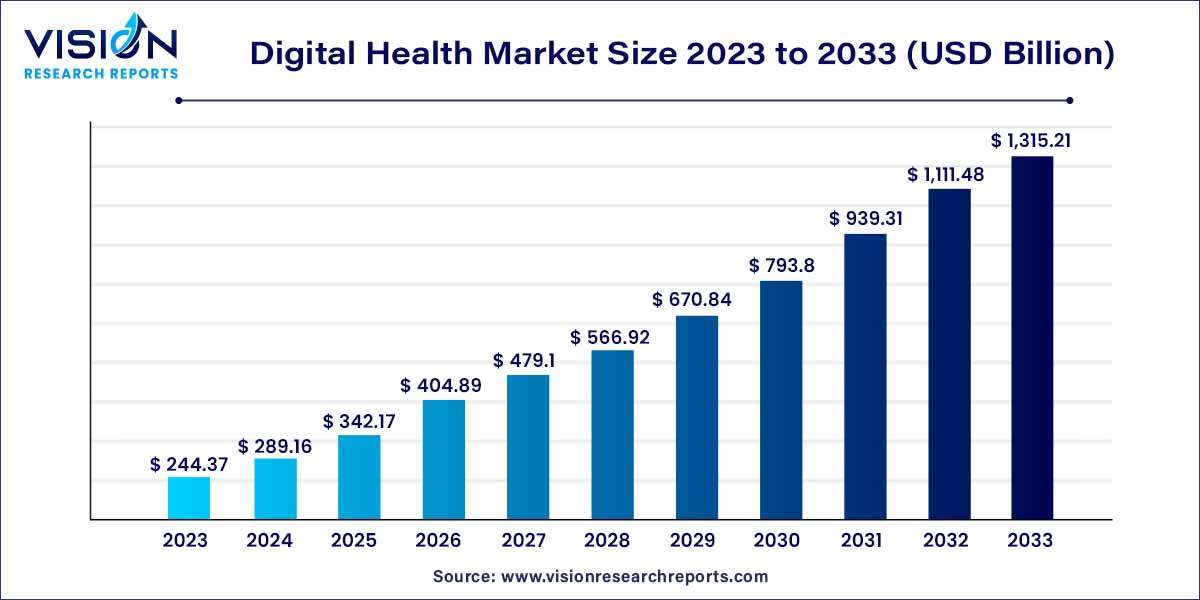

The global digital health market size was estimated at around USD 244.37 billion in 2023 and it is projected to hit around USD 1,315.21 billion by 2033, growing at a CAGR of 18.33% from 2024 to 2033.

In recent years, the digital health market has emerged as a revolutionary force, reshaping the landscape of healthcare delivery and management. Defined by the integration of digital technologies into traditional healthcare systems, Digital Health encompasses a wide range of solutions aimed at enhancing patient care, improving efficiency, and fostering better health outcomes.

The exponential growth of the digital health market is underpinned by several key factors propelling its expansion. Firstly, heightened awareness of personal health and wellness has spurred an increased demand for digital health solutions, as individuals actively seek tools to manage and monitor their well-being. Technological advancements, notably in artificial intelligence, machine learning, and the Internet of Things (IoT), contribute to the continuous innovation within the sector, enhancing the sophistication and effectiveness of digital health tools. The global response to the COVID-19 pandemic has further accelerated the adoption of digital health solutions, highlighting the need for resilient and adaptable healthcare systems. This confluence of factors positions the digital health market as a dynamic and thriving ecosystem, offering substantial opportunities for growth and transformation in the healthcare industry.

In 2023, the tele-healthcare segment emerged as the market leader, commanding a substantial revenue share of 44%. This notable growth is attributable to several key factors, including the continuous improvement of internet connectivity, widespread adoption of smartphones, technological readiness, a growing deficit in healthcare providers, escalating medical costs, easy accessibility of telehealth applications, and an increasing inclination of both patients and physicians towards adopting these technologies.

