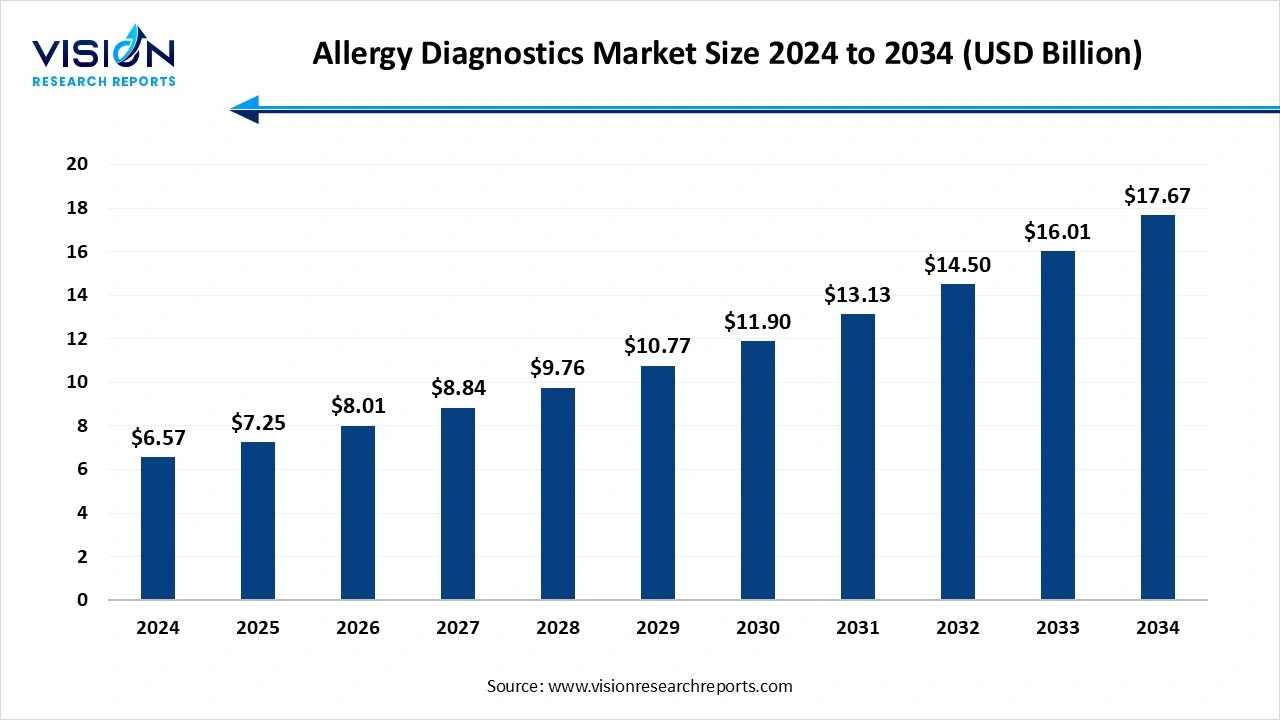

The global allergy diagnostics market size was valued at USD 6.57 billion in 2024 and is expected to grow from USD 7.25 billion in 2025 to around USD 17.67 billion by 2034, expanding at a CAGR of 10.4% during the forecast period. The rising allergy prevalence, increased air pollution, changing environments, lifestyle changes, and growing healthcare expenditure and awareness drive the market growth.

An allergy diagnosis is defined as the process of identifying specific allergens in individuals. These diagnostics help determine whether a person has an allergy, the type of allergy, and the severity of the immune response. The market growth is driven by the increasing worldwide incidence of allergic conditions, such as asthma, rhinitis, eczema, and food allergies is driving demand for accurate diagnostic solutions. Increasing in-vitro testing, molecular diagnostics, and point-of-care devices are enhancing the accuracy, speed, and accessibility of allergy testing. Growing awareness of allergy-related health risks and emphasis on early detection are encouraging more patients to undergo diagnostic testing.

