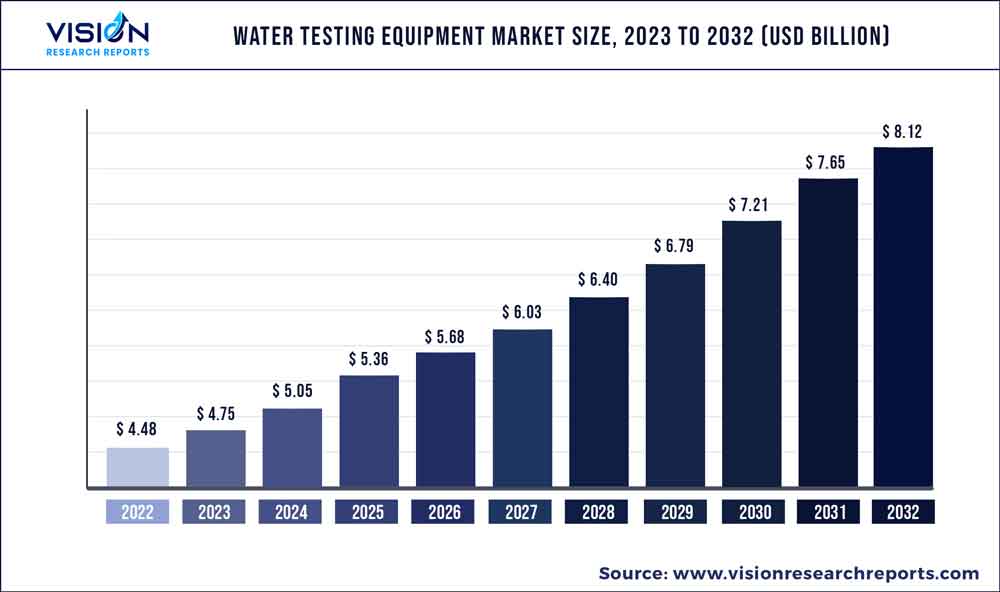

The global water testing equipment market was estimated at USD 4.48 billion in 2022 and it is expected to surpass around USD 8.12 billion by 2032, poised to grow at a CAGR of 6.13% from 2023 to 2032. The water testing equipment market in the United States was accounted for USD 1.3 billion in 2022.

Key Pointers

Report Scope of the Water Testing Equipment Market

| Report Coverage | Details |

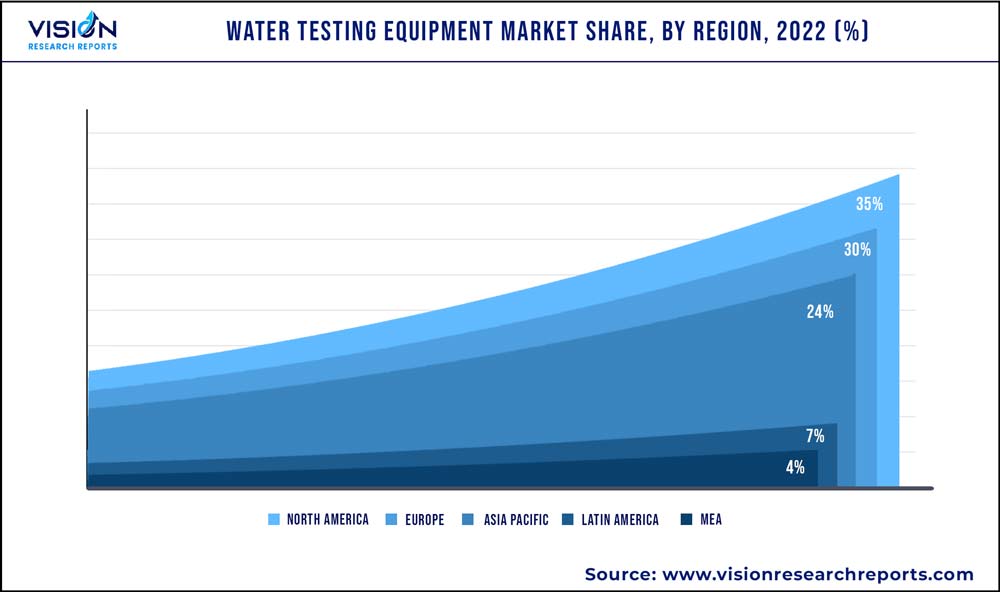

| Revenue Share of North America in 2022 | 35% |

| Revenue Forecast by 2032 | USD 8.12 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.13% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Thermo Fisher Scientific, Inc.; SGS SA; Emerson Electric Co.; Honeywell International, Inc.; Danaher Corporation; General Electric Company; Horiba Ltd.; 3M Company; Mettler-Toledo International, Inc.; Perkinelmer, Inc.; Tintometer GmbH; Eurofins Scientific SE; Idexx Laboratories Inc.; Agilent Technologies, Inc.; Shimadzu Corporation |

