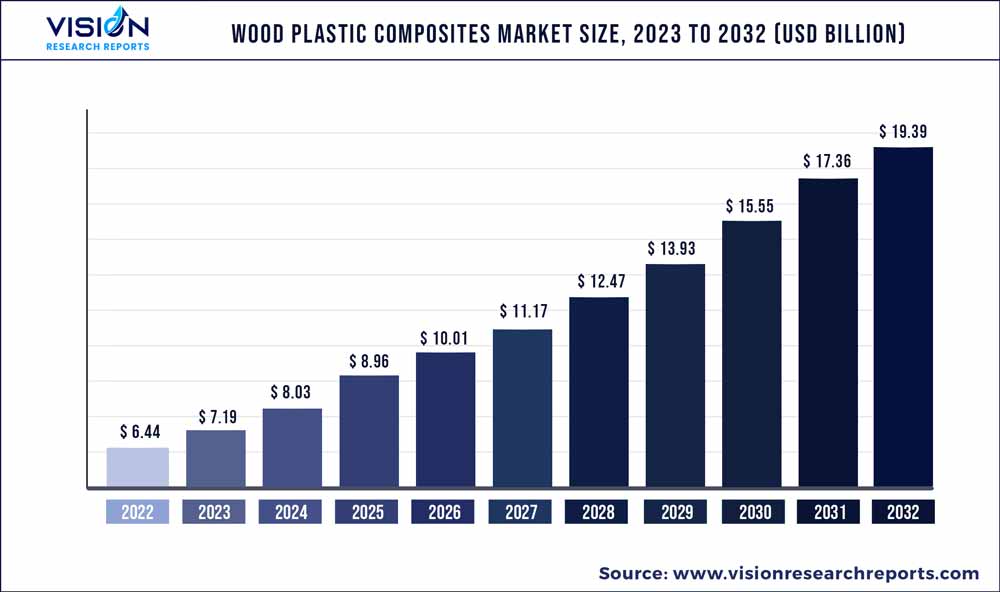

The global wood plastic composites market was surpassed at USD 6.44 billion in 2022 and is expected to hit around USD 19.39 billion by 2032, growing at a CAGR of 11.65% from 2023 to 2032.

Key Pointers

Report Scope of the Wood Plastic Composites Market

| Report Coverage | Details |

| Market Size in 2022 | USD 6.44 billion |

| Revenue Forecast by 2032 | USD 19.39 billion |

| Growth rate from 2023 to 2032 | CAGR of 11.65% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Advanced Environmental Recycling Technologies; Inc. (AERT); Axion Structural Innovations LLC; Beologic N.V.; CertainTeed Corporation; Fiberon; LLC; Fkur Kunststoff GmbH; Guangzhou Kindwood Co. Ltd.; Jelu-Werk Josef Ehrler GmbH & Co. KG; Woodmass; PolyPlank AB; Renolit; TAMKO Building Products; Inc.; TimberTech; Trex Company; Inc.; Universal Forest Product |

The market is driven by the rising demand for sustainable construction materials along with an increase in the renovation and repair activities in the residential sector across the globe.

Wood plastic composite has high durability, bending strength, shear strength, low moisture content, and low water absorption, as compared to conventional wood products. These properties have made it viable for use in railings, windows, doors, exterior siding, fencing, flooring, interior molding, and landscape materials.

The COVID-19 pandemic has resulted in significant changes in the global construction industry. Delay in new construction activities and intensification of labor shortages, along with an inadequate supply of raw materials have been some effects of the pandemic which had created an adverse impact on the market growth.

Increasing infrastructural development activities, especially in the emerging economies such as China, India, Thailand, and Brazil coupled with the growing demand for aesthetically appealing furniture and flooring solutions across the globe have surged the demand for wood plastic composite in the construction industry in the recent times.

Product Insights

Polypropylene product segment led the market and accounted for more than 12.02% share of the global revenue in 2022. The polypropylene segment is anticipated to see a boom, over the forecast period, owing to its heavy use in the niche application segments such as water-resistant coatings on furniture and high temperature controllable wooden units.

Polyvinyl chloride product segment is projected to register a CAGR of 11.05% in terms of value over the forecast period. Growing demand for polyvinylchloride thermoplastics in automotive applications for manufacturing door panels, seat cushions, cabin linings, backrests and dashboards on account of its excellent insulation properties is expected to have a positive impact on the market growth over the forecast period. Polyvinyl chloride thermoplastics have insulation properties and are thus employed in the manufacturing of insulative products for applications in electrical, and automotive industries.

