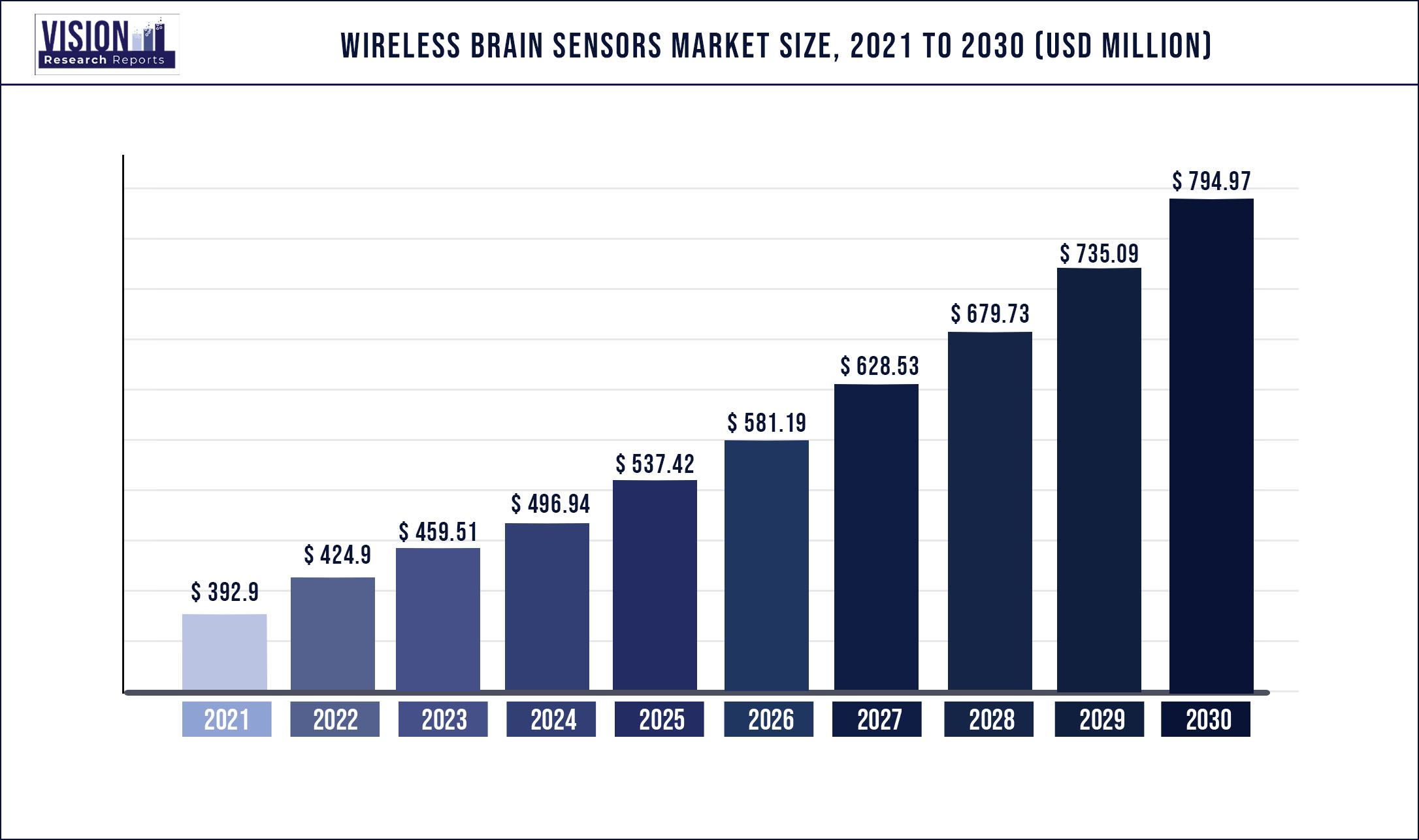

The global wireless brain sensors market was surpassed at USD 392.9 million in 2021 and is expected to hit around USD 794.97 million by 2030, growing at a CAGR of 8.15% from 2022 to 2030

Report Highlights

The increasing geriatric population, technological advancements, and rising prevalence of Traumatic Brain Injuries are the key factors driving the market.

