The global wall art market was estimated at USD 53.09 billion in 2022 and it is expected to surpass around USD 90.09 billion by 2032, poised to grow at a CAGR of 5.43% from 2023 to 2032. The wall art market in the United States was accounted for USD 4.4 billion in 2022.

Key Pointers

Report Scope of the Wall Art Market

| Report Coverage | Details |

| Revenue Share of Europe in 2022 | 29% |

| CAGR of Asia Pacific from 2023 to 2032 | 6.05% |

| Revenue Forecast by 2032 | USD 90.09 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.43% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | VGL Group; Art.com Inc.; Uprise Art LLC; Saatchi Art Limited; Society6 LLC; Minted LLC; Artsy Inc; 1stdibs.com Inc.; Artnet Worldwide Corporation; Artspace LLC |

The growth of the market is primarily driven by rising demand for ready-to-install home décor products, increasing penetration for e-commerce sales, and rising growth of residential construction across the globe. Consumer preferences play a pivotal role in shaping market dynamics, as shifts in tastes and preferences can have a profound impact on product demand. Within of interior design industry, wall art holds a vital position, and fluctuations in interior design trends can significantly influence the demand for various categories of wall art. Understanding and adapting to evolving consumer preferences becomes imperative for businesses operating in the wall art industry, as it enables them to effectively respond to market demands and maintain a competitive edge.

Additionally, a shift towards minimalism may lead to a greater demand for simplistic and understated wall art pieces. According to an online survey conducted by Rentcafe in September 2022, 59% of consumers prefer to have a clean and minimal look for their house increasing the adaption of the minimalist trend in the wall art industry. Businesses in the wall art industry should consider incorporating minimalist designs into their product offerings to meet the demand of consumers seeking a minimalist aesthetic. This can involve exploring minimalistic techniques, and materials, and collaborating with artists who specialize in this style. Keeping up with trends and evolving consumer preferences is essential for businesses to remain competitive in the dynamic market.

Consumers these days are looking for a wide range of products that enable them to personalize their spaces. In addition, the pandemic has increased the focus on home remodeling and repairs thereby boosting the sales of wall art products. The rapid growth of the real estate sector, coupled with a rise in residential and personal spaces including apartments, and houses among others, is making constructive addition to the market growth. The increasing Do it Yourself (DIY) trend in home improvement projects, induced mainly by the covid-19 induced lockdown, has also driven the demand for wall art. Furthermore, several companies have been promoting their products over social media platforms like Instagram and Pinterest, gathering increased traction from DIY enthusiasts all over the world.

According to a recent American Housing Survey from the U.S. Census Bureau in 2022, homeowners completed nearly 53 million DIY projects, which accounted for 39% of all home improvement projects and 20% of total spending during the survey period. This highlights the significant role that DIY projects play in the home improvement industry and underscores the importance of targeting DIY enthusiasts as a key demographic for key players operating in this space. By understanding the motivations and preferences of DIY homeowners, companies can tailor their product offerings and marketing strategies to better meet the needs and expectations of this important segment of the market.

The influx of artisans into the wall art market is creating a more diverse range of styles and techniques for consumers to choose from, thereby expanding the available options in the industry. Artisans' specialization in creating personalized and unique wall art products, such as customized paintings and handcrafted hangings, can cater to consumers' desire for individualized decor that reflects their tastes. This trend provides a competitive edge for businesses by offering a more tailored product line that differentiates them from their competitors and increases consumer interest and engagement.

Consumers are increasingly aware of the impact of their purchasing decisions on the environment and are seeking out products that are made from sustainable materials and have a minimal environmental impact. Many key players are incorporating sustainable materials into their products, such as bamboo, organic cotton, and natural fibers, to reduce their environmental impact. For instance, IKEA offers a variety of wall art products made from sustainable materials such as bamboo and recycled materials. They also have a "Better Cotton Initiative" that promotes sustainable cotton production methods. This is expected to boost sales in the coming years.

