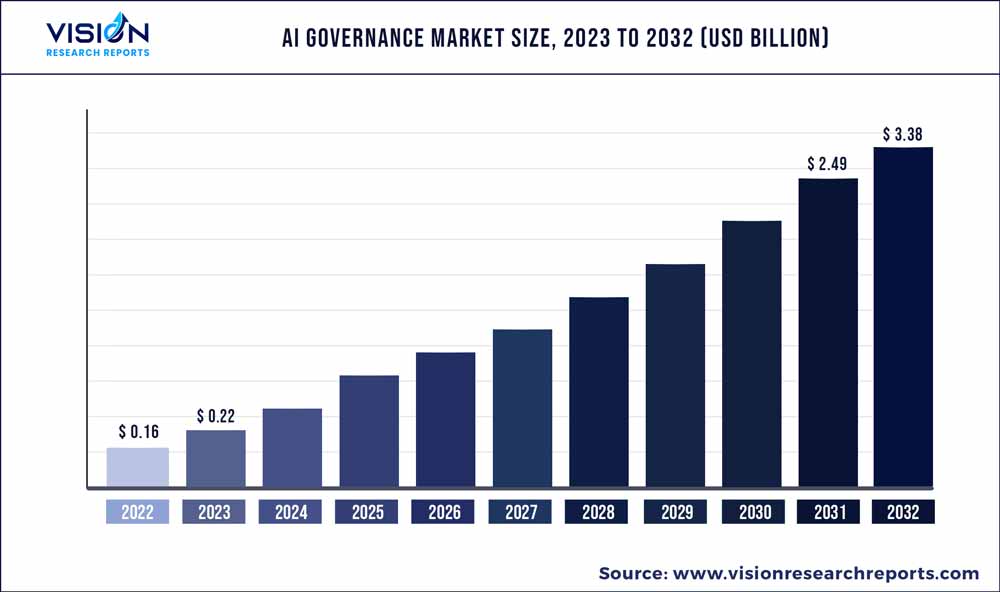

The global AI governance market was valued at USD 0.16 billion in 2022 and it is predicted to surpass around USD 3.38 billion by 2032 with a CAGR of 35.65% from 2023 to 2032. The AI governance market in the United States was accounted for USD 26.1 million in 2022.

Key Pointers

Report Scope of the AI Governance Market

| Report Coverage | Details |

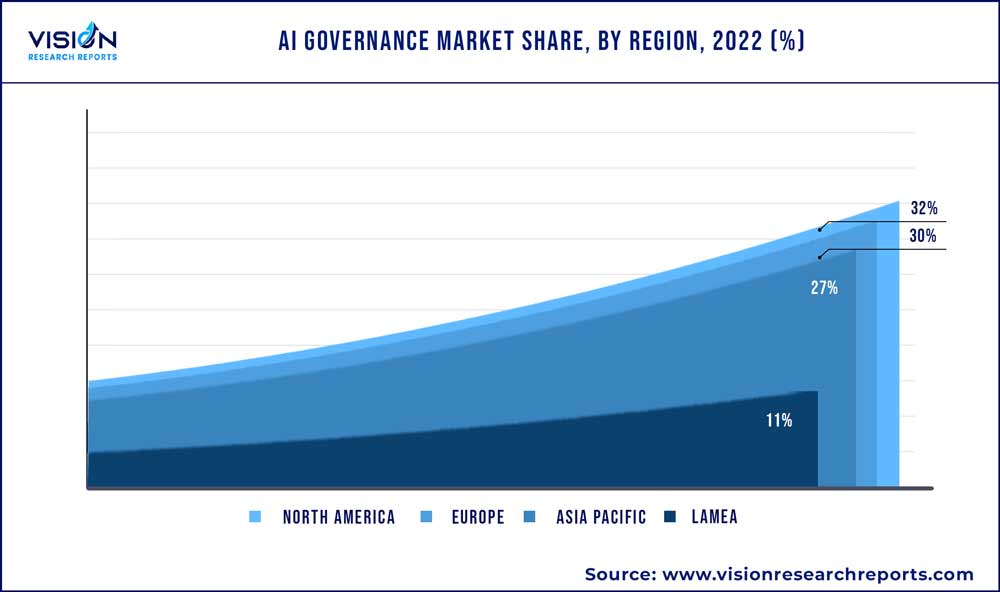

| Revenue Share of North America in 2022 | 32% |

| Revenue Forecast by 2032 | USD 3.38 billion |

| Growth Rate from 2023 to 2032 | CAGR of 35.65% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | ABB, DXC Technology Company, Infosys, Microsoft, NTT Data, Oracle, SAP SE, Siemens, Tata Communication Services (TCS), TIBCO |