The polyethylene segment is one of the fastest growing product segments on account of its high demand in manufacturing furniture for homes, offices, restaurants, resorts and hospitals. Moreover, the rising demand for polyethylene composites in the automotive industry owing to its low cost, high stiffness and biodegradability is expected to further propel the market growth over the coming years. Low cost, high stiffness, abundant raw material availability and biodegradability offered by polyethylene-based wood plastic composite products are likely to open new avenues for the market growth.

The rising demand for polystyrene and acrylonitrile butadiene styrene composites in a wide range of applications such as kitchen furniture, shower receptors, bathtubs, windowsills and whirlpool baths on account of its high durability and environment friendly characteristics is expected to boost the market growth over the next eight years.

Application Insights

Building and construction segment led the market and accounted for more than 71.04% of the global revenue share in 2022. Increasing infrastructural development activities in the emerging economies such as China, India, Thailand and Brazil coupled with the growing demand for aesthetically appealing furniture and flooring solutions across the globe, has surged the demand for wood plastic composite in the construction industry. Rising demand for various wood plastic-based wood products in construction applications, especially for decking is expected to propel market growth.

The use of recyclable or biodegradable wood-plastic composite-based parts in automobiles is expected to improve mechanical strength and acoustic performance, reduce material weight and fuel consumption, reduce manufacturing costs, improve passenger safety and shatterproof performance which will boost the demand for wood plastic composites in the automotive industry.

Wood filled PVC is gaining popularity because to its balance of thermal stability, moisture resistance, stiffness, and strength, although being more expensive than unfilled PVC. Wood-plastic composites are used in a variety of sectors across the world, although their methodologies differ. For longevity, they extrude wood filled PVC with an unfilled PVC cap stock, while others extrude a PVC core with a paintable wood filled PVC surface.

Increasing demand for wood plastic composite in manufacturing noise barriers for street construction, sheet pilings for landscaping and garden furniture, is expected to surge the product demand over the forecast period. In addition, the rising demand for wood plastic composite in manufacturing consumer goods including, toys, and showpieces is anticipated to further propel the market growth over the coming years.

Regional Insights

Asia Pacific led the market and accounted for over 30.17% share of global revenue in 2022. The region is expected to emerge as the fastest-growing market for wood plastic composite owing to the increased per capita income, coupled with rapid industrialization. The shift in Chinese consumer behavior, growing local competition, fragmented distribution and rising dual income is expected to create opportunities for wood plastic composite manufacturers over the forecast period.

Construction activities in the Central and South American economies have grown substantially owing to the rising income levels and shifting consumer preference towards green buildings. Expanding commercial construction sector coupled with the government initiatives to create awareness about green buildings among people is expected to stimulate the market growth over the forecast period. Public-private initiatives taken by the governments in the region have paved the way for foreign investment in the construction industry.

The rising concerns about the global economy because of the continued deceleration in the Eurozone and China, US-China trade discussions, political situation between China and Hong Kong and uncertainty over Brexit are expected to impact the global investments, trade, upcoming and ongoing residential/commercial projects and equity markets across the globe which is anticipated to restrict the market growth over the coming years.

The construction industry in South America mostly remained resilient even after the economic slump caused due to the pandemic. Factors such as uncertainty with respect to the economic policy and reforms in Brazil, and recent social unrest in various countries such as Colombia, Chile, Bolivia, and Ecuador are expected to have a negative impact on the region’s economic growth.

Wood Plastic Composites Market Segmentations:

By Product

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Wood Plastic Composites Market

5.1. COVID-19 Landscape: Wood Plastic Composites Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Wood Plastic Composites Market, By Product

8.1. Wood Plastic Composites Market, by Product, 2023-2032

8.1.1. Polyethylene

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Polypropylene

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Polyvinylchloride

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Wood Plastic Composites Market, By Application

9.1. Wood Plastic Composites Market, by Application, 2023-2032

9.1.1. Building and Construction

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Automotive Components

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Industrial and Consumer Goods

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Wood Plastic Composites Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Advanced Environmental Recycling Technologies; Inc. (AERT)

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Axion Structural Innovations LLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Beologic N.V.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. CertainTeed Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Fiberon; LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Fkur Kunststoff GmbH

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Guangzhou Kindwood Co. Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Jelu-Werk Josef Ehrler GmbH & Co. KG

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Woodmass

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. PolyPlank AB

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others