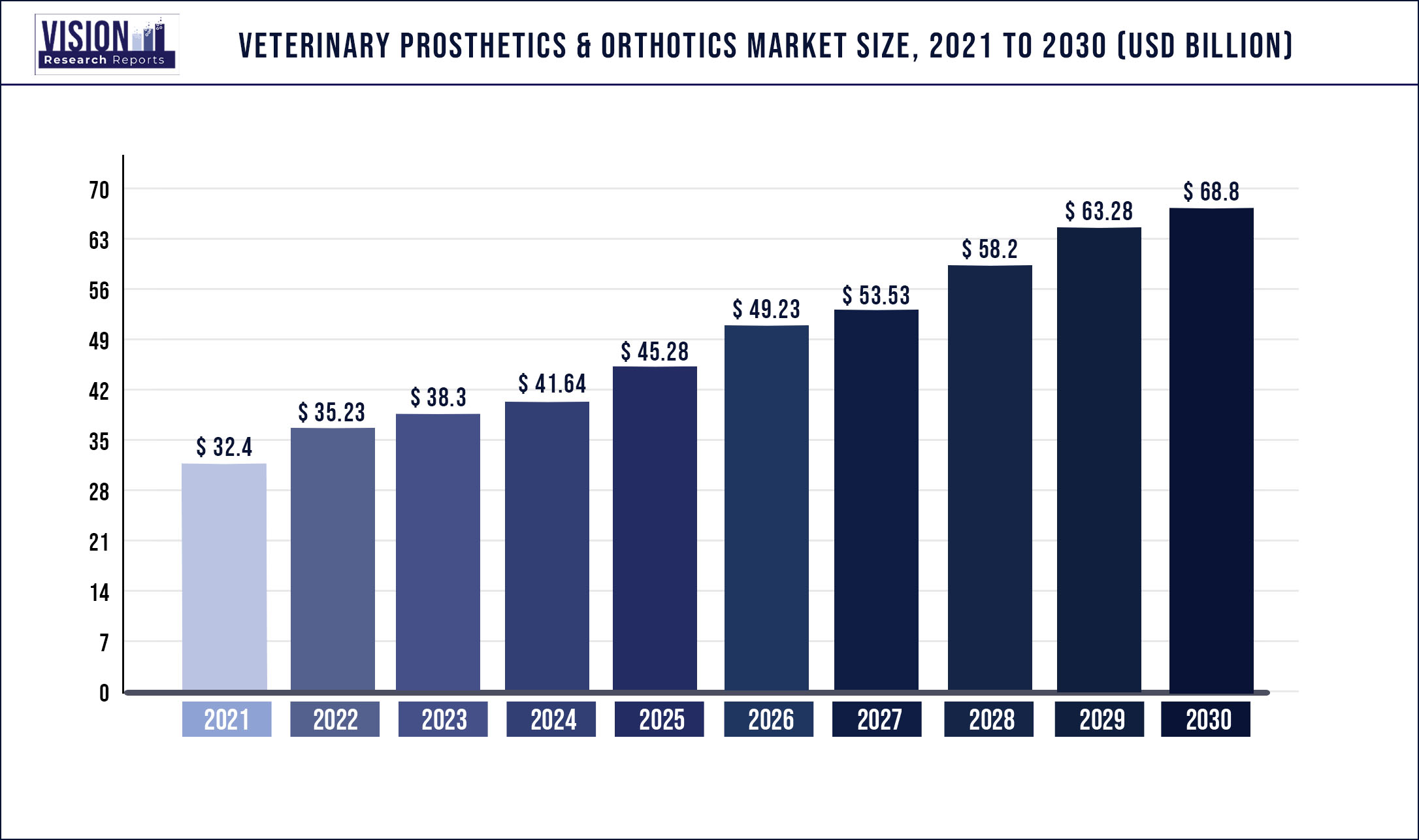

The global veterinary prosthetics & orthotics market was valued at USD 32.4 billion in 2021 and it is predicted to surpass around USD 68.8 billion by 2030 with a CAGR of 8.73% from 2022 to 2030.