Growing demand for clean water for municipal applications and demand for water for the production of food & beverages and pharmaceutical products is expected to boost the market growth. Increasing focus on sustainability due to the spread of infectious diseases like COVID-19 has resulted in a renewed focus on water resource management. Moreover, the increasing infrastructural development programs initiated through the economic stimulus for the development of drinking water facilities are also expected to augment the demand for water testing equipment over the forecast period.

The U.S. passed a new Public-Private Partnership (PPP) law to promote investments, in terms of upgrades and new establishment of desalination facilities and water purification plants, on a domestic level. This favorable initiative to promote investments in the water treatment industry on a domestic level is anticipated to have a positive impact on the water testing equipment industry’s growth over the forecast period.

According to the UN World Water Development Report, approximately 6 million people will face a clean water shortage by 2050. This is due to rapid population and economic growth worldwide, which has resulted in increased demand for clean water. Moreover, reduced water resources and increased water pollution are also contributing to the demand for water testing equipment.

Several governments have introduced stringent regulations related to safe drinking water is expected to drive the market growth over the forecast period. Key governmental authorities such as the European Environment Agency (EEA) and U.S. Environmental Protection Agency (EPA), are playing key roles in improving the quality of water environments.

As the water testing equipment industry is witnessing growth globally, a number of players are setting up their manufacturing and distribution units across the world. With multiple new players entering the market, along with the continuous exploration of new opportunities by the existing players to develop improved and innovative equipment, the market is characterized by significant competition.

Instrument Insights

Spectrometers led the market and accounted for 36% of the global revenue share in 2022. A spectrometer is a desktop laboratory tool that is used to assess the purity and quality of water in a variety of settings, including drinking water, processed water, and wastewater.

Total Organic Carbon (TOC) is a unit of analysis used to quantify the total carbon content of organic compounds in pure water and aqueous systems. Organizations and labs use this analytical technique of TOC to assess how well a solution fits their processes. By the TOC analysis, total carbon, total inorganic carbon, purgeable organic carbon, non-purgeable organic carbon, dissolved organic carbon, etc. can be measured.

The ability of ions in an aqueous solution to conduct an electrical current is measured using conductivity meters. To assess the degree of pollutants in water supplies for home use, wastewater treatment, water quality testing, as well as industrial use, conductivity is frequently utilized. Chemical, power generation, semiconductor, textile, hospitals, food and beverage, mining, iron and steel, pulp and paper, electroplating, petroleum, and marine industries are some that use this technique.

Product Type Insights

Benchtop product type led the market and accounted for 70.83% of the global revenue share in 2022. A self-contained, extremely portable, lightweight system designed for a backpack that may be used to analyze both microbiological and physicochemical water quality parameters. Ideal for water engineers doing testing or monitoring in isolated rural areas with difficult terrain.

The substantial market share of portable & handheld devices can be attributed to the rising demand for portable water testing tools that can be used in the field or in a makeshift lab to examine physical, chemical, and microbiological pollutants. Additionally, it is anticipated that during the forecast period, this segment would record the largest CAGR.

The purpose of the benchtop water test kit is to test the safety of drinking water by looking specifically for bacterial contamination. It is particularly helpful in emergencies where testing and results can be promptly ascertained so that immediate corrective action can be performed.

Test Type Insights

Physical tests led the market and accounted for 56.35% of the global revenue share in 2022. The demand is expected to progress owing to the surging awareness of water-prone diseases. The physical test records color, total solids, turbidity, suspended solids, dissolved solids, odor, and taste. The color tests suggest the effectiveness of the water treatment system.Colloidal matter and suspended solids are the causes of water turbidity. It can be the result of soil erosion brought on by dredging or the development of microorganisms. Filtration is costly when there is high turbidity.