Various initiatives undertaken by public and private organizations to raise awareness regarding TBIs are anticipated to boost the market growth. For instance, Brain Injury Awareness Month organized in the month of March, led by the Brain Injury Association of America, provides an opportunity to raise awareness regarding the lifetime effects of TBI. It is a national public awareness campaign that emphasizes the importance of acknowledging the impact of TBIs. The theme for the 2018 to 2020 campaign was “Change Your Mind.” This campaign educates the public about the prevalence of the injury and the needs of people with TBIs and their families. The goals of this campaign are primarily focused on:

According to the CDC, prominent causes of TBIs include assault, sports injuries, falls among older adults, and road accidents. The CDC is continuously taking efforts to minimize accidental injuries by improving sports concussion culture, preventing falls in older adults, and increasing vehicle safety. For instance, the CDC has introduced a new educational gaming app that educates children aged 6 to 8 years about basic concussion safety. This app shows kids how the brain can get injured in different ways during sports activities, and how important it is to tell a parent, coach, or other adults when the injury occurs. Since wireless brain sensors are highly recommended for the treatment of TBIs, thus, such awareness and initiatives are anticipated to promote market growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 392.9 million |

| Revenue Forecast by 2030 | USD 794.97 million |

| Growth rate from 2022 to 2030 | CAGR of 8.15% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, end-use, region |

| Companies Covered | EMOTIV; Advanced Brain Monitoring, Inc.; NeuroSky; Neuroelectrics; Neuronetrix Solutions LLC; Muse |

Product Insights

The Electroencephalography (EEG) devices segment dominated the market for wireless brain sensors and held the largest revenue share of 33.66% in 2021. The segment is anticipated to witness the fastest growth over the forecast period. The EEG devices allow recording the electrical activity of the brain. The device helps in collecting the electrical activity of the brain. The collected signals are digitalized and amplified and are then sent to mobile or computer for data processing and storage. Individuals can also use this device to improve their wellness and productivity by monitoring their emotions and mood.

The growth of the segment in the market for wireless brain sensors is majorly driven by the rising prevalence of traumatic brain injuries, migraine, and stroke across the globe. For instance, according to the Defense and Veterans Brain Injury Center (DVBIC), around 414,000 TBIs were reported among the U.S. service members between 2000 and late 2019. The majority of these TBIs were classified as mild. On average, about 1,600 TBIs per month occur among the U.S. service members. Thus, the growing incidence of TBIs due to an increasing number of sports injuries, road accidents, and explosive blasts is likely to boost segment growth in the market for wireless brain sensors during the forecast period.

End-use Insights

The multispecialty hospitals segment dominated the wireless brain sensors market and held the largest revenue share of 46.53% in 2021. The segment is anticipated to witness the fastest growth rate over the forecast period. The increasing cases of stroke and traumatic brain injuries are the major driving factors for the segment. For instance, according to the Centers for Disease Control and Prevention (CDC), in 2016, there were approximately 2.8 million hospitalizations, emergency department visits, and deaths in the U.S. due to TBI, representing around 2.5 million TBI-related emergency department visits, 288,000 hospitalizations, and 56,800 deaths. Hospitalization rates were the highest among individuals aged 65 and older.

Furthermore, hospitals are currently advancing in terms of technology. Brain examination is a complex process, which requires expensive and advanced equipment that is mainly found only in hospitals. Technologically advanced devices are being used extensively in hospitals to provide better treatment. These devices not only simplify treatment procedures but also provide better, faster, and accurate results. Mostly all neurological diseases and disorders, including severe TBIs, are diagnosed and treated with the help of advanced equipment used by professional neurologists, which are available in specialty hospitals. Hospitals also witness a significantly higher inflow of patients suffering from head injuries, as compared to clinics and other end-users.