The market is expected to expand at a significant CAGR of 8.9% from 2022 to 2030. Some of the drivers attributing to the market growth include rising pet dog ownership, the number of veterinary surgeries across the globe, initiatives by key companies, and orthopedic disorders in pet dogs. For injured animals, the use of orthoses (braces) and prostheses is becoming more widespread. Any medical device that is fastened to the body to provision, position, immobilize, prevent or correct deformity, help weak muscles, or increase function is referred to as an orthosis. Prosthetics are also medical devices that are used to replace a missing or severed leg section.

The COVID-19 pandemic led to a decrease in revenue for market players in the veterinary prosthetics & orthotics market. This was due to cancellation or delay in elective surgical procedures during 2020. Other challenges faced by key companies included logistical bottlenecks and dampened demand. The market, however, recovered gradually to pre-COVID numbers during 2021. In addition, the COVID-19 pandemic has catalyzed pet ownership according to findings of the Pet Food Manufacturers Association (PFMA), U.K. This is expected to contribute to market growth. The findings of the two surveys conducted in 2020 by the PFMA during the COVID-19 crisis confirmed a surge in pet ownership in the U.K. Around 3.2 million households or 11% of people brought home a pet since the start of the pandemic.

The market is predicted to rise due to factors such as the increased prevalence of obesity and the growing pet population. According to the American Pet Products Association's (APPA) 2019-2020 National Pet Owners Survey, 67% of households, or about 85 million families, in the U.S. have a pet. Furthermore, there has been a large increase in the worldwide animal population, which is expected to push the market studied in the future. According to the Department of Environment, Food and Rural Affairs' Farming Statistics 2018, the U.K. had 9.6 million cattle and calves in 2018. According to data provided by the United States Department of Agriculture, there were approximately 7.9 million cows and calves in Mexico in 2019, up from 7.7 million in 2018.

Other factors expected to fuel market expansion include increased spending on companion animals, increased availability of therapeutic choices for animals, and increased awareness in the region. Expanding adoption of companion animals and increased awareness of animal prostheses in countries like Spain, Germany, and Canada have enormous growth potential during the predicted period.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 32.4 billion |

| Revenue Forecast by 2030 | USD 68.8 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.73% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product type, technique, animal type, region |

| Companies Covered |

OrthoPets LLC.; Animal Ortho Care; Handicapped Pets; My Pet's Brace; K-9 Orthotics & Prosthetics, Inc.; DePuy Synthes; Petsthetics; Doggon Wheels; Best Friend Mobility; Movora |

Animal Type Insights

The canine segment held the largest market share of more than 60% in 2021 and is expected to grow at a high rate over the forecast period. Rising pet ownership and expenditure on pets is a key factor contributing to the demand for veterinary prosthetics & orthotics. As per FEDIAF’s 2020 report, 33% or 88 million European households own a pet. This number is anticipated to increase owing to increasing disposable income, declining birth rates in many countries, and pet humanization. Pet owners are worried about their pets and, hence, the demand for efficient treatment is increasing. This trend is expected to continue, thus, fueling market growth during the forecast period.

The feline segment is estimated to grow at the fastest CAGR of over 9% over the forecast period. Furthermore, there has been a large increase in the worldwide population of farm animals, birds, and horses, which is expected to drive the market to study in the future. The global livestock population has also been facing rapid growth over the past few decades. According to the USDA, there were around 103 million cattle and 32.05 million beef cows in the U.S. in July 2020 and the number is expected to grow substantially in the coming years.

Technique Insights

The 3D printing segment held the dominant share of the market in 2021, owing to an increase in technological advancement. Printed prosthetics can be light, inexpensive, and completely personalized. For instance, Bionic Pets is the leading provider of animal orthotics and prosthetics. DiveDesign saw an opportunity for innovation in its prosthetics development as part of its quest to transform animal rehabilitation and pain management. DiveDesign developed a digital tool using 3D scanning and printing technology to speed up the production of a full-limb prosthesis.

Furthermore, 3D printing is well renowned for its ability to benefit people from many walks of life, including animals. Animals who have lost limbs or any other essential body parts can benefit from 3D printing in the same way that people can. Numerous animals have had the opportunity to receive tailored 3d printed orthotics or prosthetics, considerably improving their life, owing to increasingly affordable technologies and accurate scans.

