The global AI in project management market was surpassed at USD 2.27 billion in 2022 and is expected to hit around USD 11.25 billion by 2032, growing at a CAGR of 17.36% from 2023 to 2032.

Key Pointers

Report Scope of the AI in Project Management Market

| Report Coverage | Details |

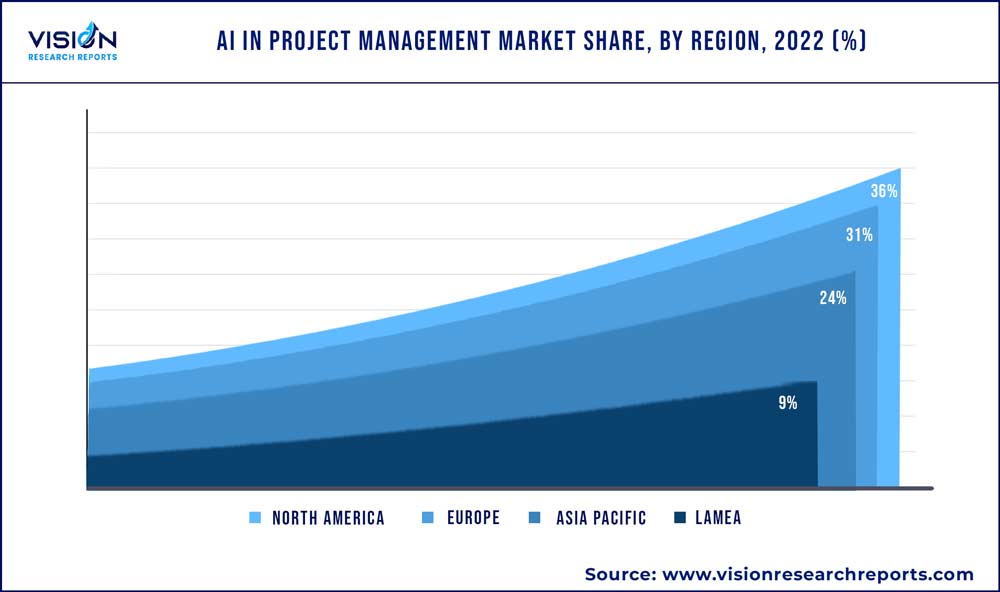

| Revenue Share of North America in 2022 | 36% |

| CAGR of Asia Pacific from 2023 to 2032 | 23.83% |

| Revenue Forecast by 2032 | USD 11.25 billion |

| Growth Rate from 2023 to 2032 | CAGR of 17.36% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Atlassian, Adobe Inc.; ALICE Technologies Inc.; Amazon Web Services Inc.; Google LLC; IBM Corporation; Intel Corporation; Microsoft Corporation; Oracle Corporation; ServiceNow; TIS Inc.; Zoho Corporation Pvt. Ltd |

The adoption of AI technologies is rapidly expanding across industries and project management domain. As organizations recognize the potential benefits of AI in improving project efficiency, reducing costs, and enhancing decision-making, the demand for AI-powered project management solutions is expected to grow. AI technologies continuously evolve, with advancements in machine learning, natural language processing, computer vision, and predictive analytics. These advancements enable more sophisticated and intelligent project management solutions, attracting organizations to invest in AI-powered tools to gain a competitive edge.

AI can automate manual and repetitive project management tasks, saving time and reducing human effort. Organizations can achieve high cost and time savings by automating data entry, progress tracking, and reporting, making AI-powered project management solutions an attractive investment. Moreover, AI algorithms can analyze vast amounts of project data and provide valuable insights for decision-making.

By leveraging AI-driven analytics, project managers can make more informed decisions, identify risks, optimize resource allocation, and improve project outcomes. For instance, in October 2022, Microsoft Corporation introduced Microsoft Syntex, a content AI incorporated into the workflow. Putting people first and integrating material effortlessly into collaboration and workflows turned content from a costly proposition into an asset. Syntex automatically reads, and categorizes large index amounts of content and connects it where needed-in search, in applications, and as reusable knowledge.

Projects are becoming increasingly complex, involving various stakeholders, dependencies, and dynamic environments. AI-powered project management solutions can help navigate this complexity by providing real-time data analysis, predictive capabilities, and intelligent automation, leading to increased demand for AI adoption. Moreover, Agile methodologies, known for their flexibility, collaboration, and iterative approach, are gaining popularity in project management. AI can support agile practices by providing real-time analytics, automated tracking, and adaptive planning capabilities, driving the demand for AI in agile project management.

Different industries have unique project management needs, and AI can be customized to address these requirements. For instance, industries such as construction, healthcare, and IT may have specific challenges that AI can help tackle, leading to industry-specific adoption and growth of AI in project management. For instance, in December 2022, IBM revealed an agreement to purchase Octo, a U.S.-based provider of IT digital transformation and modernization services that only works with the US federal government, including defense, health, and civilian agencies.

