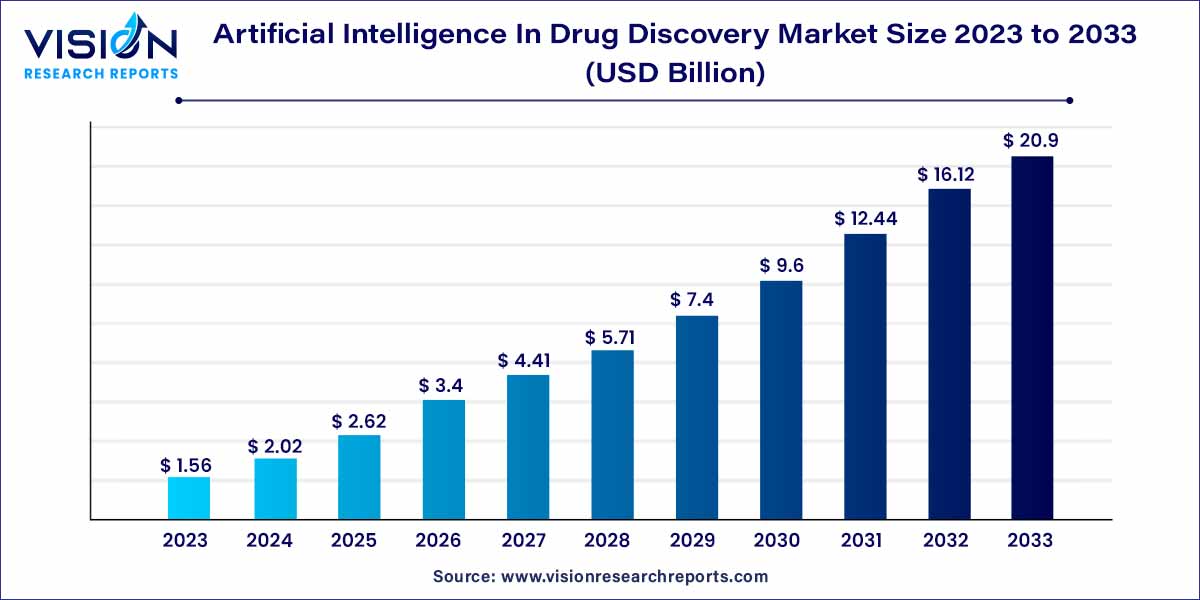

The global artificial intelligence in drug discovery market size was estimated at around USD 1.56 billion in 2023 and it is projected to hit around USD 20.9 billion by 2033, growing at a CAGR of 29.63% from 2024 to 2033.

The integration of artificial intelligence (AI) in drug discovery processes has reshaped the pharmaceutical and biotechnology industries, offering innovative solutions to complex challenges. AI technologies, including machine learning, deep learning, and data analytics, are being utilized to transform the way researchers identify, develop, and test new drugs. This overview delves into the key aspects of the artificial intelligence in drug discovery market, highlighting its growth drivers, challenges, and future prospects.

The growth of the artificial intelligence in drug discovery market is propelled by several key factors. First and foremost, the exponential increase in available biological and chemical data, coupled with advancements in computational power, empowers AI algorithms to efficiently process vast datasets, leading to the rapid identification of potential drug candidates. Additionally, the urgent need for more efficient and cost-effective drug discovery methods in the face of rising healthcare demands and chronic diseases fuels the adoption of AI technologies. Furthermore, the opportunities presented by drug repurposing, where AI analyzes existing drugs for new applications, contribute significantly to market growth. Despite challenges related to data quality and regulatory compliance, continuous advancements in AI algorithms and collaborative efforts between pharmaceutical companies and research institutions are driving innovation in the field. These factors collectively propel the expansion of the artificial intelligence in drug discovery market, promising transformative solutions and improved healthcare outcomes.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 29.63% |

| Market Revenue by 2033 | USD 20.9 billion |

| Revenue Share of North America in 2023 | 59% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The drug optimization and repurposing segment accounted for the largest revenue share of 54% in 2023. In the drug optimization and repurposing, AI algorithms analyze extensive datasets to identify existing drugs that can be repurposed for new therapeutic purposes. By mining biological and chemical databases, AI identifies compounds with the potential to target different diseases, thus saving valuable time and resources. This approach significantly expedites the drug development process, allowing researchers to focus on promising candidates and streamline clinical trials.

