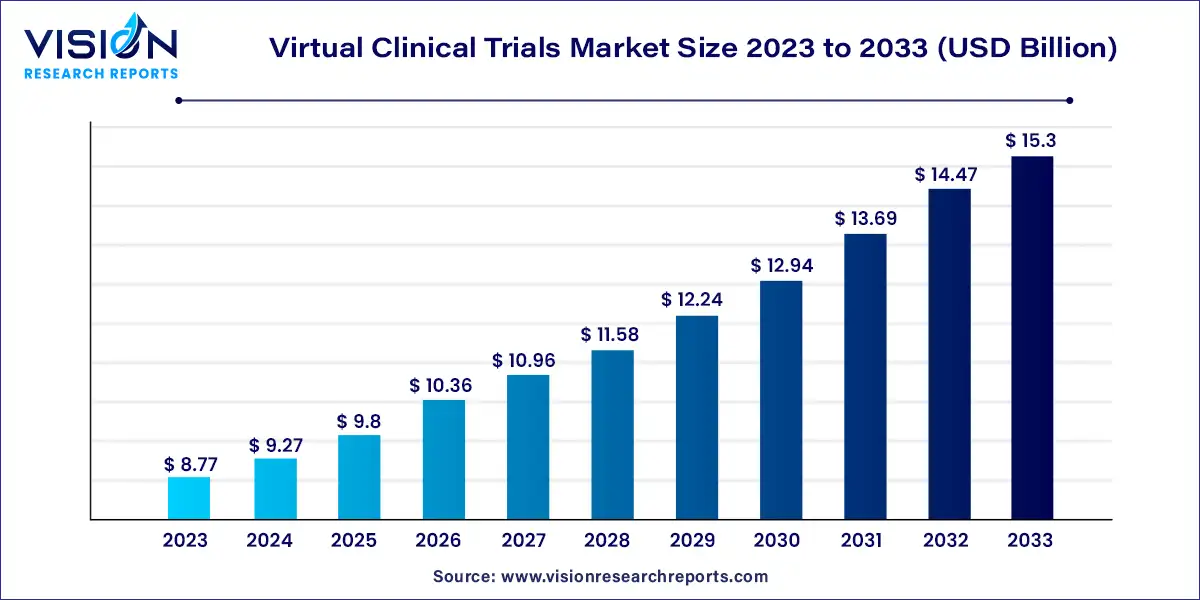

The global virtual clinical trials market size was estimated at around USD 8.77 billion in 2023 and it is projected to hit around USD 15.3 billion by 2033, growing at a CAGR of 5.72% from 2024 to 2033.

The growth of the virtual clinical trials market is propelled by various factors contributing to its rapid expansion. Foremost among these is the increasing integration of digital health technologies, such as wearable devices and telemedicine platforms, which facilitate remote patient monitoring and data collection. Additionally, the global COVID-19 pandemic has accelerated the adoption of virtual trial methodologies, as researchers seek innovative ways to overcome disruptions to traditional clinical trial conduct. Furthermore, the shift towards patient-centric approaches in healthcare and the emphasis on enhancing patient engagement and convenience have spurred interest in virtual trials. Moreover, the potential cost savings and efficiency gains associated with virtual trial conduct are attracting pharmaceutical companies and research organizations. These factors collectively contribute to a favorable environment for the growth of the virtual clinical trials market, driving innovation and expanding opportunities for stakeholders across the healthcare industry.

In 2023, the interventional design segment emerged as the leader in the virtual clinical trials market, capturing the largest revenue share of 47%. This growth was fueled by the escalating number of experiments aimed at developing novel medications for various diseases, coupled with the digitalization of laboratories. The onset of the coronavirus pandemic heightened the need for testing and trials of new drugs and vaccines worldwide, as traditional clinical trial methods posed significant infection risks. Consequently, there has been a surge in demand for interventional study designs.

