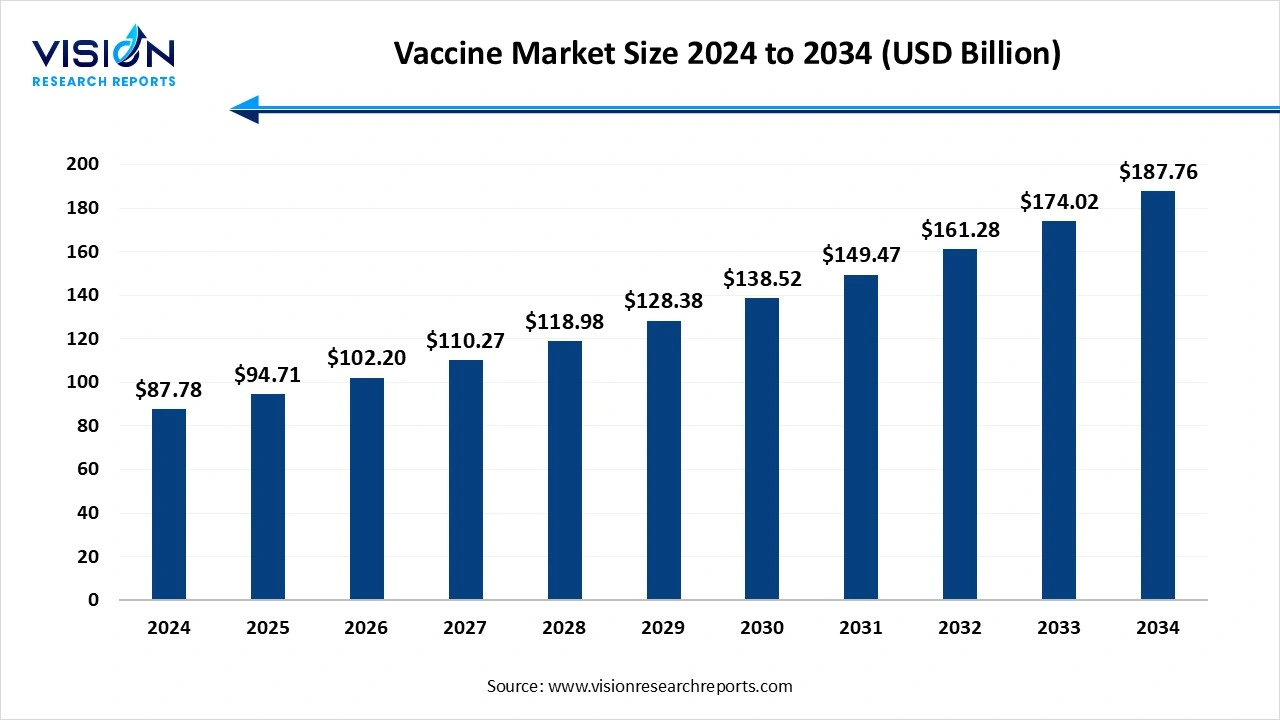

The global vaccine market size stood at USD 87.78 billion in 2024 and is estimated to reach USD 94.71 billion in 2025. It is projected to surge past USD 187.76 billion by 2034, registering a robust CAGR of 7.9% from 2025 to 2034. The governments and global health organizations run widespread immunization programs, particularly for children and vulnerable populations. This creates predictable, high scientific and technological advancement.

A vaccine is defined as a biological preparation that provides active acquired immunity to a particular infectious disease. There are several types of vaccines, each developed differently to activate the immune system effectively. The market growth is driven by the growing emphasis on ensuring vaccine safety and accessibility. Trends towards technology increasingly focus on improving vaccine development processes and accessibility. The rising prevalence of infectious diseases, heightened public health awareness following events like the COVID-19 pandemic, has led to greater public familiarity with and acceptance of the long-term benefits of immunization.

