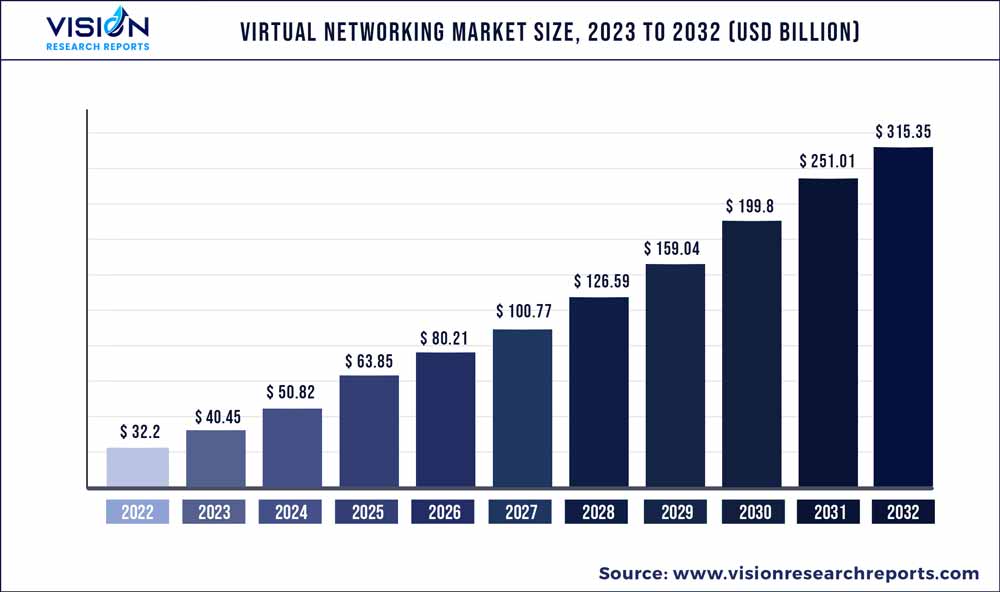

The global virtual networking market was estimated at USD 32.2 billion in 2022 and it is expected to surpass around USD 315.35 billion by 2032, poised to grow at a CAGR of 25.63% from 2023 to 2032.

Key Pointers

Report Scope of the Virtual Networking Market

| Report Coverage | Details |

| Market Size in 2022 | USD 32.2 billion |

| Revenue Forecast by 2032 | USD 315.35 billion |

| Growth rate from 2023 to 2032 | CAGR of 25.63% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Huawei Technologies Co., Ltd.; Hewlett Packard Enterprise Development LP; VMware, Inc.; Cisco Systems, Inc; Microsoft Corporation; IBM Corporation; Citrix Systems, Inc.; Juniper Networks, Inc.; Oracle; Verizon Communications Inc |

Factors such as the growing adoption of Internet-of-Things (IoT) devices, the need for improved network security, the growing adoption of cloud computing, and the rising demand for remote working are the major factors driving the market growth. As more businesses move their applications and infrastructure to the cloud, there is a growing need for virtual networking solutions that can provide secure, high-performance connectivity between different cloud environments.

Integration of virtual switches with Software-defined Networking (SDN) controllers are also expected to drive the demand for the Virtual Networking Market growth. Virtual switches are increasingly being integrated with SDN controllers, which provide centralized management and control of the network infrastructure. This allows for greater flexibility and agility in managing virtual networks and can simplify the deployment of network services such as firewalls, load balancers, and intrusion detection/prevention systems. At the same time, virtual switches are being integrated with cloud orchestration platforms such as Kubernetes and OpenStack, which allow for automated provisioning and management of virtual networks.

Cloud computing and virtual networking solutions are closely interconnected, as virtual networking is an essential component of cloud infrastructure. Cloud computing with virtual networking solutions allows businesses to create a flexible and scalable network infrastructure that can meet the needs of modern applications and workloads. In cloud computing, virtual networking solutions can provide improved performance, reliability, and cost savings compared to traditional networking solutions. By leveraging virtual networking solutions in the cloud, businesses can achieve greater efficiency, agility, and scalability in their IT operations, while also improving security and reducing costs associated with hardware and maintenance

The outbreak of the COVID-19 pandemic had a positive impact on the market. The COVID-19 pandemic has had a significant impact on the adoption and usage of virtual networking solutions, as more businesses and individuals work remotely and rely on cloud-based services. With remote work becoming more prevalent, there is greater emphasis on data security and privacy, driving demand for virtual networking solutions that can provide advanced security features such as encryption, access control, and intrusion detection/prevention. Such factors are anticipated to create more demand for the market over the coming years.

Component Insights

The software segment dominated the market in 2022 and accounted for more than 42.06% share of the global revenue owing to the increasing adoption of Software-defined Networking (SDN) technologies. SDN enables organizations to abstract the network from the underlying hardware, creating a virtualized network infrastructure that is flexible, scalable, and efficient. This has led to a greater demand for software solutions that can provide advanced networking functionality, such as routing, switching, and security, without relying on proprietary hardware. Additionally, the availability of hypervisor software solutions allowing multiple virtual machines to run on a single physical server, has further accelerated the adoption of software solutions in the virtual networking market, providing organizations with cost-effective and customizable solutions.

The services segment is projected to witness remarkable growth over the forecast period owing to the growing demand for professional and managed services that can help organizations plan, design, deploy, and manage virtual networking solutions. As virtual networking becomes more complex and critical to business operations, organizations are looking for specialized services that can provide them with the expertise, resources, and support they need to ensure the successful implementation and operation of their virtual networking solutions. Additionally, the emergence of cloud-based virtual networking solutions has created a greater need for cloud services and support, such as cloud migration, cloud management, and cloud optimization services.

