023 and it is projected to hit around USD 3.5 billion by 2033, growing at a CAGR of 7.23% from 2024 to 2033.

The growth of the vascular grafts market is driven by an increasing prevalence of vascular diseases, such as peripheral arterial disease and coronary artery disease, is driving the demand for vascular grafts as a critical treatment option. Secondly, advancements in technology, including the development of novel graft materials and minimally invasive surgical techniques, are enhancing the efficacy and safety of vascular graft procedures, thereby expanding the market. Additionally, the aging population worldwide is contributing to the rising demand for vascular grafts, as elderly individuals are more susceptible to vascular disorders. Moreover, the surge in reconstructive surgeries, such as bypass grafting and endovascular interventions, is fueling market growth by increasing the utilization of vascular grafts across various medical settings. These factors collectively create a favorable environment for the growth of the vascular grafts market, promising continued expansion in the foreseeable future.

The synthetic vascular grafts segment dominated the market in 2023, accounting for the largest revenue share at 52%. Within this segment, polyester vascular grafts play a significant role. Polyester fabric, a synthetic material known for its strong mechanical properties, forms the basis of these grafts, making them popular for vascular surgeries. Key industry players like Getinge AB are actively engaged in producing high-quality polyester grafts tailored for treating aortic and peripheral vascular diseases. Additionally, companies such as LeMaitre Vascular, Inc. and B. Braun SE are notable contributors to this market segment, offering vascular grafts made from polyester materials. The availability of polyester vascular grafts from these major players is expected to drive segment growth during the forecast period.

Hybrid vascular grafts are forecasted to experience the fastest CAGR over the forecast period. This growth is fueled by the demand for innovative solutions that blend the benefits of synthetic materials with the biocompatibility of biological components. Hybrid vascular grafts typically combine synthetic materials like polyethylene terephthalate (PET) or polytetrafluoroethylene (PTFE) with biological components such as tissue-engineered scaffolds or extracellular matrices. This combination results in improved mechanical properties, durability, and biocompatibility, making them suitable for a wide range of vascular applications.

In 2023, the endovascular stent grafts segment emerged as the market leader, commanding a substantial revenue share of 64%. Endovascular stent grafts consist of a fabric tube supported by a metal mesh stent, extensively utilized in addressing various vascular conditions, such as thoracic and abdominal aortic aneurysms. Their efficacy in delivering treatment while minimizing patient trauma and recovery time has propelled their widespread adoption, solidifying their dominance within the market.

Furthermore, the peripheral vascular grafts segment is anticipated to experience notable growth over the forecast period. This growth is attributed to the escalating prevalence of peripheral vascular diseases (PVD), serving as a significant market driver. For instance, a study published by Elsevier, Inc. in November 2023 reported approximately 145,870 diagnosed cases of peripheral arterial diseases (PAD) among the Danish population. The study forecasts a continued increase in prevalence during the forecast period, further fueling market expansion.

In 2023, the cardiac aneurysm segment emerged as the market leader, commanding the largest revenue share at 51%. Aneurysms, characterized by bulges in the walls of blood vessels, particularly arteries like the aorta responsible for oxygenated blood transport from the heart to the body, are prevalent conditions. This segment encompasses coronary artery aneurysms and abdominal aortic aneurysms (AAA), affecting a significant number of individuals. According to a July 2021 article by John Wiley & Sons, Inc., approximately 80,000 individuals aged 65 to 74 years in England suffer from AAA, contributing to around 6,000 deaths annually in England and Wales alone. Hence, the high prevalence of AAA is driving the demand for various vascular grafts utilized in treating cardiac aneurysms.

Moreover, the vascular occlusion segment is projected to witness the fastest Compound Annual Growth Rate (CAGR) during the forecast period. The rising incidence of vascular occlusive diseases such as peripheral arterial occlusive disease is expected to propel the demand for grafts used in their treatment. Peripheral arterial disease (PAD) is a prevalent chronic occlusive condition. As highlighted in a study published by Frontiers in April 2022, approximately 113,443,017 individuals globally were affected by peripheral artery disease (PAD) in 2019, with approximately 10,504,092 new cases reported. Consequently, the increasing prevalence of these occlusive diseases is anticipated to drive demand for grafts designed to address such vascular occlusive conditions.