Innovations in biotechnology and vaccine development techniques, such as the use of mRNA, recombinant platforms, and synthetic biology, are producing more effective and targeted vaccines. The use of digital health platforms and artificial intelligence in vaccine design and distribution is enhancing logistical efficiency and demand forecasting. Multivalent vaccines, which protect against multiple pathogens in a single shot, are increasingly preferred by healthcare providers for their efficiency and potential to improve patient compliance.

| Report Coverage | Details |

| Market Size in 2024 | USD 87.78 billion |

| Revenue Forecast by 2034 | USD 187.76 billion |

| Growth rate from 2025 to 2034 | CAGR of 7.9% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies | AstraZeneca, Serum Institute of India Pvt. Ltd., BioNTech SE, Seqirus, Sinovac, Sanofi, Moderna Inc., Merck & Co., Inc., Pfizer Inc., Johnson & Johnson, CSL Limited (including Seqirus), Zydus Lifesciences Ltd., GlaxoSmithKline plc (GSK), Emergent BioSolutions Inc. |

Expanding Disease Indication for the Vaccine Market

The research is expanding beyond preventative vaccines to include therapeutic vaccines for chronic conditions, including cancer, HIV, and chronic viral infections like hepatitis B. Continuous pathogen evolution and the emergence of new diseases, highlighted by the COVID-19 pandemic, create ongoing demand for a rapid-response vaccine platform.

Development and Production in the Vaccine Market

The process of a novel vaccine to market is expensive and expensive and lengthy, with estimates ranging from hundreds of millions to over a billion dollars and often taking 10 to 15 years. A significant portion of his investment is at risk, as many vaccine candidates fail during clinical trials. There is more manufacturing complexity, difficulty targeting pathogens, which hinders the market growth.

