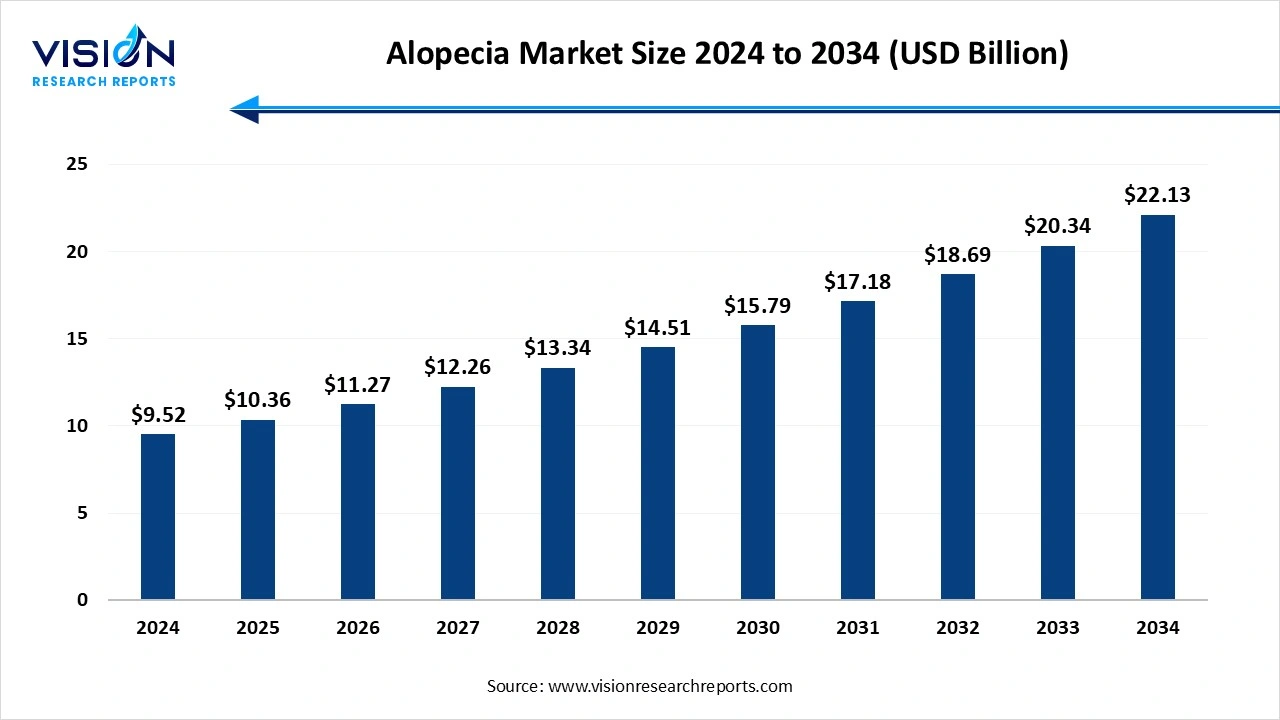

The global alopecia market size was worth USD 9.52 billion in 2024 and is expected to be worth approximately USD 10.16 billion in 2025, eventually reaching USD 22.13 billion by 2034, growing at a CAGR of 8.8% during the forecast period. The rising incidence of alopecia, changing lifestyle, and rising awareness towards alopecia treatment options.

Alopecia is defined as a term for hair loss, which can affect the scalp or other parts of the body. It can be localized or widespread, temporary or permanent, and is caused by a variety of factors, including genetics, autoimmune disorders, stress, or medical treatments. The global alopecia market growth is driven by the growing prevalence of hair loss, and awareness campaigns by organizations such as the American Hair Loss Association and the National Alopecia Areata Foundation are increasing public knowledge about hair loss and available treatments. The growing patient pool is seeking solutions for various forms of alopecia, including conditions like alopecia totalis and universalis. The innovation in treatment options and focus on aesthetic appearance drive the market growth.

