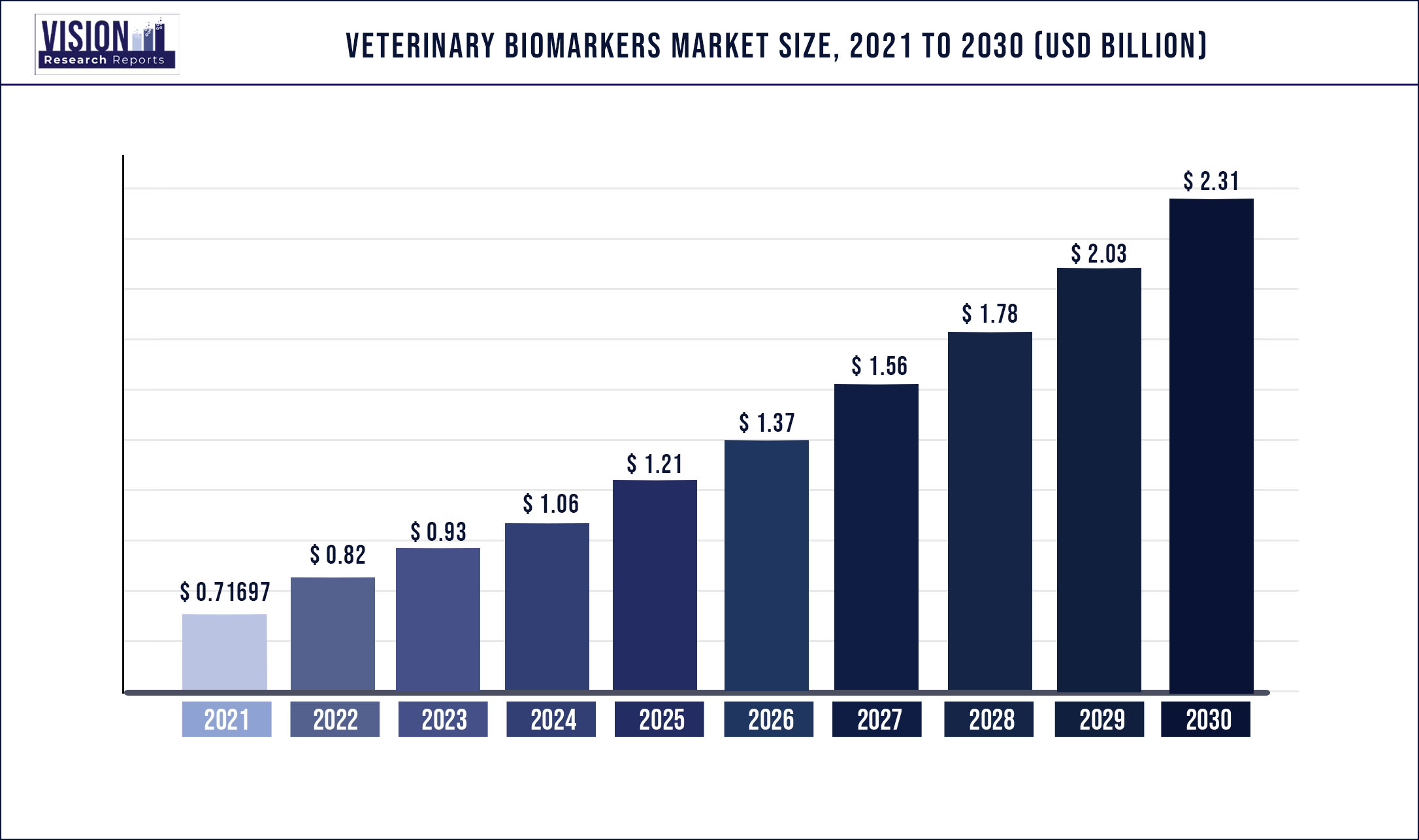

The global veterinary biomarkers market was valued at USD 716.97 million in 2021 and it is predicted to surpass around USD 2.31 billion by 2030 with a CAGR of 13.88% from 2022 to 2030

Report Highlights

The key drivers for the market growth are the increasing prevalence of numerous acute and chronic disorders among animals coupled with the growing demand for better & accurate diagnostic and monitoring technologies. According to the American Veterinary Medical Association, almost half of the dog population is developing cancer at the same rate as humans. This supports the requirement for biomarker-based specific diagnostic kits for timely disease predictions and treatments.