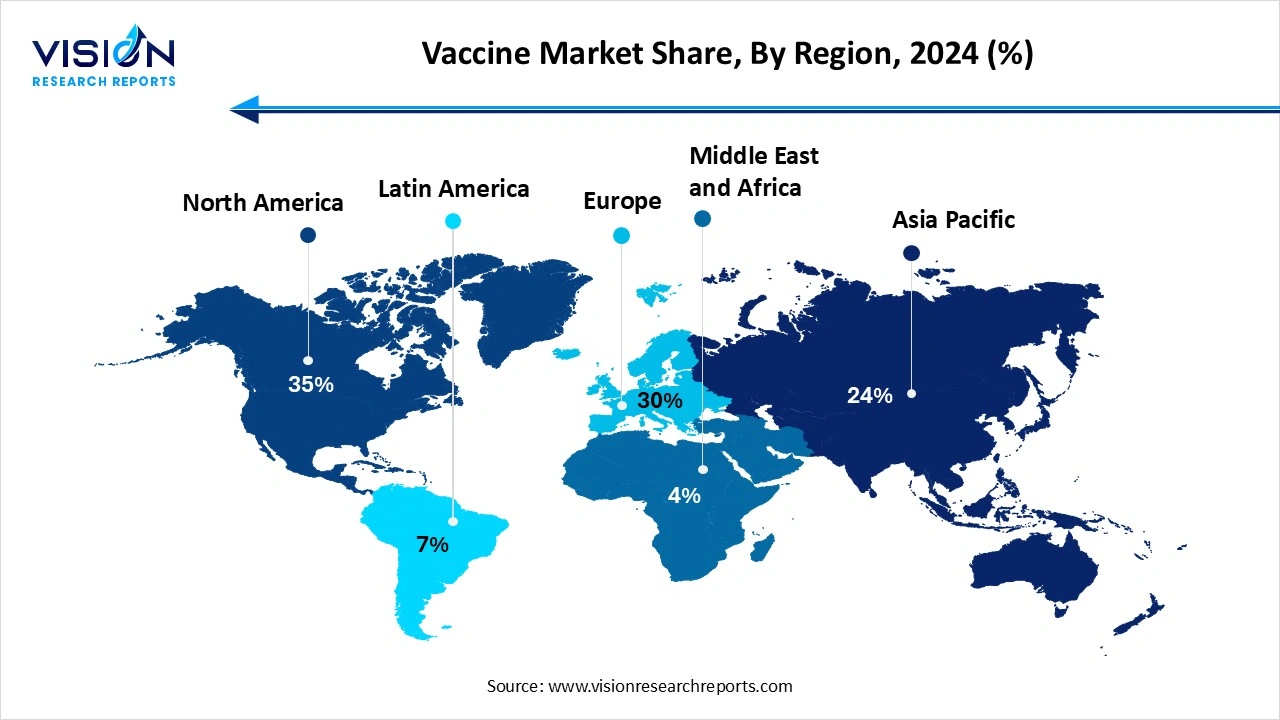

Which Region Dominated the Vaccine Market?

North America dominated the global market with highest market share of 35% in 2024. The region's investment in advanced technology, including substantial investment in cutting-edge vaccine technologies, such as mRNA and viral vector platforms. Supportive government policies, streamlined regulatory pathways, and extensive immunization programs fuel the market growth. The region's robust healthcare infrastructure, high healthcare spending, and advanced supply chain logistics drive the market growth.

United States Vaccine Market Trends

The development of mRNA, recombinant, and multivalent vaccines has enhanced efficacy, improved manufacturing speed, and made immunization simpler. Rising disease prevalence and immunization awareness, increasing number of adult populations, extensive funding for R&D, robust immunization programs, such as vaccines for children programs, and favorable reimbursement policies continue to accelerate market growth.

Why is the Asia Pacific Significantly Growing in the Vaccine Market?

Asia Pacific expects significant growth in the vaccine market during the forecast period. The region is a geographic source for new infectious diseases, and climate change is creating a higher risk for outbreaks like dengue and malaria. The Asia Pacific region is rapidly transitioning from a net importer to a global hub for vaccine manufacturing. Investment in research and development, innovating new products for infectious diseases. Economic and demographic trends are fueling demand for preventative healthcare and improving access to vaccines.

Why did the Subunit Vaccines Segment Dominate the Vaccine Market?

The vaccine market was dominated by the subunit vaccines segment, which held a 45% market share in 2024. They enhanced the safety profile, suitability for immunocompromised individuals, and stability compared to traditional live-attenuated and inactivated vaccines. Recombinant technology allowed for reliable, targeted mass production, exemplified by successful products like the hepatitis B and HPV vaccines. Despite challenges like weaker immunogenicity often requiring adjuvants and boosters, their proven track record solidified their market position. However, the rise of adaptable mRNA vaccines during the COVID-19 pandemic presents a potential challenge to this dominance, with advantages in development speed.

The mRNA vaccine segment is the fastest-growing in the vaccine market during the forecast period. The drawing on its successful application against COVID-19, mRNA vaccine technology has rapidly gained prominence in the vaccine market. Unlike conventional vaccines, which use inactive or weakened viruses, mRNA vaccines utilize synthetic genetic instructions to train the body's cells to produce proteins that trigger an immune response.

How the Parenteral Administration Segment hold the Largest Share in the Vaccine Market?

The parenteral administration remains the most preferred method for vaccine delivery, leading the segment to dominate the vaccine market with a 97% share in 2024. The parenteral route established efficacy and bioavailability; direct injection allows for faster adoption and faster action compared to other routes, such as oral vaccines. This rapid response is crucial for preventing infection or mitigating the severity of the disease. Avoidance of gastrointestinal degradation, suitability for a wide range of vaccines. Parenteral administration has been the traditional method for administering vaccines for a long time.

The oral administration segment is experiencing the fastest growth in the market during the forecast period. The oral route of administration eliminates the need for injections, reducing needle phobia and pain, especially among children and the elderly. Easier administration compared to other routes, better adherence to vaccination schedules. Oral vaccination often has simpler manufacturing procedures and may not require the rigorous cold chain storage and transportation needed for many injectable vaccines, potentially reducing overall cost.

