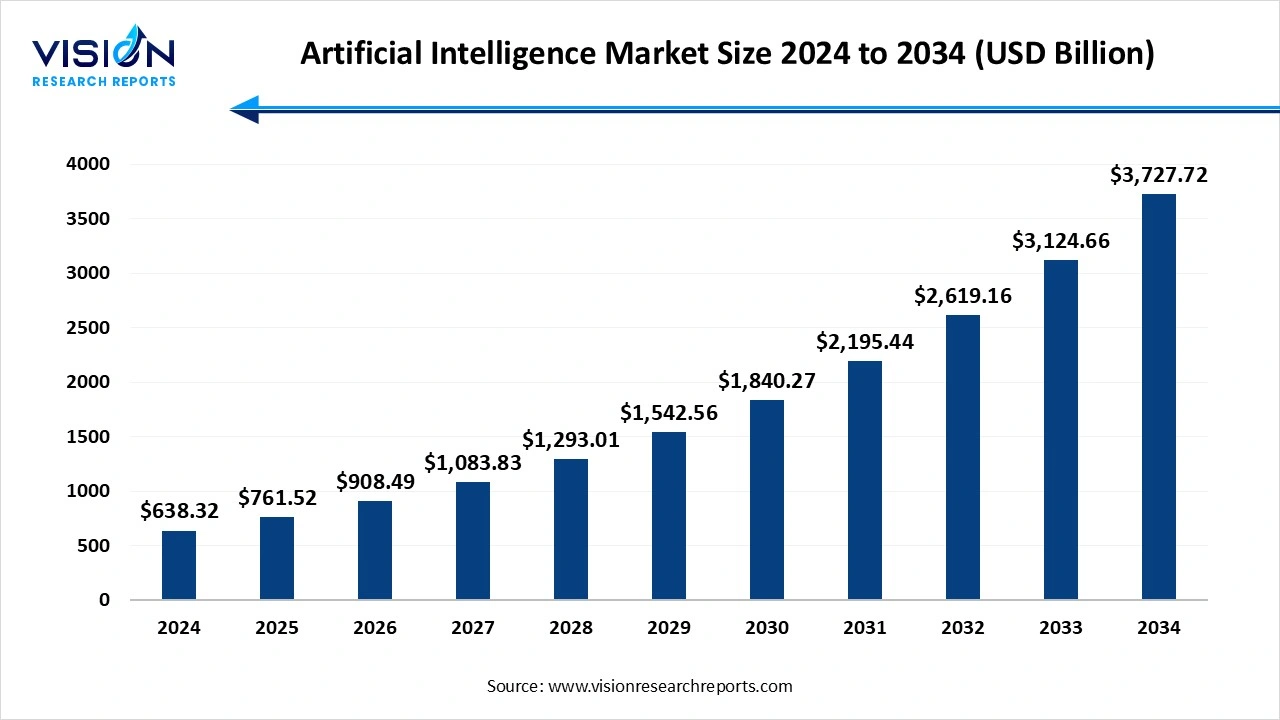

The global artificial intelligence market size stood at USD 638.32 billion in 2024 and is estimated to reach USD 761.52 expected to grow from billion 2025 to reach USD 3727.72 billion by 2034, growing at a CAGR of 19.3% from 2025 to 2034. The market growth is driven by rapid data growth, rising demand for automation, and increasing adoption of AI across industries to improve efficiency and decision-making. Advancements in machine learning, deep learning, and cloud-based AI services further accelerate market expansion. Additionally, growing investments, supportive government initiatives, and widespread digital transformation are propelling the global AI market forward.

The artificial intelligence (AI) is witnessing an unprecedented surge in growth and innovation, reshaping industries, and revolutionizing the way we interact with technology. In this comprehensive overview, we delve into the dynamic landscape of the AI market, exploring key trends, drivers, challenges, and future projections.