Virtual trials are particularly well-suited for chronic diseases and less interventional observational studies, spanning areas such as cardiovascular diseases, immunology, gastrointestinal issues, dermatology, respiratory ailments, and endocrinology. Pioneering this concept, a company conducted an entire interventional Phase 2b "site-less" clinical trial, involving 372 patients across 10 states, utilizing their proprietary mobile telemedicine-based platform called "NORA."

The expanded access segment is poised for rapid growth, projected at 5.9% during the forecast period. Expanded access represents a potential pathway, particularly suitable when the potential benefits for patients outweigh the potential risks. Hence, with the continuous emergence of new variants of COVID-19, the demand for expanded access to new drugs is expected to increase in the short term.

In 2023, the oncology segment emerged as the dominant force in the market for virtual and decentralized clinical trials, capturing the largest revenue share of over 26%. This segment is poised to maintain its lead throughout the forecast period. The surge in global cancer cases, coupled with the increasing number of oncology clinical trials, underpins this growth. Given the heightened vulnerability of cancer patients during the COVID-19 pandemic, investigators and sponsors managing oncology trials have swiftly embraced virtual and remote trial methodologies to ensure patient safety and trial continuity.

Meanwhile, the cardiovascular segment is forecasted to experience significant growth in the coming years. The rising incidence of cardiovascular disorders worldwide is expected to drive this growth trajectory. According to the World Health Organization (WHO), an estimated 17.9 million people succumb to cardiovascular diseases annually, making it the leading cause of death globally. Furthermore, according to the Centers for Disease Control and Prevention (CDC), cardiovascular diseases claim a life in the United States every 36 seconds, underscoring the urgent need for innovative approaches such as virtual and decentralized trials to advance research and improve patient outcomes in this critical area.

In 2023, the Phase II segment emerged as the dominant force in the virtual clinical trials market, commanding the largest revenue share of over 31%. This trend is primarily driven by the widespread adoption of decentralized clinical trial (DCT) tools and platforms in Phase II and Phase I clinical trial procedures, facilitating increased patient participation. Phase II trials particularly benefit from virtual methodologies, as they streamline the collection of time-sensitive patient data, reduce delays in approvals, and optimize site payments, delivering significant value to the biopharmaceutical and pharmaceutical industry.

The Phase III segment is poised to register the fastest compound annual growth rate (CAGR) of over 5.03% during the forecast period. Digital innovations such as Big Data, Artificial Intelligence, Cloud Computing, Robotics, and Social Media present opportunities to reimagine clinical trial processes. Some pharmaceutical companies are now conducting virtual trials alongside traditional onsite trials in Phase III and Phase IV, aiming to gather additional data from diverse patient populations worldwide. Virtual trials in Phase III can automate data collection, enhance patient engagement and retention, and facilitate real-time access to data through monitoring devices for trial investigators. These associated benefits are expected to offer lucrative growth opportunities for the Phase III segment in the foreseeable future.

In 2023, North America commanded the largest regional revenue share of 49% in the virtual clinical trials market, a position expected to persist throughout the forecast period. This dominance is underpinned by increasing research and development (R&D) activities, a growing adoption of new technologies in clinical research, and supportive government initiatives. Market players in North America are leveraging digital technologies to cater to client demands. For example, Parexel conducted over 100 decentralized trials, employing hybrid and virtual approaches. Covance operates approximately 1,900 LabCorp Patient Service Centers across the U.S., facilitating trial accessibility for patients.

Meanwhile, the Asia Pacific region is poised for exponential growth, projected at 6.83% over the forecast period. Factors driving this growth include the rising incidence of cardiovascular diseases and an expanding geriatric population. The region is witnessing a surge in clinical trials aimed at finding effective solutions to combat cardiovascular and other diseases, which is expected to fuel demand for virtual clinical trials. The Indian virtual clinical trials market is forecasted to experience the fastest growth in the Asia Pacific region over the next seven years, followed closely by China.

By Study Design

By Indication

By Phase

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others