Forecasts suggest that this segment is poised to achieve the highest CAGR over the projection period. Remote patient monitoring is witnessing heightened popularity, driven by the rising prevalence of chronic conditions such as diabetes and cardiovascular diseases, coupled with rapid advancements in technology. The global geriatric population is expected to expand during the forecast period, thereby augmenting the demand for remote patient monitoring services. Additionally, numerous platforms now incorporate remote patient monitoring features, contributing significantly to the growth of this segment.

In 2023, the services segment dominated the market, securing the largest revenue share at 46%. This substantial growth is primarily attributed to the increasing demand for services such as installation, staffing, training, maintenance, and other related offerings. Market players are responding to this demand by providing these services either as standalone options or bundled packages. The surge in the need for advanced software solutions and platforms, including Electronic Medical Records (EMRs) and EHR, coupled with the requisite upgrades and training to operate these systems, is a significant driver of growth within this segment. According to a 2021 report from HealthIT.gov, approximately 88% of U.S. office-based doctors utilize EHRs, with 78% opting for certified EHRs. Key industry players offer a comprehensive range of pre- and post-installation services, encompassing project planning, staffing, implementation, training, and resource allocation & optimization.

On the other hand, the software segment is poised to exhibit the fastest growth rate from 2024 to 2033, fueled by the rapid adoption of software systems across patients, healthcare facilities, providers, and insurance payers. The upsurge in healthcare expenses and the overarching trend of healthcare digitalization are pivotal factors propelling the software segment forward. The increasing consumer demand for personalized medicine and the shift towards value-based care are also significant contributors to the segment's expansion. In emerging economies, healthcare facilities readily embrace these advanced software solutions and platforms to streamline organizational workflows, ultimately enhancing clinical, operational, and financial outcomes.

In 2023, the diabetes segment held the largest revenue share of 30%, and is anticipated to experience the most rapid growth from 2024 to 2030. The prevalence of diabetes and its associated complications has solidified its standing as the predominant segment in the digital health arena. Digital health technologies present innovative solutions to cater to the specific needs of individuals with diabetes. From smartphone applications designed for glucose monitoring to wearable devices that track physical activity and provide real-time health data, these tools empower patients to actively engage in the management of their diabetes. Furthermore, these technologies facilitate remote patient monitoring, enabling healthcare providers to receive timely data, make informed decisions, and intervene promptly, thereby contributing to more effective diabetes management.

Additionally, the escalating prevalence of diabetes has generated increased demand for preventive strategies and early intervention methods. Digital health solutions play a crucial role by delivering personalized, data-driven insights that empower individuals to make lifestyle modifications and effectively manage risk factors. Consequently, the diabetes segment continues to expand, driven by the growing need for accessible, efficient, and patient-centric solutions that elevate the overall quality of diabetes care and contribute to improved health outcomes.

In 2023, the patient segment had the largest market share of 35% and is projected to experience the fastest CAGR from 2024 to 2033. This surge is attributed to the ongoing shift toward patient-centered care and the heightened awareness among individuals regarding the management of their health. Digital health technologies have profoundly transformed the healthcare landscape by equipping patients with tools for remote monitoring, self-management, and easy access to health information. From mobile health apps that monitor vital signs to telehealth platforms enabling virtual consultations, the emphasis on the patient segment underscores the industry's commitment to enhancing patient engagement, promoting proactive health management, and fostering a more collaborative and informed healthcare experience.

The provider segment held the second-largest revenue share, driven by the widespread adoption of innovative technologies like telemedicine and digital therapeutics. Healthcare providers are increasingly leveraging digital solutions to offer remote consultations, personalized treatment plans, and evidence-based therapies outside traditional care settings.