The growth of the artificial intelligence market is propelled the exponential increase in data availability, driven by the proliferation of digital devices and online activities, provides a vast reservoir for AI systems to analyze and derive insights from. Additionally, the demand for automation and efficiency gains across industries is spurring the adoption of AI technologies to streamline processes and reduce operational costs. Moreover, the competitive landscape compels businesses to leverage AI to gain a strategic edge, driving investment in AI-powered solutions for enhanced decision-making and customer engagement. Furthermore, the evolution of AI algorithms, particularly in areas like machine learning and deep learning, is enabling more sophisticated applications and driving innovation across sectors.

| Report Coverage | Details |

| Market Size in 2024 | USD 638.32 Billion |

| Revenue Forecast by 2034 | USD 3727.72 Billion |

| Growth rate from 2025 to 2034 | CAGR of 19.3% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

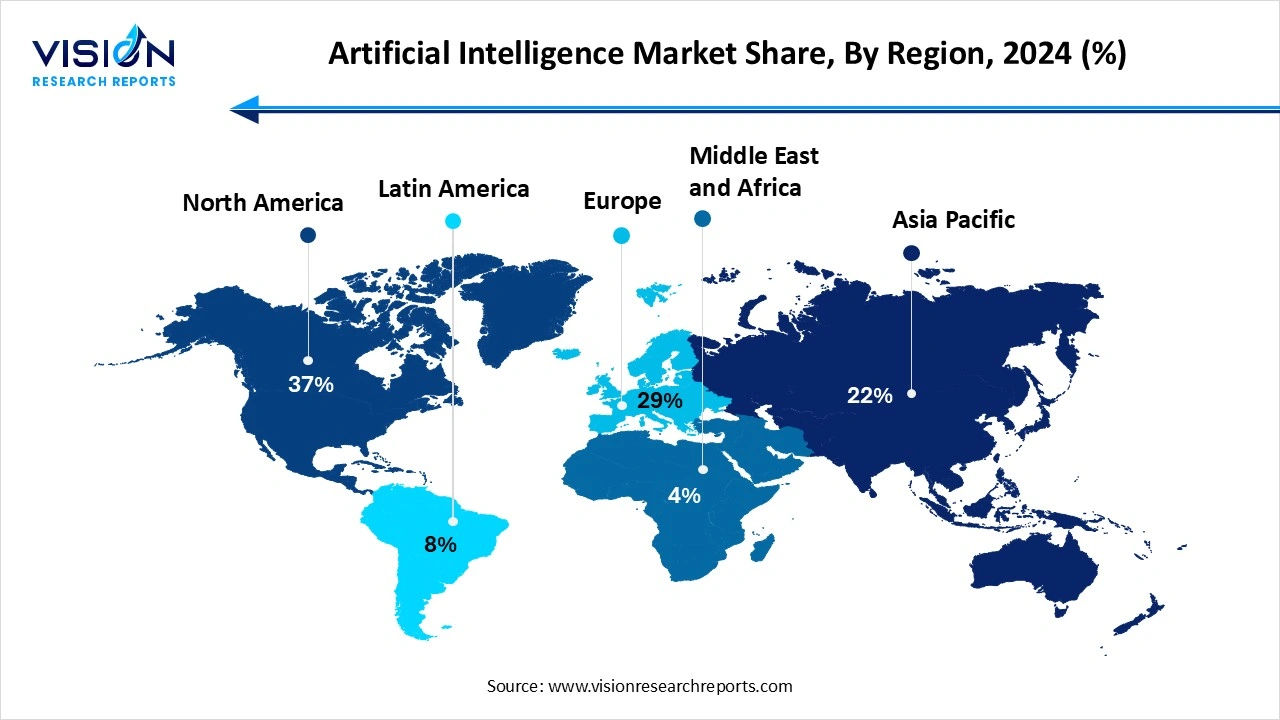

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Advanced Micro Devices, AiCure, Arm Limited, Atomwise, Inc., Ayasdi AI LLC, Baidu, Inc., Clarifai, Inc., Cyrcadia Health, Enlitic, Inc., Google LLC, H2O.ai, HyperVerge, Inc., International Business Machines Corporation, IBM Watson Health, Intel Corporation, Iris.ai AS, Lifegraph, Microsoft, NVIDIA Corporation, Sensely, Inc. |

