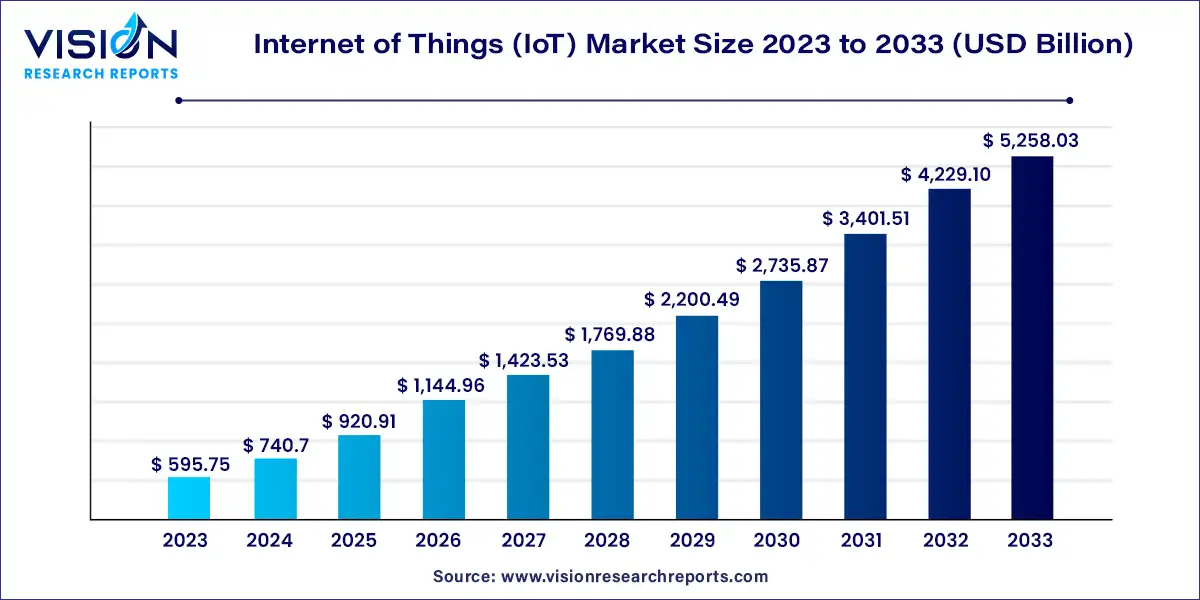

The global internet of things (IoT) market size was estimated at around USD 595.75 billion in 2023 and it is projected to hit around USD 5,258.03 billion by 2033, growing at a CAGR of 24.33% from 2024 to 2033.

The internet of things (IoT) market has emerged as a dynamic force, reshaping the way we interact with technology and the world around us. At its essence, IoT refers to the network of interconnected devices and objects embedded with sensors, software, and connectivity, allowing them to collect and exchange data. This vast ecosystem of smart devices has transcended conventional boundaries, infiltrating diverse sectors and revolutionizing industries.

The growth of the internet of things (IoT) market is driven by an increasing adoption of IoT devices across various industries, such as healthcare, manufacturing, and agriculture, drives market expansion. These sectors leverage IoT technology to enhance efficiency, reduce costs, and improve overall productivity. Secondly, advancements in connectivity solutions, including 5G networks, ensure faster and more reliable data transmission, fostering the seamless operation of IoT devices. Thirdly, the rising demand for real-time data analytics and predictive insights fuels the integration of IoT in businesses. Companies are leveraging IoT-generated data to make informed decisions, optimize operations, and deliver enhanced customer experiences.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 34% |

| Revenue Forecast by 2033 | USD 5,258.03 billion |

| Growth Rate from 2024 to 2033 | CAGR of 24.33% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The software segment held the largest market share in 2023. Software components form the intelligence and operational foundation of IoT systems. IoT software includes operating systems designed for embedded devices, allowing efficient utilization of hardware resources. Middleware solutions facilitate communication and data exchange between diverse IoT devices, ensuring interoperability and seamless integration. Data management software processes the vast volumes of data generated by IoT devices, employing analytics tools to extract valuable insights. IoT application development platforms empower businesses and developers to create customized applications tailored to specific IoT use cases, fostering innovation and driving IoT adoption.

