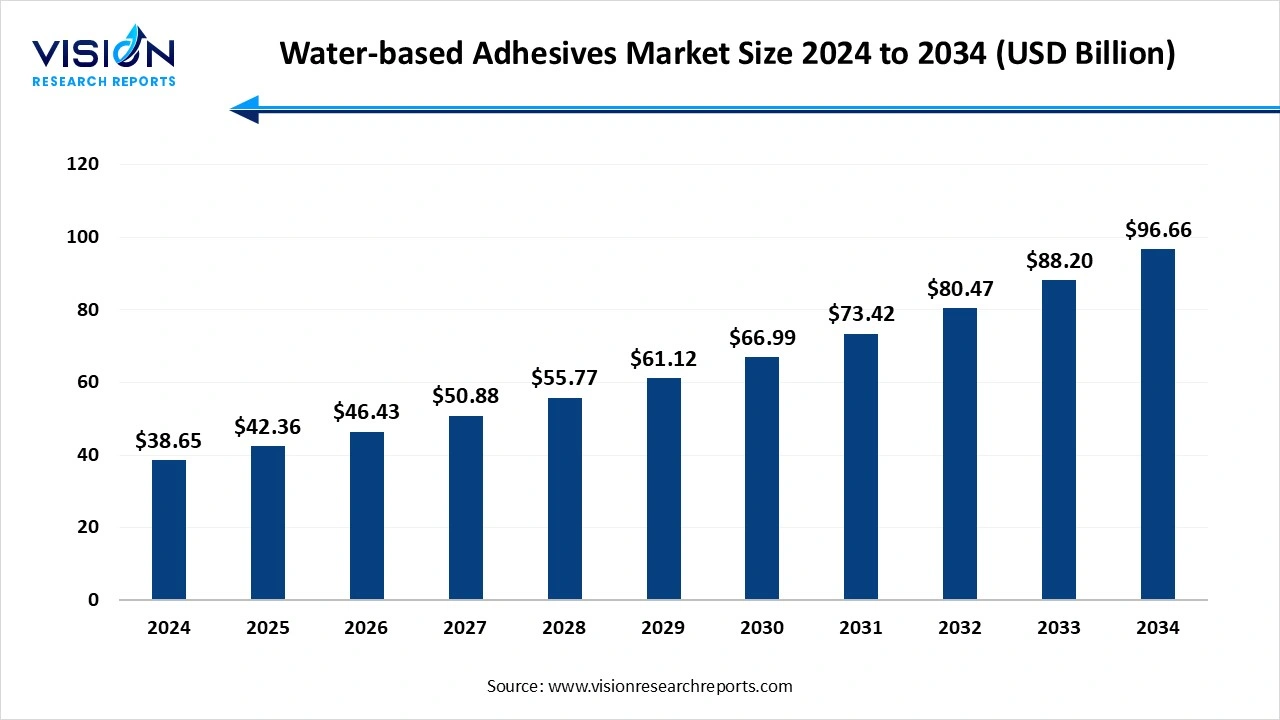

The global water-based adhesives market was size estimated at USD 38.65 billion in 2024 and is expected to hit around USD 96.66 billion by 2034, growing at a CAGR of 9.60% from 2025 to 2034.

The water-based adhesives market has witnessed steady growth in recent years, driven by increasing demand for environmentally friendly and low-VOC bonding solutions across various industries. These adhesives, which use water as a solvent, are widely used in packaging, woodworking, automotive, textiles, and construction due to their ease of application, low toxicity, and cost-effectiveness. Growing regulatory pressure to reduce solvent-based emissions, alongside rising consumer preference for sustainable products, has accelerated the adoption of water-based adhesives.

One of the primary growth drivers of the water-based adhesives market is the increasing global emphasis on environmental sustainability and regulatory compliance. As governments and regulatory bodies impose stricter limitations on volatile organic compounds (VOCs), industries are shifting away from solvent-based adhesives toward eco-friendly alternatives. Water-based adhesives, being non-toxic, low in VOCs, and easy to clean, align well with these evolving standards.