In preclinical testing, AI plays a pivotal role in predicting the efficacy and safety of potential drug candidates. By analyzing complex biological data, AI models can simulate drug interactions with target proteins and predict the outcomes of preclinical experiments. This predictive capability enables researchers to prioritize the most viable candidates for further testing, ensuring that only the most promising compounds advance to the next stages of development. AI-driven preclinical testing also enhances the understanding of drug mechanisms, enabling researchers to make data-driven decisions regarding dosage, formulation, and potential side effects.

The oncology sub-segment generated the maximum market share of 24% in 2023. In oncology, AI technologies have revolutionized the approach to cancer research and treatment. By analyzing vast datasets encompassing genomics, proteomics, and clinical information, AI algorithms assist in identifying specific genetic mutations and protein interactions associated with various cancer types. This precise understanding of the molecular basis of cancer enables the development of targeted therapies. It has paved the way for personalized medicine, where treatments are tailored to individual patients based on their genetic profiles. Moreover, AI contributes to the repurposing of existing drugs for novel therapeutic applications, significantly expediting drug discovery processes in the field of oncology.

The infectious diseases segment is expected to grow at the fastest CAGR during the forecast period. The infectious diseases, AI is playing a pivotal role in combating a wide range of pathogens. AI's ability to analyze and interpret diverse biological data, including pathogen genomes, host responses, and clinical information, enables the rapid identification of potential drug targets within pathogens. By understanding the genetic makeup of viruses and bacteria, researchers can design specific inhibitors and vaccines to combat infectious diseases effectively. AI-driven predictive modeling also helps anticipate how pathogens might evolve and develop resistance, allowing for the development of strategies to counteract these challenges proactively.

North America held the largest revenue share of over 59% in 2023. In North America, particularly in the United States, extensive research and development initiatives have propelled the region to the forefront of AI-driven drug discovery. The presence of leading pharmaceutical companies, research institutions, and technology firms has fostered a conducive environment for innovation. Moreover, collaborations between academia and industry players have accelerated the integration of AI technologies into drug discovery processes, leading to a robust market growth in the region.

Asia-Pacific, especially countries like China, Japan, and India, has emerged as a key player in the global AI in drug discovery market. Rapid technological advancements, a burgeoning biotechnology sector, and increasing research funding have fueled the adoption of AI-driven approaches. In China, for instance, government initiatives and investments in AI research have led to the establishment of innovative startups and research centers specializing in AI applications for drug discovery. Similarly, Japan and India have witnessed a surge in AI-based drug discovery initiatives, with a focus on addressing prevalent diseases in their respective populations.

By Application

By Therapeutic Area

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Artificial Intelligence in Drug Discovery Market

5.1. COVID-19 Landscape: Artificial Intelligence In Drug Discovery Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Artificial Intelligence in Drug Discovery Market, By Application

8.1. Artificial Intelligence In Drug Discovery Market, by Application, 2024-2033

8.1.1. Drug Optimization and Repurposing

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Preclinical Testing

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Artificial Intelligence in Drug Discovery Market, By Therapeutic Area

9.1. Artificial Intelligence In Drug Discovery Market, by Therapeutic Area, 2024-2033

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Neurodegenerative Diseases

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Cardiovascular Diseases

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Metabolic Diseases

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Infectious Diseases

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Artificial Intelligence in Drug Discovery Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Therapeutic Area (2021-2033)

Chapter 11. Company Profiles

11.1. IBM Watson

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Exscientia

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. GNS Healthcare

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Alphabet (DeepMind)

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Benevolent AI

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. BioSymetrics

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Euretos

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Berg Health

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Atomwise

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Insitro

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others