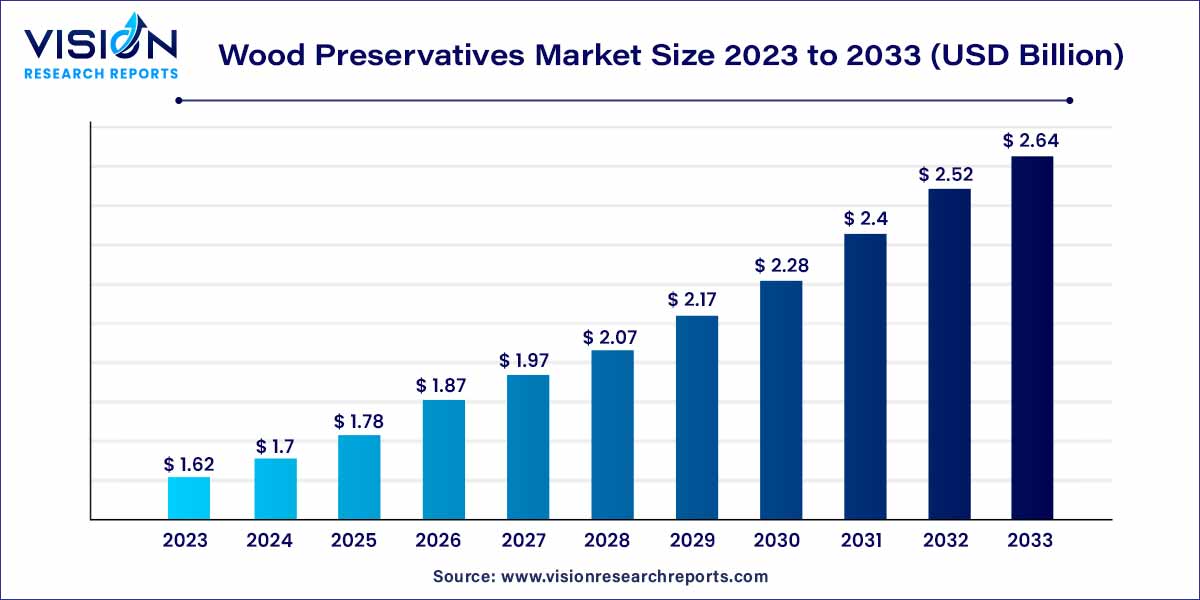

The global wood preservatives market size was estimated at around USD 1.62 billion in 2023 and it is projected to hit around USD 2.64 billion by 2033, growing at a CAGR of 5.03% from 2024 to 2033.

Wood preservatives play a pivotal role in enhancing the durability and lifespan of wood products by protecting them against decay, fungi, insects, and other environmental factors. The global wood preservatives market has witnessed significant growth in recent years, driven by the expanding construction industry, increasing demand for treated wood in outdoor applications, and rising awareness about the benefits of wood preservation.

The growth of the wood preservatives market is propelled by various factors contributing to its expansion. Firstly, the escalating pace of construction activities worldwide has significantly increased the demand for wood preservatives, as treated wood finds extensive application in residential, commercial, and industrial structures. Secondly, a growing awareness among consumers and industries about the crucial role of wood preservation in enhancing the longevity of wooden structures has driven a shift towards treated wood products. Additionally, the rising popularity of outdoor applications for wood, such as decks and fences, has stimulated the need for effective wood preservatives that can withstand environmental challenges. Stringent environmental regulations have also influenced market dynamics, prompting manufacturers to develop environmentally friendly formulations that comply with standards. Furthermore, continuous technological advancements in wood preservative technologies aim to improve efficacy while minimizing environmental impact, contributing to the sustained growth of the wood preservatives market.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 2.64 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.03% |

| Revenue Share of North Americ in 2023 | 36% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The water based product segment dominated the market with a revenue share of 74% in 2023 owing to their non-hazardous nature and no risk of fire or explosion. Moreover, the water-based product leaves the wood surface clean and paintable. This product type includes various metallic salts and other compounds. The most commonly used compounds include chromium, copper, fluoride, and arsenic. Water based product types are increasingly being used for plywood, lumber, and fence posts.

The water-based product type is formulated using water as a primary solvent instead of traditional organic solvents. This product type often contains fungicide and insecticide to protect against decay and insect damage. Moreover, these types of preservatives are safe for both the user and the environment owing to strict regulations on the VOCs. In addition, their stainable, paintable, odor-free, and clean nature makes them suitable for outdoor structures.

Solvent-based product type are used to protect the wood from degradation from degradation due to sap stains, fungal rot, molds, or wood-destroying insects. They are commonly used for outdoor applications such as seasoned building materials, utility poles, and fence posts among others. Solvent based product type is known for its ability to penetrate deep into wood providing long-lasting protection. Moreover, they are protective against a wide range of wood-destroying organisms.

Oil type preservatives are generally classified into two main groups including creosote solutions and creosote. Creosote includes creosote-coal tar, creosote, and creosote-petroleum formulations. The composition of oil-borne preservatives consists of preservative chemicals dissolved in a nonaqueous solvent. Some of the common types of oil-based products include motor oil, tung oil and linseed oil. Linseed oil is a natural wood preservative that penetrates deep in the porous fibers of wood, protecting it from moisture and rot. Tung oil is another natural wood preservative that provides a protective finish to the wood.