Allergies are among the most common chronic conditions worldwide, affecting all age groups and significantly reducing quality of life. According to the World Allergy Organization, nearly 30-40% of the global population suffers from one or more allergic conditions, including asthma, allergic rhinitis, atopic dermatitis, urticaria, and food allergies. Rising the burdens of allergic diseases in urbanized regions is fueling a steady increase in diagnosed cases.

| Report Coverage | Details |

| Market Size in 2024 | USD 6.57 billion |

| Revenue Forecast by 2034 | USD 17.67 billion |

| Growth rate from 2025 to 2034 | CAGR of 10.4% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Thermo Fisher Scientific, Danaher (Beckman Coulter), bioMérieux, Siemens Healthineers, Stallergenes Greer, HYCOR Biomedical, Omega Diagnostics, R-Biopharm, ACON Laboratories, and Lincoln Diagnostics. |

The focus is on developing tests that can provide highly specific information to guide personalized treatment strategies for individual patients. Predictive capabilities more beyond reactive diagnosis to a more predictive approach, helping identify individuals at risk and enabling proactive care. Advancement in molecular diagnostics, taking action to prevent disease onset or worsening.

High Cost of Instruments and Procedures in the Allergy Diagnostics Market The premium price of advanced diagnostic instruments, such as immunoassay analyzers and molecular diagnostics, limits their widespread adoption, especially in developing regions and smaller healthcare facilities with tight budgets. A lack of standardized or sufficient reimbursement policies for allergy diagnostic testing in some regions can deter both healthcare providers and patients.

