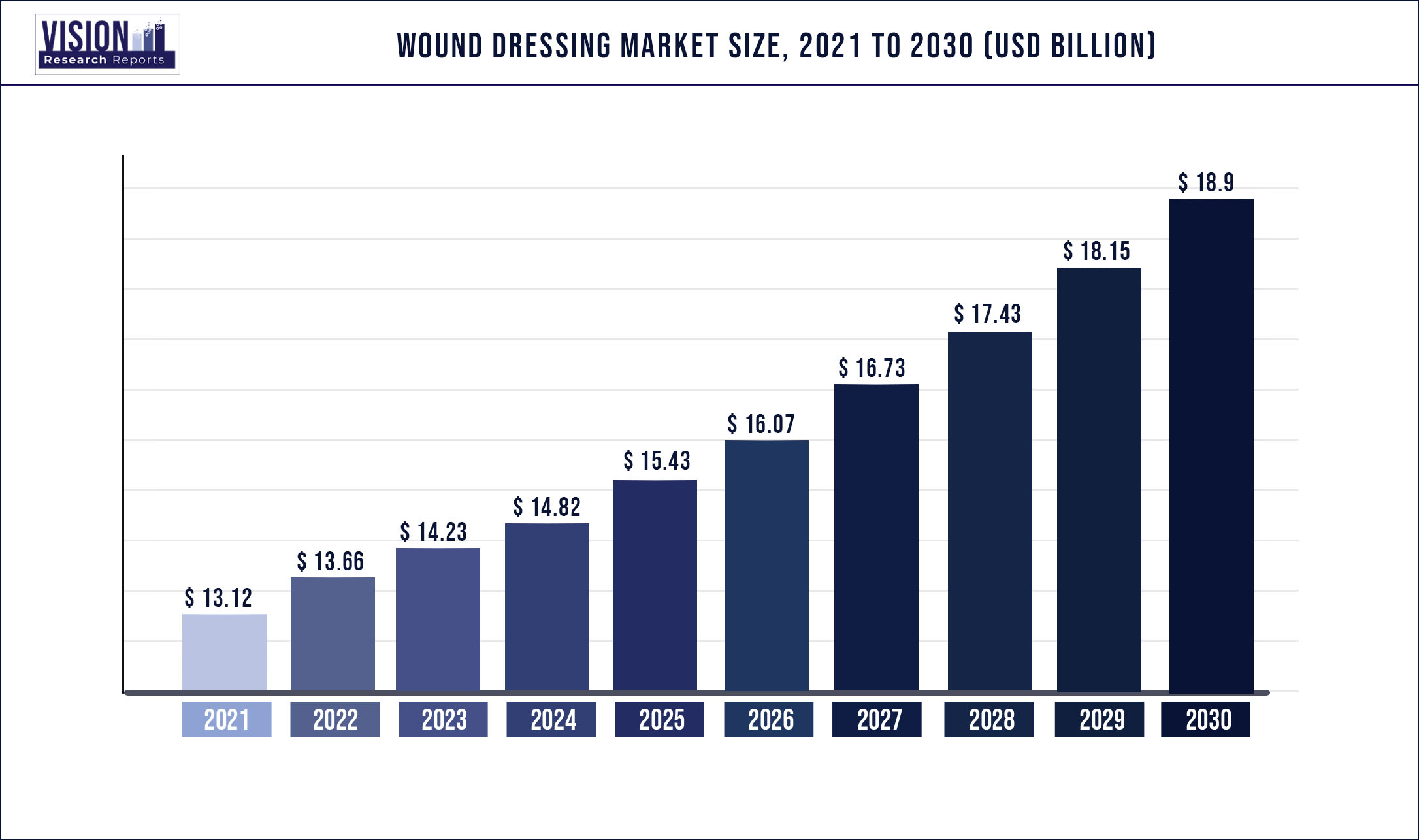

The global wound dressing market size was estimated at around USD 13.12 billion in 2021 and it is projected to hit around USD 18.9 billion by 2030, growing at a CAGR of 4.14% from 2022 to 2030.

