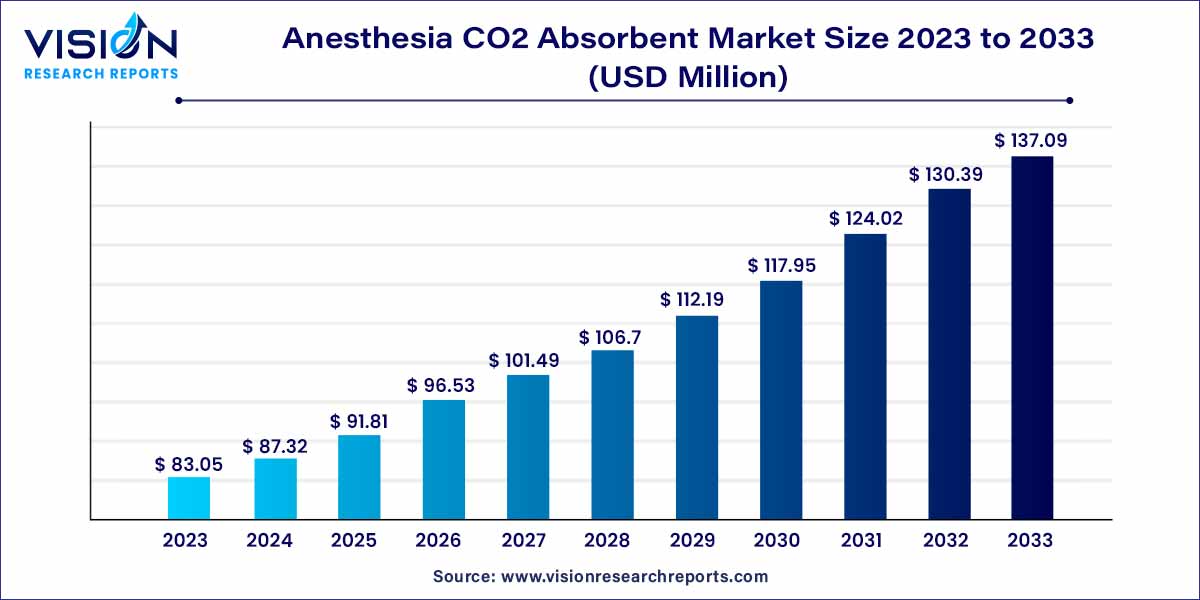

The global anesthesia CO2 absorbent market size was valued at USD 83.05 million in 2023 and it is predicted to surpass around USD 130.39 million by 2033 with a CAGR of 5.14% from 2024 to 2033.

The anesthesia CO2 absorbent market is a critical segment within the healthcare industry, essential for ensuring patient safety during surgical procedures. Anesthesia CO2 absorbents play a vital role in anesthesia machines by removing carbon dioxide (CO2) from the exhaled air of patients. This process prevents the re-breathing of CO2 during the next inhalation, ensuring the patient receives precise and safe anesthesia.

The growth of the anesthesia CO2 absorbent market is fueled by several key factors. Firstly, the increasing prevalence of surgeries and medical procedures worldwide has directly augmented the demand for anesthesia CO2 absorbents, as these procedures often require precise and efficient anesthesia delivery systems. Secondly, the rising awareness among healthcare professionals and facilities about the significance of patient safety during anesthesia administration has led to a higher adoption rate of advanced anesthesia CO2 absorbents, thereby boosting market growth. Additionally, continuous advancements in healthcare infrastructure and technology have contributed to the development of more sophisticated and reliable anesthesia CO2 absorbent products, further driving market expansion. Furthermore, the aging global population, with a higher incidence of chronic diseases requiring surgical interventions, has created a sustained demand for anesthesia CO2 absorbents. Lastly, the ongoing efforts by manufacturers to produce eco-friendly and sustainable absorbents align with the growing global focus on environmentally responsible healthcare practices, making these products more appealing to healthcare providers and contributing to market growth.

