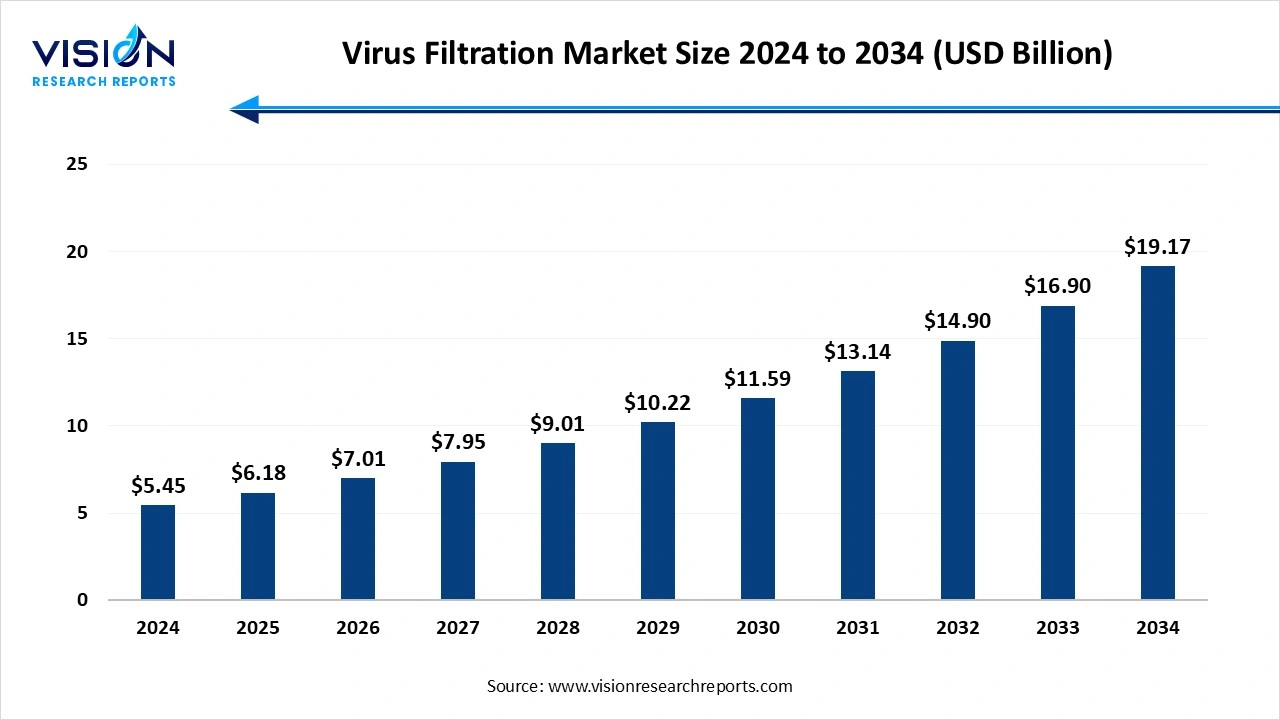

The global virus filtration market size stood at USD 5.45 billion in 2024 and is estimated to reach USD 6.18 billion in 2025. It is projected to hit USD 19.17 billion by 2034, registering a robust CAGR of 13.4% from 2025 to 2034. The growing demand for biologics and vaccines, innovation in biopharmaceutical therapies, and the growing prevalence of chronic diseases fuel the market growth.

A virus filtration is defined as a robust and effective method for removing viral contaminants from biological fluids during the manufacturing of biopharmaceutical products. It is a size-based separation process that utilizes specialized porous membranes to physically retain virus particles while allowing smaller product molecules, such as proteins, to pass through. The biopharmaceutical industry drives the market growth, focused on therapies, such as monoclonal antibodies, recombinant proteins, and gene therapies, which require stringent viral removal steps. The expanding pharmaceutical industry relies on viral filtration to ensure the safety and quality of products, fuelling market growth.