Another key factor propelling market growth is technological advancement in adhesive formulations. Modern water-based adhesives now offer enhanced bonding strength, durability, and faster curing times, making them suitable for high-performance applications. Growth in end-use sectors particularly in emerging markets across Asia-Pacific and Latin America also contributes to increased consumption. Rising disposable income, urbanization, and infrastructure development in these regions are generating higher demand for consumer goods, furniture, and construction materials, all of which rely heavily on water-based adhesives for assembly and finishing.

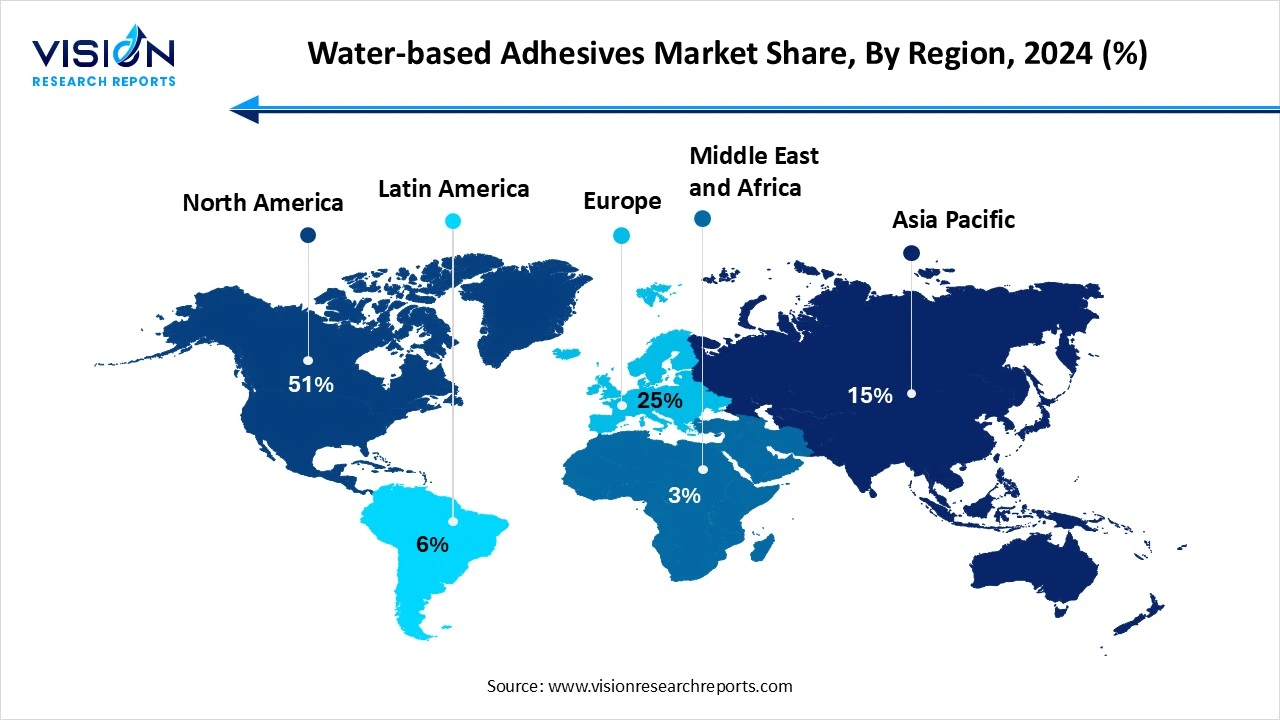

North America dominated the global market with highest share of 51% in 2024. North America remains a key market due to the presence of well-established industries such as automotive, construction, and packaging, coupled with stringent environmental regulations that promote the adoption of eco-friendly adhesive solutions. The United States, in particular, leads in innovation and demand, driven by rising consumer awareness and the shift towards sustainable products.

The Asia Pacific region emerged as the leading market for the water-based adhesives industry in 2024. The Asia-Pacific region is witnessing rapid expansion and is emerging as the fastest-growing market for water-based adhesives. This growth is primarily driven by increasing industrialization, urbanization, and rising disposable incomes in countries such as China, India, Japan, and South Korea. The construction, packaging, and woodworking industries are expanding rapidly, creating substantial demand for cost-effective and environmentally friendly adhesive solutions.

