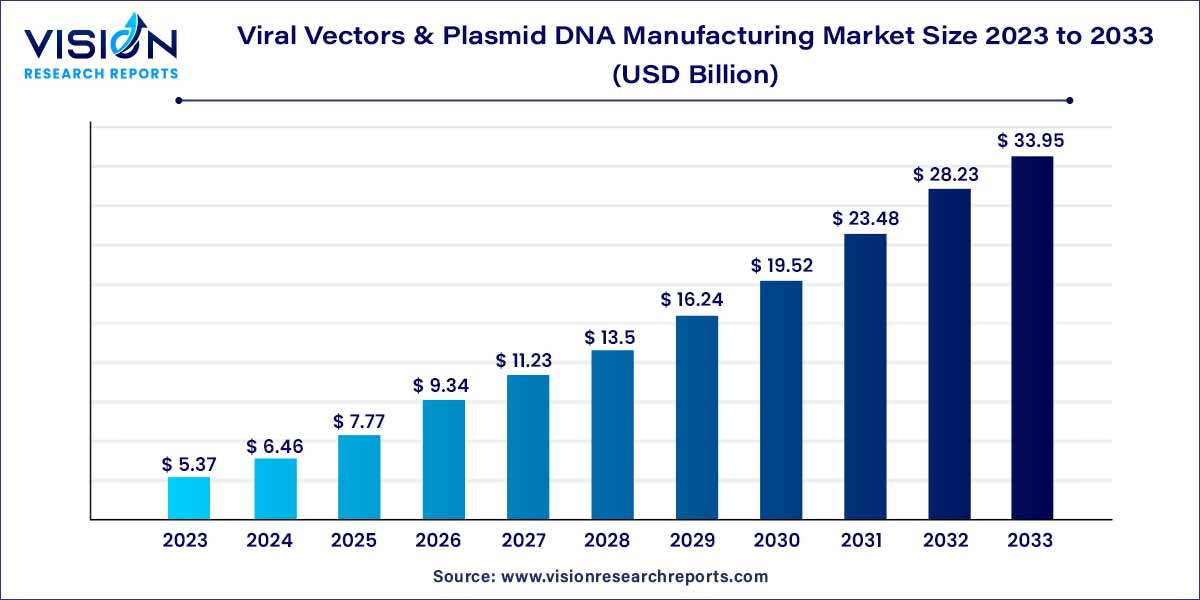

The global viral vector and plasmid DNA manufacturing market size was estimated at around USD 5.37 billion in 2023 and it is projected to hit around USD 33.95 billion by 2033, growing at a CAGR of 20.25% from 2024 to 2033.

In recent years, the viral vector and plasmid DNA manufacturing market has witnessed significant growth and garnered attention within the biopharmaceutical industry. This surge can be attributed to the increasing demand for advanced gene therapies and vaccines, as well as the expanding field of gene editing technologies. This overview aims to provide insights into the key facets of this market, shedding light on its current landscape and future prospects.

The growth of the viral vector and plasmid DNA manufacturing market can be attributed to several key factors. Firstly, the escalating demand for advanced gene therapies and vaccines has fueled increased production of viral vectors and plasmid DNA, reflecting the market's responsiveness to emerging healthcare needs. Additionally, the expanding field of gene editing technologies, such as CRISPR-Cas9, has driven the need for efficient manufacturing processes, stimulating growth within the industry. Furthermore, advancements in molecular biology and genetic engineering have played a pivotal role in enhancing the capabilities and applications of viral vectors and plasmid DNA, propelling the market forward.

The adeno-associated virus (AAV) segment took the lead in the market based on vector type, commanding a significant 21% revenue share in 2023. AAVs are witnessing high demand, particularly in clinical trials, owing to their precision in delivering genes to specific regions. The surge in adoption is evident in clinical trials focused on orthopedic and ocular gene therapies, showcasing enhanced efficiency and efficacy. A noteworthy development in August 2022 highlighted AAV-mediated gene therapy's potential to prevent acquired hearing loss. The application of AAVs is expanding across various therapeutic areas, leading to a considerable increase in adoption rates.

Concurrently, the lentivirus segment is anticipated to exhibit substantial growth at a noteworthy Compound Annual Growth Rate (CAGR) during the forecast period. The heightened use of lentiviral vectors in ongoing research activities underscores the industry's focus on advancing these vectors. Scientists are exploring non-integrating lentiviral vectors (NILVs) to mitigate insertional mutagenesis risks, as NILVs can transduce both dividing and non-dividing cells. This versatility positions NILVs as valuable tools in CAR-T cell therapy research.