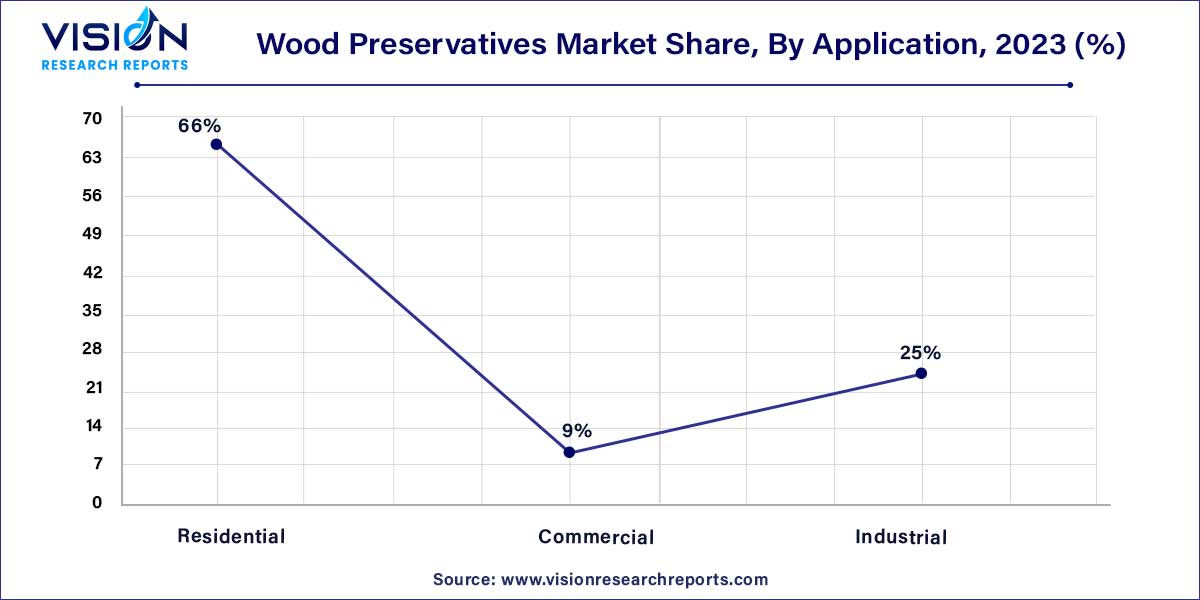

The residential application segment led the market with the highest revenue share of 66% in 2023. In residential application the product is used in doors, staircases, roofs, cabinets, columns, and beams. The shift of people from rural to urban areas globally is further driving the demand for construction activities which is further increasing the consumption of wood and the product. As per the Government of India, approximately 600 million people are expected to live in urban areas in India till 2030 creating a demand for about 25 million additional household units. This is one of the drivers and an opportunity for the product market in the country.

trusses, and tied rafters among others. The increasing demand for residential project in countries like China, India, Japan, the U.S., and the U.K. is further expected to boost the product demand in the respective countries.

The commercial construction industry is increasing using wood, particularly mass timer for various applications due to its sustainability, aesthetic appeal and cost competitiveness. The mass timber construction is energy efficient alternative to high rise and commercial buildings, with lighter carbon footprint than steel or concrete. Moreover, the traditional wood frame construction is also considered to be a cost-effective option for shopping malls, restaurants and big box stores. The product plays a crucial role in commercial construction activities as they help to protect the wood from degradation.

Wood is used in various industrial construction activities including warehouses, manufacturing facilities and distribution centers. Moreover, wooden cribbing is also used as a temporary structure for overseas shipping and to support heavy objects. Apart from this, it is also used in corbels and pilings. The developing industrial sector globally is increasing the demand for wood which is further expected to boost the global consumption of the product.

North America region dominated the market with a revenue share of more than 36% in 2023. There were more than 919,000 constructions in the U.S. in the first quarter of 2022 as per the Associated General Contractors (AGC) of America. The rapidly developing construction activities in the region are driving the demand for products in the region. Moreover, the construction industry in Canada is a vital sector contributing significantly to the country’s economy. It includes a broad range of activities like residential, commercial, and infrastructure development.

Asia Pacific is also a potential market for products owing to rapidly developing construction industry in countries like China, India, Japan, and South Korea. According to the report published by Oxford Economics in May 2022, the construction industry in India is expected to witness the fastest growth in the world by 2032. It is projected to add USD 1 trillion to the growth of the global construction industry by 2032. Favorable policies by the government of India to strengthen the urban infrastructure in the country and meet the demands of the rapidly growing urbanizing population are contributing to the growth of the construction industry in the country. Thus, the rapidly growing construction activities globally are considered to be the major driving factor for the product market.

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Wood Preservatives Market

5.1. COVID-19 Landscape: Wood Preservatives Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Wood Preservatives Market, By Type

8.1. Wood Preservatives Market, by Type, 2024-2033

8.1.1. Water Based

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Solvent Based

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Oil Based

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Wood Preservatives Market, By Application

9.1. Wood Preservatives Market, by Application, 2024-2033

9.1.1. Residential

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Wood Preservatives Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Jubilant

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Dolphin Bay

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Rio Tinto

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. LANXESS

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Viance

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Nisus Corporation

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. BERKEM

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Troy Corporation

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Impra Wood Protection Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Wykamol Group Ltd

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others