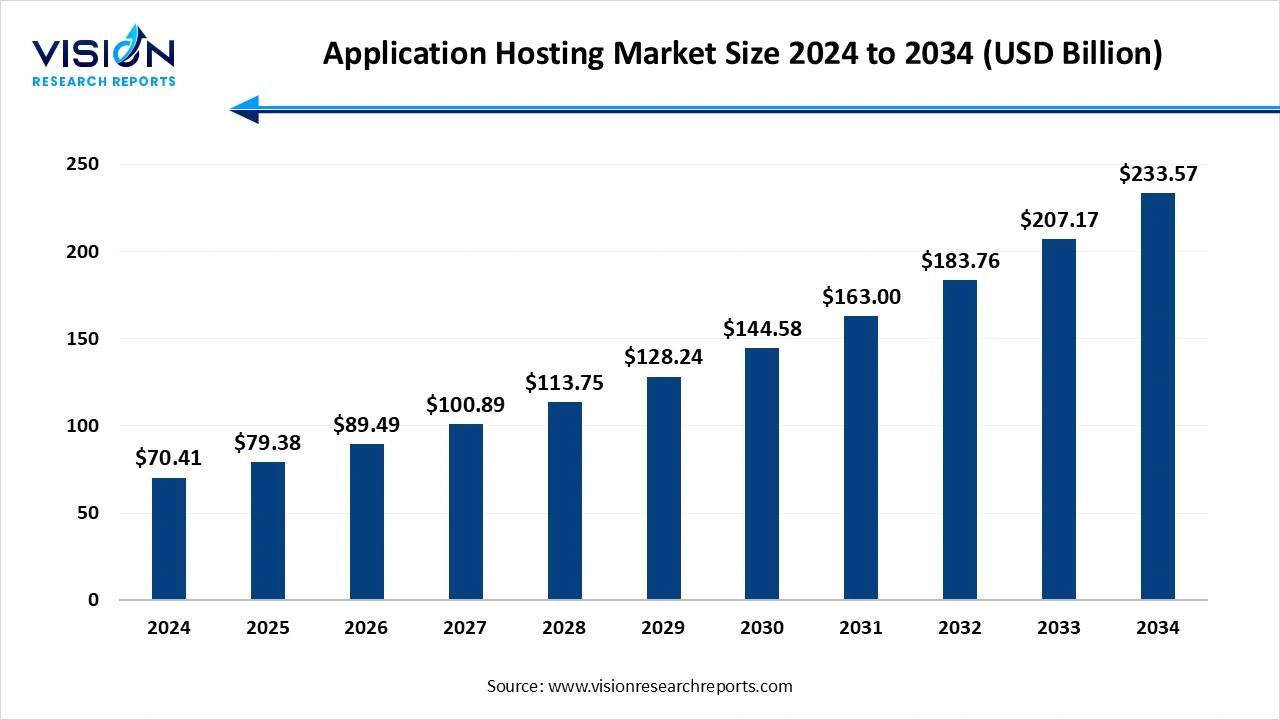

The global application hosting market size was valued at USD 70.41 billion in 2024 and is anticipated to reach around USD 233.57 billion by 2034, growing at a CAGR of 12.74% from 2025 to 2034.

The application hosting market has witnessed significant growth in recent years, driven by the increasing demand for scalable, cost-effective, and efficient IT infrastructure solutions. As businesses across industries embrace digital transformation, hosted applications offer the flexibility and agility required to support remote operations, streamline workflows, and enhance user experience. Cloud-based hosting models, particularly SaaS, PaaS, and IaaS, have emerged as dominant forces, allowing enterprises to shift from traditional on-premise systems to more dynamic, subscription-based services. Key market players are focusing on innovation, cybersecurity, and performance optimization to stay competitive, while SMEs and large organizations alike continue to adopt hosted solutions to reduce capital expenditure and improve operational efficiency.

One of the primary growth drivers of the application hosting market is the rising adoption of cloud computing technologies across businesses of all sizes. Organizations are increasingly shifting from traditional in-house IT infrastructure to hosted solutions to gain benefits such as cost efficiency, scalability, and remote accessibility. The demand for Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS), and Infrastructure-as-a-Service (IaaS) continues to rise, fueled by the need for flexible IT environments that can support rapid deployment, integration, and updates.

Another key factor propelling market growth is the heightened focus on cybersecurity, data privacy, and compliance. Application hosting providers are continuously enhancing their security protocols and infrastructure resilience to meet industry-specific regulations and growing customer concerns around data protection. The increasing adoption of artificial intelligence (AI), machine learning (ML), and automation tools within hosted environments is enabling more intelligent application management, monitoring, and optimization.