The COVID-19 pandemic created barriers and challenges in the global animal health industry that include decreased marketing and sales activities, low veterinary clinic admission, cancellation of routine pet check-ups, and a low number of disease diagnoses tests performed in veterinary hospitals. However, governments and veterinary organizations of various countries implemented strategies and safety measures to resume veterinary practices and research during the pandemic. According to the American Veterinary Medical Association, telemedicine services were widely incorporated in veterinary clinics and hospitals to curb the impact of lockdowns and the pet parents were given digital training to use certain diagnostic kits.

The increasing animal care expenditure in both developing and developed economies is a significant opportunity considered for market growth. According to the American Kennel Club (AKC), pet owners in the U.S. were seen to spend more money on their pet’s wellness and related healthcare products. The American Pet Products Association reported that the overall pet industry sale exceeded USD 100 billion by the end of 2020. The AKC also stated that online veterinary diagnosis product shopping increased by 86% after the emergence of the pandemic. In addition, the research and development activity in the upcoming fields such as biomarkers in the veterinary is significantly growing over the last decade. These factors are expected to boost the growth of the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 716.97 million |

| Revenue Forecast by 2030 | USD 2.31 billion |

| Growth rate from 2022 to 2030 | CAGR of 13.88% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Animal type, product type, application, disease type, Region |

| Companies Covered | Zoetis; Virbac; Life Diagnostics; ACUVET BIOTECH; Merck & Co., Inc.; IDEXX Laboratories, Inc.; MI:RNA Diagnostics Ltd.; Mercodia AB; Antech Diagnostics, Inc.; Avacta Animal Health Limited |

Animal Type Insights

The companion animals segment dominated the market for veterinary biomarkers and accounted for the highest revenue share of 61.62% in 2021. This is due to the rising adoption rates of dogs, and the significant disease prevalence rates that were seen among them. According to American Veterinary Medical Association, 45% of American households owned dogs in 2020. Similarly, according to the European Pet Food Industry, nearly 88 million households in Europe owned a pet, and the cat population rate in the region was estimated to be 110 million followed by dogs with 90 million in 2020. In addition, the COVID-19 pandemic has encouraged most people in the world to adopt companion animals for psychological comfort.

The production animal segment accounted for a significant share in the market for veterinary biomarkers in 2021, owing to the growing population of production animals such as cattle, and livestock in developing countries such as China, India, and Japan. For instance, according to the National Dairy Development Board, the cattle population in India grew from 185 million in 2003 to 193 million in 2019. Similarly, the total bovine population increased from 283 million in 2003 to 302 million in 2019. In addition, the growing prevalence of serious infectious diseases such as tuberculosis among the production animals is a major concern to increase numerous diagnostic approaches.

Product Type Insights

The biomarkers, kits, and reagents segment held the largest revenue share of 81.27% in 2021. This is owing to the wide availability of major brands of biomarkers and test kits launched by key players in the market. The veterinarians prefer sensitive and accurate disease diagnostic approaches using biomarker test kits to understand the progression of the disorder and to provide specific treatments targeting the biological indicator of the disease. In addition, the growing awareness of biomarker application in the veterinary field in developing countries is fueling the growth of the market for veterinary biomarkers in recent years.

The biomarker readers segment is expected to witness a significant revenue share over the forecast period owing to the growing diagnosis rate in veterinary practices. As human biomarker readers are not accurate and calibrated for animal readings, specific veterinary biomarker readers have been launched by the key players. For instance, Virbac launched an intuitive and compact laser-based fluorescent reader called Speed Reader that exactly measures the biomarker concentration in animal serum or plasma samples. This factor is fueling the growth of the segment in the market for veterinary biomarkers.

Application Insights

The disease diagnostics segment held the largest revenue share of 57.95% in 2021. This is owing to the growing number of veterinary admissions in both developed and developing countries for numerous diseases diagnosis. In addition, the rising number of veterinary clinics and hospitals with trained veterinarians is another factor that boosts the growth of the segment. For instance, according to the Federation of Veterinarians of Europe, the number of veterinarians was approximately 263 million in Europe in 2019.

