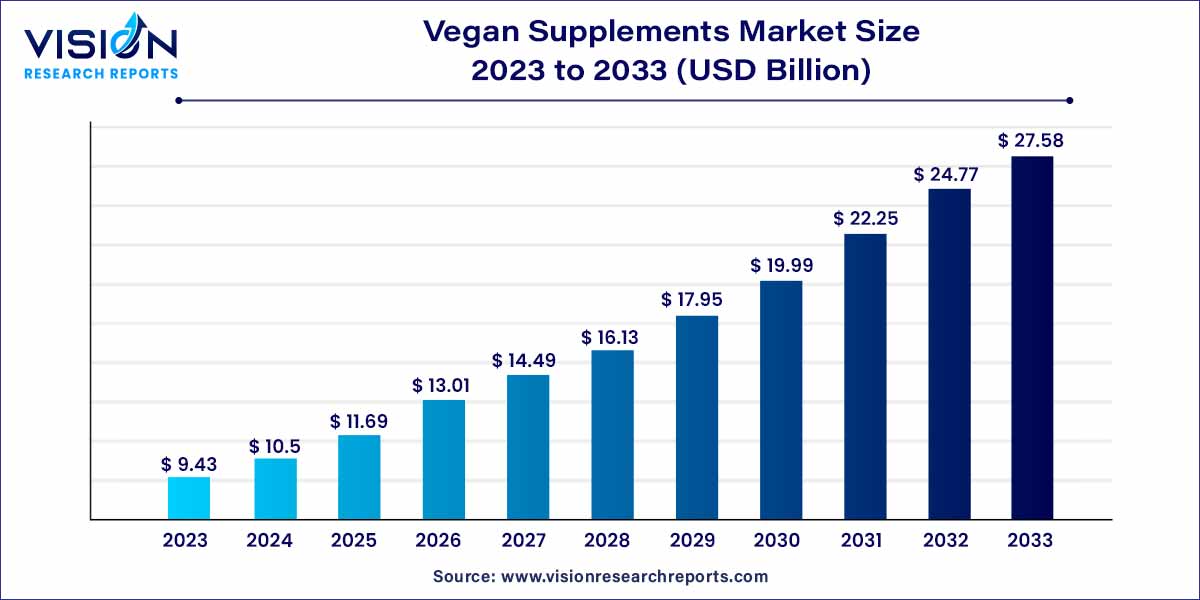

The global vegan supplements market was estimated at USD 9.43 billion in 2023 and it is expected to surpass around USD 27.58 billion by 2033, poised to grow at a CAGR of 11.33% from 2024 to 2033.

The global market for vegan supplements has witnessed a significant surge in recent years, driven by the increasing adoption of plant-based lifestyles and a growing awareness of health and environmental concerns. As consumers seek ethical and sustainable alternatives, the demand for vegan supplements continues to rise, creating a dynamic and evolving market landscape.

The burgeoning growth of the vegan supplements market can be attributed to a confluence of factors propelling its expansion. Foremost among these is the escalating adoption of veganism as a lifestyle choice, fueled by ethical considerations and a heightened awareness of environmental impact. With an increasing number of individuals opting for plant-based diets, the demand for vegan supplements has surged significantly. Additionally, the global emphasis on health and wellness has driven consumers to seek clean, plant-derived alternatives, positioning vegan supplements as a preferred choice for the health-conscious demographic. Furthermore, the rising tide of environmental sustainability concerns has prompted consumers to scrutinize the ecological footprint of their choices, and vegan supplements, known for their comparatively lower environmental impact, align seamlessly with this conscientious shift. These intertwined factors contribute to a robust and sustained growth trajectory for the vegan supplements market, creating a landscape ripe with opportunities for businesses in this thriving sector.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 11.33% |