North America accounted for more than 41% of the global application hosting market share in 2024. North America holds a dominant position in the market, fueled by the presence of advanced IT infrastructure, widespread cloud adoption, and a large number of enterprises investing in digital transformation initiatives. The region’s mature technology landscape, coupled with stringent data protection regulations, has accelerated demand for secure and reliable hosting services. North America benefits from a strong base of hosting service providers offering innovative solutions such as managed hosting, hybrid cloud, and AI-driven infrastructure management.

The application hosting market in Europe is projected to expand at a compound annual growth rate (CAGR) of 13.1% between 2025 and 2034. The European market is also shaped by strict regulatory frameworks such as the General Data Protection Regulation (GDPR), which influence hosting service providers to prioritize data security and compliance. Countries such as the United Kingdom, Germany, and France are key contributors to the market’s expansion, with industries ranging from finance to manufacturing adopting hosted application solutions to enhance operational efficiency and customer engagement.

The managed hosting segment accounted for more than 52% of the market share in 2024. Among the core hosting types, managed hosting and cloud hosting are emerging as the most prominent models due to their distinct advantages and growing demand across industries. Managed hosting, in particular, appeals to organizations looking for a fully outsourced IT environment where the service provider takes care of all infrastructure, software, and security needs. This model allows businesses to focus on their core operations while benefiting from expert management, high reliability, and 24/7 support.

The cloud hosting sector is projected to expand at a compound annual growth rate (CAGR) of 12.7% over the forecast period. Businesses are increasingly adopting cloud-based hosting solutions to support dynamic workloads, reduce capital expenditure, and enable remote accessibility. Cloud hosting allows applications to be hosted on virtual servers that draw resources from extensive underlying physical networks. This not only ensures optimal performance and quick deployment but also supports high levels of customization and integration with other cloud services. As enterprises prioritize digital transformation, cloud hosting has become an essential enabler of innovation, real-time data processing, and operational agility.

The infrastructure services segment dominated the market in 2024, holding the largest share. Infrastructure services encompass a wide range of critical components, including servers, storage, networking, virtualization, and data center management. As businesses increasingly move their operations online and rely on hosted applications for essential functions, the demand for robust, scalable, and high-performance infrastructure services continues to grow. These services enable organizations to deploy, manage, and scale applications efficiently without the need to invest heavily in physical hardware or internal IT resources.

The application security segment is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period. With sensitive data and mission-critical applications being hosted externally, ensuring end-to-end protection against breaches, data loss, and unauthorized access is paramount. Hosting providers are increasingly integrating advanced security features such as firewalls, intrusion detection systems, encryption protocols, and multi-factor authentication into their service offerings.

The mobile-based segment accounted for the largest market share in 2024. As smartphones and tablets become the primary devices for accessing digital services, businesses across industries are prioritizing mobile-first strategies to engage users and streamline operations. Hosting providers are responding to this trend by offering optimized environments that support the performance, scalability, and responsiveness required by mobile apps. These hosted solutions enable developers to deploy updates seamlessly, ensure cross-platform compatibility, and manage backend infrastructure without the burden of maintaining physical servers.

The web-based segment is anticipated to record the fastest CAGR over the forecast period. Unlike traditional software installations, web-based applications are accessed through browsers, eliminating the need for complex local setups and enabling real-time collaboration across geographic boundaries. Hosting providers are increasingly tailoring their services to meet the diverse needs of web-based application deployment, from content management systems and e-commerce platforms to enterprise software and customer portals. The ability to scale resources based on traffic, ensure high uptime, and integrate with various APIs and third-party services makes hosted environments ideal for web application delivery.

Large enterprises accounted for the largest share of the market in 2024. These organizations often manage vast amounts of data and run mission-critical applications that demand high availability, disaster recovery capabilities, and compliance with stringent regulatory standards. As a result, large enterprises tend to invest in customized hosting solutions, including private cloud environments and managed hosting services, which provide enhanced control and tailored support.

The SMEs segment is anticipated to experience substantial growth at a notable CAGR throughout the forecast period. SMEs often prefer cloud-based hosting models such as SaaS and PaaS that minimize the need for in-house IT infrastructure and allow for pay-as-you-go pricing. This approach not only reduces capital expenditure but also offers scalability, enabling SMEs to adjust resources according to their business growth and fluctuating demands.