North America asserted its dominance in the market, capturing over 37% of the global revenue share in 2024. This commanding share can be attributed to favorable government initiatives aimed at encouraging the widespread adoption of artificial intelligence (AI) across various industries. Governments in North America are actively investing in AI research and development, establishing specialized research institutes and centers, and providing funding for AI-related projects. Moreover, AI is extensively utilized in diverse fields within the region, ranging from enhancing public safety and transportation to driving innovation in healthcare.

The Asia Pacific region is poised to witness significant growth in the artificial intelligence market. This growth is fueled by the substantial increase in investments in artificial intelligence across the region. China, in particular, boasts a diverse AI market covering various applications such as natural language processing, computer vision, robotics, autonomous vehicles, and virtual assistants. With its vast population and abundant data resources, China offers a fertile ground for the development and implementation of AI technologies.

The Asia Pacific region is poised to witness significant growth in the artificial intelligence market. This growth is fueled by the substantial increase in investments in artificial intelligence across the region. China, in particular, boasts a diverse AI market covering various applications such as natural language processing, computer vision, robotics, autonomous vehicles, and virtual assistants. With its vast population and abundant data resources, China offers a fertile ground for the development and implementation of AI technologies.

Furthermore, the government of Saudi Arabia is actively promoting artificial intelligence through a series of initiatives, policies, and financial support programs. For instance, the Saudi Data and AI Authority (SDAIA) serves as a government agency dedicated to fostering an AI ecosystem encompassing both government and private sector entities. SDAIA is instrumental in deploying innovative AI solutions, which include strategies for integrating data and AI across key domains.

Software solutions led the market, accounting for over 37% of global revenue in 2024. This substantial share can be attributed to significant advancements in information storage capacity, robust computing power, and parallel processing capabilities, enabling the delivery of high-end services. Additionally, the capability to extract data, offer real-time insights, and facilitate decision-making has positioned this segment to capture a noteworthy portion of the market. Artificial intelligence software solutions encompass libraries tailored for designing and deploying AI applications, including primitives, linear algebra, inference, sparse matrices, video analytics, and diverse hardware communication capabilities.

Companies embrace AI services to streamline operational costs, resulting in increased profitability. Artificial Intelligence as a Service (AIaaS) is increasingly utilized by firms to gain a competitive edge via cloud-based solutions, thereby fostering the growth of the mobile AI market. AI services entail installation, integration, maintenance, and support tasks, with this segment anticipated to witness substantial growth in the forecast period. AI hardware encompasses chipsets such as GPUs (Graphics Processing Units), CPUs, application-specific integrated circuits (ASICs), and field-programmable gate arrays (FPGAs). Currently, GPUs and CPUs dominate the artificial intelligence hardware market due to their high computing capabilities essential for AI frameworks

Driven by its increasingly intricate data-driven applications, such as text and speech recognition, the deep learning segment emerged as a frontrunner, commanding approximately 37% of the global revenue share in 2024. Deep learning presents lucrative investment opportunities, particularly in addressing the challenges posed by vast data volumes. For instance, in July 2020, Zebra Medical Vision partnered with TELUS Ventures to expand the accessibility of its deep learning solutions across North America, extending AI applications to clinical care settings and novel modalities.

Machine learning and deep learning represent substantial investments in AI, encompassing AI platforms and cognitive applications. These applications include tagging, clustering, categorization, hypothesis generation, alerting, filtering, navigation, and visualization, facilitating the development of advisory, intelligent, and cognitively enhanced solutions. The increased adoption of cloud-based computing platforms and on-premises hardware equipment for secure data storage has fueled the growth of analytics platforms. Moreover, heightened investments in research and development by key industry players are poised to bolster the uptake of artificial intelligence technologies. Over the forecast period, the natural language processing (NLP) segment is anticipated to gain momentum. NLP is increasingly utilized across various industries to gain deeper insights into client preferences, evolving trends, purchasing behavior, decision-making processes, and more effectively.

