The global wildlife health market size was estimated at around USD 2.26 billion in 2022 and it is projected to hit around USD 5.82 billion by 2032, growing at a CAGR of 9.92% from 2023 to 2032. The wildlife health market in the United States was accounted for USD 574 million in 2022.

Key Pointers

Report Scope of the Wildlife Health Market

| Report Coverage | Details |

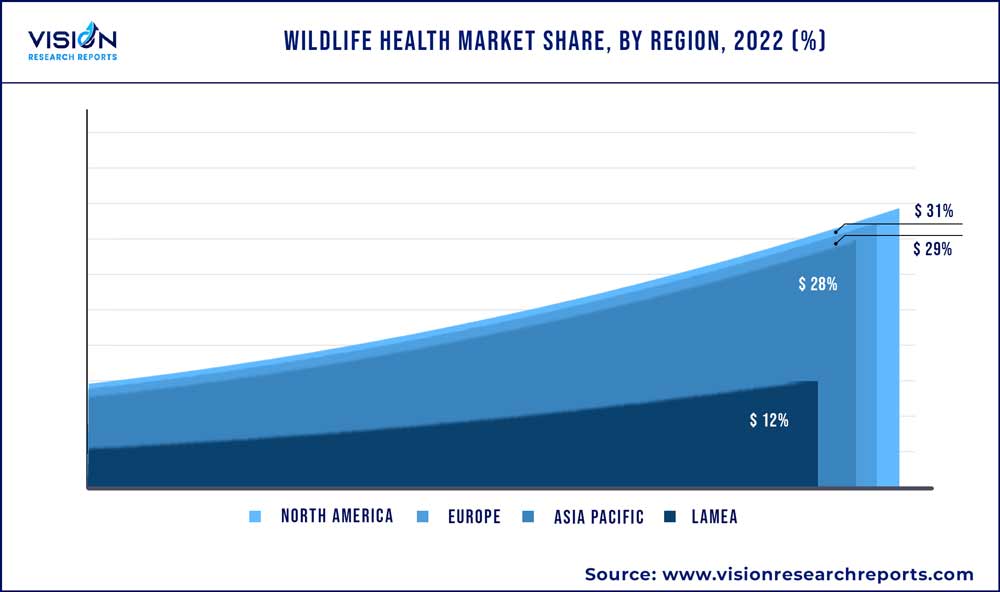

| Revenue Share of North America in 2022 | 31% |

| CAGR of Asia Pacific from 2023 to 2032 | 11.03% |

| Revenue Forecast by 2032 | USD 5.82 billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.92% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Boehringer Ingelheim International GmbH; NexGen Pharmaceuticals; Virbac; Pneu-Dart Inc.; Dong Bang Co., Ltd.; DANiNJECT; Genia; Wedgewood Pharmacy; The Pet Apothecary; Taylors Pharmacy |

Some of the key factors driving the market include the increasing number of emerging & re-emerging zoonotic diseases from wild animal origins, growing government intervention in protecting wildlife Animal health by acknowledging its interconnectedness with human health, collaboration framework of multiple public sectors to promote wildlife conservation with funded programs, and growing establishments of national parks, zoos, and animal protection sanctuaries with standardized animal care. For instance, the Indian Ministry of Environment, Forest, and Climate has launched the “Vision-Plan 2021 - 2031” strategy that focuses on strengthening Central Zoo Authority and transforming Indian zoos with global standards to have advanced animal care.

The COVID-19 infection brought unprecedented changes in wildlife activities, with extensive lockdown measures and supply chain disruptions. According to an article published on May 2022 by the National Library of Medicine, the pandemic-imposed restrictions on movements have simultaneously reduced the patrolling and monitoring activities in several areas of wildlife facilities. The reduced forest-law enforcement, in turn, has increased the opportunities for illegal wildlife hunting by poachers. Furthermore, the pandemic has delayed funding services for wildlife management in several parts of the globe. For instance, according to the Euro Group for Animals Organization, the pandemic has delayed public funding to provide free emergency care for distressed & injured wild animals.

Organizations, such as OIE (World Organization for Animal Health), have been striving for over a decade to support & improve wildlife health. Their key figures indicate that around 40% of amphibians, 25% of mammals, and 14% of birds are under threat of extinction. To mitigate this, several steps have been taken by governments of various countries along with key wildlife organizations, such as the World Wilde Fund (WWF), Wildlife Conservation Society (WCS), International Union for Conservation of Nature (IUCN), and National Resources Defense Council, Inc. among others, thereby protecting wild animals. In addition, OIE also states that 72% of the emerging infectious diseases around the world have a wildlife origin. Therefore, a well-advanced disease surveillance system and management measures with necessary medications may reduce the burden of life-threatening diseases similar to COVID-19.