The BFSI segment captured the largest share of the market in 2024. Risk management, and customer service. As digital banking and fintech innovations grow rapidly, the demand for hosted applications that ensure data integrity, regulatory compliance, and robust cybersecurity is intensifying. Application hosting solutions enable BFSI firms to deploy scalable and flexible IT environments that support online banking platforms, mobile financial services, and automated insurance processing, all while minimizing downtime and operational costs.

The IT and telecommunications sector is projected to experience substantial growth with a notable CAGR throughout the forecast period. Telecom providers and IT service companies rely on application hosting to manage vast networks, deliver cloud-based services, and enable digital communication platforms. Hosting solutions in this sector facilitate the deployment of customer relationship management (CRM) systems, billing software, and real-time data analytics tools essential for maintaining service quality and improving customer experience.

By Hosting

By Service

By Application

By Organization Size

SMEs

Large enterprises

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Application Hosting Market

5.1. COVID-19 Landscape: Application Hosting Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Application Hosting Market, By Hosting

8.1. Application Hosting Market, by Hosting

8.1.1. Managed Hosting

8.1.1.1. Market Revenue and Forecast

8.1.2. Cloud Hosting

8.1.2.1. Market Revenue and Forecast

8.1.3. Colocation Hosting

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Application Hosting Market, By Service

9.1. Application Hosting Market, by Service

9.1.1. Application Monitoring

9.1.1.1. Market Revenue and Forecast

9.1.2. Application Programming Interface Management

9.1.2.1. Market Revenue and Forecast

9.1.3. Infrastructure Services

9.1.3.1. Market Revenue and Forecast

9.1.4. Database Administration

9.1.4.1. Market Revenue and Forecast

9.1.5. Backup and Recovery

9.1.5.1. Market Revenue and Forecast

9.1.5. Application Security

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Application Hosting Market, By Application

10.1. Application Hosting Market, by Application

10.1.1. Mobile-based

10.1.1.1. Market Revenue and Forecast

10.1.2. Web-based

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Application Hosting Market, By Organization Size

11.1. Application Hosting Market, by Organization Size

11.1.1. SMEs

11.1.1.1. Market Revenue and Forecast

11.1.2. Large enterprises

11.1.2.1. Market Revenue and Forecast

Chapter 12. Global Application Hosting Market, By End Use

12.1. Application Hosting Market, by End Use

12.1.1. Government and Public Sector

12.1.1.1. Market Revenue and Forecast

12.1.2. Consumer Goods and Retail

12.1.2.1. Market Revenue and Forecast

12.1.3. Healthcare and Life Sciences

12.1.3.1. Market Revenue and Forecast

12.1.4. Banking, Financial Services, and Insurance (BFSI)

12.1.4.1. Market Revenue and Forecast

12.1.5. IT and Telecommunications

12.1.5.1. Market Revenue and Forecast

12.1.5. Manufacturing

12.1.5.1. Market Revenue and Forecast

12.1.5. Others

12.1.5.1. Market Revenue and Forecast

Chapter 13. Global Application Hosting Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Hosting