Application Insights

The others segment dominated the market for wireless brain sensors and held the largest revenue share of 45.97% in 2021. The others segment majorly includes migraine, stroke, sleep disorders, and Huntington's disease. The increasing cases of migraines and stroke among all age groups across the globe is the major factor promoting the growth of the segment in the market for wireless brain sensors. For instance, as per a report published by the Migraine Research Foundation in 2020, migraine is the third most prevalent illness in the world. It also reported that migraine has affected around 39.0 million people in the U.S. and 1.0 billion people globally.

The traumatic brain injuries segment is anticipated to witness the fastest growth rate in the market for wireless brain sensors over the forecast period. The rising awareness regarding TBIs and increasing prevalence of TBIs are the major factors boosting segment growth in the market for wireless brain sensors. For instance, the National Association of State Head Injury Administrators (NASHIA) has started online workshops focusing on issues related to mental health and traumatic brain injuries for the year 2020-2021. NASHIA encourages state governments in developing rehabilitation centers to fulfill the requirements of people with TBIs. Moreover, many national and federal organizations, agencies, and state brain injury institutions organize various events and workshops to spread awareness regarding brain injury, and its treatment options, during the month of March.

Regional Insights

North America dominated the market for wireless brain sensors and accounted for the largest revenue share of 45.63% in 2021. The region is expected to witness the fastest growth rate of 10.4% over the forecast period owing to the increase in the prevalence of TBIs, well-established healthcare infrastructure, and favorable reimbursement policies and regulatory reforms in the healthcare sector. According to the Centers for Medicare and Medicaid Services (CMS), the national health spending of the U.S. is expected to grow at a 5.97% rate every year from 2022 to 2030 and is estimated to reach USD 6.0 trillion by 2030. In addition, rapid technological advancements and the presence of major medical devices companies, such as BioDirection, Inc.; BrainScope Company, Inc.; Neural Analytics, Inc.; and Advanced Brain Monitoring Inc., offering TBI assessment and management devices are also among the factors contributing to the growth of the market for wireless brain sensors in the region.

In Asia Pacific, the market for wireless brain sensors is anticipated to witness a considerable growth rate during the forecast period. The presence of a large target population and high unmet needs, with regards to minimally invasive techniques, is expected to present significant growth opportunities for the key players operating in the market for wireless brain sensors. Moreover, an increase in the number of clinical trials and high R&D investments by global market players, owing to low-cost services in the region, are high impact rendering drivers of the market for wireless brain sensors. An increase in the number of road accidents, government initiatives, and advancements in the clinical development framework of developing economies are few other factors aiding market growth in this region. However, the low adoption of advanced healthcare facilities, lack of skilled professionals, as well as poor healthcare reimbursement facilities in some of the countries in this region may hinder the growth of the market for wireless brain sensors.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Wireless Brain Sensors Market

5.1. COVID-19 Landscape: Wireless Brain Sensors Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Wireless Brain Sensors Market, By Product

8.1. Wireless Brain Sensors Market, by Product, 2022-2030

8.1.1 Electroencephalography (EEG) Devices

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Sleep Monitoring Devices

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Intracranial Pressure (ICP) Monitors

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Transcranial Doppler (TCD) Devices

8.1.4.1. Market Revenue and Forecast (2017-2030)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Wireless Brain Sensors Market, By Application

9.1. Wireless Brain Sensors Market, by Application, 2022-2030

9.1.1. Dementia

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Epilepsy

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Parkinson's Disease

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Traumatic Brain Injuries

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Wireless Brain Sensors Market, By End-use

10.1. Wireless Brain Sensors Market, by End-use, 2022-2030

10.1.1. Multispecialty Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Research Institutes

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Others

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Wireless Brain Sensors Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. EMOTIV

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Advanced Brain Monitoring, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. NeuroSky

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Neuroelectrics

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Neuronetrix Solutions, LLC

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Muse

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others