In 2023, the downstream processing segment emerged as the market leader in terms of workflow, capturing the largest revenue share at 54%. This dominance is attributed to the intricate procedures involved in refining and purifying clinical-grade final products. With an escalating demand for clinical-grade viral vectors, manufacturers are actively engaged in developing innovative and cost-effective downstream processes to overcome challenges associated with conventional lab-scale vector manufacturing. One notable example is the integration of a fed-batch fermentation technique and genetically optimized cell systems with both traditional and novel purification technologies.

Concurrently, the upstream processing segment is poised to exhibit a substantial Compound Annual Growth Rate (CAGR) throughout the forecast period. Upstream processing encompasses infecting cells with the virus, cultivating cells, and harvesting the virus from these cells. Advancements in product development, exemplified by the ambr 15 microbioreactor system designed for high-throughput upstream process development, are anticipated to propel this segment. The ambr 15 microbioreactor system streamlines cell culture processing through automated experimental setup and sampling, reducing the need for labor, laboratory space, and minimizing the time required for cleaning and sterilization

In 2023, the vaccinology segment emerged as the market leader in terms of application, securing the largest revenue share at 23%. This dominance is propelled by the escalating demand for vaccines targeting a range of diseases, including cancer and infectious diseases like COVID-19. The widespread utilization of viral vectors and plasmid DNA in vaccine development, coupled with a growing emphasis on research and development for novel vaccines, is anticipated to drive sustained growth in this market segment.

Concurrently, the cell therapy segment is poised to exhibit the fastest Compound Annual Growth Rate (CAGR) over the forecast period. This growth is attributed to the increasing adoption of personalized cancer treatments. Notably, the success of Chimeric Antigen Receptor (CAR)-based cell therapies for cancer treatment is anticipated to act as a catalyst, further propelling market growth in this segment.

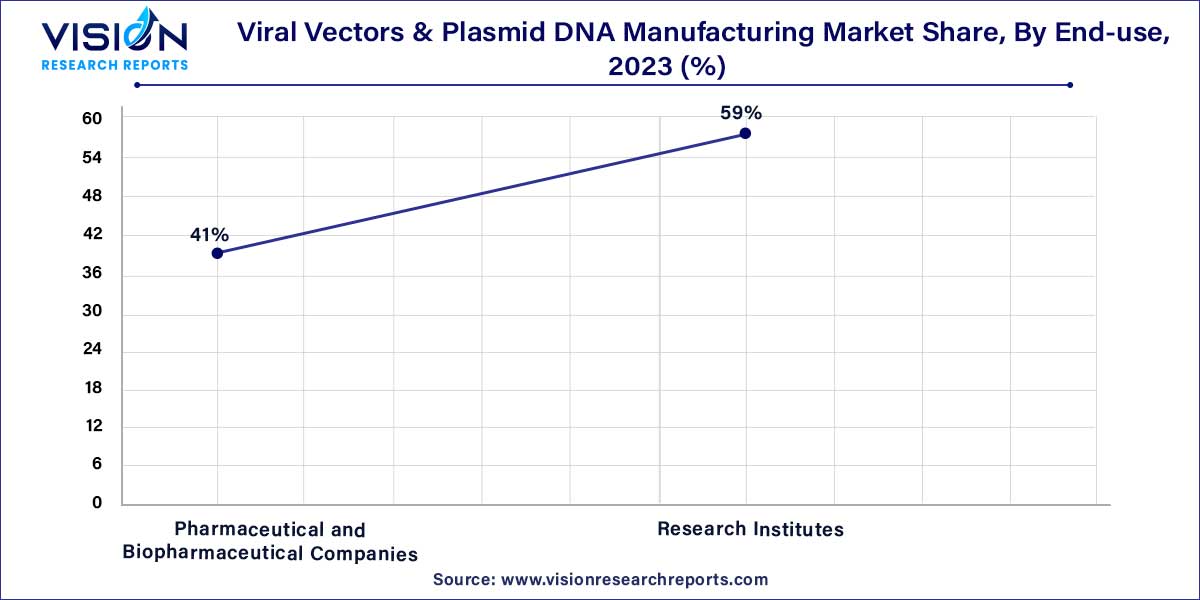

In 2023, the research institutes segment emerged as the dominant force in the market, securing the largest revenue share at 59%. This leadership is propelled by research activities focused on enhancing vector production conducted by various research entities. An illustrative example is the collaboration between Bluebird Bio and the Institute for NanoBiotechnology in July 2021. This partnership aims to develop innovative technologies that enhance the production of viral vectors for the advancement of novel gene therapies.

Concurrently, the pharmaceutical and biotechnology companies segment is projected to exhibit a substantial Compound Annual Growth Rate (CAGR) over the forecast period. This growth can be attributed to the continuous introduction of advanced therapies, coupled with a subsequent increase in the number of gene therapy-based research programs initiated by pharmaceutical firms. The expanding utilization of vectors for therapeutic production by a growing number of biotech companies is contributing significantly to the anticipated growth in this segment.