The preclinical research segment held a significant market share in 2021 and is expected to witness the fastest CAGR over the forecast period. This is owing to the increasing research and development activities in the area of veterinary biomarkers and post-genomic technologies. The advanced strategies initiated by animal health key players to identify novel biomarkers or disease indicators are further enhancing the opportunity for segment growth. For instance, Boehringer Ingelheim announced in April 2022, that the company welcomes any partnership or collaboration to develop novel cancer therapeutic concepts with a specific biomarker-based approach.

Disease Type Insights

The inflammatory and infectious diseases segment held the largest revenue share of over 35.2% in 2021. This is owing to the growing prevalence of various types of infectious diseases that arises among companion and production animals. The concern of the government to prevent zoonotic disease transmission from animals to humans has led to various diagnostic strategies in many countries. The penetration of biomarker-based diagnostic kits is rising in such activities, thereby widening the scope of the products in the market for veterinary biomarkers.

Other disease types such as cardiovascular diseases and cancer are commonly prevailing among animals demanding more attention for proper diagnosis. Most of these diseases are commonly asymptomatic and widely getting ignored until the progression of serious stages. For instance, according to the University of Kentucky, U.K., most of the cattle infected with cancer show no sign, thereby being neglected for timely treatments leading to 5-20% of sudden death cases. Hence, the demand for accurate diagnostic tests to predict progressing diseases and their risk factors in benign stages is widely growing.

Regional Insights

North America held more than a 35.06% share of the market in 2021. The high share of the region is due to the significant presence of key players, the adoption of various strategies initiated by key companies to increase market penetration, rising research activities, rising diagnostic rates, and increasing animal population and vet care expenditure. The growing number of veterinary clinics with licensed and trained veterinarians in the countries is another factor to boost the growth of the market for veterinary biomarkers. According to the AVMA, in 2020 nearly 118,624 licensed veterinarians were estimated in the U.S. which majorly catered to companion animal patients.

Europe region held the second-largest revenue share in 2021. This is owing to the presence of major key players such as Virbac, ACUVET BIOTECH, and others in the European countries. The Asia Pacific region is estimated to grow fast with a CAGR of over 13.73% in the next few years. This is attributable to the rising animal healthcare expenditure and disposable income in key markets coupled with rising awareness for biomarkers in veterinary practices. The growing demand for the proper and timely diagnosis of numerous diseases, and pet humanization in developing countries like India are further boosting the growth of the market for veterinary biomarkers.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Veterinary Biomarkers Market

5.1. COVID-19 Landscape: Veterinary Biomarkers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Veterinary Biomarkers Market, By Animal Type

8.1. Veterinary Biomarkers Market, by Animal Type, 2022-2030

8.1.1. Companion Animals

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Production Animals

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Veterinary Biomarkers Market, By Product Type

9.1. Veterinary Biomarkers Market, by Product Type e, 2022-2030

9.1.1. Biomarkers, Kits & Reagents

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Biomarker Readers

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Veterinary Biomarkers Market, By Application

10.1. Veterinary Biomarkers Market, by Application, 2022-2030

10.1.1. Disease Diagnostics

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Preclinical Research

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Veterinary Biomarkers Market, By Disease Type

11.1. Veterinary Biomarkers Market, by Disease Type, 2022-2030

11.1.1. Inflammatory & Infectious Diseases

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Cardiovascular Diseases

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Skeletal Muscle Diseases

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Tumor

11.1.4.1. Market Revenue and Forecast (2017-2030)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Veterinary Biomarkers Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.1.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.4. Market Revenue and Forecast, by Disease Type (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Animal Type (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Product Type (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.4. Market Revenue and Forecast, by Disease Type (2017-2030)

Chapter 13. Company Profiles

13.1. Zoetis

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Virbac

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Life Diagnostics

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. ACUVET BIOTECH

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Merck & Co., Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. IDEXX Laboratories, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. MI:RNA Diagnostics Ltd.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Mercodia AB

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Antech Diagnostics, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Avacta Animal Health Limited

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others