The growing biopharmaceutical industry, with its focus on therapies such as monoclonal antibodies, recombinant proteins, and gene therapies, relies heavily on effective viral clearance. The emergence of mRNA-based vaccines and therapies has also boosted demand for these technologies. The increasing prevalence of health challenges, such as chronic hepatitis B, further contributes to the need for biologics and, consequently, virus filtration solutions.

| Report Coverage | Details |

| Market Size in 2024 | USD 5.45 billion |

| Revenue Forecast by 2034 | USD 19.17 billion |

| Growth rate from 2025 to 2034 | CAGR of 13.4% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

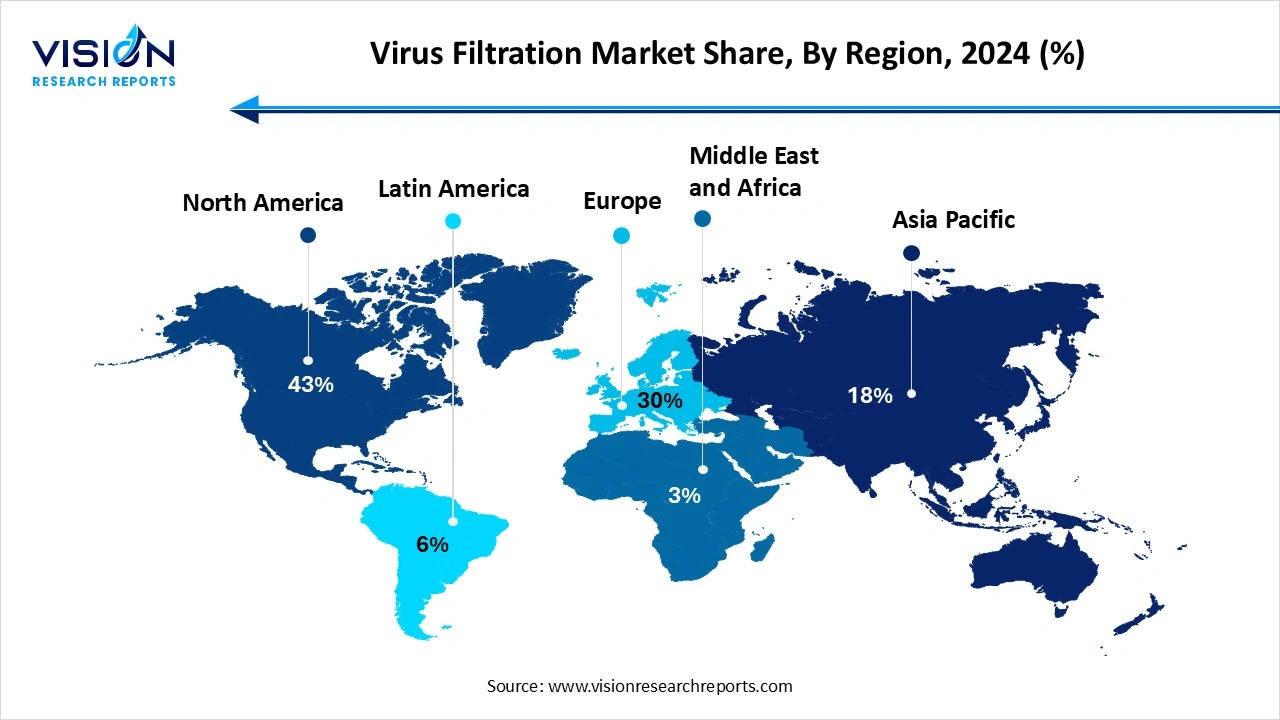

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Merck KGaA (MilliporeSigma), Sartorius AG, GE Healthcare (Cytiva), Pall Corporation (Danaher), 3M Company, Danaher Corporation, Thermo Fisher Scientific Inc., Asahi Kasei Corporation, Porvair Filtration Group, and Parker Hannifin Corporation. |

The innovations in membrane materials, such as nanofiber membranes and PFAS-free options, are enhancing virus removal efficiency and throughput. The integration of AI-enabled monitoring and digital analytics for predictive maintenance and real-time control also presents a significant opportunity.