The growing patient pool seeks solutions for various forms of alopecia, including conditions such as alopecia totalis and universalis. Innovation in Low-Level Laser Therapy, such as laser helmets, caps, and combs, offers non-invasive, at-home hair regrowth stimulation, driving market growth due to their convenience. The FDA has cleared devices such as the iRestore and Hairmax for the treatment of androgenetic alopecia.

| Report Coverage | Details |

| Market Size in 2024 | USD 9.52 billion |

| Revenue Forecast by 2034 | USD 22.13 billion |

| Growth rate from 2025 to 2034 | CAGR of 8.8% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

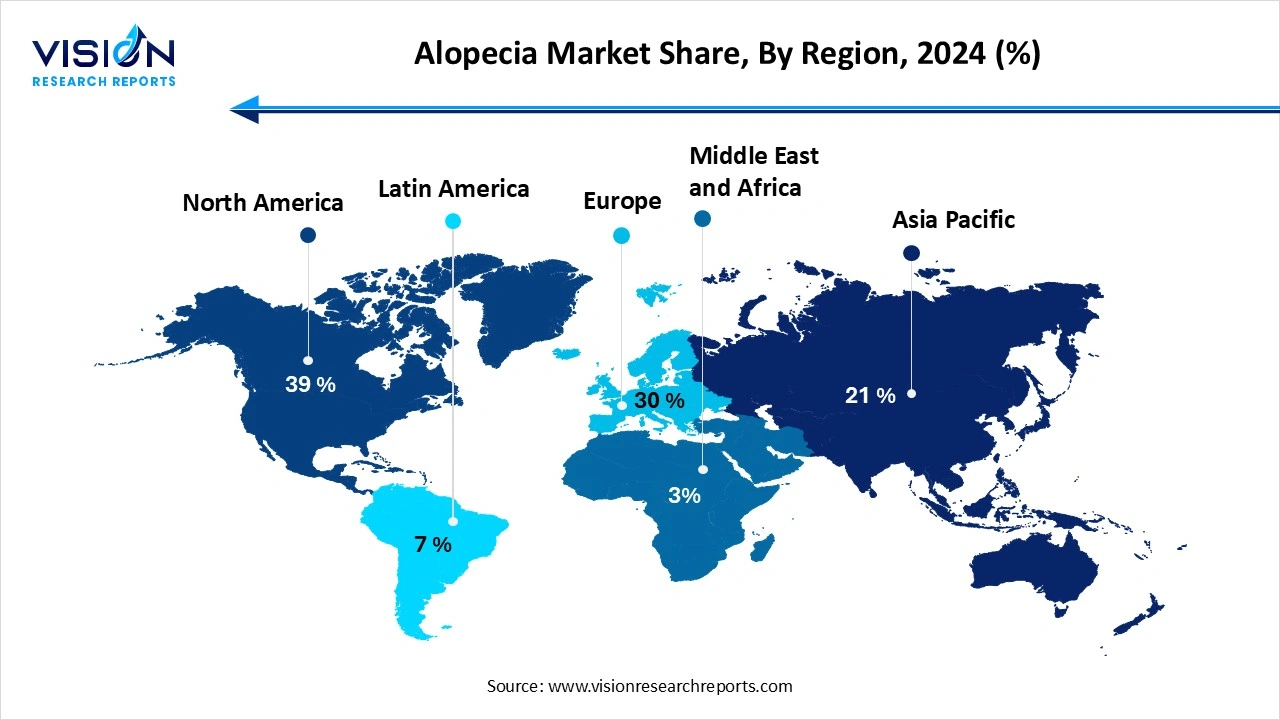

| Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Johnson & Johnson Services, Inc., Pfizer Inc., Sun Pharmaceutical Industries Ltd., Merck & Co., Inc., Dr. Reddy’s Laboratories Ltd., Cipla Inc., Lifes2Good, Histogen Inc., Follica Inc., Concert Pharmaceuticals, Inc. (acquired by Sun Pharma), Revian Inc., Hims & Hers Health, Inc., Aclaris Therapeutics, Inc., |