Report Highlights

An increasing number of people suffering from chronic wounds, a rise in technologically advanced dressing, and rising cases of traumatic accidents are expected to be the key driving factors for the market.

There has been an increase in the number of people suffering from chronic disorders such as diabetes, as a result, the number of people suffering from diabetic foot ulcers is increasing. For instance, as per the International Diabetes Federation, an estimated population of 61 million people aged between 20-79 years living in Europe were suffering from diabetes. Similarly, according to NCBI, the incidence rate of diabetes foot ulcers globally is between 9.1 million to 26.1 million annually. Thus, the rise in diabetes and diabetic foot ulcer patients is increasing the demand for wound dressing products, thereby impelling the market over the forecast period.

Moreover, there has been a global increase in the number of traumatic accidents such as burns, gunshots, and road accidents. For instance, according to stats by WHO, approximately 11 million burn cases occur worldwide, which leads to 180,000 deaths globally, Similarly, as per NCBI, every day, more than 30,000 burn cases are registered globally. Therefore, the rising global number of burn cases is anticipated to impel market growth over the forecast period.

The outbreak of COVID-19 resulted in nationwide lockdowns worldwide, and as a result, the growth of the market was restricted to a certain extent. However, the market is projected to witness a significant growth rate during the post-pandemic period. This can be attributed to various strategies such as product launches, partnerships, and geographic expansion used by leading market players. For instance, in December 2020, Molnlycke Health Care AB launched a new distribution in the U.K. It was a strategic move, strengthening their supply chain to increase the product reach in the U.K. population. Thus, as a result of the aforementioned factors, the market is expected to have significant growth during the post-pandemic period, thereby, propelling the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 13.12 billion |

| Revenue Forecast by 2030 | USD 18.9 billion |

| Growth rate from 2022 to 2030 | CAGR of 4.14% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, application, end-use, region |

| Companies Covered |

3M; Coloplast Corp.; Medline Industries; Smith & Nephew; Medtronic; ConvaTec Group PLC; Derma Sciences (Integra LifeSciences); Ethicon (Johnson & Johnson); Baxter International; Molnlycke Health Care AB |

Product Insights

Based on product, the advanced dressing segment is expected to dominate the market with a revenue share of 54.3% in 2021. This can be attributed to rising cases of obesity and venous leg ulcers. For instance, as per a study by Sage Journals, the prevalence rate of obesity in India is 40.3%. Similarly, according to WHO, 25.1% of people in Germany are obese. Obese people are more susceptible to venous leg ulcers, thus, rising obesity among the population is expected to help the advanced dressing segment dominate over the forecast period.

The traditional dressing segment is expected to witness a considerable CAGR of 3.6% over the forecast period. Traditional dressings are most commonly used to treat burn cases, thus, the rising number of burn cases is expected to boost the traditional dressing segment. For instance, according to WHO, on average, 265,000 deaths are caused due to burns every year. Moreover, in India, around 1,000,000 people are moderately or severely burnt each year. Similarly, as per CDC in the U.S. approximately, 4,500 burn victims die annually & 10,000 die due to burn-related infections, thereby, boosting the segment growth.

Application Insights

Based on application, the chronic wounds segment dominated the market with a revenue share of 59.89% in 2021. This can be attributed to the increasing incidence of chronic diseases and the geriatric population globally. For instance, as per Ageing Asia, in Indonesia, the number of people aged above 60 was 27,524,000 in 2019, which is projected to reach 69,792,000 in 2050. Similarly, there has been increasing in people suffering from diabetes & diabetic foot ulcers. For instance, as per ScienceDirect, diabetic foot ulcers may affect 25% of the diabetic population & may lead to amputation in around 20% of the infected population. According to American Diabetes Association, in 2018, around 34.2 million people in the U.S. has diabetes, which according to BMC Population Health Metrics is anticipated to triple by 2060. Thus, boosting the segment growth.