The advertising and media segment emerged as the market leader, capturing over 20% of the global revenue share in 2024. This significant share is driven by the escalating adoption of AI in marketing applications, which are gaining substantial traction. For instance, in January 2023, Cadbury launched an initiative allowing small business owners to create advertisements featuring the face and voice of a celebrity using an AI tool, free of charge. However, the healthcare sector is poised to claim a leading share by 2030. Within the healthcare segment, various use cases have been identified, including robot-assisted surgery, dosage error reduction, virtual nursing assistants, clinical trial participant identification, hospital workflow management, preliminary diagnosis, and automated image diagnosis.

The BFSI (Banking, Financial Services, and Insurance) segment has also witnessed significant adoption of artificial intelligence, driven by the high demand for risk and compliance applications, as well as regulatory and supervisory technologies (SupTech). Authorities are increasingly leveraging AI-based insights in SupTech tools to scrutinize FinTech-based applications used for regulatory, supervisory, and oversight purposes. Similarly, regulated institutions are developing and deploying FinTech applications to meet reporting, regulatory, and compliance obligations. AI applications are also being utilized by financial institutions for risk management and internal controls. The integration of AI technology with behavioral sciences empowers large financial organizations to prevent misconduct, shifting the focus from reactive resolution to proactive prevention.

By Solution

By Technology

By Function

By End-use

By Region

Artificial Intelligence Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Artificial Intelligence Market

5.1. COVID-19 Landscape: Artificial Intelligence Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Artificial Intelligence Market, By Solution

8.1. Artificial Intelligence Market, by Solution

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast

8.1.2. Software

8.1.2.1. Market Revenue and Forecast

8.1.3. Services

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Artificial Intelligence Market, By Technology

9.1. Artificial Intelligence Market, by Technology

9.1.1. Deep Learning

9.1.1.1. Market Revenue and Forecast

9.1.2. Machine Learning

9.1.2.1. Market Revenue and Forecast

9.1.3. Natural Language Processing (NLP)

9.1.3.1. Market Revenue and Forecast

9.1.4. Machine Vision

9.1.4.1. Market Revenue and Forecast

9.1.5. Generative AI

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Artificial Intelligence Market, By Function

10.1. Artificial Intelligence Market, by Function

10.1.1. Human Resource Management

10.1.1.1. Market Revenue and Forecast

10.1.2. Operations

10.1.2.1. Market Revenue and Forecast

10.1.3. Legal and Compliance

10.1.3.1. Market Revenue and Forecast

10.1.4. Sales and Marketing

10.1.4.1. Market Revenue and Forecast

10.1.5. Supply Chain Management

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Artificial Intelligence Market, By End-use

11.1. Artificial Intelligence Market, by End-use

11.1.1. Healthcare

11.1.1.1. Market Revenue and Forecast

11.1.2. BFSI

11.1.2.1. Market Revenue and Forecast

11.1.3. Law

11.1.3.1. Market Revenue and Forecast

11.1.4. Retail

11.1.4.1. Market Revenue and Forecast

11.1.5. Advertising & Media

11.1.5.1. Market Revenue and Forecast

11.1.6. Automotive & Transportation

11.1.6.1. Market Revenue and Forecast

11.1.7. Agriculture

11.1.7.1. Market Revenue and Forecast

11.1.8. Manufacturing

11.1.8.1. Market Revenue and Forecast

Chapter 12. Global Artificial Intelligence Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Solution