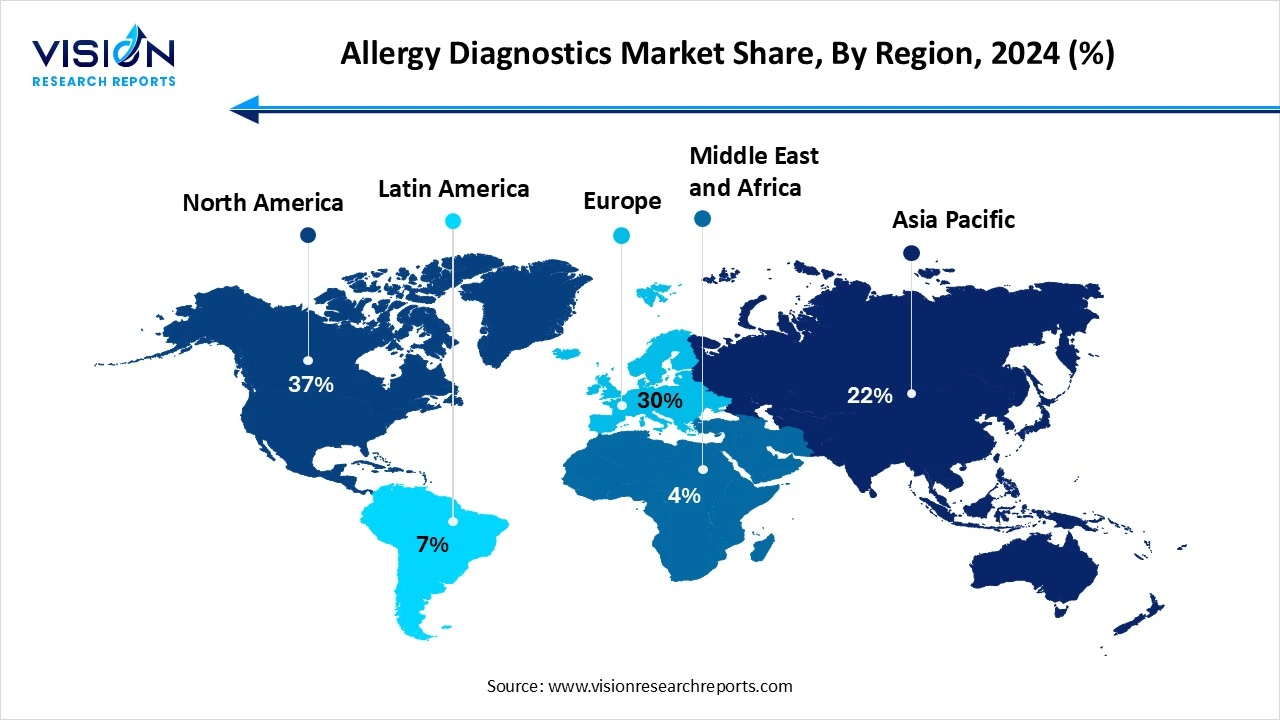

North America led the allergy diagnostics market, holding the largest share at 37% in 2024. North America has a significant portion of its population suffering from various allergies, which drives consistent demand for diagnostic services. The region's strong healthcare infrastructure, such as specialized care, technological adoption, significant investment, and favourable policies, creates a fertile ground for market growth and adoption of advanced diagnostics.

United States Allergy Diagnostics Market Trends

The increasing prevalence of allergies, rising environmental pollution, climate change extending pollen seasons, and urbanization are increasing exposure to allergens and driving the prevalence of respiratory and other allergies. Technological innovations are improving the accuracy and speed of allergy testing.

Asia Pacific expects significant growth in the allergy diagnostics market during the forecast period. The increased allergy prevalence from pollution and urbanization, along with improvements in healthcare infrastructure and access to advanced tools in countries like China and India. The market is further propelled by rising awareness of allergies and the benefits of early diagnosis, alongside technological advancements such as molecular diagnostics that improve testing accuracy

Why did the Consumable Segment Dominate the Allergy Diagnostics Market?

The consumables accounted for the highest revenue share in the allergy diagnostics market, representing 64% of the total. The global rate of allergies is rising due to factors such as environmental pollution, urbanization, and lifestyle changes. As more people seek allergy testing, the demand for diagnostic consumables increases commensurately. Consumers are more affordable than the high-cost instruments required to run tests. This affordability makes them a preferred option for many healthcare providers.

The instruments segment is the fastest-growing in the allergy diagnostics market during the forecast period. The increasing adoption of automated and advanced instruments in diagnostic workflow, especially in specialized laboratories and hospital settings, contributes to segment growth. Innovation in molecular diagnostics and genomic profiling, supported by specific instruments, is increasing the prevalence of allergies, a growing trend in precision medicine, with diagnostic instruments playing a major role in identifying and creating tailored treatments, improving patient outcomes.

How the Inhaled Allergens Segment hold the Largest Share in the Allergy Diagnostics Market?

The inhaled allergens segment held the largest revenue share in the allergy diagnostics market in 2024. The high prevalence of respiratory allergies, rising air pollution levels, industrialization, and urbanization contribute to the increasing burden of inhaled allergens globally. Pollutants can exacerbate allergic responses and contribute to the development of respiratory allergies. The highest awareness among patients and healthcare providers about the importance of early diagnosis drives the demand. With technological advancements enabling the identification of individual allergen components, clinicians are better equipped to tailor treatment plans and manage chronic respiratory allergic conditions effectively.

The food allergens segment is experiencing the fastest growth in the market during the forecast period. The increasing food allergies, particularly among children. Enhanced awareness among the general public, healthcare professionals, and regulatory bodies regarding the severity of food allergies emphasizes the importance of early and accurate diagnosis. Increased consumption of processed foods, advancement in diagnostic technology, boost in market growth.

How the In Vitro Test Segment hold the Largest Share in the Allergy Diagnostics Market?

The in vitro test segment held the largest revenue share in the allergy diagnostics market in 2024. The its safety, precision, and broad-spectrum testing capabilities. It avoids the risk of severe allergic reactions and is unaffected by patient medications or skin conditions. Ongoing technological innovations like Component-Resolved Diagnostics enhance test accuracy and support the growing demand for personalized medicine. This makes in vitro testing a preferred and rapidly growing option for accurate allergy diagnosis and management.