How the Viral Disease Segment hold the Largest Share in the Vaccine Market?

The viral diseases segment led the vaccine market with share of 64% in 2024, primarily driven by the widespread administration of COVID-19 vaccines. The high global incidence of diseases such as hepatitis, influenza, and COVID-19 drives significant demand for preventative measures. Secondly, advancements in vaccine technology, including mRNA and recombinant DNA, enable the rapid development of effective vaccines to combat these threats. Thirdly, government initiatives and substantial funding from both governments and global health organizations further bolster research, production, and distribution efforts.

The bacterial diseases segment is experiencing the fastest growth in the market during the forecast period. The high global burden of bacterial infections and the urgent need to combat antimicrobial resistance. This growth is propelled by continuous technological innovations that produce more effective vaccines and the expansion of vaccination programs to include both pediatric and adult populations. Additionally, strong support from governments and global health organizations significantly fuels market expansion by promoting immunization and funding research.

How the Adults Segment hold the Largest Share in the Vaccine Market?

The adults represented 56% of the total share in the vaccine market in 2024. There is an increasing prevalence of infectious diseases among adults and the elderly, such as influenza, pneumococcal infections, shingles, and hepatitis. Developed regions, in particular, have aging populations. Older adults with chronic health conditions are especially vulnerable to infections, driving the need for preventative vaccinations. Employers and governments are actively promoting adult vaccination through public health initiatives and workplace wellness programs, further boosting demand.

The pediatric segment is experiencing the fastest growth in the market during the forecast period. The rising awareness of vaccine benefits, increasing prevalence of infectious diseases in children, and technological innovation in vaccine development, such as conjugated vaccines and recombinant vaccines, offer improved safety, efficacy, and ease of administration, making them more attractive for childhood immunizations. Increasing focus on pediatric research and development, robust government and public health initiatives, fuel the market growth.

How the Government Suppliers Segment hold the Largest Share in the Vaccine Market?

The government suppliers led the vaccine market, capturing a 55% share in 2024. The government leads numerous vaccination initiatives and immunization programs. Governments prioritize making vaccines affordable and accessible to all citizens, including vulnerable populations. Increasing response to public health emergencies, supporting domestic vaccine manufacturing, bulk procurement, and distribution, will fuel the market growth.

The hospital and retail pharmacy segment is experiencing the fastest growth in the market during the forecast period. They are leveraging their accessibility and convenience, which has been crucial in meeting a surge in demand following the pandemic. They have capitalized on their extensive geographical reach and flexible hours, offering a trusted, familiar setting where trained pharmacists can provide immunizations. Furthermore, operational efficiencies and new technologies have enhanced distribution and delivery, allowing these settings to scale up vaccination services and better serve communities.

By Type

By Route of Administration

By Disease Indication

By Age Group

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Vaccine Market

5.1. COVID-19 Landscape: Vaccine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market TrDistribution Channels and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and TrDistribution Channels

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. VDistribution Channelor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Vaccine Market, By Type

8.1. Vaccine Market, by Type

8.1.1. Subunit Vaccines

8.1.1.1. Market Revenue and Forecast

8.1.2. Recombinant vaccines

8.1.2.1. Market Revenue and Forecast

8.1.3. Conjugate Vaccines

8.1.3.1. Market Revenue and Forecast

8.1.4. Toxoid vaccines

8.1.4.1. Market Revenue and Forecast

8.1.5. Inactivated

8.1.5.1. Market Revenue and Forecast

8.1.6. Live Attenuated

8.1.6.1. Market Revenue and Forecast

8.1.7. mRNA vaccines

8.1.7.1. Market Revenue and Forecast

8.1.8. Viral vector vaccines

8.1.8.1. Market Revenue and Forecast

Chapter 9. Global Vaccine Market, By Route of Administration

9.1. Vaccine Market, by Route of Administration

9.1.1. Oral

9.1.1.1. Market Revenue and Forecast

9.1.2. Parenteral

9.1.2.1. Market Revenue and Forecast

9.1.3. Nasal

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Vaccine Market, By Disease Indication