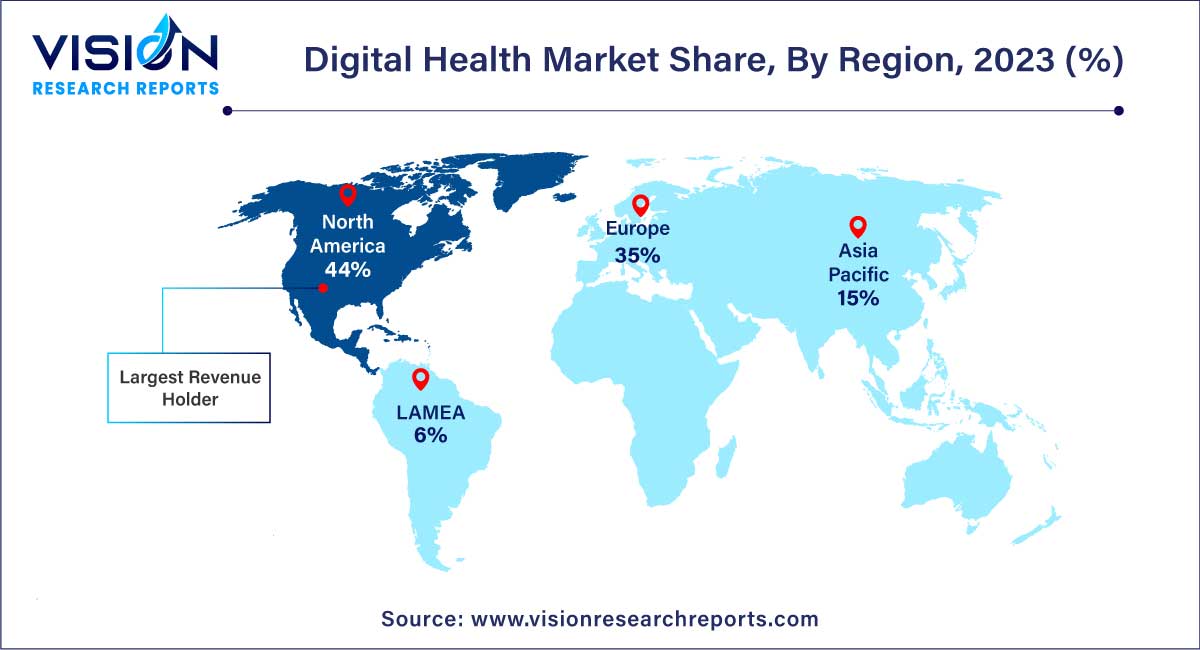

In 2023, North America region dominated the market with the largest market share of 44%. This leadership position can be attributed to various factors, including technological advancements, increased healthcare IT expenditure aimed at advancing infrastructure, supportive government initiatives, the emergence of startups, a proactive readiness to adopt advanced technological solutions, the availability of options for growing smartphone penetration, improvements in internet connectivity, and substantial funding opportunities.

Asia Pacific is anticipated to witness the highest growth rate from 2024 to 2033. This growth is fueled by the rising adoption of eHealth platforms and increased healthcare spending across the region. The surge in demand for remote patient monitoring and other telehealth services, driven by increased government spending on healthcare, is expected to propel industry growth in Asia Pacific. For instance, based on The World Bank's 2019 estimates, China allocated 5.4% of its GDP to healthcare spending, India allocated 3.1%, and Japan allocated 10.7%.

By Technology

By Component

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Digital Health Market

5.1. COVID-19 Landscape: Digital Health Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Digital Health Market, By Technology

8.1. Digital Health Market, by Technology, 2024-2033

8.1.1. Tele-healthcare

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. mHealth

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Healthcare Analytics

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Digital Health Systems

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Digital Health Market, By Component

9.1. Digital Health Market, by Component, 2024-2033

9.1.1. Software

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hardware

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Services

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Digital Health Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.2. Market Revenue and Forecast, by Component (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.2. Market Revenue and Forecast, by Component (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Component (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Component (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Component (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Component (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Component (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Component (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Component (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.2. Market Revenue and Forecast, by Component (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Component (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Component (2021-2033)

Chapter 11. Company Profiles

11.1. BioTelemetry Inc

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. eClinicalWorks

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Allscripts Healthcare Solutions Inc

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. iHealth Lab Inc

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. AT & T

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Honeywell International Inc

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Athenahealth Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Cisco Systems

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. McKesson Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Koninklijke Philips N.V.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others