The recent report published by the WWF Living Planet on October 2022 revealed that the global wildlife population has declined by 69% since 1970. Therefore, to conserve and protect wild species, the national governments of many countries are implementing measures to establish new biosphere reserves, national parks, sanctuaries, wildlife rehabilitation centers, and other conservation facilities. Moreover, veterinary drugs play an important role in wildlife research and management. Several medicines are used in wildlife facilities for multiple purposes, including capturing & transporting animals, treating injuries, preventing diseases with core wild animal vaccinations, and rehabilitating or rescuing distressed animals, among others. These affirmative factors are significantly contributing to the growth of the market.

Animal Type Insights

In 2022, the mammals segment accounted for the largest revenue share of 46%. Several species of wild mammals, such as lions, elephants, tigers, monkeys, leopards, bears, pandas, giraffes, zebra, wild canines & felines, wild cattle, and whales, among others, are found majorly in the wildlife spaces with enormous protection measures. For instance, FAO states that the ‘Wild Mammals Protection Act 1996’ has been implemented to specifically protect wild mammals against any source of harm. Furthermore, organizations like Wildlife Vets International, Worldwide Veterinary Service, and Smithsonian Institution have been supporting tiger veterinary care projects in India, Bangladesh, Russia, the U.S., and Indonesia, among other countries, to provide vital veterinary medication treatments in local conservations.

The reptiles animal type segment willregister the fastest CAGR of around 11.03% over the forecast period. The ample availability of non-prescription reptile medicines and the increasing need to protect several reptile species from extinction are some of the factors contributing to the substantial segment growth. In addition, the birds segment is also expected to growsignificantly over the forecast period owing to the increasing number of rehab facilities with trained veterinarians dedicated to protecting captive wild birds. Furthermore, the number of bird protection helplines and rescue centers is growing in developed countries to treat abandoned or injured wild birds immediately.

Product Insights

Based on products, the medicine segment dominated the market with the highest revenue share in 2022. According to the guidelines published by the American Association of Zoo Veterinarians, every zoo and aquarium must have on-site veterinary pharmacies to routinely supply basic veterinary drugs, such as antibiotics, anesthetics, emergency resuscitative medications, analgesics, fluids, anthelmintics, and tranquilizers, among others. Immobilizing drugs, such as tranquilizers, sedatives/hypnotics, narcotics, dissociative/combination drugs, and reversals or antagonist drugs, have been extensively used as a part of veterinary practices in wildlife management. The wide usage and requirement of medicines in rehabilitation & rescue centers further contribute to the substantial segment share.

The equipment and consumables segment is anticipated to grow at the fastest CAGR of over 10.05% during the projected timeline owing to its ample commercial availability for wildlife veterinary purposes. According to the Indian Central Zoo Authority, every mini to large-sized zoo in the country must be equipped with critical care units, diagnostic/vital monitoring systems, surgical supplies, stretchers, medical tool kit, electro-surgical units, medicine baits, color doppler ultrasound, and animal tranquilizing guns, among others. The growing technological advancements in equipment to make wildlife health management easy for zoo keepers, sanctuary veterinarians, and other key personnel in wildlife facilities are further supporting the growth of the segment.

Route Of Administration Insights

The injectable route of administration held the dominant share of over 46% in 2022. The veterinarians and wildlife officers are mostly involved in tranquilizing or sedating animals in national parks, sanctuaries, and zoos, typically using intramuscular or intravenous injections. Some injectable drugs are also provided through a subcutaneous route based on the requirements. In addition, the remote drug delivery system has now become a safe and easy way of delivering vaccines, medicines, and sedatives to wild animals. As per an article published by the National Library of Medicine on March 2022, double dart injection guns are used efficiently at a distance of 5-20 meters to deliver medicines to wild animals.

The oral route of drug administration is anticipated to grow at the fastest CAGR of more than 10.04% over the projected timeline. The NC Department of Health and Human Services reported on September 2022 that the wildlife services department would be distributing consumable forms of rabies vaccines through 500,000 oral baits in the borders of North Carolina Zones, targeting wild raccoons. Moreover, the World Organization for Animal Health published a report on September 29, 2022, stating that oral vaccine baits have been successfully implemented to prevent rabies from wildlife reservoirs in North America and Europe.