10.1 Vaccine Market, by Disease Indication

10.1.1. Viral Diseases

10.1.1.1. Market Revenue and Forecast

10.1.2. Bacterial Vaccines

10.1.2.1. Market Revenue and Forecast

10.1.3. Cancer Vaccines

10.1.3.1. Market Revenue and Forecast

10.1.4. Allergy Vaccines

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Vaccine Market, By Age Group

11.1. Vaccine Market, by Age Group

11.1.1. Pediatric

11.1.1.1. Market Revenue and Forecast

11.1.2 Adult

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Vaccine Market, By Distribution Channel

12.1. Vaccine Market, by Distribution Channel

12.1.1. Hospital & Retail Pharmacies

12.1.1.1. Market Revenue and Forecast

12.1.2. Government Suppliers

12.1.2.1. Market Revenue and Forecast

12.1.3. Others

12.1.3.1. Market Revenue and Forecast

Chapter 13. Global Vaccine Market, Regional Estimates and TrDistribution Channel Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Type

13.1.2. Market Revenue and Forecast, by Route of Administration

13.1.3. Market Revenue and Forecast, by Disease Indication Mode

13.1.4. Market Revenue and Forecast, by Age Group Size

13.1.5. Market Revenue and Forecast, by Distribution Channel Use

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Type

13.1.6.2. Market Revenue and Forecast, by Route of Administration

13.1.6.3. Market Revenue and Forecast, by Disease Indication Mode

13.1.6.4. Market Revenue and Forecast, by Age Group Size

13.1.7. Market Revenue and Forecast, by Distribution Channel Use

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Type

13.1.8.2. Market Revenue and Forecast, by Route of Administration

13.1.8.3. Market Revenue and Forecast, by Disease Indication

13.1.8.4. Market Revenue and Forecast, by Age Group

13.1.8.5. Market Revenue and Forecast, by Distribution Channel

13.2. Europe

13.2.1. Market Revenue and Forecast, by Type

13.2.2. Market Revenue and Forecast, by Route of Administration

13.2.3. Market Revenue and Forecast, by Disease Indication

13.2.4. Market Revenue and Forecast, by Age Group

13.2.5. Market Revenue and Forecast, by Distribution Channel

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Type

13.2.6.2. Market Revenue and Forecast, by Route of Administration

13.2.6.3. Market Revenue and Forecast, by Disease Indication

13.2.7. Market Revenue and Forecast, by Age Group

13.2.8. Market Revenue and Forecast, by Distribution Channel

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Type

13.2.9.2. Market Revenue and Forecast, by Route of Administration

13.2.9.3. Market Revenue and Forecast, by Disease Indication

13.2.10. Market Revenue and Forecast, by Age Group

13.2.11. Market Revenue and Forecast, by Distribution Channel

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Type

13.2.12.2. Market Revenue and Forecast, by Route of Administration

13.2.12.3. Market Revenue and Forecast, by Disease Indication

13.2.12.4. Market Revenue and Forecast, by Age Group

13.2.13. Market Revenue and Forecast, by Distribution Channel

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Type

13.2.14.2. Market Revenue and Forecast, by Route of Administration

13.2.14.3. Market Revenue and Forecast, by Disease Indication

13.2.14.4. Market Revenue and Forecast, by Age Group

13.2.15. Market Revenue and Forecast, by Distribution Channel

13.3. APAC

13.3.1. Market Revenue and Forecast, by Type

13.3.2. Market Revenue and Forecast, by Route of Administration

13.3.3. Market Revenue and Forecast, by Disease Indication

13.3.4. Market Revenue and Forecast, by Age Group

13.3.5. Market Revenue and Forecast, by Distribution Channel

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Type

13.3.6.2. Market Revenue and Forecast, by Route of Administration

13.3.6.3. Market Revenue and Forecast, by Disease Indication

13.3.6.4. Market Revenue and Forecast, by Age Group

13.3.7. Market Revenue and Forecast, by Distribution Channel

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Type

13.3.8.2. Market Revenue and Forecast, by Route of Administration