Type Insights

The wallpaper wall art dominated the market with a share of 38% in 2022. The demand for wallpapers and wallcoverings has been traditionally higher in Europe and Asia compared to America. However, there has been notable growth in the U.S. market, as evidenced by a 50% increase in wallpaper-related online searches in the 12 months leading up to March 2020. This surge in interest can be attributed to younger consumers, who are discovering wallpaper through social media and recognizing its potential for easy customization of living spaces. The advancements in removability technology have kept up with consumer expectations, making wallpaper a more viable option for personalizing spaces.

The wall hangings are projected to register a CAGR of 5.93% from 2023 to 2032. Woven wall hangings are a popular and versatile form of wall art, made using traditional weaving techniques with a modern twist. These can be made of natural fibers like wool, cotton, or linen, and can be customized with a range of colors, textures, and patterns. For instance, West Elm offers a range of woven wall hangings made using natural fibers like cotton, wool, and jute. These hangings feature modern designs and textures and are available in a range of sizes and styles.

Sales Channel Insights

The offline sales channel dominated the market with a share of more than 66% in 2022. The growth is driven by the increasing demand for unique and personalized wall art products. Specialty stores often offer a wide range of products that are not available in mass-market retail stores, providing consumers with access to unique and customized designs. In addition, specialty stores often provide a higher level of expertise and customer service, helping consumers to find the right products and providing guidance on how to display and care for their wall art.

The online sales channel is estimated to expand with the fastest CAGR of 6.14% over the forecast period. The ease of ordering these products through online websites has led manufacturers to sell products through e-commerce portals. Consumers purchase unique and trendy wall art through prominent e-commerce portals such as Hygge & West (Propitious Jackson Inc.), Wallshoppe, Graham & Brown Ltd, Elle Gibson, Flavor Paper, Mitchell Black, Etsy, Inc., Chasing Paper, Wayfair LLC, Hovia, and Urban Outfitters. The e-commerce industry has experienced tremendous growth in recent years, driven by advancements in technology and changing consumer behavior. Increasing internet penetration, widespread smartphone usage, and convenience have contributed to the rise of online shopping.

