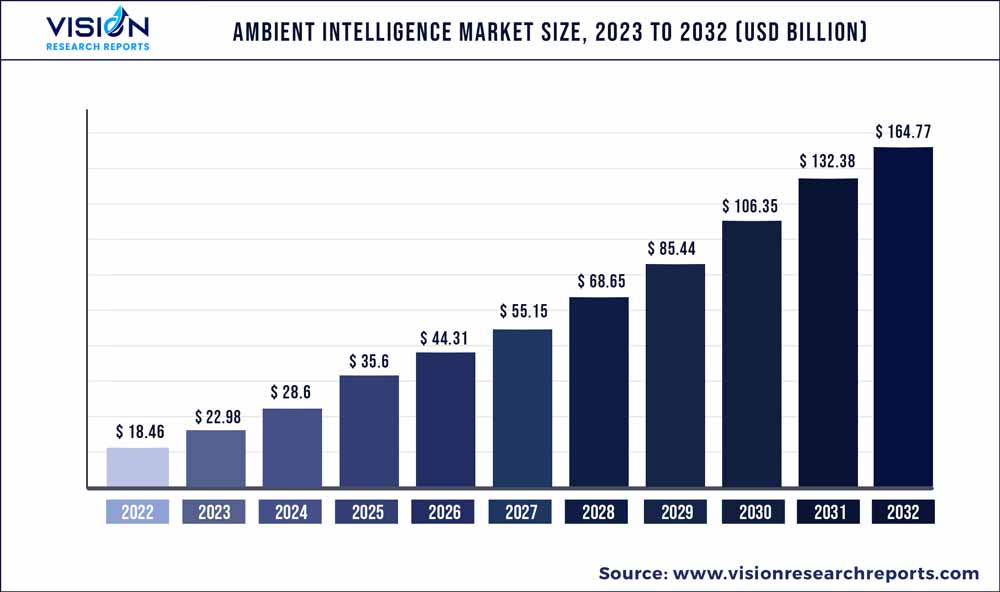

The global ambient intelligence market size was estimated at around USD 18.46 billion in 2022 and it is projected to hit around USD 164.77 billion by 2032, growing at a CAGR of 24.47% from 2023 to 2032.

Key Pointers

Report Scope of the Ambient Intelligence Market

| Report Coverage | Details |

| Market Size in 2022 | USD 18.46 billion |

| Revenue Forecast by 2032 | USD 164.77 billion |

| Growth rate from 2023 to 2032 | CAGR of 24.47% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Johnson Controls; Siemens; Honeywell International; Nuance Communications, Inc.; Infosys Limited; Zippin; Ambient; Noonum; Accel Robotics; Elos Health, Inc.; Spark Works; Eyeris Technologies, Inc.; care.ai; BioIntelliSense, Inc. |

Growing adoption of big data analytics is opening new opportunities for integrating Artificial Intelligence (AI) and Internet of Things (IoT) into ambient intelligence. The large volumes of data generated by IoT devices can be analyzed using big data analytics to provide useful insights that can be used to optimize the user experience and make the environment more responsive to the users’ needs.

The strong emphasis on energy efficiency and sustainability is also driving the use of low-power sensors and processors in IoT devices, thereby making them more energy-efficient and cost-effective in addition to facilitating their integration into AmI. Moreover, governments across the globe are investing more in ambient intelligence, while Nanotechnologies, smart technologies, and autonomous cars are being increasingly adopted, all of which contribute to the expansion of the market.

In 2021, the European Union launched the Digital Europe program, which aims to support the development and deployment of digital technologies across Europe. The program includes funding for research and development in areas such as AI, cyber security, and digital infrastructure, which are essential components of ambient intelligence.

Platform Insights

In terms of platform, the market is further segmented into solution and services. The solution segment accounted for the largest revenue share of 61.53% in 2022 and is expected to continue to dominate the market during the forecast period. The segment growth is driven by the rise in the development of smart devices to provide an improved virtual experience for the day-to-day tasks. The solution segment includes both hardware and software. The presence of specific sensors and components in the device is referred to as hardware, while software allows users to pair up and control various smart devices.

Virtual environments are developed more seamlessly owing to the system's software and hardware integration. Furthermore, smart companies are incorporating artificial intelligence into their product lines to generate an additional revenue stream. With such innovative components and unique advancements in ambient intelligence technology, users give voice instructions for controlling gadgets such as lights, audio systems, air conditioning units, and other digital equipment.

The services segment is anticipated to witness the highest growth rate of 25.51% during the forecast period. The services in the ambient intelligence industry refer to consulting, integration, maintenance, and support services. The demand for ambient intelligence services is driven by a combination of the factors, including the complexity of implementation and the need for ongoing support & maintenance.

Technology Insights

Based on the technology, the global market is sub-segmented into, Bluetooth low energy, RFID, ambient light sensor, software agents, affective computing, biometrics and others. The affective computing segment accounted for the largest revenue share of 20.34% % in 2022 and is expected to continue to dominate the market during the forecast period. With the development of more powerful processors, sensors, and machine learning algorithms, it has become increasingly possible to create systems that can accurately recognize and interpret human emotions.