End-use Insights

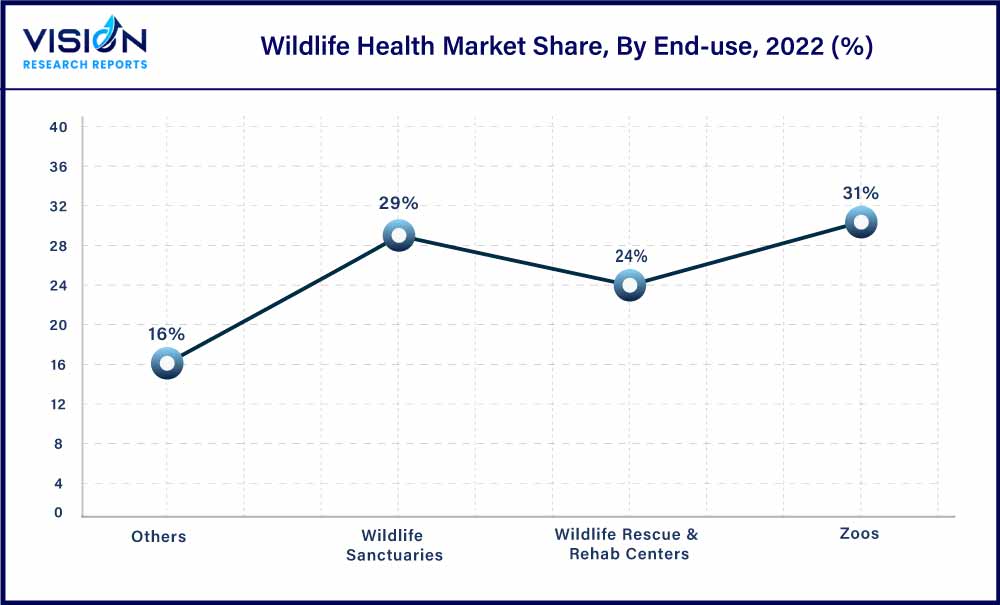

The zoos segment held the dominant market share of over 31% in 2022. The substantial share is owing to the strict standards & guidelines followed in the zoological parks with employed trained veterinarians to offer medical services for captive animals. With over 2,400 zoos located just in the U.S., all of the animals are provided routine veterinary care with several invasive medical procedures. Moreover, zoos in developing countries like India have on-site veterinary hospitals with the required personnel and laboratory facilities to meet the global standards of wildlife health preventative measures.

The wildlife rescue & rehab centers segment is anticipated to grow at the fastest CAGR of around 10.55% over the forecast period. With the growing number of people valuing wildlife conservation & preventing wild animal extinctions, the count of volunteer wild animal rehabilitators and rescue teams who protects abandoned, injured, or wounded animals is also increasing. According to a study published by the National Library of Medicine in March 2022, millions of native wild animals are rescued, rehabilitated, and protected by wildlife rehabilitators each year globally.

Regional Insights

The North America region held over 31% revenue share of the market in 2022. The significant availability of wildlife veterinary care facilities, advanced technologies in delivering medicines for animals in sanctuaries/zoos, increasing government initiatives to prevent zoonotic diseases from wild reservoirs, ample number of trained wildlife veterinarians, and the growing number of wildlife conservation measures, programs, and funding activities, are some of the key factors contributing to the region’s growth.

On the other side, the Asia Pacific region is anticipated to grow at the fastest CAGR of approximately 11.03% over the projected period. As a part of the ‘One Health’ approach, wildlife health stakeholders are networking and working together across the Asia region to protect the health of wild animals. The World Organization for Animal Health indicated that the wildlife health framework would enhance the existing networks and their goals to achieve the strategy of protecting animals and associated human health. Moreover, with several biodiverse countries, the region is home to multiple species of wild animals coupled with country-wise wildlife protection systems.

Wildlife Health Market Segmentations:

By Animal Type

By Product

By Route of Administration

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Wildlife Health Market

5.1. COVID-19 Landscape: Wildlife Health Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Wildlife Health Market, By Animal Type

8.1. Wildlife Health Market, by Animal Type, 2023-2032

8.1.1. Mammals

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Birds

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Fish

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Reptiles

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Amphibians

8.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Wildlife Health Market, By Product

9.1. Wildlife Health Market, by Product, 2023-2032

9.1.1. Medicine

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Equipment & Consumables

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Wildlife Health Market, By Route of Administration

10.1. Wildlife Health Market, by Route of Administration, 2023-2032

10.1.1. Oral

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Injectable

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Wildlife Health Market, By End-use

11.1. Wildlife Health Market, by End-use, 2023-2032

11.1.1. Zoos

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Wildlife Sanctuaries

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Wildlife Rescue & Rehab Centers

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Wildlife Health Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.2.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Product (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.3.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Product (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.4.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Product (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Product (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Animal Type (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Product (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Route of Administration (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. Boehringer Ingelheim International GmbH

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. NexGen Pharmaceuticals

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Virbac

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Pneu-Dart Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Dong Bang Co., Ltd.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. DANiNJECT

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Genia

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Wedgewood Pharmacy

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. The Pet Apothecary

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Taylors Pharmacy

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others