The innovation in treatments such as JAK inhibitors, low-level laser therapy devices, and advanced topical formulations offers promising alternatives to traditional methods. LLLT devices use red or near-infrared laser light to stimulate hair follicles, boost blood flow to the scalp, and increase cell metabolism. This non-invasive and painless approach is gaining popularity due to the rise of convenient at-home devices. Regenerative medicine is at the forefront of innovation, with research exploring new ways to regenerate or reactivate hair follicles.

Many treatments for alopecia, such as advanced therapies, certain medications, and hair transplants, can be costly. These costs can pose a financial burden for patients. For example, certain advanced treatments can range significantly in price per treatment. These expenses are often not covered by insurance, as many treatments are considered cosmetic rather than medically essential. This limited insurance coverage, combined with the high cost, can restrict access to effective care, particularly for newer treatments.

North America is projected to dominate the global alopecia market, holding the largest regional share of 39% in 2024. The large number of people suffering from these diseases has widened awareness about hair loss and its treatment options among the general population and healthcare professionals, leading to early diagnosis and increased demand for treatments. The rising disposable income to spend on healthcare treatments, such as cosmetic treatments. Robust innovation in research and development of pharmaceutical and cosmetic companies drives the market growth.

United States Alopecia Market Trends

The innovation in the drug delivery systems, regenerative medicine, and biotech advancements targeting genetic processes is expanding treatment options. Consumers' greater knowledge about existing and emerging hair loss solutions is prompting more individuals to seek treatments. Increasing demand for hair care products with natural ingredients and botanical extracts. Consumers show increasing preference for non-surgical options like PRP therapy, exosome therapy, and LLLT.

Asia Pacific expects significant growth in the Alopecia market during the forecast period. The growing disposable income in countries such as China, India, and South Korea leads to increased spending on personal care and aesthetic treatments. Consumers are more willing to invest in advanced and effective hair restoration technologies, fueling market expansion. Increased consumer awareness and focus on aesthetics, technological progress in alopecia therapy is a key driver, with innovative breakthroughs in drug formulations and delivery systems transforming treatment methods. Innovation in healthcare infrastructure and access fuels the market growth.

Why did the Alopecia Areata Segment Dominate the Alopecia Market?

The alopecia areata accounted for the largest market share, representing 35% of the total in 2024. The high global prevalence and increasing patient awareness. Significant market growth results from breakthrough therapies, especially FDA-approved oral JAK inhibitors like Litfulo and Olumiant, which offer effective targeted treatments. This combines with a strong focus on R&D for novel solutions, driving high-value drug sales within dermatology and specialized clinics. The severe psychosocial impact of AA also fuels a demand for advanced treatments, cementing its market leadership.

The alopecia universalis segment is the fastest-growing in the alopecia market during the forecast period. Its extensive nature and limited response to traditional therapies. The total loss of body and scalp hair creates significant emotional and psychological distress for patients, making the need for effective, durable treatment critically important. While conventional options have often been unsatisfactory, recent advancements in biologics and immune-modifying agents, such as Janus kinase (JAK) inhibitors, are offering renewed hope. These breakthrough therapies have shown promising results in stimulating hair regrowth and improving patients' quality of life. However, the high cost of these new treatments and limited access to specialized care in certain regions remain major barriers to widespread adoption, highlighting a persistent disparity in treatment availability.

How the Pharmaceutical Segment hold the Largest Share in the Alopecia Market?