12.1.2. Market Revenue and Forecast, by Technology

12.1.3. Market Revenue and Forecast, by Function

12.1.4. Market Revenue and Forecast, by End-use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Solution

12.1.5.2. Market Revenue and Forecast, by Technology

12.1.5.3. Market Revenue and Forecast, by Function

12.1.5.4. Market Revenue and Forecast, by End-use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Solution

12.1.6.2. Market Revenue and Forecast, by Technology

12.1.6.3. Market Revenue and Forecast, by Function

12.1.6.4. Market Revenue and Forecast, by End-use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Solution

12.2.2. Market Revenue and Forecast, by Technology

12.2.3. Market Revenue and Forecast, by Function

12.2.4. Market Revenue and Forecast, by End-use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Solution

12.2.5.2. Market Revenue and Forecast, by Technology

12.2.5.3. Market Revenue and Forecast, by Function

12.2.5.4. Market Revenue and Forecast, by End-use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Solution

12.2.6.2. Market Revenue and Forecast, by Technology

12.2.6.3. Market Revenue and Forecast, by Function

12.2.6.4. Market Revenue and Forecast, by End-use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Solution

12.2.7.2. Market Revenue and Forecast, by Technology

12.2.7.3. Market Revenue and Forecast, by Function

12.2.7.4. Market Revenue and Forecast, by End-use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Solution

12.2.8.2. Market Revenue and Forecast, by Technology

12.2.8.3. Market Revenue and Forecast, by Function

12.2.8.4. Market Revenue and Forecast, by End-use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Solution

12.3.2. Market Revenue and Forecast, by Technology

12.3.3. Market Revenue and Forecast, by Function

12.3.4. Market Revenue and Forecast, by End-use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Solution

12.3.5.2. Market Revenue and Forecast, by Technology

12.3.5.3. Market Revenue and Forecast, by Function

12.3.5.4. Market Revenue and Forecast, by End-use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Solution

12.3.6.2. Market Revenue and Forecast, by Technology

12.3.6.3. Market Revenue and Forecast, by Function

12.3.6.4. Market Revenue and Forecast, by End-use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Solution

12.3.7.2. Market Revenue and Forecast, by Technology

12.3.7.3. Market Revenue and Forecast, by Function

12.3.7.4. Market Revenue and Forecast, by End-use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Solution

12.3.8.2. Market Revenue and Forecast, by Technology

12.3.8.3. Market Revenue and Forecast, by Function

12.3.8.4. Market Revenue and Forecast, by End-use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Solution

12.4.2. Market Revenue and Forecast, by Technology

12.4.3. Market Revenue and Forecast, by Function

12.4.4. Market Revenue and Forecast, by End-use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Solution

12.4.5.2. Market Revenue and Forecast, by Technology

12.4.5.3. Market Revenue and Forecast, by Function

12.4.5.4. Market Revenue and Forecast, by End-use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Solution

12.4.6.2. Market Revenue and Forecast, by Technology

12.4.6.3. Market Revenue and Forecast, by Function

12.4.6.4. Market Revenue and Forecast, by End-use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Solution

12.4.7.2. Market Revenue and Forecast, by Technology

12.4.7.3. Market Revenue and Forecast, by Function

12.4.7.4. Market Revenue and Forecast, by End-use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Solution

12.4.8.2. Market Revenue and Forecast, by Technology

12.4.8.3. Market Revenue and Forecast, by Function

12.4.8.4. Market Revenue and Forecast, by End-use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Solution

12.5.2. Market Revenue and Forecast, by Technology

12.5.3. Market Revenue and Forecast, by Function

12.5.4. Market Revenue and Forecast, by End-use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Solution

12.5.5.2. Market Revenue and Forecast, by Technology

12.5.5.3. Market Revenue and Forecast, by Function

12.5.5.4. Market Revenue and Forecast, by End-use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Solution

12.5.6.2. Market Revenue and Forecast, by Technology

12.5.6.3. Market Revenue and Forecast, by Function

12.5.6.4. Market Revenue and Forecast, by End-use

Chapter 13. Company Profiles

13.1. Advanced Micro Devices

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. AiCure

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Arm Limited

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Atomwise, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Ayasdi AI LLC

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Baidu, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Clarifai, Inc

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Cyrcadia Health

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. HyperVerge, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Microsoft

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others