| Report Coverage | Details |

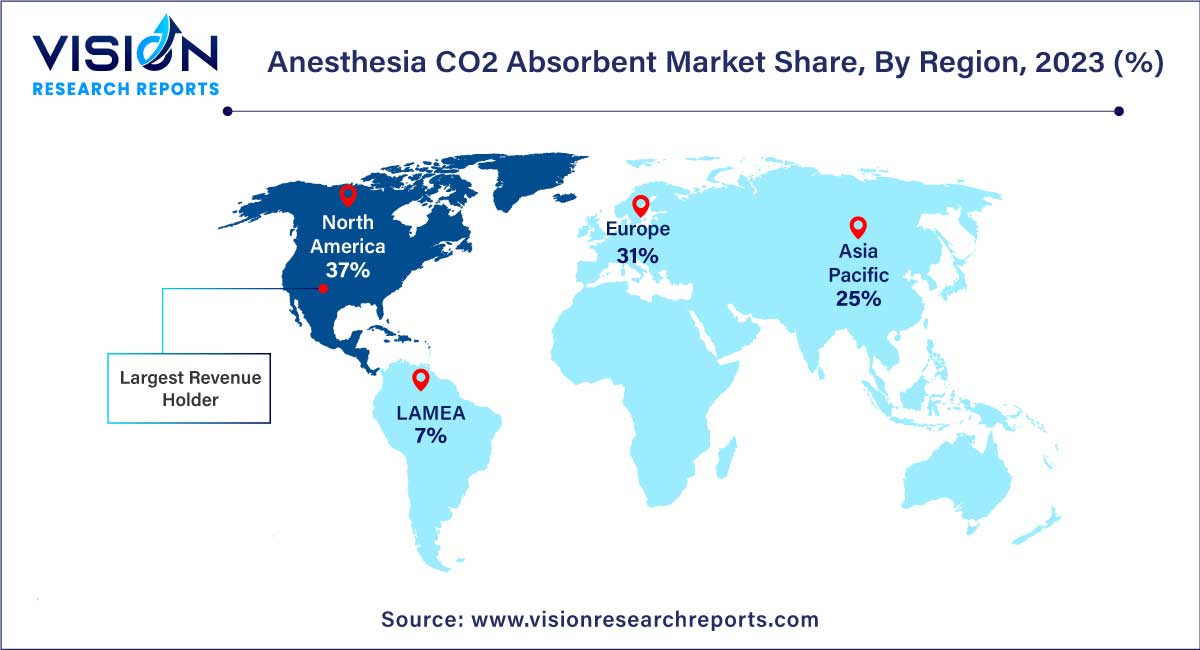

| Revenue Share of North America in 2023 | 37% |

| CAGR of Latin America from 2024 to 2033 | 6.43% |

| Revenue Forecast by 2033 | USD 130.39 million |

| Growth Rate from 2024 to 2033 | CAGR of 5.14% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The medisorb segment held the highest market share of 32% in 2023. Medisorb, known for its cutting-edge technology, provides anesthesia CO2 absorbents designed to ensure optimal patient safety during surgical procedures. Their products are characterized by high efficiency in CO2 absorption, minimizing the risks associated with elevated CO2 levels in the breathing circuit. Medisorb's dedication to research and development has resulted in advanced absorbents that meet stringent quality standards, making them a trusted choice among healthcare providers worldwide.

The amsorb CO2 absorbents segment is expected to grow at the fastest CAGR of 6.16% during the forecast period. Amsorb, on the other hand, is renowned for its commitment to environmental sustainability. Their anesthesia CO2 absorbents not only excel in performance but also adhere to eco-friendly practices. Amsorb products are designed with a focus on biodegradability and reduced environmental impact, aligning with the global shift toward greener healthcare solutions. Their innovative approach combines efficiency with environmental responsibility, appealing to healthcare facilities and professionals seeking high-quality, sustainable options for anesthesia administration.

North America dominated the market with the largest market share of 37% in 2023. In North America, the market is driven by advanced healthcare infrastructure and a high prevalence of surgical procedures. The region's focus on patient safety and technological innovations has fostered the demand for efficient anesthesia CO2 absorbents. Similarly, Europe boasts a mature market, characterized by stringent regulatory standards and a growing aging population. The emphasis on sustainable healthcare practices has encouraged the adoption of eco-friendly anesthesia CO2 absorbents, promoting market growth in the region.

Latin America is anticipated to grow at the CAGR of 6.44% during the forecast period. Latin America and the Middle East and Africa regions are experiencing growing demand for anesthesia CO2 absorbents as healthcare access improves and awareness of patient safety during anesthesia administration increases. While these regions represent emerging markets, the market players are actively expanding their presence, providing healthcare facilities with access to advanced anesthesia CO2 absorbents.

In December 2020, The EchoGlo peripheral nerve block portfolio has been launched by Smiths Medical, a major medical device producer. This addition to the Portex pain management product line provides customers with a complete regional anaesthetic solution, from the pump to the patient.

By Product

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Anesthesia CO2 Absorbent Market

5.1. COVID-19 Landscape: Anesthesia CO2 Absorbent Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Anesthesia CO2 Absorbent Market, By Product

8.1.Anesthesia CO2 Absorbent Market, by Product Type, 2024-2033

8.1.1. Soda lime

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Medisorb

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Dragersorb

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Amsorb

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Litholyme

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Anesthesia CO2 Absorbent Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

Chapter 10. Company Profiles

10.1. GE HealthCare

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Drägerwerk AG & Co. KGaA

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Armstrong Medical Ltd

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Smiths Group plc

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. BD (Becton Dickinson and Company)

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others