Application Insights

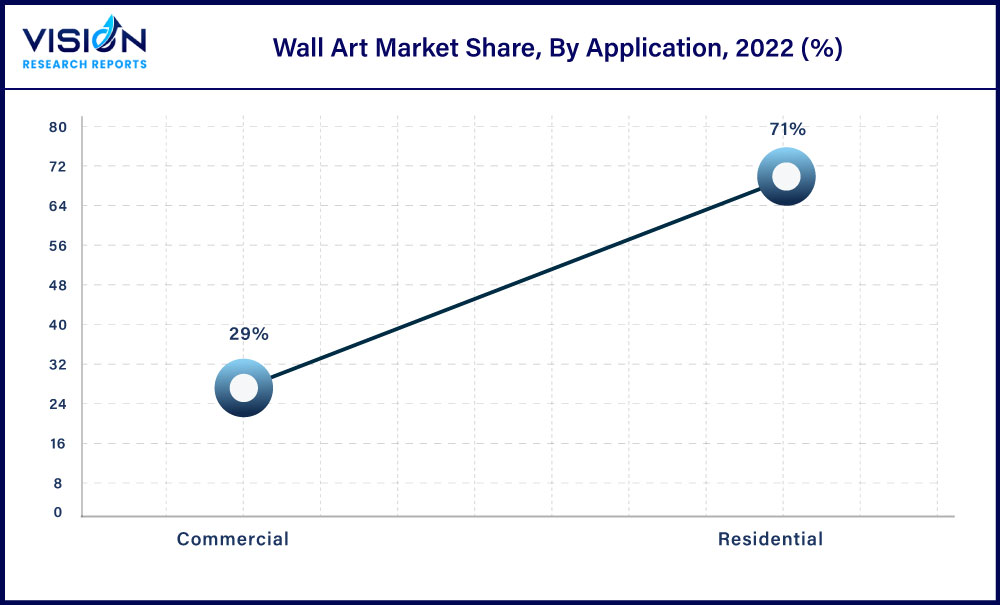

The residential application dominated the market with a share of around 71% in 2022. One of the improvements included personalizing existing spaces to better suit homeowners’ personalities, tastes, aesthetics, and overall functionality of the space. According to Porch.com, an online marketplace that connects homeowners and contractors, the number of U.S. Google searches for home improvement work during June-August 2020 stood at 330 million, an increase of close to 50% from the same period the previous year. This is expected to boost the demand for wall art products in residential settings.

The commercial application is estimated to expand with the second fastest CAGR of 4.63% over the forecast period. Wall art products are majorly used in offices and corporate spaces, hotels, hospitality, educational institutes, stores, shops, etc. The rising number of hotels and restaurants and the growth of the travel and tourism industry across the world have widened the commercial application scope of wall art. The growing demand for wall art products is driven by the expansion of commercial spaces such as malls, retail stores, and offices. Additionally, a prominent trend in this market is the adoption of environmentally friendly materials for manufacturing wallpapers.

Regional Insights

Asia Pacific is expected to witness a CAGR of 6.05% from 2023 to 2032. The Indian wall art market is estimated to be USD 4.3 billion in 2022. Increasing demand for wall art has been gaining momentum across the country, which is supported by growth in home real estate, lifestyle, and hospitality. For instance, IDECORWALA.COM is an online platform that seeks to penetrate the growing Indian market with its deep industry knowledge, established e-commerce platform, last-mile delivery, and installation, apart from a dedicated customer help desk is offering an interior décor range and selling products directly to customers, hotels and commercial establishments. Such initiatives are expected to offer key players an opportunity to expand their product line to cater to particular industries.

Rising homeownership in the U.S. is also a key factor fueling the U.S. wall art market. The U.S. market is estimated to be USD 7.3 billion in 2022. According to a Housing Vacancy Survey, the nationwide homeownership rate rose by 65.6% in the first quarter of 2021, a 0.3%-point growth from 2020. Preliminary Census Bureau data also shows that the number of homeowners rose by about 1.3 million over the period between 2014 and 2021 Q1 reliable with average yearly gains from 2016 to 2019. This favorable housing scenario bodes well for the market.

Europe held the second largest market share with revenue of around 29% in 2022. The market for Germany is estimated to be USD 4.4 billion in 2022. Market players such as Marburger Tapetenfabrik offer a wide range of wall art such as digital wallpapers, hangings, and wallcoverings, online to consumers across the country and the U.K. Furthermore, as per an article published on Messe Frankfurt Exhibition GmbH, in July 2019, an increasing number of consumers and professionals were finding wallpapers, including digital wallpapers, an attractive element of interior design. Owing to this, several players in the market started advertising campaigns to promote their products and gain consumer engagement, which has been boosting the segment’s growth.

Wall Art Market Segmentations:

By Type

By Sales Channel

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Wall Art Market

5.1. COVID-19 Landscape: Wall Art Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Wall Art Market, By Type

8.1. Wall Art Market, by Type, 2023-2032

8.1.1 Wallpapers/Stickers/Wall Coverings

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Hangings

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Frameworks

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Décor Shelves

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Wall Art Market, By Sales Channel

9.1. Wall Art Market, by Sales Channel, 2023-2032

9.1.1. Offline

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Online

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Wall Art Market, By Application

10.1. Wall Art Market, by Application, 2023-2032

10.1.1. Residential

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Commercial

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Wall Art Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.1.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Application (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Application (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.5.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Application (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Sales Channel (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Application (2020-2032)

Chapter 12. Company Profiles

12.1. VGL Group

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Art.com Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Uprise Art LLC

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Saatchi Art Limited

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Society6 LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Minted LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Artsy Inc

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. 1stdibs.com Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Artnet Worldwide Corporation

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Artspace LLC

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others