The chemical test records pH, the presence of a defined group of chemical parameters, hardness, biocides, highly toxic chemicals, and B.O.D. The concentration of hydrogen ions is gauged by pH. It serves as a gauge for the water's relative acidity or alkalinity. B.O.D. is the measure of how much oxygen microorganisms require to stabilize degradable organic matter in aerobic environments. Having a high BOD signifies organic pollution and a lack of oxygen necessary for living.

Technique Insights

Electrochemistry led the market and accounted for 42.64% of the global revenue share in 2022. Electrochemical methods are appealing because of their small size, chemical selectivity, a wide range of applications, and minimal production of secondary waste.

The electrochemical measurement equipment is chosen to regulate variables including pH, conductivity, redox, dissolved oxygen, and TDS. The method may be used right away on the job site and has advantages such as being adaptable to any environment, portable, simple to understand, and simple to use.

Atomic and molecular spectroscopy is a potent technique for analyzing the chemical makeup or structure of a substance, whether it be a pure compound, a simple mixture, or a solution of two or more different phases of crystalline or amorphous material.

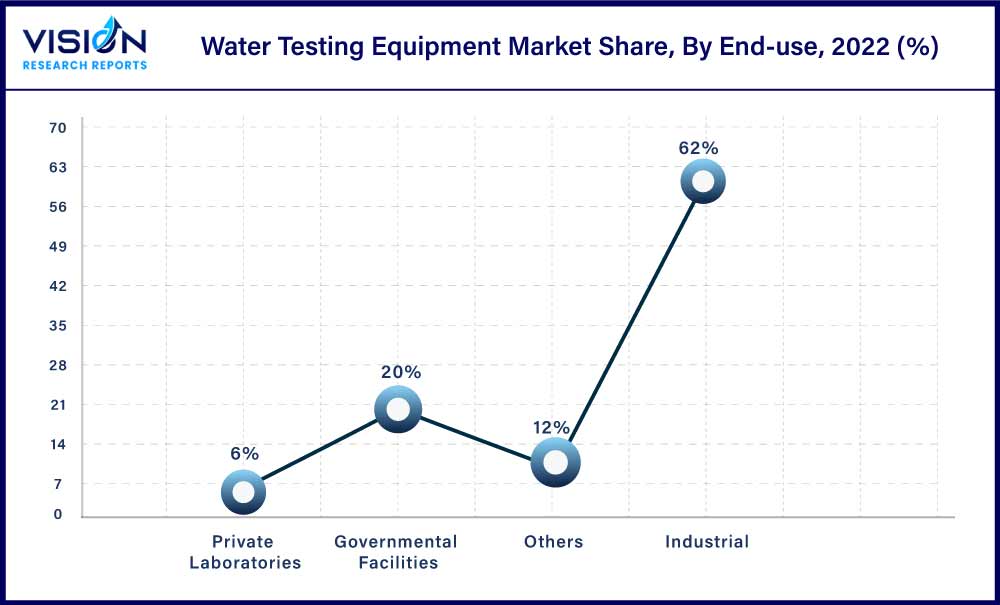

End-use Insights

The industrial end-use segment led the water testing equipment market and accounted for 62% of the global revenue share in 2022. The surging industrial development globally owing to favorable government policies is expected to escalate the count of manufacturing facilities and correspondingly augment the product demand.

The industrial application segment presents a wide application scope for fresh and processed water in several industries including chemical, paper & pulp, food & beverages, mining, and refineries. Rapid urbanization, technological advancements, and a rising number of production units are resulting in high demand for fresh and processed water. These factors are, in turn, projected to promote the market growth over the forecast period.

Increasing urban population, rising investment, and favorable government policies promoting infrastructure development are projected to foresee tremendous demand for water treatment systems in municipal sectors of developing markets, including Turkey, China, India, Thailand, and Bangladesh. These factors are projected to propel the growth of the water testing equipment industry.

The private laboratories end-use segment also had significant growth in 2022. The rising requirements for clean water owing to rapid urbanization & industrialization and the depleting freshwater supplies are expected to drive the segment growth over the projected period.

Regional Insights

North America led the market and accounted for 35% of the global revenue share in 2022. Several regulations, including the Clean Water Act, recommend that states in the U.S. designate surface waters used for drinking water and set water quality standards. This Act also establishes programs to prevent pollution from entering these waters. Furthermore, the Safe Drinking Water Act (SDWA) mandates the safety of U.S. public drinking water supplies are expected to fuel market growth over the forecast period.

The demand for water testing equipment is estimated to witness a significant CAGR in the Middle East and Africa over the forecast period. Increasing expenditure on the establishment of water treatment facilities in the Middle East and rising demand for processed water for food & beverages are some of the key factors for market growth.