The market for artificial intelligence (AI) governance is expanding due to several factors, including rising regulatory and legal requirements, industry-specific considerations, the emergence of AI governance consulting services, and rising demand for explainable AI. These factors also include rising awareness of AI’s potential risks and challenges. As its usage spreads across sectors, there is rising awareness of the possible hazards and difficulties connected with AI, such as algorithmic bias, privacy problems, and safety risks. To ensure the appropriate and ethical development and use of AI, businesses, and governments are spending more and more on AI governance.

There is a rising need for AI governance solutions to handle AI systems' ethical, legal, and societal ramifications as it becomes more common in many industries. As a result, platforms, and tools for AI governance have increased, including explainable AI (XAI) solutions, tools for bias detection and reduction, and frameworks for AI ethics. Several organizations are integrating AI governance into their business risk management frameworks to address the potential risks and liabilities of AI systems. It entails identifying and evaluating the risks associated with AI, putting controls and governance mechanisms in place, monitoring risk levels associated with AI, and reporting those risks.

The application of AI to reduce gender inequality and discrimination opens attractive potential in the global AI governance Market. The growing number of government attempts to utilize AI technology, modernize data warehouse architecture and bridge the ethical-accountability gap are the few significant factors propelling the growth of the global AI governance market. The proactive customer experience provided by AI-assisted backend process automation, which eliminates human errors, propels AI growth in the BFSI industry. Using chatbots and robot advisers for financial products and smart wallets is one of the additional factors impacting the industry's growth.

Component Insights

The solution segment dominated the market in 2022 with a market share of 66%. Owing to the existence of well-diversified market competitors, the solution sector is also expected to dominate the segment market throughout the projection period. To meet the increasing customer demand across several end-user industry verticals, such suppliers are concentrating on offering fresh, creative solutions continuously in step with technological advancement. For instance, in October 2021, Datatron announced an improvement to their MLOps and Al governance solution, which makes it simple for businesses to catalog, operationalize, monitor, and control Al/ML models.

Owing to the rising demand for Al governance solutions, which has increased demand for software integration services, installation services, deployment, maintenance, and upgrade services, the service segment also have considerable growth soon. The complexity of implementing Al governance systems and software and the demand for integrating them into customers' IT infrastructures will fuel the expansion of integration services. Businesses are developing new AI governance training and education programs to assist individuals and organizations in understanding AI's ethical and legal consequences. For instance, in 2021, Intel unveiled its educational program in collaboration with the Central Board of Secondary Education (CBSE) for the basic understanding of Artificial intelligence (AI) for Citizens, which offers free online courses on AI ethics and ethical AI development.

Deployment Type Insights

The on-premises segment dominated the market in 2022 with a market share of 54%. Data governance, explainable AI, edge computing, integration with DevOps workflows, scalability, and flexibility are some of the main trends in the on-premises AI governance market that are driving the industry's growth. These developments show the rising significance of AI governance and the requirement for businesses to manage the governance of their AI systems in a scalable, adaptable, and open way. Additionally, the need for a traditional on-premises environment that offers a single monolithic network with suitable security measures is projected to soon lead to considerable development in the on-premises category. Although the use of cloud solutions has grown over time, effective security measures are still required to safeguard user data and applications.

There are numerous benefits of employing, the cloud is predicted to drive the global market during the forecast period. Implementation of Al governance in the cloud and accurate asset allocation are some of the significant advantages of cloud-based services. With the help of this, users may remotely audit and check on the adherence to current policies and IT standards outlined in contracts for services with Cloud service providers. Cloud service providers rapidly include AI governance tools into their platforms to fulfill the rising need for moral and responsible AI. For instance, In December 2021, Microsoft announced the introduction of responsible AI capabilities in its Azure cloud platform, which include tools for bias detection and model interpretability.

Organization Size Insights

The large enterprise segment dominated 2022 with a market share of 72%. Businesses are focusing more on data privacy and security as they want to ensure that their AI systems protect sensitive information. Furthermore, as large organizations become more susceptible to cyberattacks and other security issues, integrating AI governance to reduce risk is projected to rise, promoting market growth in this sector. Consulting companies have teamed with AI governance solution vendors to deliver complete AI governance services to their clients. Large enterprises have been acquiring smaller AI governance startups to expand their capabilities in this area. For Instance, in July 2020, IBM acquired WDG Automation, a firm specializing in AI governance and compliance. With this acquisition, IBM's extensive AI-infused automation capabilities, which span business processes and IT operations, are further advanced.

