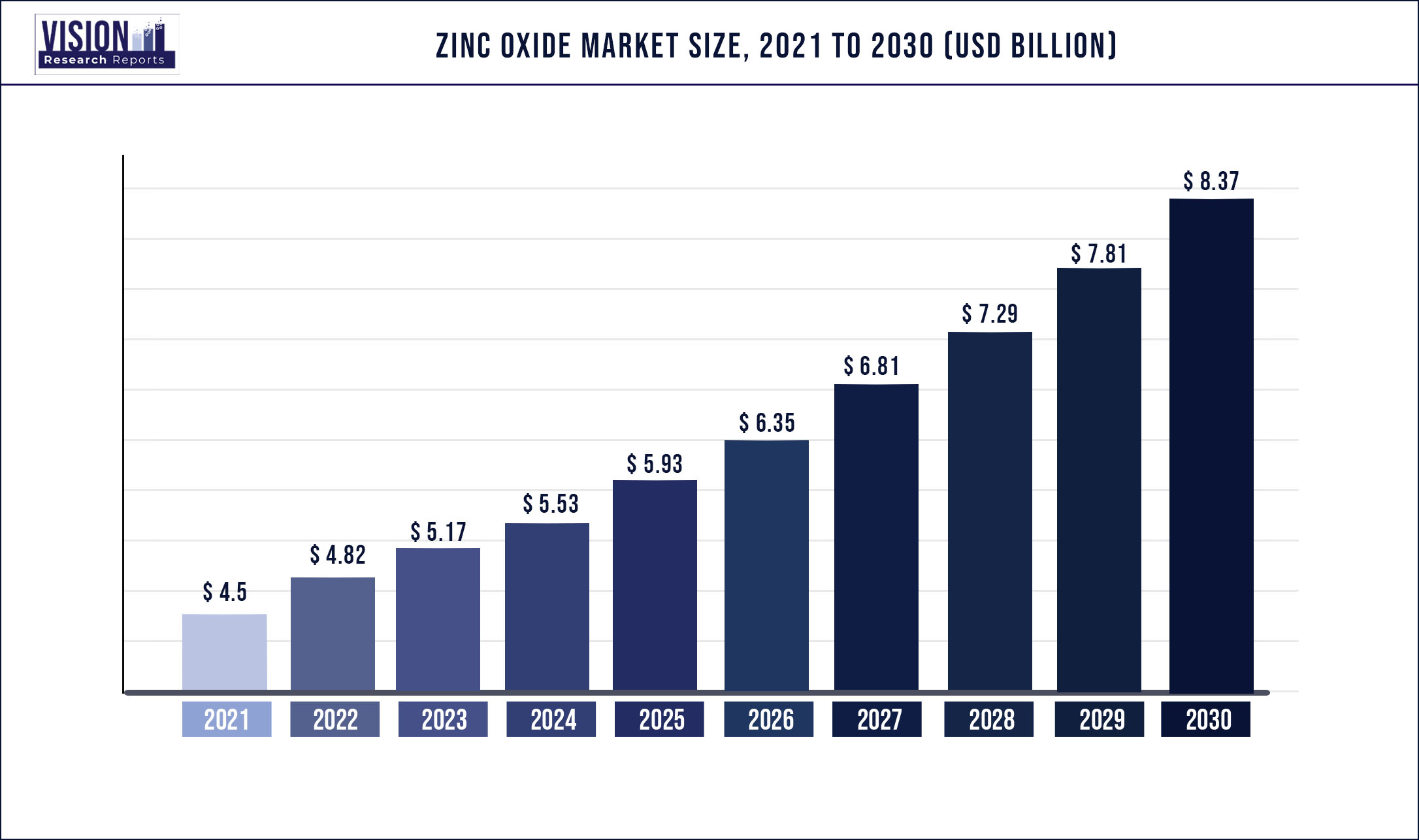

The global zinc oxide market was valued at USD 4.5 billion in 2021 and it is predicted to surpass around USD 8.37 billion by 2030 with a CAGR of 7.14% from 2022 to 2030.

Report Highlights

Growth can be attributed to the rising product demand for vulcanization of rubber in the tire industry. In addition, the growing consumption of premium skincare products in emerging economies due to the increasing disposable income is expected to drive market growth. The raw materials used to manufacture the product using direct processes include sulfuric acid and zinc chloride. The availability of raw material impacts zinc oxide (ZnO) prices and production.