In 2023, the cancer segment emerged as the market leader, commanding the largest revenue share at 38%. This dominance is fueled by the alarming increase in new cancer cases, projected to reach 28.4 million within the next two decades according to Globocan. The anticipated 47% rise from 2020 is attributed to the adoption of a western lifestyle, high alcohol consumption, smoking, poor dietary choices, and physical inactivity. The growing prevalence of cancer cases is expected to drive demand for gene therapies aimed at treating cancer patients, consequently elevating the need for viral vectors and plasmid DNA for the development of these gene therapies.

Concurrently, genetic disorders are forecasted to register a significant CAGR during the forecast period. Gene therapy applications in genetic disorders constitute a highly focused area, with more than 10% of ongoing clinical trials directed toward this category. This positioning makes gene therapy for genetic disorders one of the most pivotal markets in the forecast years, expected to strongly support the growth of the viral vectors and plasmid DNA manufacturing market.

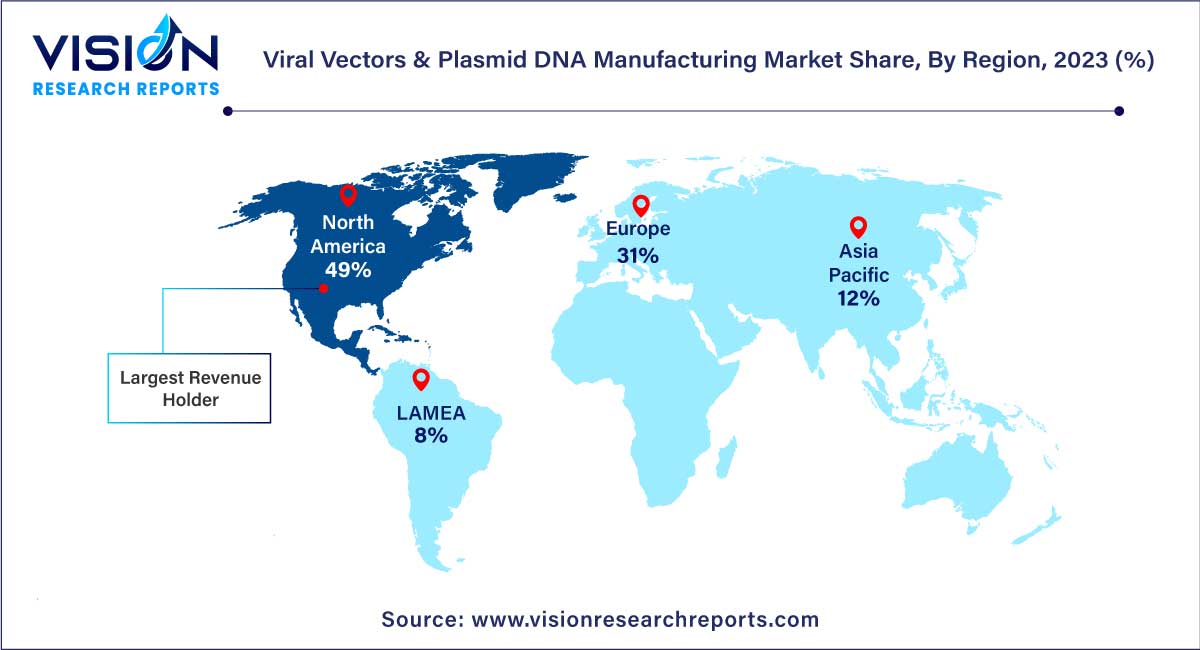

In 2023, North America asserted its dominance in the market, accounting for a substantial 49% share. This stronghold can be attributed to the heightened engagement of companies in gene and cell therapy research and product development, coupled with a significant presence of contract development organizations in the region. Additionally, indigenous companies are expanding their manufacturing facilities, further contributing to North America's leading position. Within North America, the U.S. held the highest revenue share in the viral vectors and plasmid DNA manufacturing market, driven by the presence of key market players, including Contract Development and Manufacturing Organizations (CDMOs) offering Good Manufacturing Practice (GMP) services. The adoption of highly innovative manufacturing technologies for production has also played a crucial role in the U.S. market's prominence.

Concurrently, Asia Pacific is poised to be the fastest-growing region, exhibiting a notable Compound Annual Growth Rate (CAGR) during the forecast period. China, in particular, stands out as one of the leading countries, propelled by advancements in the regulatory framework for cell-based research activities. These regulatory developments significantly contribute to the overall growth of the Asia Pacific market. Moreover, the increasing development and commercialization of novel vaccines in China are anticipated to further fuel market expansion.