The Sartorius has released single-use virus filters, such as the Virosart® HF, which are optimized for monoclonal antibodies and reduce footprint and validation costs.

The advanced filtration systems, especially those using technologies such as ultrafiltration and nanofiltration, come with substantial initial installation, maintenance, and operational costs. This can be a barrier for smaller companies and those in developing regions.

North America led the global virus filtration market, capturing the largest revenue share at 43% in 2024. The well-established biopharmaceutical sector continuously invests in research and development activities, fostering innovations in filtration technologies and ensuring the quality and safety of biopharmaceutical products. Regulatory bodies like the FDA enforce rigorous standards for viral clearance, mandating the use of advanced filtration technologies and adherence to best practices, which in turn drives market adoption.

United States Virus Filtration Market Trends

The strongest research and developments in biopharmaceuticals require robust virus filtration for product safety. Innovation in membrane materials and filtration methods enhances efficiency and throughput. The integration of AI for monitoring and predictive maintenance is an emerging trend. The increasing use of contract research organizations (CROs) and contract development and manufacturing organizations (CDMOs) for virus filtration studies and manufacturing also drives the market.

The Asia Pacific virus filtration market is projected to experience the fastest growth globally, with a compound annual growth rate CAGR of 15.1% during the forecast period. The massive investment in biopharmaceutical infrastructure across the country and the rising capital expenditure on research and development. Increasing regulatory scrutiny regarding viral safety in biologics manufacturing is driving the adoption of robust virus filtration methods. Innovation in filter materials and designs, such as nanofiber membranes and single-use systems, is improving filtration efficiency and driving adoption. The integration of AI-driven analytics is also accelerating product development.

Why did the Consumable Segment Dominate the Virus Filtration Market?

The consumables segment led the virus filtration market, accounting for the largest revenue share at 54% in 2024. Their essential role in manufacturing biologics like vaccines and antibodies. Their single-use nature minimizes cross-contamination, a critical factor in pharmaceutical production. This creates a steady demand for recurring purchases, driving vendor revenue as companies continually invest in new therapies and stringent viral safety protocols. Regulatory requirements, such as FDA validation rules for virus removal filters, also push the procurement of advanced consumables.

The instruments segment is projected to experience substantial growth, with a compound annual growth rate CAGR of 13% during the forecast period. The rising demand in the development and production of biological therapeutics, and continuous innovation in developing next-generation membrane technologies, single-use filters, and automated systems to improve filtration efficiency. The continuous innovation in pharmaceutical and biotechnology companies is driving the need for cutting-edge filtration instruments for both research and commercial production of biologics. Adoption of single use technologies and expansion of new technologies fuel the market growth

How the Biologicals Segment hold the Largest Share in the Virus Filtration Market?

The biologicals segment held the largest revenue share in the virus filtration market in 2024. The critical necessity of virus filtration for product safety is driven by the inherent risk of viral contamination in cell-based manufacturing. Heightened demand for biopharmaceuticals like monoclonal antibodies and gene therapies further requires robust viral clearance. Stricter regulatory mandates and ongoing advancements in filtration technology reinforce this segment's dominant market position.

The medical devices segment is experiencing the fastest growth in the market during the forecast period. The rising aging population and increasing prevalence of chronic diseases drive the demand for a wide range of medical devices, including implantable devices, surgical instruments, and devices used in diagnostics. This growing demand naturally translates to increased adoption of virus filtration technologies within the medical device manufacturing process. Continued advancements in filtration technologies, such as the development of more efficient and reliable membranes and the integration of single-use systems and automation, are making virus filtration more accessible and cost-effective for medical device manufacturers. Emphasis on infection control and specific applications in medical devices fuels the market growth.

How the Biopharmaceutical & Biotechnology Companies Segment hold the Largest Share in the Virus Filtration Market?

