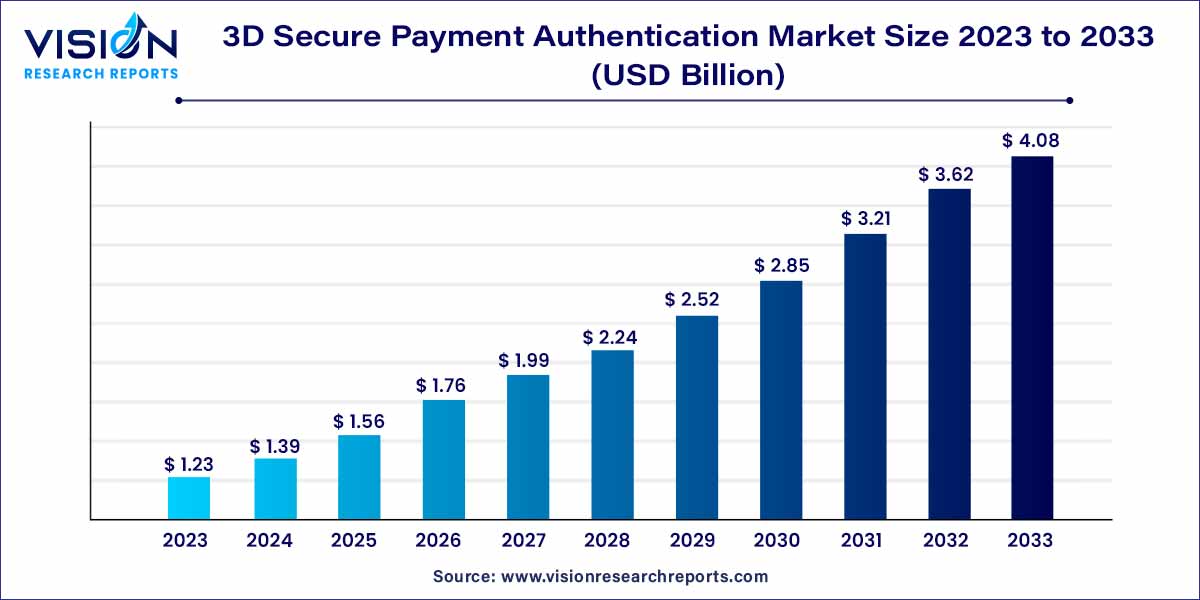

The global 3D secure payment authentication market size was surpassed at USD 1.23 billion in 2023 and is expected to hit around USD 4.08 billion by 2033, growing at a CAGR of 12.73% from 2024 to 2033. The 3D secure payment authentication market represents a pivotal sector in the ever-evolving landscape of digital finance. With the global surge in online transactions, ensuring the security of these payments has become paramount. 3D secure payment authentication stands out as a robust solution, offering an extra layer of protection through advanced authentication processes.

The growth of the 3D secure payment authentication market is propelled by several key factors. Firstly, the escalating trend of online shopping and digital transactions worldwide has significantly increased the demand for secure payment methods. As consumers continue to embrace e-commerce, businesses are adopting 3D secure protocols to instill trust and ensure the safety of online payments. Secondly, stringent regulatory requirements and industry standards mandating enhanced security measures in financial transactions have driven the widespread adoption of 3D secure payment authentication. These regulations create a compelling incentive for businesses to invest in advanced authentication solutions, thereby fueling market growth. Additionally, the continuous advancements in technology, such as biometric authentication and artificial intelligence, are revolutionizing the security landscape. Integration of these innovative technologies not only enhances the effectiveness of 3D secure systems but also augments user experience, contributing significantly to the market's expansion. Overall, the convergence of increased online activities, regulatory mandates, and technological innovations forms the cornerstone of the 3D Secure Payment Authentication market's remarkable growth trajectory.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.73% |

| Market Revenue by 2033 | USD 4.08 billion |

| Revenue Share of North America in 2023 | 29% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The merchant plug-in segment generated the maximum market share of 41% in 2023. The merchant plug-in serves as a bridge between the merchant's website and the Access Control Server, facilitating the authentication process. It acts as the intermediary responsible for gathering necessary transaction data and directing it to the Access Control Server. Merchants integrate the MPI into their e-commerce platforms, enabling the verification of cardholder identities before processing payments. This integration empowers merchants with the ability to customize authentication protocols, aligning them with specific business needs and customer preferences.

The access control server segment is anticipated to grow at the CAGR over the forecast period. The access control server stands as the central intelligence of the 3D Secure ecosystem. It serves as the hub where the authentication process unfolds. When a customer initiates a transaction, the ACS evaluates the risk level associated with the payment. Leveraging sophisticated algorithms, it assesses various factors, including transaction history, device information, and user behavior. Based on this analysis, the ACS triggers authentication requests to the card issuer, prompting the cardholder to verify their identity. This interaction ensures that only legitimate users gain access, safeguarding against unauthorized transactions and bolstering confidence in online payment systems.

The banks segment captured the maximum market share of 61% in 2023. Banks, as custodians of financial security, have embraced 3D Secure protocols to fortify their digital banking services. By integrating these advanced authentication methods, banks ensure that their customers' online transactions are shielded against unauthorized access and fraudulent activities. This proactive approach not only instills trust but also aligns with regulatory mandates, creating a secure environment for their clients to engage in online banking seamlessly.

