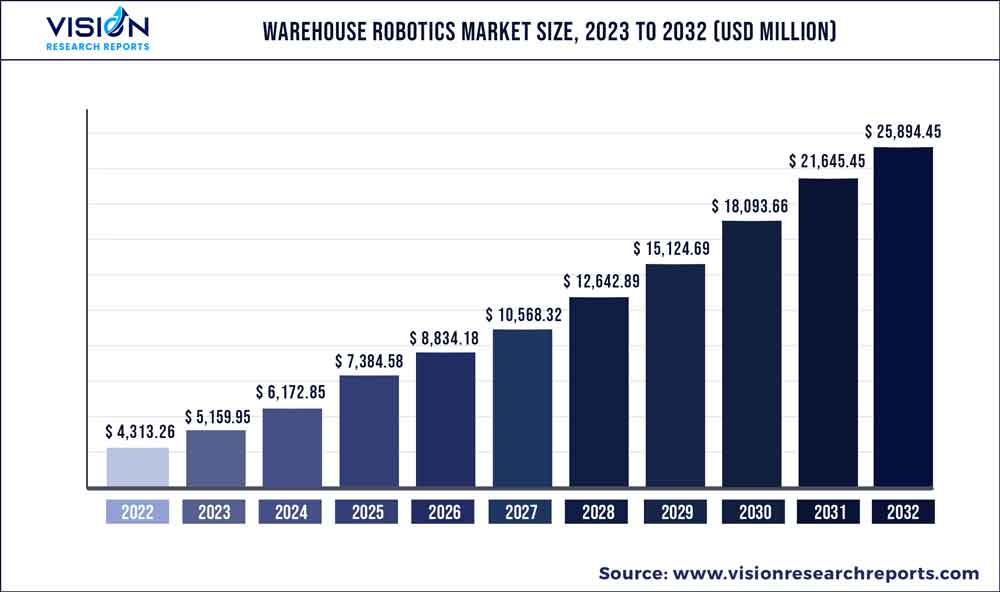

The global warehouse robotics market was surpassed at USD 4,313.26 million in 2022 and is expected to hit around USD 25,894.45 million by 2032, growing at a CAGR of 19.63% from 2023 to 2032. By function segment, the warehouse robotics market in the United States was accounted for USD 905.9 million in 2022.

Key Pointers

Report Scope of the Warehouse Robotics Market

| Report Coverage | Details |

| Revenue Forecast by 2032 | USD 25,894.45 million |

| Growth rate from 2023 to 2032 | CAGR of 19.63% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | ABB; Bastian Solutions LLC; Daifuku Co. Ltd.; Dematic; Fetch Robotics Inc.; Honeywell International Inc.; KNAPP AG; KUKA AG; OMRON Corporation; YASKAWA Electric Corporation; FANUC Corporation |

The expansion of the e-commerce industry, rising labor costs, and the need for greater efficiency and accuracy in warehouse operations fuel the growth of the market.

The e-commerce sector is witnessing remarkable growth due to technological advancements. Technologies like Virtual Reality (VR), Augmented Reality (AR), blockchain technology, Machine Learning (ML), and Artificial Intelligence (AI) are enhancing the shopping experience. Thus, companies seek new methods to enhance operations and logistics while reducing delivery time and costs.

Robots offer a smart, cost-efficient alternative to human labor by automating warehouses catering to the increasing need of the e-commerce sector. The robots help companies to maintain employee safety standards and enhance production quality by performing various tasks such as handling the incoming consignment, picking, packing, slotting, shipping, and asset tracking by saving considerable time and effort.

The COVID-19 pandemic impacted the warehouse robotics industry substantially in terms of the demand for robotics and the supply chain of the robotics industry. However, the need for efficient and contactless order fulfillment and labor shortage due to lockdowns fueled the demand for robots and other automation tools in business operations. The market has shown rising demand and continuously growing as companies invest heavily in research and development activities to improve existing technologies and launch advanced robots.

The initial investment of the robotic set-up into the warehouse is high, creating significant challenges for small and mid-sized companies. Furthermore, implementing robots in warehouse operations is affecting labor jobs. The rising adoption of robots is expected to affect employment and wages, affecting the further growth of the warehouse robotics industry over the forecast period.

Product Insights

The cartesian robots product segment is expected to witness a CAGR of more than 20.02% from 2023 to 2032. The growth of the segment is attributed to the increasing demand for automation in the packaging, automotive, and pharmaceutical industries. Cartesian robots are widely adopted in such industries due to their accuracy, precision, and ability to handle heavy loads.

Moreover, demand for automated material handling in the industrial sector due to the need for higher productivity, efficiency, and flexibility in warehouse operations is expected to fuel the further growth of cartesian robots over the forecast period.

The mobile robots accounted for the highest market share in 2022. Ongoing technological advancements in the global wearehouse & logistics industry, including machine learning, computer vision, and artificial intelligence is contributing to the development of smarter mobile robots.