13.3.8.3. Market Revenue and Forecast, by Disease Indication

13.3.8.4. Market Revenue and Forecast, by Age Group

13.3.9. Market Revenue and Forecast, by Distribution Channel

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Type

13.3.10.2. Market Revenue and Forecast, by Route of Administration

13.3.10.3. Market Revenue and Forecast, by Disease Indication

13.3.10.4. Market Revenue and Forecast, by Age Group

13.3.10.5. Market Revenue and Forecast, by Distribution Channel

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Type

13.3.11.2. Market Revenue and Forecast, by Route of Administration

13.3.11.3. Market Revenue and Forecast, by Disease Indication

13.3.11.4. Market Revenue and Forecast, by Age Group

13.3.11.5. Market Revenue and Forecast, by Distribution Channel

13.4. MEA

13.4.1. Market Revenue and Forecast, by Type

13.4.2. Market Revenue and Forecast, by Route of Administration

13.4.3. Market Revenue and Forecast, by Disease Indication

13.4.4. Market Revenue and Forecast, by Age Group

13.4.5. Market Revenue and Forecast, by Distribution Channel

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Type

13.4.6.2. Market Revenue and Forecast, by Route of Administration

13.4.6.3. Market Revenue and Forecast, by Disease Indication

13.4.6.4. Market Revenue and Forecast, by Age Group

13.4.7. Market Revenue and Forecast, by Distribution Channel

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Type

13.4.8.2. Market Revenue and Forecast, by Route of Administration

13.4.8.3. Market Revenue and Forecast, by Disease Indication

13.4.8.4. Market Revenue and Forecast, by Age Group

13.4.9. Market Revenue and Forecast, by Distribution Channel

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Type

13.4.10.2. Market Revenue and Forecast, by Route of Administration

13.4.10.3. Market Revenue and Forecast, by Disease Indication

13.4.10.4. Market Revenue and Forecast, by Age Group

13.4.10.5. Market Revenue and Forecast, by Distribution Channel

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Type

13.4.11.2. Market Revenue and Forecast, by Route of Administration

13.4.11.3. Market Revenue and Forecast, by Disease Indication

13.4.11.4. Market Revenue and Forecast, by Age Group

13.4.11.5. Market Revenue and Forecast, by Distribution Channel

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Type

13.5.2. Market Revenue and Forecast, by Route of Administration

13.5.3. Market Revenue and Forecast, by Disease Indication

13.5.4. Market Revenue and Forecast, by Age Group

13.5.5. Market Revenue and Forecast, by Distribution Channel

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Type

13.5.6.2. Market Revenue and Forecast, by Route of Administration

13.5.6.3. Market Revenue and Forecast, by Disease Indication

13.5.6.4. Market Revenue and Forecast, by Age Group

13.5.7. Market Revenue and Forecast, by Distribution Channel

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Type

13.5.8.2. Market Revenue and Forecast, by Route of Administration

13.5.8.3. Market Revenue and Forecast, by Disease Indication

13.5.8.4. Market Revenue and Forecast, by Age Group

13.5.8.5. Market Revenue and Forecast, by Distribution Channel

Chapter 14. Company Profiles

14.1. Pfizer Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Moderna, Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Johnson & Johnson

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. GlaxoSmithKline plc (GSK)

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Sanofi S.A.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. AstraZeneca plc

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Serum Institute of India Pvt. Ltd.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Bharat Biotech International Ltd.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. CSL Limited (including Seqirus)

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Novavax, Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. AppDistribution Channelix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others