Component Insights

The solution segment dominated the market with a revenue share of 73% in 2022. Predictive analytics solutions in project management are becoming more sophisticated and advanced. Machine learning algorithms, such as regression, decision trees, and neural networks, are used to create predictive models that can forecast project outcomes, estimate timelines, and identify potential risks. These models continuously learn from new datasets and improve their accuracy over time. Moreover, intelligent virtual assistants powered by AI are becoming popular in project management. These assistants can handle routine tasks, provide real-time project updates, schedule meetings, and answer queries, thereby improving productivity and reducing the administrative burden on project teams.

The service segment is expected to grow with the fastest CAGR of 18.34% from 2023 to 2032. In project management, AI often requires customization and integration with existing systems and processes. Service providers offer customization and integration services to ensure seamless integration of AI solutions with project management software and tools. This involves configuring AI algorithms, data pipelines, and user interfaces to align with the organization's project management practices. Moreover, As AI technologies are increasingly adopted in project management, there is a growing demand for AI consulting and implementation services. Organizations seek assistance from AI experts and consultants to assess their project management needs, develop AI strategies, and implement AI solutions tailored to their requirements. These services involve AI solution design, integration, deployment, and training.

Deployment Insights

The on-premises segment dominates the market with a revenue share of 64% in 2022. On-premises deployment enables organizations to have complete control over their data and infrastructure and maintain their security standards. This is particularly important for organizations that need to abide by strict regulatory requirements or work on sensitive data projects. Moreover, on-premise AI solutions are often integrated with existing project management tools, such as on-premises task management software, collaboration tools, and time-tracking software. Integration with existing tools enables organizations to leverage AI insights and automation within their existing project management processes without requiring significant changes in workflows.

The cloud segment is expected to register strong growth during the forecast period, driven by the growing trend toward cloud-based deployment of AI in project management. Cloud-based deployment offers several advantages, including scalability, cost-effectiveness, and accessibility. Organizations can easily scale up or down their AI resources per their project needs and pay only for the resources they use. Hybrid deployment of AI in project management involves combining on-premises and cloud-based solutions. This approach offers the flexibility and cost-effectiveness of cloud-based deployment and the security and control of on-premises deployment. A hybrid deployment is particularly useful for organizations with sensitive project data or complex IT environments.

Organization size Insights

The large organization segment led the market with a revenue share of 74% in 2022. Large organizations are increasingly adopting AI solutions in project management, driven by the need to manage complex and large-scale projects more efficiently. AI solutions can help large organizations automate repetitive tasks, analyze large datasets, and optimize project workflows, leading to improved productivity, faster project delivery, and reduced costs. Furthermore, AI solutions in project management are increasingly being customized to meet the specific needs of different organization sizes. For example, AI solutions for large organizations may have more advanced features for project portfolio management, while AI solutions for SMEs may focus more on task management and collaboration.

While large organizations are the main adopters of AI in project management, there is a growing trend wherein SMEs show an increased willingness to adopt AI solutions. This is driven by the increasing availability of affordable and easy-to-use AI tools and the need for SMEs to compete with larger organizations & enterprises by improving their project management capabilities. Companies are increasingly partnering with service providers to implement and manage AI solutions in project management. Service providers offer expertise in AI implementation, customization, & maintenance, enabling organizations of different sizes to benefit from AI without requiring significant in-house resources.

Application Insights

The project scheduling and budgeting segment dominated the market, with a revenue share of 22% in 2022. AI is being utilized to provide real-time schedule adjustments based on changing project conditions and unforeseen events. AI algorithms can detect delays, bottlenecks, and disruptions by continuously analyzing project data and performance metrics. This allows project managers to make timely adjustments and optimize schedules to mitigate risks and improve project delivery. AI's predictive analytics capabilities are being leveraged to estimate project schedules and budgets more accurately. Analyzing historical project data allows AI algorithms to identify patterns, trends, and correlations to generate more precise estimates. This helps in setting realistic project timelines and budgets, reducing the risk of cost overestimations and operational risks such as overruns.

Artificial intelligence can optimize resource allocation in project management. AI algorithms can recommend optimal resource allocation strategies by analyzing project requirements, resource availability, and skillsets. This helps maximize resource utilization, reduce conflicts, and ensure that the right resources are allocated to the right tasks. AI-powered NLP tools can facilitate effective communication in project management. NLP algorithms can analyze project-related conversations via emails, and documents to extract insights, identify sentiment, and identify potential communication gaps. This helps in improving collaboration, managing stakeholder expectations, and addressing communication challenges.