This has created an opportunity for the integration of affective computing in ambient intelligence. There is growing recognition of the importance of emotional intelligence in various fields, including healthcare, education, and customer services. Affective computing can help to create more empathetic and responsive systems that can better meet the emotional needs of the users. The aim of developing more emotional and adaptable devices, which can better align the personal demands of consumers, is driving segment growth.

On the other hand, the RFID segment is expected to witness the highest CAGR rate of 29.31% during the forecast period. RFID is increasingly being used in supply chain management to track the movement of goods from production to delivery. By integrating RFID into ambient computing systems, businesses can create more efficient and responsive supply chains, thus reducing costs and improving customer satisfaction.

For instance, in October 2022, Wiliot, an Internet of Things (IoT) company, collaborated with Identiv, Inc., a manufacturer of specialty RFID tags, inlays, and labels, to produce an initial batch of 25.0 million units of its IoT pixel labels. Wiliot is pioneering the ambient IoT evolution with a vital advancement in ambient computer technologies provided by its IoT Pixels. The Pixels are stamp-sized computer labels that attach to any goods or packaging and power themselves by generating power from radio signals broadcasted by other IoT systems.

End-use Industry Insights

Based on the end-use industry, the market is segmented into IT and telecommunication, healthcare, retail, residential, manufacturing, automotive, education, and others. The healthcare segment held the largest revenue share of 20.56% in 2022 and is expected to maintain its position during the forecast period. Remote Patient Monitoring (RPM) applications, sensors, and ambient assisted living (AAL) systems are gaining popularity worldwide. Rising awareness of health systems and solutions such as electronic medical records and mobile health applications are fueling market growth. According to an MSI International survey conducted in June 2021, 70.0% of Americans prefer remote patient monitoring, and among 70.0% of Americans, nearly 40.0% of Americans refer to its incorporation into medical treatment.

On the other hand, the education segment is anticipated to witness the highest CAGR rate of 28.67% during the forecast period. The increased demand for ambient computing in education is driven by the need for more innovative and effective learning experiences that can enhance students’ academic achievements and increase access to education. Ambient computing can be used to support remote learning, allowing students to access educational content and resources from anywhere in the world.

According to a study from the University of Potomac in 2020, a high percentage of its students chose e-learning compared to traditional educational environments. This preferred approach to education is based on the advantages like lower expenses, improved efficiency, and the ability to learn on a flexible schedule using new technologies.

Regional Insights

North America dominated the market with a share of 34.11% in 2022 and is anticipated to retain its dominance during the forecast period. The presence of smart home product providers, coupled with rising awareness towards energy efficiency is driving the market demand in the region. As per International Energy Agency (IEA), investments toward electricity grids in the U.S. increased by 10.0% in 2021. Furthermore, demand for smart energy has significantly increased in the region in recent years, encouraging investors to inject funds into the energy management sector.

In January 2022, Andreessen Horowitz announced a funding of USD 52.0 million to California-based software company, Ambient.ai to introduce the first computer vision intelligence platform. After being installed on any video surveillance system, the Ambient.ai platform can instantly handle hundreds of physical security incidents and dangers. Ambient.ai uses human-in-the-loop feedback to prepare threat signatures and ensure accuracy in detection systems and automated feedback to constantly improve efficiency.

Asia Pacific is anticipated to expand at the highest CAGR of 27.59% during the forecast period. The rise in the adoption of the 5G network is expected to drive the market growth in the region. Edge deployments in Asia-Pacific are growing four times quicker than digital core implementations. According to Equinix, a digital infrastructure company, the global infrastructure edge footprint is expected to reach 40.0 gigatons by 2028, with 63.0% assisting healthcare, manufacturing, energy, commerce, and transportation.

Ambient Intelligence Market Segmentations:

By Platform

By Technology

By End-use Industry

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Platform Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Ambient Intelligence Market

5.1. COVID-19 Landscape: Ambient Intelligence Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Ambient Intelligence Market, By Platform

8.1. Ambient Intelligence Market, by Platform, 2023-2032

8.1.1 Solution

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Services

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Ambient Intelligence Market, By Technology

9.1. Ambient Intelligence Market, by Technology, 2023-2032

9.1.1. Bluetooth Low Energy

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. RFID

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Ambient Light Sensor

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Software Agents

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Affective Computing

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Biometrics

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Ambient Intelligence Market, By End-use Industry

10.1. Ambient Intelligence Market, by End-use Industry, 2023-2032

10.1.1. IT And Telecommunication

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Healthcare

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Retail

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Residential

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Manufacturing

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Automotive

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. Education

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Ambient Intelligence Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Platform (2020-2032)

11.1.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Platform (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Platform (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Platform (2020-2032)

11.2.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Platform (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Platform (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Platform (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Platform (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Platform (2020-2032)

11.3.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Platform (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Platform (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Platform (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Platform (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Platform (2020-2032)

11.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Platform (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Platform (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Platform (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Platform (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Technology (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Platform (2020-2032)

11.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Platform (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Platform (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Technology (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use Industry (2020-2032)

Chapter 12. Company Profiles

12.1. Johnson Controls

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Siemens

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Honeywell International

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Nuance Communications, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Infosys Limited

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Zippin

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Ambient

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Noonum

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Accel Robotics

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Elos Health, Inc.

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others