Hardware components play a pivotal role in enabling the seamless functioning of interconnected devices. These components encompass a diverse range of physical devices, sensors, and equipment that form the backbone of IoT systems. Microcontrollers, a fundamental hardware component, serve as the brain of IoT devices, facilitating the processing and transmission of data. Sensors and actuators, another essential hardware element, collect real-time data from the environment and enable devices to respond to specific triggers.

The cloud segment is expected to dominate the market during the forecast period. Cloud-based deployment, a dominant force in the IoT arena, offers businesses unparalleled flexibility and scalability. By leveraging cloud platforms, companies can store vast amounts of IoT-generated data securely, enabling seamless access and analysis from anywhere in the world. Cloud solutions eliminate the need for extensive on-site hardware, reducing infrastructure costs and enhancing resource allocation efficiency. Cloud-based IoT solutions are particularly attractive to enterprises seeking rapid deployment, global accessibility, and the ability to harness the full potential of big data analytics.

On the other hand, On-premises deployment, while requiring a substantial initial investment in infrastructure, offers businesses greater control over their IoT ecosystems. Organizations opt for on-premises solutions, especially when dealing with sensitive data or industries where regulatory compliance is stringent. By housing IoT infrastructure within their premises, companies maintain direct oversight of data security protocols, ensuring compliance with industry regulations and internal policies.

The large enterprises segment is expected to hold a significant market share over the forecast period. Large enterprises, armed with substantial resources and extensive infrastructure, have been at the forefront of embracing IoT solutions. These industry giants leverage IoT to optimize their operations, enhance productivity, and deliver seamless customer experiences. With the ability to invest in comprehensive IoT ecosystems, large enterprises often deploy intricate networks of interconnected devices and sensors, revolutionizing sectors like manufacturing, logistics, and healthcare.

Small and Medium-sized Enterprises (SMEs) are navigating the IoT landscape with innovation and agility. Despite limited resources compared to their larger counterparts, SMEs have found their foothold in the IoT market by capitalizing on specialized IoT applications. These businesses deploy IoT solutions tailored to their specific needs, focusing on areas such as inventory management, customer engagement, and process automation.

RFID technology employs electromagnetic fields to automatically identify and track tags attached to objects. In the context of IoT, RFID plays a crucial role in asset management and supply chain optimization. By embedding RFID tags into products, manufacturers and businesses gain real-time visibility into their inventory. This real-time tracking not only enhances supply chain efficiency but also helps prevent losses and reduce operational costs. RFID-enabled IoT applications find extensive use in retail, logistics, and manufacturing sectors, transforming traditional inventory management into intelligent, data-driven processes.

Network communications, a cornerstone of IoT technology, facilitates seamless data exchange between interconnected devices. Wireless communication protocols like Wi-Fi, Bluetooth, and Zigbee enable IoT devices to transmit data over networks, enabling remote monitoring and control. Furthermore, the advent of 5G technology has revolutionized IoT connectivity by offering faster speeds, lower latency, and increased device density.

In the Energy & Utilities sector, IoT technologies have ushered in a new era of efficiency and sustainability. Smart grids, equipped with IoT sensors and communication devices, enable real-time monitoring of energy production, distribution, and consumption. This granular data allows utility companies to optimize their grids, reduce energy wastage, and enhance overall operational efficiency.

In the healthcare sector, IoT technologies are transforming patient care, treatment methods, and healthcare management. Wearable devices equipped with sensors monitor vital signs, allowing healthcare professionals to track patient health remotely. This remote patient monitoring not only enhances patient comfort but also facilitates early detection of health issues, enabling timely interventions.

North America dominated the global market with the highest market share of 34% in 2023. In North America, particularly in the United States, IoT adoption has been robust, driven by technological innovation and significant investments by industry leaders. The region's early embrace of IoT applications in sectors such as healthcare, smart cities, and industrial automation has established it as a frontrunner in the global IoT arena.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Asia-Pacific, encompassing countries like China, Japan, and South Korea, stands as a hotbed for IoT innovation. The region's rapid urbanization, coupled with a burgeoning middle class, has spurred demand for smart home solutions, connected vehicles, and advanced healthcare technologies.