The in vivo test segment is experiencing the fastest growth in the market during the forecast period. The in vivo tests, primarily skin prick tests (SPT), are considered convenient and cost-effective compared to other types of tests, such as in vitro (blood) tests. Rapid and simple testing, in vivo tests effectively assess the reactivity and susceptibility of dermal mast cells, providing valuable insights into a patient's allergic sensitivity, and widespread adoption in clinical practice drives the market growth.

How the Hospitals and Clinics Segment hold the Largest Share in the Allergy Diagnostics Market?

The hospitals and clinics segment held the largest revenue share in the allergy diagnostics market in 2024. Their comprehensive services, integrated patient care, and extensive infrastructure. These facilities serve as a central point for managing the rising burden of allergies, from emergency cases to long-term management. Equipped with advanced diagnostic tools and staffed by expert healthcare professionals, they provide accurate and timely testing. High patient volume also enhances cost efficiency, solidifying their dominance in the market.

The research institution segment is experiencing the fastest growth in the market during the forecast period. Its focus is on cutting-edge innovation. By developing novel biomarkers and molecular testing, these institutions facilitate more precise, personalized medicine. Strategic collaborations with industry accelerate the translation of these discoveries into commercial products. This emphasis on translational research and advanced technology makes research institutes a primary growth driver.

By Products and Services

By Allergen

By Test Type

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Allergy Diagnostics Market

5.1. COVID-19 Landscape: Allergy Diagnostics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Allergy Diagnostics Market, By Products and Services

8.1. Allergy Diagnostics Market, by Products and Services

8.1.1. Instruments

8.1.1.1. Market Revenue and Forecast

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast

8.1.3. Services

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Allergy Diagnostics Market, By Allergen

9.1. Allergy Diagnostics Market, by Allergen

9.1.1. Food

9.1.1.1. Market Revenue and Forecast

9.1.2. Inhaled

9.1.2.1. Market Revenue and Forecast

9.1.3. Drug

9.1.3.1. Market Revenue and Forecast

9.1.4. Obstetrics

9.1.4.1. Market Revenue and Forecast

9.1.5. Other Allergens

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Allergy Diagnostics Market, By Test Type

10.1. Allergy Diagnostics Market, by Test Type

10.1.1. In Vivo Test

10.1.1.1. Market Revenue and Forecast

10.1.2. In vitro Test

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Allergy Diagnostics Market, By End Use

11.1. Allergy Diagnostics Market, by End Use

11.1.1. Hospitals & Clinics

11.1.1.1. Market Revenue and Forecast

11.1.2. Diagnostics Laboratories

11.1.2.1. Market Revenue and Forecast

11.1.3. Research Institutions

11.1.3.1. Market Revenue and Forecast

11.1.4. Others

11.1.4.1. Market Revenue and Forecast

Chapter 12. Global Allergy Diagnostics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Products and Services