Industry Vertical

The BFSI segment dominated the market with a revenue share of 22% in 2022. The key factor attributed to the segment growth is the increasing utilization of artificial intelligence in the BFSI industry to automate compliance processes and enhance risk management. AI algorithms can analyze vast amounts of data, including regulatory requirements and risk indicators, to ensure adherence to regulations and identify potential risks. This helps in streamlining compliance efforts, improving risk assessment, and enhancing overall project governance.

AI plays a crucial role in improving project efficiency, enhancing decision-making capabilities, and driving innovation within the government and defense sectors. AI technologies assist in security and surveillance projects undertaken by government and defense organizations. AI algorithms can analyze real-time data from various sources, such as video feeds, sensors, and social media, to detect anomalies, identify potential threats, and support decision-making for security operations.

Regional Insights

North America dominated the market with a revenue share of 36% in 2022. North America has been at the forefront of AI adoption in various industries, including project management. The region has witnessed a significant increase in AI-powered project management tools and platforms. The focus has been leveraging AI for automation, predictive analytics, and decision support to improve project planning, resource allocation, risk management, and overall project outcomes. AI applications have been used for intelligent scheduling, real-time monitoring, natural language processing (NLP)-based communication, and collaborative project management.

The Asia Pacific region is expected to grow with the fastest CAGR of 23.83% from 2023 to 2032. The Asia-Pacific region has witnessed rapid growth in the AI project management market. Countries such as China, India, Japan, and South Korea have been investing heavily in AI technologies for project management. AI-powered project management platforms have streamlined project workflows, improved communication and collaboration, and optimized resource utilization. Europe has also seen substantial growth in AI adoption in project management. Countries like the United Kingdom, Germany, and France have been leading the way in implementing AI technologies to enhance project management processes.

AI in Project Management Market Segmentations:

By Component

By Deployment

By Organization Size

By Application

By Industry Vertical

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on AI in Project Management Market

5.1. COVID-19 Landscape: AI in Project Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global AI in Project Management Market, By Component

8.1. AI in Project Management Market, by Component, 2023-2032

8.1.1. Solution

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global AI in Project Management Market, By Deployment

9.1. AI in Project Management Market, by Deployment, 2023-2032

9.1.1. Cloud

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. On-premise

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global AI in Project Management Market, By Organization Size

10.1. AI in Project Management Market, by Organization Size, 2023-2032

10.1.1. SMEs

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Large Organizations

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global AI in Project Management Market, By Application

11.1. AI in Project Management Market, by Application, 2023-2032

11.1.1. Data Analytics, Reporting, and Visualization

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Project Task Management, Automation, and Prioritization

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Project Scheduling and Budgeting

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Risk Assessment and Management

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Project Data Management

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Resource Allocation and Forecasting

11.1.6.1. Market Revenue and Forecast (2020-2032)

11.1.7. Others (project quality management, Project communication management, Project support, and administration, Project Monitoring, etc.)

11.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global AI in Project Management Market, By Industry Vertical

12.1. AI in Project Management Market, by Industry Vertical, 2023-2032

12.1.1. BFSI

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Healthcare

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Manufacturing

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. Government and Defense

12.1.4.1. Market Revenue and Forecast (2020-2032)

12.1.5. Retail & E-commerce

12.1.5.1. Market Revenue and Forecast (2020-2032)

12.1.6. IT & Telecom

12.1.6.1. Market Revenue and Forecast (2020-2032)

12.1.7. Energy & Utilities

12.1.7.1. Market Revenue and Forecast (2020-2032)

12.1.8. Others (construction, media & entertainment, etc.)

12.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global AI in Project Management Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.1.4. Market Revenue and Forecast, by Application (2020-2032)

13.1.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.1.7. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.1.8.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.4. Market Revenue and Forecast, by Application (2020-2032)

13.2.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.7. Market Revenue and Forecast, by Application (2020-2032)

13.2.8. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.10. Market Revenue and Forecast, by Application (2020-2032)

13.2.11. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Application (2020-2032)

13.2.13. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Component (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Application (2020-2032)

13.2.15. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.7. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.9. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.10.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.11.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.7. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.9. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.10.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Component (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.11.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.5.4. Market Revenue and Forecast, by Application (2020-2032)

13.5.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.5.7. Market Revenue and Forecast, by Industry Vertical (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Component (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Deployment (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Organization Size (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.5.8.5. Market Revenue and Forecast, by Industry Vertical (2020-2032)

Chapter 14. Company Profiles

14.1. Atlassian, Adobe Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. ALICE Technologies Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Amazon Web Services Inc.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Google LLC

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. IBM Corporation

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Intel Corporation

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Microsoft Corporation

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Oracle Corporation

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. ServiceNow

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. TIS Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others