The merchants & payment gateway segment is anticipated to witness significant growth over the forecast period. Merchants and payment gateways have swiftly adopted 3D Secure Payment Authentication to elevate the safety of their e-commerce platforms. For merchants, integrating 3D Secure technology translates into enhanced credibility. By providing a secure payment environment, merchants can attract a wider customer base, fostering loyalty and encouraging repeat transactions. The integration of 3D Secure protocols by payment gateways further augments this security net. Acting as intermediaries between merchants and financial institutions, payment gateways play a pivotal role in authenticating transactions. By employing 3D Secure methods, payment gateways ensure that the payment data transmitted between merchants and banks remains encrypted and immune to cyber threats.

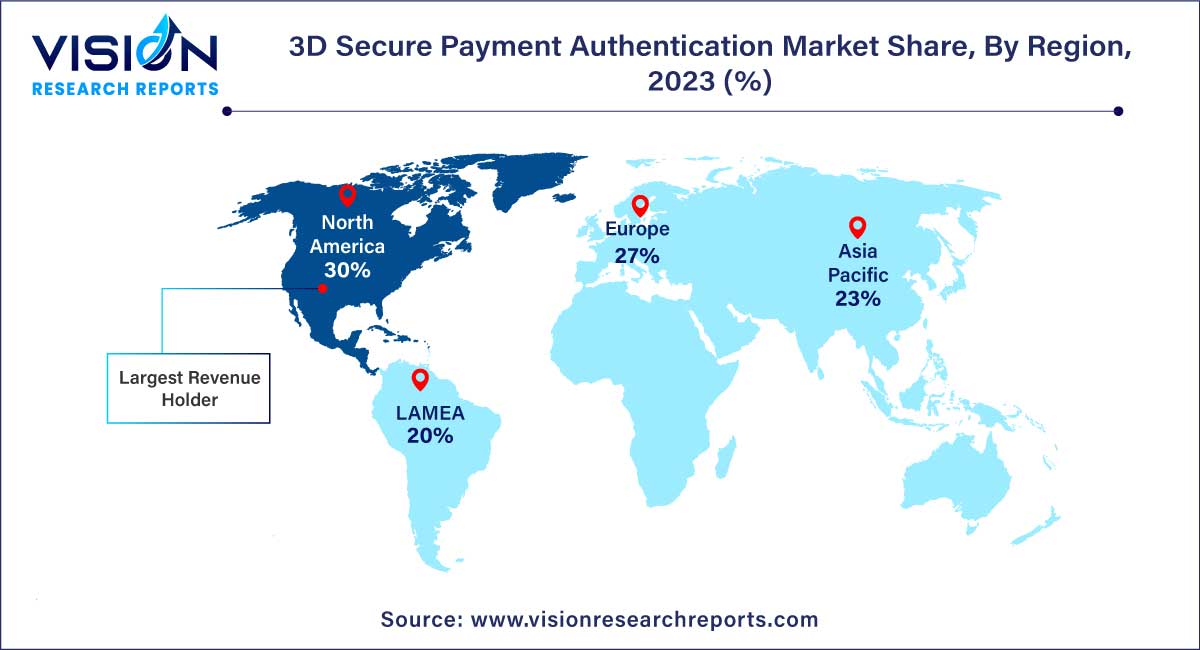

North America dominated the global market with the largest market share of 30% in 2023. North America, a frontrunner in digital innovation, has witnessed widespread acceptance of 3D Secure protocols. The region's robust financial infrastructure and stringent regulatory framework have encouraged banks, merchants, and payment gateways to invest in advanced authentication methods, ensuring secure online transactions. Additionally, the region's tech-savvy consumer base demands seamless yet secure payment experiences, further propelling the adoption of 3D Secure technology.

Asia Pacific is expected to witness the fastest growth over the forecast period. Asia-Pacific, home to some of the world's fastest-growing digital economies, has experienced a surge in online transactions. In this region, the adoption of 3D Secure Payment Authentication is driven by a burgeoning middle class, rapid urbanization, and the proliferation of smartphones. Banks and merchants in Asia-Pacific are investing in cutting-edge authentication methods to cater to the diverse payment preferences of their tech-savvy consumers. Additionally, the rise of digital commerce platforms and mobile payment apps has further accelerated the implementation of 3D Secure protocols, ensuring the security of online transactions across a vast and dynamic market.

By Component

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on 3D Secure Payment Authentication Market

5.1. COVID-19 Landscape: 3D Secure Payment Authentication Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global 3D Secure Payment Authentication Market, By Component

8.1. 3D Secure Payment Authentication Market, by Component, 2024-2033

8.1.1. Access Control Server

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Merchant Plug-in

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global 3D Secure Payment Authentication Market, By Application

9.1. 3D Secure Payment Authentication Market, by Application, 2024-2033

9.1.1. Banks

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Merchants & Payment Gateway

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global 3D Secure Payment Authentication Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Component (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Component (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Component (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Component (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. GPayments Pty Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Broadcom Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Mastercard Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. RSA Security LLC

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Modirum

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Visa Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Bluefin Payment Systems LLC

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. DECTA Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. American Express Company

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. JCB Co., Ltd

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others