The Asia Pacific region emerged as the leading market for the water-based adhesives industry in 2024. The Asia-Pacific region is witnessing rapid expansion and is emerging as the fastest-growing market for water-based adhesives. This growth is primarily driven by increasing industrialization, urbanization, and rising disposable incomes in countries such as China, India, Japan, and South Korea. The construction, packaging, and woodworking industries are expanding rapidly, creating substantial demand for cost-effective and environmentally friendly adhesive solutions.

The acrylic polymer emulsion segment held the largest revenue share at 38% and is projected to maintain its leading position throughout the forecast period in 2024. These adhesives are widely used across industries including packaging, construction, textiles, and automotive, owing to their ability to form durable bonds with a variety of substrates. The inherent flexibility and fast drying nature of acrylic emulsions also contribute to their growing preference, especially in applications requiring high-performance and long-lasting adhesion.

polyvinyl acetate (PVA) emulsions continue to hold a strong position in the market due to their cost-effectiveness, ease of use, and good adhesion properties, particularly on porous substrates like paper, wood, and fabric. PVA-based adhesives are commonly utilized in woodworking, paper converting, and packaging industries, where their quick bonding and non-toxic nature make them ideal for both industrial and consumer applications. Despite some limitations in water resistance compared to acrylic emulsions, ongoing advancements in formulation technology have improved the durability and performance of PVA emulsions, ensuring their continued relevance in the water-based adhesives market.

The tapes and labels segment led the market, capturing a 15% share in 2024. In the global water-based adhesives market, the application segment of tapes and labels has seen substantial growth driven by increasing demand for lightweight, eco-friendly, and strong bonding solutions. Water-based adhesives are preferred in this sector due to their excellent adhesion to various substrates such as paper, film, and foil, along with their low environmental impact and safety benefits. The rise of the packaging industry, especially in food, pharmaceuticals, and consumer goods, has further accelerated the use of water-based adhesives in tapes and labels, as manufacturers seek adhesives that ensure reliable performance while complying with stringent regulatory standards on volatile organic compounds (VOCs).

The woodworking sector is another significant application area for water-based adhesives, favored for their strong bonding capabilities on porous materials such as wood and wood composites. These adhesives offer advantages including low toxicity, easy cleanup, and reduced environmental footprint compared to traditional solvent-based adhesives. The growing demand for furniture, flooring, and cabinetry in both residential and commercial construction projects has contributed to increased adoption of water-based adhesives in woodworking.

By Resin Type

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Water-based Adhesives Market

5.1. COVID-19 Landscape: Water-based Adhesives Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Water-based Adhesives Market, By Resin Type

8.1. Water-based Adhesives Market, by Resin Type

8.1.1. Acrylic Polymer Emulsion

8.1.1.1. Market Revenue and Forecast

8.1.2. Polyvinyl Acetate Emulsion

8.1.2.1. Market Revenue and Forecast

8.1.3. Vinyl Acetate Ethylene Emulsion

8.1.3.1. Market Revenue and Forecast

8.1.4. Styrene Butadiene Latex

8.1.4.1. Market Revenue and Forecast

8.1.5. Polyurethane Dispersions

8.1.5.1. Market Revenue and Forecast

8.1.6. Other Resin Type

8.1.6.1. Market Revenue and Forecast

Chapter 9. Water-based Adhesives Market, By Application

9.1. Water-based Adhesives Market, by Application

9.1.1. Tapes & Labels

9.1.1.1. Market Revenue and Forecast

9.1.2. Paper & Packaging

9.1.2.1. Market Revenue and Forecast

9.1.3. Woodworking

9.1.3.1. Market Revenue and Forecast

9.1.4. Building & Construction

9.1.4.1. Market Revenue and Forecast

9.1.5. Automotive & Transportation

9.1.5.1. Market Revenue and Forecast

9.1.6. Other Application

9.1.6.1. Market Revenue and Forecast

Chapter 10. Water-based Adhesives Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Resin Type

10.1.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. Henkel AG & Co. KGaA

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. 3M Company

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. H.B. Fuller Company

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Sika AG

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Jowat SE

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Arkema Group (Bostik)

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. RPM International Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Evonik Industries AG

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Huntsman Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others