13.1.2. Market Revenue and Forecast, by Service

13.1.3. Market Revenue and Forecast, by Application

13.1.4. Market Revenue and Forecast, by Organization Size

13.1.5. Market Revenue and Forecast, by End Use

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Hosting

13.1.6.2. Market Revenue and Forecast, by Service

13.1.6.3. Market Revenue and Forecast, by Application

13.1.6.4. Market Revenue and Forecast, by Organization Size

13.1.7. Market Revenue and Forecast, by End Use

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Hosting

13.1.8.2. Market Revenue and Forecast, by Service

13.1.8.3. Market Revenue and Forecast, by Application

13.1.8.4. Market Revenue and Forecast, by Organization Size

13.1.8.5. Market Revenue and Forecast, by End Use

13.2. Europe

13.2.1. Market Revenue and Forecast, by Hosting

13.2.2. Market Revenue and Forecast, by Service

13.2.3. Market Revenue and Forecast, by Application

13.2.4. Market Revenue and Forecast, by Organization Size

13.2.5. Market Revenue and Forecast, by End Use

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Hosting

13.2.6.2. Market Revenue and Forecast, by Service

13.2.6.3. Market Revenue and Forecast, by Application

13.2.7. Market Revenue and Forecast, by Organization Size

13.2.8. Market Revenue and Forecast, by End Use

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Hosting

13.2.9.2. Market Revenue and Forecast, by Service

13.2.9.3. Market Revenue and Forecast, by Application

13.2.10. Market Revenue and Forecast, by Organization Size

13.2.11. Market Revenue and Forecast, by End Use

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Hosting

13.2.12.2. Market Revenue and Forecast, by Service

13.2.12.3. Market Revenue and Forecast, by Application

13.2.12.4. Market Revenue and Forecast, by Organization Size

13.2.13. Market Revenue and Forecast, by End Use

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Hosting

13.2.14.2. Market Revenue and Forecast, by Service

13.2.14.3. Market Revenue and Forecast, by Application

13.2.14.4. Market Revenue and Forecast, by Organization Size

13.2.15. Market Revenue and Forecast, by End Use

13.3. APAC

13.3.1. Market Revenue and Forecast, by Hosting

13.3.2. Market Revenue and Forecast, by Service

13.3.3. Market Revenue and Forecast, by Application

13.3.4. Market Revenue and Forecast, by Organization Size

13.3.5. Market Revenue and Forecast, by End Use

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Hosting

13.3.6.2. Market Revenue and Forecast, by Service

13.3.6.3. Market Revenue and Forecast, by Application

13.3.6.4. Market Revenue and Forecast, by Organization Size

13.3.7. Market Revenue and Forecast, by End Use

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Hosting

13.3.8.2. Market Revenue and Forecast, by Service

13.3.8.3. Market Revenue and Forecast, by Application

13.3.8.4. Market Revenue and Forecast, by Organization Size

13.3.9. Market Revenue and Forecast, by End Use

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Hosting

13.3.10.2. Market Revenue and Forecast, by Service

13.3.10.3. Market Revenue and Forecast, by Application

13.3.10.4. Market Revenue and Forecast, by Organization Size

13.3.10.5. Market Revenue and Forecast, by End Use

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Hosting

13.3.11.2. Market Revenue and Forecast, by Service

13.3.11.3. Market Revenue and Forecast, by Application

13.3.11.4. Market Revenue and Forecast, by Organization Size

13.3.11.5. Market Revenue and Forecast, by End Use

13.4. MEA

13.4.1. Market Revenue and Forecast, by Hosting

13.4.2. Market Revenue and Forecast, by Service

13.4.3. Market Revenue and Forecast, by Application

13.4.4. Market Revenue and Forecast, by Organization Size

13.4.5. Market Revenue and Forecast, by End Use

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Hosting

13.4.6.2. Market Revenue and Forecast, by Service

13.4.6.3. Market Revenue and Forecast, by Application

13.4.6.4. Market Revenue and Forecast, by Organization Size

13.4.7. Market Revenue and Forecast, by End Use

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Hosting

13.4.8.2. Market Revenue and Forecast, by Service

13.4.8.3. Market Revenue and Forecast, by Application

13.4.8.4. Market Revenue and Forecast, by Organization Size

13.4.9. Market Revenue and Forecast, by End Use

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Hosting

13.4.10.2. Market Revenue and Forecast, by Service

13.4.10.3. Market Revenue and Forecast, by Application

13.4.10.4. Market Revenue and Forecast, by Organization Size

13.4.10.5. Market Revenue and Forecast, by End Use

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Hosting

13.4.11.2. Market Revenue and Forecast, by Service

13.4.11.3. Market Revenue and Forecast, by Application

13.4.11.4. Market Revenue and Forecast, by Organization Size

13.4.11.5. Market Revenue and Forecast, by End Use

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Hosting

13.5.2. Market Revenue and Forecast, by Service

13.5.3. Market Revenue and Forecast, by Application

13.5.4. Market Revenue and Forecast, by Organization Size

13.5.5. Market Revenue and Forecast, by End Use

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Hosting

13.5.6.2. Market Revenue and Forecast, by Service

13.5.6.3. Market Revenue and Forecast, by Application

13.5.6.4. Market Revenue and Forecast, by Organization Size

13.5.7. Market Revenue and Forecast, by End Use

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Hosting

13.5.8.2. Market Revenue and Forecast, by Service

13.5.8.3. Market Revenue and Forecast, by Application

13.5.8.4. Market Revenue and Forecast, by Organization Size

13.5.8.5. Market Revenue and Forecast, by End Use

Chapter 14. Company Profiles

14.1. Amazon Web Services (AWS)

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Microsoft Corporation (Azure)

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Google Cloud Platform (GCP)

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Oracle Corporation

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Rackspace Technology

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Alibaba Cloud

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. DigitalOcean

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Linode

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Salesforce

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others