The acute wounds segment is projected to witness the fastest growth rate of CAGR of 4.18% during the forecast period. This can be accredited to the rising number of surgical wounds and surgical site infections worldwide. For instance, as per a study by Wound International, the incidence rate of surgical site infections in general surgery was found to be 11.7%. Similarly, the rising incidence of traumatic accidents is expected to impel the segment growth. For instance, as per an article by Brady United Organization, around 316 people in the U.S. are shot every day, leading to acute wounds, which require wound dressing to heal. Thus, due to the above-mentioned factors, the wound dressing market is expected to impel over the forecast years.

End-use Insights

Based on end-use, the hospital segment dominated the market with a revenue share of 45.17% in 2021. This can be credited to rising surgical procedures and an increasing number of hospitals. For instance, according to a study published by NCBI in 2020, globally, an estimated of 310 million surgical cases are recorded annually, out of which 40 million - 50 million are carried out in the U.S. alone. Moreover, there has been an increase in the number of hospitals and hospitalization worldwide. For instance, as per the Australian Institute of Health & Welfare, the number of hospitalization in Australia has increased. For instance, in 2019 - 2020, 11.1 million people in Australia were hospitalized. Thus, due to the aforementioned factors, the hospital segment is expected to dominate the end-use segment.

However, the home healthcare segment is projected to witness the fastest CAGR of 4.79% during the forecast period. Home healthcare settings have been increasing in many countries. Moreover, many surgeries require a prolonged recovery period, leading to frequent change of wound dressing. Further, the geriatric population and bariatric population prefer home healthcare settings. Thus, the rising bariatric population & geriatric population is anticipated to boost the home healthcare segment. For instance, as per WHO, world obesity has tripled since 1975. Additionally, as per a similar source, in 2020, wound 39 million children under the age of five were overweight or obese. Thereby, impelling the home healthcare segment during the forecast period.

Regional Insights

Based on region, North America dominated the wound dressing market with a revenue share of 45.34% in 2021. This dominance can be accredited to well-developed healthcare infrastructure, increasing awareness, and the presence of major key players in the region. Additionally, an increase in the number of surgeries in the North American region is expected to impel the wound dressing market. For instance, according to Life Span Organization, approximately 500,000 open heart surgeries were performed in the U.S. in 2018. Similarly, according to AHA Journals, approximately, 40,000 children undergo congenital heart surgery in the U.S. As such surgeries take time to heal, and wound dressing products help in healing these wounds in a quick duration. Hence, wound dressings are preferred post-surgery, thereby, impelling the wound dressing market in the North American region.

However, Asia Pacific is estimated to witness the fastest CAGR of 4.77% during the forecast period. This can be accredited to the proliferating diabetic population in the region. For instance, according to the Down to Earth organization, as of December 2021, India had a 74.2 million diabetic population, which was aged between 20 - 79. Moreover, this number is anticipated to increase and reach 124.8 million by 2045. Similarly, according to IDF, in 2019, 3,993,300 people out of the total population of 63,265,700 in the Philippines were diabetic. As diabetic people are more prone to diabetic foot ulcers, therefore, an increase in the diabetic population may help the wound dressing market grow in the Asia Pacific region.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Wound Dressing Market

5.1. COVID-19 Landscape: Wound Dressing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Wound Dressing Market, By Product

8.1. Wound Dressing Market, by Product, 2022-2030

8.1.1 Traditional Dressing

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Advanced Dressing

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Antimicrobial Dressing

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Active Dressing

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Wound Dressing Market, By Application

9.1. Wound Dressing Market, by Application, 2022-2030

9.1.1. Chronic Wounds

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Acute Wounds

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Wound Dressing Market, By End-use

10.1. Wound Dressing Market, by End-use , 2022-2030

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Specialty Clinics

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Home Healthcare

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Wound Dressing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-use (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Application (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-use (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Application (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 12. Company Profiles

12.1. 3M

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Coloplast Corp.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Medline Industries

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Smith & Nephew

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Medtronic

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. ConvaTec Group PLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Derma Sciences (Integra LifeSciences)

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Ethicon (Johnson & Johnson)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Baxter International

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Molnlycke Health Care AB

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others