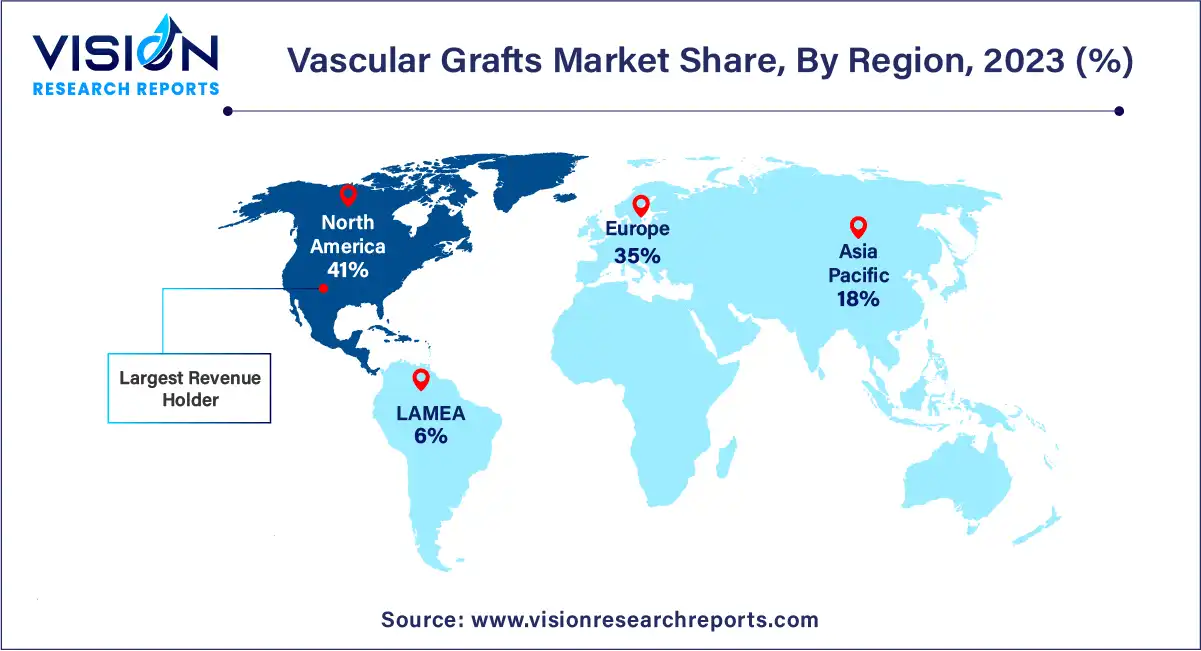

In 2023, North America emerged as the dominant force in the vascular grafts market, holding a significant revenue share of 41%. The region's market growth is propelled by the escalating prevalence of cardiovascular diseases and the growing demand for vascular surgeries. Conditions such as atherosclerosis and aneurysms are on the rise, creating an increasing need for vascular grafts to facilitate blood flow and address vascular issues. According to CDC data, heart disease stands as the leading cause of mortality across various demographic segments in the U.S., emphasizing the urgent requirement for medical interventions, including vascular grafts. With cardiovascular disease claiming a life every 33 seconds and contributing to approximately 699,659 deaths in 2022, the demand for effective treatment modalities remains substantial.

Meanwhile, the vascular grafts market in Asia Pacific emerged as the fastest-growing market in 2023. The surge in kidney disorders across the Asia Pacific region is a key driver behind this growth. With an estimated 434.3 million cases in the region, including 65.6 million individuals with advanced disease, the prevalence of kidney disorders varies significantly, ranging from 4.7% to 17.4%. China and India carry the highest burdens in this regard.

By Product

By Application

By Raw Material

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others