Inconsistency in the prices of raw materials and regulations against the usage of the product in several end-use industries are likely to hamper the demand in the coming years. Asia Pacific is projected to be the largest and fastest-growing regional marketover the forecast period. Factors, such as the growing automotive industry and increasing consumer spending on personal care products, are likely to fuel the market growth in the coming years. Key players in the market are inclined towards mergers & acquisitions and joint ventures. For instance, In September 2017, Zinc Oxide LLC acquired Zochem Inc., a subsidiary of American Zinc Recycling Corp. LLC. This deal has increased the revenue and production capacity of the company.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 4.5 billion |

| Revenue Forecast by 2030 | USD 8.37 billion |

| Growth rate from 2022 to 2030 | CAGR of 7.14% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Process, application, region |

| Companies Covered |

U.S. Zinc; Zinc Oxide LLC; EverZinc; Rubamin; Grupo Promax; Weifang Longda Zinc Industry Co., Ltd.; Yongchang Zinc IndustryCo. Ltd. |

Process Insights

The indirect process (French process) segment accounted for the largest revenue share of more than 82.7% in 2021. The segment will expand further at a steady CAGR retaining its leading position over the forecast period. This growth is attributed to the fact that the French process is the fastest and most productive industrial method to produce zinc oxide. The wet chemical process is expected to grow with the fastest CAGR, in terms of revenue, over the forecast years. Zinc oxide obtained from this method is very fine in size, has a slow settling rate, and has good dispersion.

Properties of wet chemical grades of ZnO, such as porosity, specific surface area, morphology, and quality, are variable and depend upon process conditions, precursors, and other factors. Other processes include the soft gel method, controlled precipitation, and mechanochemical process. Properties of the soft gel method include simplicity, reliability, low cost, and comparatively mild conditions of synthesis. Controlled precipitation involves spontaneous & fast reduction of a solution of zinc salt using a reducing agent limiting the particles growth having specified dimensions, which is followed by precipitation of a precursor of ZnO from the solution.

Application Insights

On the basis of applications, the global market has been divided into rubber, ceramics, chemicals, cosmetics & personal care, paints & coatings, pharmaceuticals, agriculture, and others. The rubber segment accounted for the largest revenue share of more than 41.03% in 2021. This is attributed to the high consumption of zinc oxide in the rubber industry owing to the growing production of tires. ZnO is used as a vulcanizing activator, a substance applied in small doses to increase the effectiveness of the vulcanization accelerator. It is also used as a curing or cross-linking agent for halogen-containing elastomers, such as neoprene or polysulfides.

The ceramics segment is projected to hold the second-largest market share by 2030. Desirable properties of ZnO in the production of ceramics include relatively high heat capacity, high-temperature stability, thermal conductivity coupled with a comparatively low coefficient of expansion. Both direct and indirect process ZnO is suitable for the application of ceramic. A wide range of cosmetic products, such as foundation, lip products, mineral make-up bases, face powder, hand creams, moisturizers, lotions, and ointments use ZnO. It helps cosmetics to adhere to the skin. Also, it is a broad-spectrum UV absorber that attenuates UV radiation in both the UVA and UVB range effectively. ZnO promotes wound healing and keeps wounds moist and clean.

Regional Insights

Asia Pacific region accounted for the largest revenue share of more than 30.11% in 2021. This is attributed to the large manufacturing base in the region that houses several end-use sectors, such as pharmaceuticals, rubber, and ceramics. In addition, the growing consumption of skincare products and the rise in the tire industries in India and China are likely to drive the market growth in the region. China is a major producer and consumer of ZnO globally.Increasing population, growing urbanization, and an increase in average disposable income in China, India, Indonesia, and Vietnam are expected to drive the demand for paints and coatings.

The increasing housing and construction sector coupled with support from the Chinese Government for commercial construction projects in the country is expected to increase the demand for paints & coatings in the near future. North America plays a significant role in the zinc oxide market with a revenue share of 16.31% in 2021. The U.S. has a major influence on the North America market owing to the presence of major manufacturers in the industry. The increasing demand for ZnO from the pharmaceutical and cosmetics industries due to the rising geriatric population is expected to boost the market growth in the coming years.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Zinc Oxide Market

5.1. COVID-19 Landscape: Zinc Oxide Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Zinc Oxide Market, By Process

8.1. Zinc Oxide Market, by Process, 2022-2030

8.1.1. Indirect

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Direct

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Wet Chemical

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Zinc Oxide Market, By Application

9.1. Zinc Oxide Market, by Application, 2022-2030

9.1.1. Rubber

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Ceramics

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Chemicals

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Cosmetics and Personal Care

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Paints & Coatings

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Pharmaceuticals

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Agriculture

9.1.7.1. Market Revenue and Forecast (2017-2030)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Zinc Oxide Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Process (2017-2030)

10.1.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Process (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Process (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Process (2017-2030)

10.2.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Process (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Process (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Process (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Process (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Process (2017-2030)

10.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Process (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Process (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Process (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Process (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Process (2017-2030)

10.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Process (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Process (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Process (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Process (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Application (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Process (2017-2030)

10.5.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Process (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Application (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Process (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Application (2017-2030)

Chapter 11. Company Profiles

11.1. U.S. Zinc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Zinc Oxide LLC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. EverZinc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Rubamin

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Grupo Promax

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Weifang Longda Zinc Industry Co., Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Yongchang zinc industry Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others