| Market Revenue by 2033 | USD 27.58 billion |

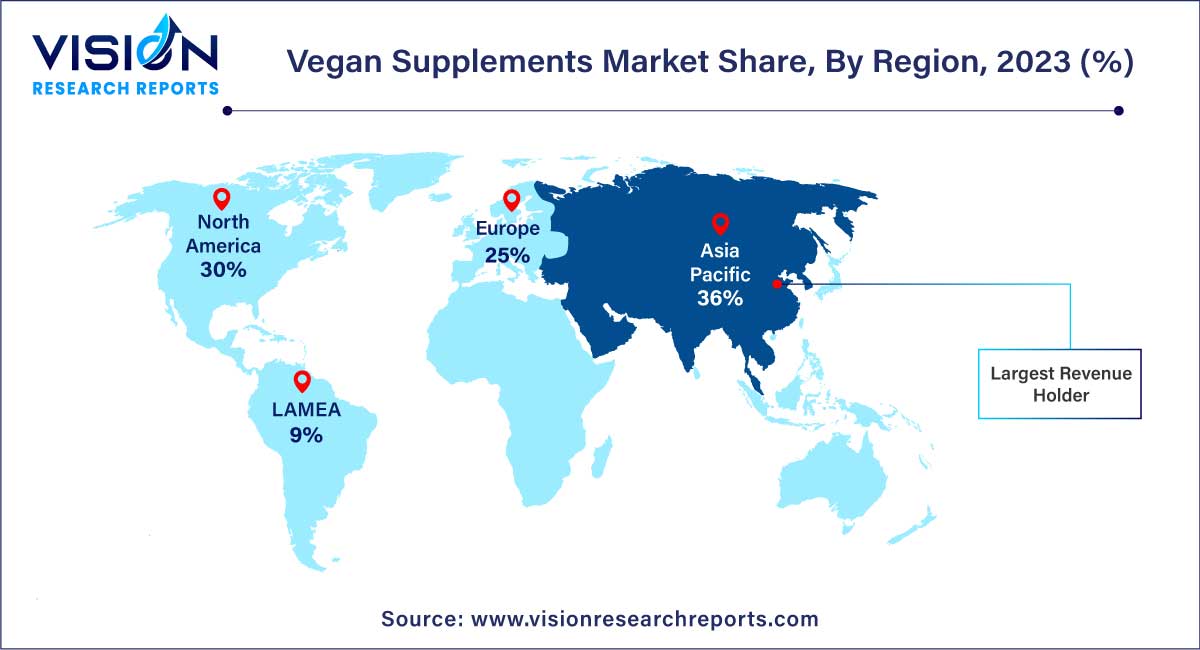

| Revenue Share of Asia Pacific in 2023 | 36% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The vitamins and minerals segment dominated the market with the largest revenue share of 36% in 2023. The escalating adoption of vegan and flexitarian diets, coupled with a growing health-conscious population, has fueled a notable increase in the demand for vegan vitamins and minerals supplements. These supplements boast enhanced ingredient profiles tailored to meet specific nutritional requirements. According to the World Animal Foundation (WAF), the global vegan population reached 88 million in March 2023, with approximately 629,000 individuals participating in the Veganuary Campaign in 2022. Research indicates that vegans may exhibit lower levels of certain nutrients and health markers compared to non-vegetarians, such as vitamin D, iodine, selenium, among others. A study by King's College of London revealed that 20% of vegans are at risk of Vitamin B12 deficiency. Given the substantial demand, the vitamins and minerals segment is poised for lucrative growth in the foreseeable future.

On the other hand, the protein supplements segment is expected to experience the fastest CAGR of 12.35% throughout the forecast period. This surge is attributed to the rising popularity of plant-based protein supplements, particularly among vegetarians. These plant-based proteins are allergen-free and non-GMO, making them an attractive choice for individuals with food sensitivities. The increasing demand for these supplements is driven by a need to address the nutritional requirements of those who are lactose-intolerant and individuals with specific dietary preferences.

The capsules segment held the largest revenue share in 2023. The growing preference for plant-based supplements in capsule form is a key driver, attributed to their increasing availability, allergen-free and non-GMO characteristics, and alignment with ethical and environmental considerations. Capsules are favored for being tasteless, quick to dissolve in the intestines, and easier to manufacture than tablets, contributing to their popularity among consumers. Additionally, ongoing innovations introduce newer capsules designed to enhance bioavailability, optimize release, and prolong the benefits of supplements. The numerous advantages offered by capsule formulations, such as a higher rate of absorption, lower irritation to the Gastrointestinal (GI) tract, and availability in various sizes based on dosage, are significant factors fueling the growth of this segment.