By Vector Type

By Workflow

By Application

By End-use

By Disease

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Viral Vector and Plasmid DNA Manufacturing Market

5.1. COVID-19 Landscape: Viral Vector and Plasmid DNA Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Viral Vector and Plasmid DNA Manufacturing Market, By Vector Type

8.1. Viral Vector and Plasmid DNA Manufacturing Market, by Vector Type, 2024-2033

8.1.1. Adenovirus

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Retrovirus

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Adeno-Associated Virus (AAV)

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Lentivirus

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Plasmids

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Viral Vector and Plasmid DNA Manufacturing Market, By Workflow

9.1. Viral Vector and Plasmid DNA Manufacturing Market, by Workflow, 2024-2033

9.1.1. Upstream Manufacturing

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Downstream Manufacturing

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Viral Vector and Plasmid DNA Manufacturing Market, By Application

10.1. Viral Vector and Plasmid DNA Manufacturing Market, by Application, 2024-2033

10.1.1. Antisense & RNAi Therapy

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Gene Therapy

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cell Therapy

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Vaccinology

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Research Applications

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Viral Vector and Plasmid DNA Manufacturing Market, By End-use

11.1. Viral Vector and Plasmid DNA Manufacturing Market, by End-use, 2024-2033

11.1.1. Pharmaceutical and Biopharmaceutical Companies

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Research Institutes

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Viral Vector and Plasmid DNA Manufacturing Market, By Disease

12.1. Viral Vector and Plasmid DNA Manufacturing Market, by Disease, 2024-2033

12.1.1. Cancer

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Genetic Disorders

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Infectious Diseases

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Viral Vector and Plasmid DNA Manufacturing Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.1.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.1.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.4. Market Revenue and Forecast, by End-use (2021-2033)

13.1.5. Market Revenue and Forecast, by Disease (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

13.1.7. Market Revenue and Forecast, by Disease (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.1.8.4. Market Revenue and Forecast, by End-use (2021-2033)

13.1.8.5. Market Revenue and Forecast, by Disease (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.2.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.2.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.4. Market Revenue and Forecast, by End-use (2021-2033)

13.2.5. Market Revenue and Forecast, by Disease (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.7. Market Revenue and Forecast, by End-use (2021-2033)

13.2.8. Market Revenue and Forecast, by Disease (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.10. Market Revenue and Forecast, by End-use (2021-2033)

13.2.11. Market Revenue and Forecast, by Disease (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.12.4. Market Revenue and Forecast, by End-use (2021-2033)

13.2.13. Market Revenue and Forecast, by Disease (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Application (2021-2033)

13.2.14.4. Market Revenue and Forecast, by End-use (2021-2033)

13.2.15. Market Revenue and Forecast, by Disease (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.3.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.3.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.4. Market Revenue and Forecast, by End-use (2021-2033)

13.3.5. Market Revenue and Forecast, by Disease (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

13.3.7. Market Revenue and Forecast, by Disease (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

13.3.9. Market Revenue and Forecast, by Disease (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.10.4. Market Revenue and Forecast, by End-use (2021-2033)

13.3.10.5. Market Revenue and Forecast, by Disease (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Application (2021-2033)

13.3.11.4. Market Revenue and Forecast, by End-use (2021-2033)

13.3.11.5. Market Revenue and Forecast, by Disease (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.4.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.4.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.4. Market Revenue and Forecast, by End-use (2021-2033)

13.4.5. Market Revenue and Forecast, by Disease (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

13.4.7. Market Revenue and Forecast, by Disease (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

13.4.9. Market Revenue and Forecast, by Disease (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.10.4. Market Revenue and Forecast, by End-use (2021-2033)

13.4.10.5. Market Revenue and Forecast, by Disease (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Application (2021-2033)

13.4.11.4. Market Revenue and Forecast, by End-use (2021-2033)

13.4.11.5. Market Revenue and Forecast, by Disease (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.5.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.5.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.4. Market Revenue and Forecast, by End-use (2021-2033)

13.5.5. Market Revenue and Forecast, by Disease (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

13.5.7. Market Revenue and Forecast, by Disease (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Vector Type (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Workflow (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Application (2021-2033)

13.5.8.4. Market Revenue and Forecast, by End-use (2021-2033)

13.5.8.5. Market Revenue and Forecast, by Disease (2021-2033)

Chapter 14. Company Profiles

14.1. Merck KGaA

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Lonza

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. FUJIFILM Diosynth Biotechnologies

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Thermo Fisher Scientific

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Cobra Biologics

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Catalent Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Wuxi Biologics

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Takara Bio Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Waisman Biomanufacturing

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Genezen laboratories

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others