The pharmaceutical segment accounted for the largest share of the global alopecia market, commanding 99% of the total market in 2024. The proven efficacy and accessibility of established medications like minoxidil and finasteride. Ongoing, robust R&D by major companies continually introduces new therapies, such as JAK inhibitors, expanding treatment options for more severe cases. Furthermore, many pharmacological treatments target the underlying biological causes of hair loss, building strong physician trust and patient reliance. This combination of scientific validation, ease of access, and deep research investment secures its leading market position over other treatment methods.

The devices segment is experiencing the fastest growth in the market during the forecast period. The growing preference for treatments that are painless and have fewer side effects, innovations in technology, and developments of new, more effective devices, such as AI-assisted microneedle patches, are enhancing treatment efficacy and expanding the market. Increased public awareness of alopecia and available treatment options, combined with the efforts of organizations like the National Alopecia Areata Foundation and the American Hair Loss Association, is driving demand in device segments.

How the Male Alopecia Segment hold the Largest Share in the Alopecia Market?

The male alopecia segment held the largest market share of 54%, primarily due to the widespread incidence of hair loss among men across the globe in 2024. The higher prevalence and visibility of male pattern baldness (androgenetic alopecia) is driven by genetics and hormones. The market is also propelled by men's more proactive pursuit of established treatments, such as pharmaceuticals and hair transplants. In contrast, female hair loss is often less visible and can stem from more varied causes, though the female segment is growing. This combination of higher incidence, clearer presentation, and strong treatment-seeking behavior secures the male segment's largest market share.

The female alopecia segment is experiencing the fastest growth in the market during the forecast period. The increased awareness and reduced social stigma are leading to more diagnoses and demand for treatment. This growth is further fueled by advancements in female-specific treatment options, including the development of new topical and oral therapies, along with the growing popularity of non-invasive procedures like laser therapy. Finally, socio-cultural shifts emphasizing aesthetic appearance and wellness, coupled with rising disposable incomes and the expansion of the female patient pool, are significantly boosting the segment's expansion.

How the Prescription Segment hold the Largest Share in the Alopecia Market?

The prescription segment held the largest revenue share in the alopecia market share 68% in 2024. The effective, medically supervised treatments are necessary for many types of hair loss. Patients and dermatologists have confidence in tailored prescription-strength medications, which often offer superior and targeted results compared to over-the-counter options. The market is also fueled by a strong pipeline of innovative prescription drugs and increasing public awareness, driving more people to seek a professional diagnosis.

The home care settings segment is experiencing the fastest growth in the market during the forecast period. The increased demand for convenient and accessible treatment options. This is driven by technological advancements enabling user-friendly at-home devices, such as FDA-approved low-level laser therapy devices. The preference for managing hair loss privately and comfortably at home, coupled with rising patient satisfaction, fuels this segment's rapid expansion.

How the Dermatology Clinics Segment hold the Largest Share in the Alopecia Market?

The dermatology clinics accounted for the largest market share at 57%, establishing their dominance in the segment in 2024. The expertise in diagnosing and treating hair loss, offering personalized care plans. They utilize advanced techniques like laser therapy and PRP treatments, driven by increasing awareness and demand for effective solutions. Additionally, their role in prescribing medications and addressing cosmetic concerns reinforces their leading position in the market.

The home care setting segment is experiencing the fastest growth in the market during the forecast period. The convenience, privacy, and user-friendliness of at-home treatments. This is supported by the increasing regulatory approval of home-use devices like laser caps and the rising popularity of non-invasive therapies. The trend toward self-care, along with the accessibility of products through e-commerce and telemedicine, further accelerates this shift. For patients seeking discreet and flexible options, home-based care provides a highly appealing solution.