Deployment Insights

The cloud segment dominated the market in 2022 and accounted for more than 55.05% share of the global revenue. As organizations are increasingly adopt cloud computing, they are also looking to leverage the benefits of virtual networking in the cloud, such as flexibility, scalability, and cost-effectiveness. One emerging trend is the use of cloud-based virtual private networks (VPNs), which enable organizations to securely connect their cloud resources to their on-premises network and other cloud-based resources. Additionally, the use of cloud-based load balancers, which can distribute traffic across multiple servers and optimize application performance. As organizations continue to adopt cloud computing, these trends are expected to continue to drive the growth of the cloud segment over the coming years.

The on-premise segment is projected to witness significant growth over the forecast period. Increasing demand for hybrid cloud and multi-cloud environments, which require on-premise virtual networking solutions to securely connect the cloud-based resources with the on-premise resources, is a significant factor driving the segment growth. As organizations adopt more cloud-based services and applications, the need for secure and reliable on-premise virtual networking solutions will continue to grow. Moreover, the use of NFV and SDN solutions to optimize on-premise virtual networking infrastructure is also a significant factor contributing to the growth of the segment.

Enterprise Size Insights

The large enterprises segment dominated the market in 2022 and accounted for more than 68.06% share of the global revenue. Large enterprises across the globe are increasingly adopting cloud-based solutions and infrastructure to increase their scalability. As a result, there is a growing need for virtual networking solutions that can provide secure and reliable connectivity between different cloud environments, as well as between on-premises infrastructure and cloud environments. Moreover, with the rise of remote and hybrid work models, organizations need virtual firewall solutions as employees are accessing corporate resources from various locations and devices. Such factors mentioned above bode well for the growth of the segment over the forecast period.

The small and medium enterprises segment is projected to expand at the highest CAGR over the forecast period as small and medium enterprises are increasingly adopting cloud-based solutions for their IT infrastructure, including cloud storage, SaaS applications, and cloud-hosted servers. Virtual networking solutions can help small & medium enterprises segment to connect their on-premises infrastructure to the cloud, as well as provide secure and reliable connectivity between different cloud environments. Moreover, SDNs can help small & medium enterprises to centralize and automate network management while reducing costs and increasing agility. Such factors are expected to create growth opportunities for the segment over the coming year.

Application Insights

The IT & Telecommunication segment dominated the market in 2022 and accounted for more than 25.02% share of the global revenue. The ability of virtual networking solutions to offer better flexibility, cost savings, and scalability is a major factor driving segment growth. Virtual networking solutions allow IT & telecommunication companies to create, modify, or remove virtual networks as needed to support changing business requirements without the need to deploy and manage physical network infrastructure. This increases agility and reduces costs associated with physical network infrastructure, such as hardware, cabling, and maintenance. Additionally, virtual networking solutions enable companies to scale their networks easily and efficiently without investing in additional hardware or software.

The BFSI segment is expected to grow significantly over the forecast period. BFSI firms are increasingly implementing virtual networking technologies to improve network performance, boost agility, and minimize expenses, thereby contributing to segment growth. BFSI firms may use virtual networking solutions to construct customized and secure virtual networks that are independent of their physical network infrastructure, allowing them to manage better and safeguard critical data. Moreover, virtual networking solutions can offer higher flexibility and scalability than traditional networking solutions, allowing BFSI firms to easily adapt their networks to changing business needs. Additionally, virtual networking solutions may assist BFSI businesses in lowering the cost of hardware and maintenance associated with traditional network infrastructure while boosting network performance and dependability.

Regional Insights

The North America region dominated the market in 2022 and accounted for more than 30.06% share of the global revenue. North America is experiencing significant growth due to the increasing demand for cloud computing, software-defined networking (SDN), and Network Function Virtualization (NFV) solutions. Cloud computing adoption is boosting demand for virtual networking solutions in North America as businesses migrate their IT infrastructure to the cloud to improve agility, save costs, and increase scalability. Because of its capacity to consolidate and automate network administration while lowering costs and enhancing agility, SDN is gaining popularity in North America. Those elements mentioned above point to a positive outlook for the region's economy throughout the anticipated period.

The Asia Pacific region is anticipated to emerge as the fastest-growing segment over the forecast period. Increasing adoption of hybrid cloud models, where organizations use a combination of public and private clouds to achieve greater flexibility, scalability, and cost-effectiveness is a significant factor contributing to the regional growth. Cloud computing also includes the use of virtual routers and virtual firewalls, as well as more sophisticated technologies such as Zero Trust Network Access (ZTNA) and Secure Service Edge (SSE), to safeguard workloads as they migrate to the public cloud.

Virtual Networking Market Segmentations:

By Component

By Deployment

By Enterprise Size

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Virtual Networking Market

5.1. COVID-19 Landscape: Virtual Networking Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Virtual Networking Market, By Component

8.1. Virtual Networking Market, by Component, 2023-2032

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Virtual Networking Market, By Deployment

9.1. Virtual Networking Market, by Deployment, 2023-2032

9.1.1. On-Premise

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Virtual Networking Market, By Enterprise Size

10.1. Virtual Networking Market, by Enterprise Size, 2023-2032

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Small & Medium Enterprises

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Virtual Networking Market, By Application

11.1. Virtual Networking Market, by Application, 2023-2032

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Public sector

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Manufacturing

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Hospitality

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. IT and Telecommunication

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Healthcare

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Others

11.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Virtual Networking Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Application (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Application (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Application (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Enterprise Size (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Application (2020-2032)

Chapter 13. Company Profiles

13.1. Huawei Technologies Co., Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Hewlett Packard Enterprise Development LP

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. VMware, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Cisco Systems, Inc

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Microsoft Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. IBM Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Citrix Systems, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Juniper Networks, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Oracle

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Verizon Communications Inc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others