The biopharmaceutical & biotechnology companies segment held the largest revenue share in the virus filtration market in 2024. The biopharmaceutical and biotechnology companies are at the forefront of developing innovative therapies and vaccines, requiring significant investments in R&D. Many biopharmaceutical companies operate in-house process development labs and established GMP facilities, allowing them to manage critical clearance steps and ensure regulatory inspection readiness. Stringent regulatory requirements and the importance of biologics and vaccine production fuel the market growth.

The contract research organization (CRO) segment is experiencing the fastest growth in the market during the forecast period. The increased outsourcing for cost-efficiency and specialized expertise. CROs help navigate stringent regulatory requirements and accelerate complex drug development timelines for biopharmaceutical companies. The rising prevalence of chronic diseases also fuels the demand for biologics, increasing the need for specialized viral safety services that CROs provide. This combination of outsourcing trends and expert services positions CROs for the fastest market growth.

By Product

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Virus Filtration Market

5.1. COVID-19 Landscape: Virus Filtration Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Virus Filtration Market, By Product

8.1. Virus Filtration Market, by Product

8.1.1 Consumables

8.1.1.1. Market Revenue and Forecast

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast

8.1.3. Services

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Virus Filtration Market, By Application

9.1. Virus Filtration Market, by Application

9.1.1. Biologicals

9.1.1.1. Market Revenue and Forecast

9.1.2. Medical devices

9.1.2.1. Market Revenue and Forecast

9.1.3. Water purification

9.1.3.1. Market Revenue and Forecast

9.1.4. Air purification

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Virus Filtration Market, By End-use

10.1. Virus Filtration Market, by End-use

10.1.1. Biopharmaceutical & biotechnology companies

10.1.1.1. Market Revenue and Forecast

10.1.2. Contract research organizations

10.1.2.1. Market Revenue and Forecast

10.1.3. Medical device companies

10.1.3.1. Market Revenue and Forecast

10.1.4. Academic institutes & research laboratories

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Virus Filtration Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by Application

11.1.3. Market Revenue and Forecast, by End-use

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by Application

11.1.4.3. Market Revenue and Forecast, by End-use

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by Application

11.1.5.3. Market Revenue and Forecast, by End-use

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by Application

11.2.3. Market Revenue and Forecast, by End-use

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by Application

11.2.4.3. Market Revenue and Forecast, by End-use

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by Application

11.2.5.3. Market Revenue and Forecast, by End-use

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by Application

11.2.6.3. Market Revenue and Forecast, by End-use

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by Application

11.2.7.3. Market Revenue and Forecast, by End-use

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by Application

11.3.3. Market Revenue and Forecast, by End-use

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by Application

11.3.4.3. Market Revenue and Forecast, by End-use

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by Application

11.3.5.3. Market Revenue and Forecast, by End-use

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by Application

11.3.6.3. Market Revenue and Forecast, by End-use

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by Application

11.3.7.3. Market Revenue and Forecast, by End-use

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by Application

11.4.3. Market Revenue and Forecast, by End-use

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by Application

11.4.4.3. Market Revenue and Forecast, by End-use

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by Application

11.4.5.3. Market Revenue and Forecast, by End-use

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by Application

11.4.6.3. Market Revenue and Forecast, by End-use

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by Application

11.4.7.3. Market Revenue and Forecast, by End-use

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by Application

11.5.3. Market Revenue and Forecast, by End-use

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by Application

11.5.4.3. Market Revenue and Forecast, by End-use

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by Application

11.5.5.3. Market Revenue and Forecast, by End-use

Chapter 12. Company Profiles

12.1. Merck KGaA (MilliporeSigma).

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Sartorius AG.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. GE Healthcare (now part of Cytiva).

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Pall Corporation (a division of Danaher Corporation).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. 3M Company .

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Danaher Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Thermo Fisher Scientific Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Asahi Kasei Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Porvair Filtration Group.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Parker Hannifin Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others