On the other hand, the powder segment is projected to register the fastest CAGR over the forecast period. Vegan supplements in powdered form present advantages in terms of easier breakdown, processing, and absorption by the body, resulting in reduced bloating and improved digestion compared to alternative options. Furthermore, powder supplements offer versatility, as they can be incorporated into various forms such as baked goods, soups, stews, smoothies, and used as a garnish on salads and prepared vegetables, making them exceptionally popular among the vegan population.

The offline segment asserted its dominance in the market in 2023, with offline distribution channels such as drug stores, hypermarkets, and supermarkets playing a pivotal role. These brick-and-mortar platforms provide a diverse landscape for consumer preferences and market dynamics. They offer customers the opportunity to physically examine products, read labels, seek advice from knowledgeable staff, and benefit from loyalty programs, all while enjoying the convenience of easy access. Offline retailers remain essential in delivering personalized assistance, immediate access to product ingredients, and establishing tangible connections between consumers and the expanding array of plant-based supplement options.

Conversely, the online segment is poised to experience the fastest CAGR throughout the forecast period. The increasing adoption of e-commerce platforms for the sale of vegan supplements is a primary driver for the growth of this segment. Additionally, the surge in self-directed consumers significantly contributes to the utilization of online channels for purchasing nutritional ingredients, driven by frequent discounts on a diverse range of supplements. For instance, in October 2022, Amazon offered a substantial 50% discount on leading supplement brands such as Solgar, Inc. The heightened demand for personalized ingredients, coupled with the ease of purchasing supplements online compared to traditional modes, has led to significant sales growth on e-commerce platforms, thereby contributing to the overall expansion of the online segment.

In 2023, the Asia Pacific region dominated the market with the largest market share of 36%. The dominance of this region can be attributed to its large and diverse population, coupled with a heightened awareness of health and wellness. This has led to a notable shift towards plant-based diets, with growing concerns about environmental sustainability and animal welfare further contributing to the popularity of plant-based supplements in the Asia Pacific region.

Within Asia Pacific, Japan held a significant market share in 2023. The country's strong cultural tradition of plant-based diets, rooted in a history of Buddhist vegetarianism, has cultivated a receptive population for vegan products. Moreover, Japan's aging demographic is increasingly focused on health and wellness, fostering a growing demand for nutritional supplements, including vegan options.

Looking ahead, North America is poised to experience a lucrative CAGR from 2024 to 2033. The region has witnessed a substantial surge in the adoption of plant-based diets and vegan lifestyles, driven by an increasing awareness of health and environmental concerns. The presence of key market players, continuous product innovation, and a proactive approach to sustainable and ethical consumer choices further contribute to North America's prominence in propelling the growth of the market.

By Ingredient

By Form

By Distribution Channel

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Ingredient Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Vegan Supplements Market

5.1. COVID-19 Landscape: Vegan Supplements Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Vegan Supplements Market, By Ingredient

8.1. Vegan Supplements Market, by Ingredient, 2024-2033

8.1.1 Vitamins & Minerals

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Protein Supplements

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Omega-3 Fatty Acids

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Vegan Supplements Market, By Form

9.1. Vegan Supplements Market, by Form, 2024-2033

9.1.1. Capsules

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Tablets

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Powders

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Liquids

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Vegan Supplements Market, By Distribution Channel

10.1. Vegan Supplements Market, by Distribution Channel, 2024-2033

10.1.1. Offline

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Online

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Vegan Supplements Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.1.2. Market Revenue and Forecast, by Form (2021-2033)

11.1.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.2.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Form (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.3.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Form (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Form (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Form (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Ingredient (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Form (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 12. Company Profiles

12.1. Deva Nutrition LLC

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Amazing Grass

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Vega

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. NOW Foods

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Nordic Naturals

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. PlantFusion

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Orgain, LLC.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Solgar, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Nutricost

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. NutraBlast

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others