The rising need for efficient and cost-effective solutions in logistics and warehousing to increase productivity and profitability, has inspired companies to adopt mobile robots. Moreover, the adoption of mobile robots is growing in various industries, such as manufacturing, healthcare, retail, and agriculture, due to their features such as easy maneuverability and autonomous operation.

Function Insights

In the function segment, the transport segment is anticipated to gain a CAGR of more than 20.04% from 2023 to 2032. Ongoing growth of the retail and e-commerce sector coupled with the growing demand for automated robots for improved efficiency and reduced costs in logistics has driven growth of the transport segment.

Furthermore, incorporating robots for transport function helps companies overcome labor shortage concerns by automating a variety of tasks. For instance, in November 2022, KNAPP AG collaborated with eMAG.ro, MALL.CZ, HPTRONICS and Alza.cz. This partnership has helped companies to enhance their logistics and operations and hold a strong position as a major technology provider for e-com logistics in Central and South Eastern Europe.

The pick & place accounted for the highest market share in 2022 in the function segment. This growth is attributed to the continuous technological advancements in robots, making them more efficient, accurate, and versatile for pick-and-place activities.

For instance, in December 2022, ABB announced the launch of the SWIFTI CRB1300 industrial collaborative robot; the robot is specially designed for activities from machine tending and palletizing to pick and place and screw driving. Moreover, the cost of pick-and-place robots has decreased over the years; they have become more accessible to smaller businesses and manufacturers, resulting in increased adoption of robots for pick and place activities.

Components Insights

The software segment is estimated to experience a CAGR of approximately 21.02% over the forecast period. The segment is divided into a warehouse management system, a warehouse control system, and a warehouse execution system. The software tools helps in reducing the manual tasks necessary across warehouse operations.

Thus, need for increased efficiency in warehouse operations and to reduce human errors has contributed to the growth of the warehouse robotics software segment. Furthermore, the incorporation of Artificial Intelligence (AI) is anticipated to boost the growth in the forthcoming years.

The hardware segment is expected to witness a CAGR of more than 17.1% from 2023 to 2032. The developments in the hardware of robots, such as foldable robots that can change shape and size, making them more versatile, are becoming increasingly popular. Furthermore, the increasing adoption of collaborative robots in a wide range of industries owing to their variety of advantages compared to traditional robots is expected to fuel the growth of the hardware segment from 2023 to 2032.

Application Insights

The healthcare industry is expected to witness the fastest CAGR of approximately 21.04% in the application segment from 2023 to 2032. Technological developments have enabled machines with remarkable machine dexterity, which allows machines to perform delegated tasks with significant ease in healthcare warehouses. Increasing demand for medications and vaccines, pharmaceutical companies are looking for ways to improve their supply chain and reduce errors in medication dispensing. Warehouse robotics can help automate the process to improve efficiency.

The e-commerce segment accounted for the highest market share in 2022. The growth is attributed to the increased preference for online shopping; the rising demand for fast and efficient order fulfillment has played an important role in automating warehouses and fulfillment centers.E-commerce companies are increasingly adopting warehouse robotics solutions to improve their supply chain management and order fulfillment processes. The increased demand to increase the speed while maintaining accuracy is expected to fuel the further growth of the e-commerce segment over the forecast period.

Payload Capacity Insights

The below 10 kg warehouse robots accounted for the highest revenue share in 2022 in payload capacity. The increasing volume of lightweight and small packages that need to be handled in distribution centers and warehouse options owing to the rising adoption of e-commerce shopping is a major driver for the growth of below 10 kg warehouse robots. The increased adoption of lower payload capacity robots in consumer electronics and food & beverages industries is expected to drive the growth of the below 10 kg warehouse robots segment over the forecast period.

The 11 kg to 80 kg warehouse robots is anticipated to witness a CAGR of approximately 20.07% from 2023 to 2032. The growth is attributed to their ability to efficiently handle medium to heavy-weight items. Moreover, the demand for robots with higher payload capacity is increasing in warehouses of various applications such as manufacturing, healthcare, food, beverages, and more. The continuous technological developments and rising demand for automation in logistics and warehouse operations are expected to support market growth.

Regional Insights

The Asia Pacific region accounted for the highest revenue share in 2022 and is anticipated to maintain its dominance over the forecast period. The increasing installation of warehouse robotics in the region, coupled with the presence of key market players such as Fanuc Corporation, Yaskawa Electric Corporation, Singapore Technologies Engineering Ltd., TOSHIBA CORP., and many others has driven growth of the market. In addition, continuous rise of the retail, manufacturing, and FMCG industries in the region is expected to create lucrative growth opportunities for the market.

The Latin America region is expected to witness the highest CAGR from 2023 to 2032. The region offers lucrative growth opportunities owing to a significant rise in the e-commerce industry. The key players focus on entering a region to add value to the market. For instance, in July 2022, Geek+, the autonomous mobile robot (AMR) technology company, announced a collaboration with Körber Supply Chain to expand into Latin America. The rising research and development investments are expected to create lucrative growth prospects for the market.

Warehouse Robotics Market Segmentations:

By Product

By Function

By Payload Capacity

By Component

By Software

By Application Capacity

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others