The European Commission has set a mission to transform water utilities in less developed parts of Europe. EU’s water policy which is primarily driven by three directives, namely, the drinking water directive, the water framework directive, and the urban wastewater treatment directive is expected to increase the demand for water testing equipment on a domestic level.

The U.S. Mexico Border Water Infrastructure Grant Program is expected to prove beneficial for the country with grants for water infrastructure projects along Tijuana, New, and San Pedro rivers. Public-private partnerships in these projects are expected to increase over the years, augmenting the growth of the water testing equipment industry in Mexico.

Water Testing Equipment Market Segmentations:

By Instrument

By Product Type

By Test Type

By Technique

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Water Testing Equipment Market

5.1. COVID-19 Landscape: Water Testing Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Water Testing Equipment Market, By Instrument

8.1. Water Testing Equipment Market, by Instrument, 2023-2032

8.1.1. TOC Meter

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. pH Meter

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Dissolved Oxygen Meter

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Conductivity Meter

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Turbidity Meter

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Spectrometer

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Chromatograph

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Water Testing Equipment Market, By Product Type

9.1. Water Testing Equipment Market, by Product Type, 2023-2032

9.1.1. Portable & Handheld

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Benchtop

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Water Testing Equipment Market, By Test Type

10.1. Water Testing Equipment Market, by Test Type, 2023-2032

10.1.1. Physical Test

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Chemical Test

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Biological Test

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Water Testing Equipment Market, By Technique

11.1. Water Testing Equipment Market, by Technique, 2023-2032

11.1.1. Electrochemistry

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Separation Technique

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Atomic & Molecular Spectroscopy

11.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Water Testing Equipment Market, By End-use

12.1. Water Testing Equipment Market, by End-use, 2023-2032

12.1.1. Industrial

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Governmental Facilities

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Private Laboratories

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Water Testing Equipment Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.1.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.1.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.1.4. Market Revenue and Forecast, by Technique (2020-2032)

13.1.5. Market Revenue and Forecast, by End-use (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Technique (2020-2032)

13.1.7. Market Revenue and Forecast, by End-use (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Technique (2020-2032)

13.1.8.5. Market Revenue and Forecast, by End-use (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.2.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.4. Market Revenue and Forecast, by Technique (2020-2032)

13.2.5. Market Revenue and Forecast, by End-use (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.7. Market Revenue and Forecast, by Technique (2020-2032)

13.2.8. Market Revenue and Forecast, by End-use (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.10. Market Revenue and Forecast, by Technique (2020-2032)

13.2.11. Market Revenue and Forecast, by End-use (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Technique (2020-2032)

13.2.13. Market Revenue and Forecast, by End-use (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Technique (2020-2032)

13.2.15. Market Revenue and Forecast, by End-use (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.3.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.4. Market Revenue and Forecast, by Technique (2020-2032)

13.3.5. Market Revenue and Forecast, by End-use (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Technique (2020-2032)

13.3.7. Market Revenue and Forecast, by End-use (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Technique (2020-2032)

13.3.9. Market Revenue and Forecast, by End-use (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Technique (2020-2032)

13.3.10.5. Market Revenue and Forecast, by End-use (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Technique (2020-2032)

13.3.11.5. Market Revenue and Forecast, by End-use (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.4.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.4. Market Revenue and Forecast, by Technique (2020-2032)

13.4.5. Market Revenue and Forecast, by End-use (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Technique (2020-2032)

13.4.7. Market Revenue and Forecast, by End-use (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Technique (2020-2032)

13.4.9. Market Revenue and Forecast, by End-use (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Technique (2020-2032)

13.4.10.5. Market Revenue and Forecast, by End-use (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Technique (2020-2032)

13.4.11.5. Market Revenue and Forecast, by End-use (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.5.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.5.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.5.4. Market Revenue and Forecast, by Technique (2020-2032)

13.5.5. Market Revenue and Forecast, by End-use (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Technique (2020-2032)

13.5.7. Market Revenue and Forecast, by End-use (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Instrument (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Product Type (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Technique (2020-2032)

13.5.8.5. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 14. Company Profiles

14.1.Thermo Fisher Scientific, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. SGS SA

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Emerson Electric Co.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Honeywell International, Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Danaher Corporation

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. General Electric Company

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Horiba Ltd.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. 3M Company

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Mettler-Toledo International, Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Perkinelmer, Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others