By Disease Type

By Treatment

By Gender

By Sales Channel

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Alopecia Market

5.1. COVID-19 Landscape: Alopecia Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market TrEnd Uses and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and TrEnd Uses

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. VEnd Useor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Alopecia Market, By Disease Type

8.1. Alopecia Market, by Disease Type

8.1.1. Alopecia Areata

8.1.1.1. Market Revenue and Forecast

8.1.2. Cicatricial Alopecia

8.1.2.1. Market Revenue and Forecast

8.1.3. Traction Alopecia

8.1.3.1. Market Revenue and Forecast

8.1.4. Alopecia Totalis

8.1.4.1. Market Revenue and Forecast

8.1.5. Alopecia Universalis

8.1.5.1. Market Revenue and Forecast

8.1.6. Androgenetic Alopecia

8.1.6.1. Market Revenue and Forecast

8.1.7. Others

8.1.7.1. Market Revenue and Forecast

Chapter 9. Global Alopecia Market, By Treatment

9.1. Alopecia Market, by Treatment

9.1.1. Pharmaceuticals

9.1.1.1. Market Revenue and Forecast

9.1.2. Pharmaceuticals

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Alopecia Market, By Gender

10.1 Alopecia Market, by Gender

10.1.1. Male

10.1.1.1. Market Revenue and Forecast

10.1.2. Female

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Alopecia Market, By Sales Channel

11.1. Alopecia Market, by Sales Channel

11.1.1. Prescriptions

11.1.1.1. Market Revenue and Forecast

11.1.2 OTC

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Alopecia Market, By End Use

12.1. Alopecia Market, by End Use

12.1.1. Homecare Settings

12.1.1.1. Market Revenue and Forecast

12.1.2. Dermatology Clinics

12.1.2.1. Market Revenue and Forecast

Chapter 13. Global Alopecia Market, Regional Estimates and TrEnd Use Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Disease Type