The market for AI governance in small- and medium-sized businesses (SMEs) is anticipated to develop quickly throughout the anticipated period. Some reasons in the SME market that drive the category's growth include the rising desire for scalable, inexpensive solutions that may assist SMEs in ensuring responsible, ethical, and transparent usage of artificial intelligence. SMEs might also require additional resources to create and maintain their AI governance frameworks. Cloud-based solutions from AGaaS providers let SMEs apply best practices in AI governance without making significant infrastructure expenditures.

Vertical Insights

The Government and Defense segment dominated the market in 2022 with a share of approximately 20%. Several trends in assuring the appropriate, ethical, and transparent use of AI in different areas, including healthcare & life sciences, are propelling market expansion. AI use in healthcare and life sciences presents privacy and data security issues since these sectors deal with sensitive patient data. Therefore, there is an increasing focus on ensuring that AI systems in these industries abide by data privacy laws and are protected from potential cyber threats. Healthcare professionals also employ AI to help with diagnosis and therapy. However, applying AI in these situations raises questions about bias and accuracy, so it's crucial to ensure the systems are properly validated and trained before being applied in clinical settings.

Autonomous cars are one of the domains where AI governance solutions are expected to be necessary. The fact that several projects are working on creating self-driving cars is a crucial factor propelling the growth of this market. Like the emergence of AI-enabled hardware, specialized GPUs have significantly increased the potential to enable and improve self-driving technologies and AI algorithms. Additionally, crucial AI characteristics, including enhanced processing and decision-making capabilities, have strengthened self-control, self-regulation, and self-actuation, which have expanded the usage of AI in the defense, military, and government sectors. Some advantages of AI techniques include their development to increase the accuracy of target recognition in complex conflict circumstances.

Regional Insights

The North American region accounted for the highest share of the market at 32% in 2022. North America is expected to capture a significant share due to the increased use of artificial intelligence (Al) by commercial and governmental organizations is responsible is one of the main factors propelling the market growth. In the last several years, American legislators and government organizations have been creating Al and automated systems plans and regulations to balance limiting the negative effects of Al technology and promoting healthy competition and advances. Additionally, early adoption of technologies like machine learning by developed countries like the U.S. and Canadian businesses is anticipated to fuel market expansion in the North American area.

Europe is another critical market for AI regulation, with a heavy emphasis on data privacy and ethical AI. The General Data Protection Regulation (GDPR) and the AI Act, which aim to address data privacy, prejudice and discrimination, and algorithmic transparency, are some recent rules of the EU that have been adopted or proposed. Additionally, there has been an increased emphasis on creating frameworks and norms for AI ethics, with groups like the European Alliance and the high-level expert group on AI leading the charge. Moreover, Several European nations have created AI governance ethical frameworks. For instance, the UK government has released an AI Code of Conduct that outlines a few principles for the moral use of AI, such as justice, accountability, and openness.

AI Governance Market Segmentations:

By Component

By Deployment Type

By Organization Size

By Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on AI Governance Market

5.1. COVID-19 Landscape: AI Governance Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global AI Governance Market, By Component

8.1. AI Governance Market, by Component, 2023-2032

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global AI Governance Market, By Deployment

9.1. AI Governance Market, by Deployment, 2023-2032

9.1.1. On-Premises

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global AI Governance Market, By Organization Size

10.1. AI Governance Market, by Organization Size, 2023-2032

10.1.1. Large Enterprise

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. SMEs

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global AI Governance Market, By Vertical

11.1. AI Governance Market, by Vertical, 2023-2032

11.1.1. BFSI

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Government and Defense

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Healthcare and life sciences

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Media and Entertainment

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Retail

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. IT and Telecommunication

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Automotive

11.1.7.1. Market Revenue and Forecast (2020-2032)

11.1.8. Others (Education, Travel and Tourism, Manufacturing and Etc)

11.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global AI Governance Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.1.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.1.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.1.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.2.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.3.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.7.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.4.8.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.5.5.4. Market Revenue and Forecast, by Vertical (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

12.5.6.4. Market Revenue and Forecast, by Vertical (2020-2032)

Chapter 13. Company Profiles

13.1. ABB

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. DXC Technology Company

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Infosys

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Microsoft

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. NTT Data

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Oracle

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. SAP SE

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Siemens

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Tata Communication Services (TCS)

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. TIBCO

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others