By Component

By Deployment

By Organization Size

By Technology

By Industry Vertical

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Internet of Things (IoT) Market

5.1. COVID-19 Landscape: Internet of Things (IoT) Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Internet of Things (IoT) Market, By Component

8.1. Internet of Things (IoT) Market, by Component, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Internet of Things (IoT) Market, By Deployment

9.1. Internet of Things (IoT) Market, by Deployment, 2024-2033

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. On-premises

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Internet of Things (IoT) Market, By Organization Size

10.1. Internet of Things (IoT) Market, by Organization Size, 2024-2033

10.1.1. Large Enterprises

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. SMEs

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Internet of Things (IoT) Market, By Technology

11.1. Internet of Things (IoT) Market, by Technology, 2024-2033

11.1.1. Radiofrequency Identification

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Pressure Sensors

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Network Communications

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Data Processing

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Near-field Communication

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Internet of Things (IoT) Market, By Industry Vertical

12.1. Internet of Things (IoT) Market, by Industry Vertical, 2024-2033

12.1.1. Energy & Utility

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Healthcare

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Transportation & Logistics

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. IT & Telecom

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Manufacturing

12.1.5.1. Market Revenue and Forecast (2021-2033)

12.1.6. E-commerce

12.1.6.1. Market Revenue and Forecast (2021-2033)

12.1.7. Others

12.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Global Internet of Things (IoT) Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.4. Market Revenue and Forecast, by Technology (2021-2033)

13.1.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.6.4. Market Revenue and Forecast, by Technology (2021-2033)

13.1.7. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.1.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.1.8.4. Market Revenue and Forecast, by Technology (2021-2033)

13.1.8.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.4. Market Revenue and Forecast, by Technology (2021-2033)

13.2.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.7. Market Revenue and Forecast, by Technology (2021-2033)

13.2.8. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.9.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.9.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.10. Market Revenue and Forecast, by Technology (2021-2033)

13.2.11. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.12.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.12.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.12.4. Market Revenue and Forecast, by Technology (2021-2033)

13.2.13. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2021-2033)

13.2.14.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.2.14.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.2.14.4. Market Revenue and Forecast, by Technology (2021-2033)

13.2.15. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.4. Market Revenue and Forecast, by Technology (2021-2033)

13.3.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.6.4. Market Revenue and Forecast, by Technology (2021-2033)

13.3.7. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.8.4. Market Revenue and Forecast, by Technology (2021-2033)

13.3.9. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.10.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.10.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.10.4. Market Revenue and Forecast, by Technology (2021-2033)

13.3.10.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.3.11.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.3.11.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.3.11.4. Market Revenue and Forecast, by Technology (2021-2033)

13.3.11.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.4. Market Revenue and Forecast, by Technology (2021-2033)

13.4.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.6.4. Market Revenue and Forecast, by Technology (2021-2033)

13.4.7. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.8.4. Market Revenue and Forecast, by Technology (2021-2033)

13.4.9. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.10.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.10.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.10.4. Market Revenue and Forecast, by Technology (2021-2033)

13.4.10.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2021-2033)

13.4.11.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.4.11.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.4.11.4. Market Revenue and Forecast, by Technology (2021-2033)

13.4.11.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.4. Market Revenue and Forecast, by Technology (2021-2033)

13.5.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.6.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.6.4. Market Revenue and Forecast, by Technology (2021-2033)

13.5.7. Market Revenue and Forecast, by Industry Vertical (2021-2033)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2021-2033)

13.5.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

13.5.8.3. Market Revenue and Forecast, by Organization Size (2021-2033)

13.5.8.4. Market Revenue and Forecast, by Technology (2021-2033)

13.5.8.5. Market Revenue and Forecast, by Industry Vertical (2021-2033)

Chapter 14. Company Profiles

14.1. Intel Corporation

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Hewlett Packard Enterprise

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Sap SE

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Bosch Software Innovation

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Amazon Web Service

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Google

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Microsoft Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Oracle Corporation

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. IBM Corporation

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Cisco Systems

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others