12.1.2. Market Revenue and Forecast, by Allergen

12.1.3. Market Revenue and Forecast, by Test Type

12.1.4. Market Revenue and Forecast, by End Use

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Products and Services

12.1.5.2. Market Revenue and Forecast, by Allergen

12.1.5.3. Market Revenue and Forecast, by Test Type

12.1.5.4. Market Revenue and Forecast, by End Use

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Products and Services

12.1.6.2. Market Revenue and Forecast, by Allergen

12.1.6.3. Market Revenue and Forecast, by Test Type

12.1.6.4. Market Revenue and Forecast, by End Use

12.2. Europe

12.2.1. Market Revenue and Forecast, by Products and Services

12.2.2. Market Revenue and Forecast, by Allergen

12.2.3. Market Revenue and Forecast, by Test Type

12.2.4. Market Revenue and Forecast, by End Use

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Products and Services

12.2.5.2. Market Revenue and Forecast, by Allergen

12.2.5.3. Market Revenue and Forecast, by Test Type

12.2.5.4. Market Revenue and Forecast, by End Use

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Products and Services

12.2.6.2. Market Revenue and Forecast, by Allergen

12.2.6.3. Market Revenue and Forecast, by Test Type

12.2.6.4. Market Revenue and Forecast, by End Use

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Products and Services

12.2.7.2. Market Revenue and Forecast, by Allergen

12.2.7.3. Market Revenue and Forecast, by Test Type

12.2.7.4. Market Revenue and Forecast, by End Use

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Products and Services

12.2.8.2. Market Revenue and Forecast, by Allergen

12.2.8.3. Market Revenue and Forecast, by Test Type

12.2.8.4. Market Revenue and Forecast, by End Use

12.3. APAC

12.3.1. Market Revenue and Forecast, by Products and Services

12.3.2. Market Revenue and Forecast, by Allergen

12.3.3. Market Revenue and Forecast, by Test Type

12.3.4. Market Revenue and Forecast, by End Use

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Products and Services

12.3.5.2. Market Revenue and Forecast, by Allergen

12.3.5.3. Market Revenue and Forecast, by Test Type

12.3.5.4. Market Revenue and Forecast, by End Use

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Products and Services

12.3.6.2. Market Revenue and Forecast, by Allergen

12.3.6.3. Market Revenue and Forecast, by Test Type

12.3.6.4. Market Revenue and Forecast, by End Use

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Products and Services

12.3.7.2. Market Revenue and Forecast, by Allergen

12.3.7.3. Market Revenue and Forecast, by Test Type

12.3.7.4. Market Revenue and Forecast, by End Use

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Products and Services

12.3.8.2. Market Revenue and Forecast, by Allergen

12.3.8.3. Market Revenue and Forecast, by Test Type

12.3.8.4. Market Revenue and Forecast, by End Use

12.4. MEA

12.4.1. Market Revenue and Forecast, by Products and Services

12.4.2. Market Revenue and Forecast, by Allergen

12.4.3. Market Revenue and Forecast, by Test Type

12.4.4. Market Revenue and Forecast, by End Use

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Products and Services

12.4.5.2. Market Revenue and Forecast, by Allergen

12.4.5.3. Market Revenue and Forecast, by Test Type

12.4.5.4. Market Revenue and Forecast, by End Use

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Products and Services

12.4.6.2. Market Revenue and Forecast, by Allergen

12.4.6.3. Market Revenue and Forecast, by Test Type

12.4.6.4. Market Revenue and Forecast, by End Use

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Products and Services

12.4.7.2. Market Revenue and Forecast, by Allergen

12.4.7.3. Market Revenue and Forecast, by Test Type

12.4.7.4. Market Revenue and Forecast, by End Use

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Products and Services

12.4.8.2. Market Revenue and Forecast, by Allergen

12.4.8.3. Market Revenue and Forecast, by Test Type

12.4.8.4. Market Revenue and Forecast, by End Use

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Products and Services

12.5.2. Market Revenue and Forecast, by Allergen

12.5.3. Market Revenue and Forecast, by Test Type

12.5.4. Market Revenue and Forecast, by End Use

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Products and Services

12.5.5.2. Market Revenue and Forecast, by Allergen

12.5.5.3. Market Revenue and Forecast, by Test Type

12.5.5.4. Market Revenue and Forecast, by End Use

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Products and Services

12.5.6.2. Market Revenue and Forecast, by Allergen

12.5.6.3. Market Revenue and Forecast, by Test Type

12.5.6.4. Market Revenue and Forecast, by End Use

Chapter 13. Company Profiles

13.1. Thermo Fisher Scientific Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Danaher Corporation (Beckman Coulter)

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. bioMérieux SA

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Siemens Healthineers

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Stallergenes Greer

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. HYCOR Biomedical

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Omega Diagnostics Group PLC

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. R-Biopharm AG

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. ACON Laboratories Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Lincoln Diagnostics, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others