Product Type Insights

The Prosthetics segment held the largest market share in 2021 and is expected to grow at a high rate over the forecast period. It offers certain advantages over other products and is seen as a viable alternative for surgical treatments and post-surgery recovery support. Animal prostheses are medical devices that help animals with lost or severed limbs. The key factors driving market expansion are technological advancements in prostheses and increased adoption rates. Furthermore, technological developments and the introduction of low-cost 3D-printed prosthetics are likely to enhance the market growth.

Furthermore, the growing awareness of prosthetics across numerous organizations contributes to market growth. Bionic Pets, for example, is a company founded by a Penn State alum that makes prosthetics and braces for a variety of animals. It distributes casting molds all around the world before manufacturing prosthetic legs or braces in Sterling, Virginia. As a result of the aforementioned factors, the prosthetics market is predicted to increase significantly over the forecast period.

Regional Insights

North America held over 45% of the veterinary prosthetics & orthotics market in 2021. Higher availability of therapeutic choices for animals, greater awareness of prosthetics & orthotics, the existence of key market participants, and rising animal health expenditure are all contributing aspects to this region's dominance and growth. Furthermore, with rising companion animal adoption, increasing prevalence of canine arthritis, and rising per capita animal health expenditure, the U.S. is expected to dominate the North American animal veterinary & orthotics market over the forecast period.

The rest of the World is estimated to grow at the fastest CAGR of over 11.3% over the next few years. This is owing to the growing presence of local players, increasing pet dog population, and expenditure on pets. In addition, obesity and overweight are directly associated with osteoarthritis and movement disorders in animals, so an increase in this disease is expected to drive demand for orthotic devices. Excess fat and weight increase stress on the joints, leading to further difficulty in developing and moving arthritis.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Veterinary Prosthetics & Orthotics Market

5.1. COVID-19 Landscape: Veterinary Prosthetics & Orthotics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Veterinary Prosthetics & Orthotics Market, By Product Type

8.1. Veterinary Prosthetics & Orthotics Market, by Product Type, 2022-2030

8.1.1 Orthotics

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Prosthetics

8.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Veterinary Prosthetics & Orthotics Market, By Animal Type

9.1. Veterinary Prosthetics & Orthotics Market, by Animal Type, 2022-2030

9.1.1. Canine

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Feline

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Veterinary Prosthetics & Orthotics Market, By Technique

10.1. Veterinary Prosthetics & Orthotics Market, by Technique, 2022-2030

10.1.1. Molding

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. 3D Printing

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Veterinary Prosthetics & Orthotics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.1.3. Market Revenue and Forecast, by Technique (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.1.4.3. Market Revenue and Forecast, by Technique (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.1.5.3. Market Revenue and Forecast, by Technique (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.3. Market Revenue and Forecast, by Technique (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.4.3. Market Revenue and Forecast, by Technique (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.5.3. Market Revenue and Forecast, by Technique (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.6.3. Market Revenue and Forecast, by Technique (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.2.7.3. Market Revenue and Forecast, by Technique (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.3. Market Revenue and Forecast, by Technique (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.4.3. Market Revenue and Forecast, by Technique (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.5.3. Market Revenue and Forecast, by Technique (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.6.3. Market Revenue and Forecast, by Technique (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.3.7.3. Market Revenue and Forecast, by Technique (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.3. Market Revenue and Forecast, by Technique (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.4.3. Market Revenue and Forecast, by Technique (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.5.3. Market Revenue and Forecast, by Technique (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.6.3. Market Revenue and Forecast, by Technique (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.4.7.3. Market Revenue and Forecast, by Technique (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.5.3. Market Revenue and Forecast, by Technique (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.5.4.3. Market Revenue and Forecast, by Technique (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Animal Type (2017-2030)

11.5.5.3. Market Revenue and Forecast, by Technique (2017-2030)

Chapter 12. Company Profiles

12.1. OrthoPets LLC.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Animal Ortho Care

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Handicapped Pets

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. My Pet's Brace

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. K-9 Orthotics & Prosthetics, Inc.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. DePuy Synthes

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Petsthetics

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Doggon Wheels

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Best Friend Mobility

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Movora

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others