13.1.2. Market Revenue and Forecast, by Treatment

13.1.3. Market Revenue and Forecast, by Gender Mode

13.1.4. Market Revenue and Forecast, by Sales Channel Size

13.1.5. Market Revenue and Forecast, by End Use Use

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Disease Type

13.1.6.2. Market Revenue and Forecast, by Treatment

13.1.6.3. Market Revenue and Forecast, by Gender Mode

13.1.6.4. Market Revenue and Forecast, by Sales Channel Size

13.1.7. Market Revenue and Forecast, by End Use Use

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Disease Type

13.1.8.2. Market Revenue and Forecast, by Treatment

13.1.8.3. Market Revenue and Forecast, by Gender

13.1.8.4. Market Revenue and Forecast, by Sales Channel

13.1.8.5. Market Revenue and Forecast, by End Use

13.2. Europe

13.2.1. Market Revenue and Forecast, by Disease Type

13.2.2. Market Revenue and Forecast, by Treatment

13.2.3. Market Revenue and Forecast, by Gender

13.2.4. Market Revenue and Forecast, by Sales Channel

13.2.5. Market Revenue and Forecast, by End Use

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Disease Type

13.2.6.2. Market Revenue and Forecast, by Treatment

13.2.6.3. Market Revenue and Forecast, by Gender

13.2.7. Market Revenue and Forecast, by Sales Channel

13.2.8. Market Revenue and Forecast, by End Use

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Disease Type

13.2.9.2. Market Revenue and Forecast, by Treatment

13.2.9.3. Market Revenue and Forecast, by Gender

13.2.10. Market Revenue and Forecast, by Sales Channel

13.2.11. Market Revenue and Forecast, by End Use

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Disease Type

13.2.12.2. Market Revenue and Forecast, by Treatment

13.2.12.3. Market Revenue and Forecast, by Gender

13.2.12.4. Market Revenue and Forecast, by Sales Channel

13.2.13. Market Revenue and Forecast, by End Use

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Disease Type

13.2.14.2. Market Revenue and Forecast, by Treatment

13.2.14.3. Market Revenue and Forecast, by Gender

13.2.14.4. Market Revenue and Forecast, by Sales Channel

13.2.15. Market Revenue and Forecast, by End Use

13.3. APAC

13.3.1. Market Revenue and Forecast, by Disease Type

13.3.2. Market Revenue and Forecast, by Treatment

13.3.3. Market Revenue and Forecast, by Gender

13.3.4. Market Revenue and Forecast, by Sales Channel

13.3.5. Market Revenue and Forecast, by End Use

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Disease Type

13.3.6.2. Market Revenue and Forecast, by Treatment

13.3.6.3. Market Revenue and Forecast, by Gender

13.3.6.4. Market Revenue and Forecast, by Sales Channel

13.3.7. Market Revenue and Forecast, by End Use

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Disease Type

13.3.8.2. Market Revenue and Forecast, by Treatment

13.3.8.3. Market Revenue and Forecast, by Gender

13.3.8.4. Market Revenue and Forecast, by Sales Channel

13.3.9. Market Revenue and Forecast, by End Use

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Disease Type

13.3.10.2. Market Revenue and Forecast, by Treatment

13.3.10.3. Market Revenue and Forecast, by Gender

13.3.10.4. Market Revenue and Forecast, by Sales Channel

13.3.10.5. Market Revenue and Forecast, by End Use

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Disease Type

13.3.11.2. Market Revenue and Forecast, by Treatment

13.3.11.3. Market Revenue and Forecast, by Gender

13.3.11.4. Market Revenue and Forecast, by Sales Channel

13.3.11.5. Market Revenue and Forecast, by End Use

13.4. MEA

13.4.1. Market Revenue and Forecast, by Disease Type

13.4.2. Market Revenue and Forecast, by Treatment

13.4.3. Market Revenue and Forecast, by Gender

13.4.4. Market Revenue and Forecast, by Sales Channel

13.4.5. Market Revenue and Forecast, by End Use

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Disease Type

13.4.6.2. Market Revenue and Forecast, by Treatment

13.4.6.3. Market Revenue and Forecast, by Gender

13.4.6.4. Market Revenue and Forecast, by Sales Channel

13.4.7. Market Revenue and Forecast, by End Use

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Disease Type

13.4.8.2. Market Revenue and Forecast, by Treatment

13.4.8.3. Market Revenue and Forecast, by Gender

13.4.8.4. Market Revenue and Forecast, by Sales Channel

13.4.9. Market Revenue and Forecast, by End Use

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Disease Type

13.4.10.2. Market Revenue and Forecast, by Treatment

13.4.10.3. Market Revenue and Forecast, by Gender

13.4.10.4. Market Revenue and Forecast, by Sales Channel

13.4.10.5. Market Revenue and Forecast, by End Use

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Disease Type

13.4.11.2. Market Revenue and Forecast, by Treatment

13.4.11.3. Market Revenue and Forecast, by Gender

13.4.11.4. Market Revenue and Forecast, by Sales Channel

13.4.11.5. Market Revenue and Forecast, by End Use

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Disease Type

13.5.2. Market Revenue and Forecast, by Treatment

13.5.3. Market Revenue and Forecast, by Gender

13.5.4. Market Revenue and Forecast, by Sales Channel

13.5.5. Market Revenue and Forecast, by End Use

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Disease Type

13.5.6.2. Market Revenue and Forecast, by Treatment

13.5.6.3. Market Revenue and Forecast, by Gender

13.5.6.4. Market Revenue and Forecast, by Sales Channel

13.5.7. Market Revenue and Forecast, by End Use

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Disease Type

13.5.8.2. Market Revenue and Forecast, by Treatment

13.5.8.3. Market Revenue and Forecast, by Gender

13.5.8.4. Market Revenue and Forecast, by Sales Channel

13.5.8.5. Market Revenue and Forecast, by End Use

Chapter 14. Company Profiles

14.1. Johnson & Johnson Services, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Pfizer Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Sun Pharmaceutical Industries Ltd.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Merck & Co., Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Dr. Reddy’s Laboratories Ltd.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Cipla Inc.

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Lifes2Good

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Histogen Inc.

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Follica Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Concert Pharmaceuticals, Inc. (acquired by Sun Pharma)

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. AppEnd Useix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others