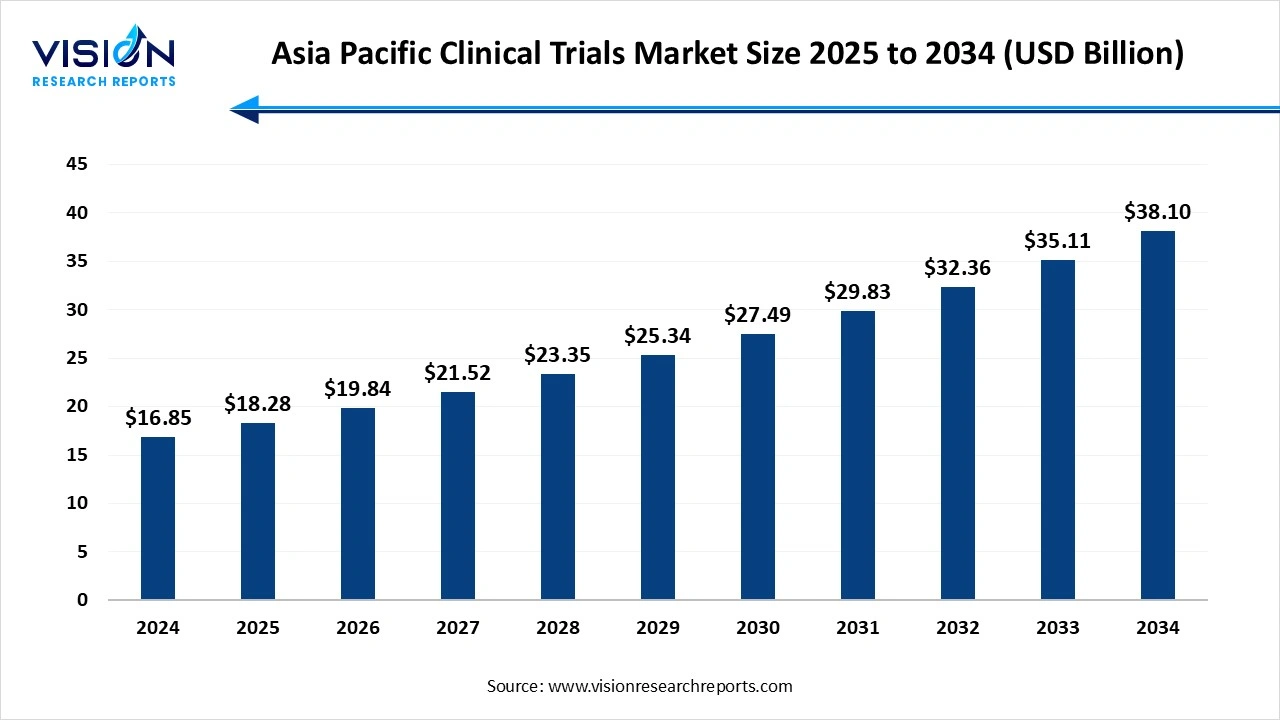

The Asia Pacific clinical trials market size was estimated at around USD 16.85 billion in 2024 and it is projected to hit around USD 38.10 billion by 2034, growing at a CAGR of 8.5% from 2025 to 2034. The market growth is driven by increasing R&D investments, favorable government initiatives, and a rising prevalence of chronic diseases, the Asia Pacific clinical trials market is witnessing substantial growth.

| Report Coverage | Details |

| Market Size in 2024 | USD 16.85 billion |

| Revenue Forecast by 2034 | USD 38.10 billion |

| Growth rate from 2025 to 2034 | CAGR of 8.5% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Companies Covered | IQVIA Inc., Parexel International Corporation, ICON plc, Syneos Health, PPD (part of Thermo Fisher Scientific) Covance Inc. (a Labcorp company), Charles River Laboratories, Pharmaceutical Product Development LLC, WuXi AppTec, Novotech, SGS SA, PRA Health, Sciences, Clinipace, GVK Biosciences, Asia CRO |

The Asia Pacific clinical trials market has witnessed substantial growth in recent years, driven by a combination of favorable regulatory reforms, cost efficiency, a large and diverse patient pool, and a growing presence of contract research organizations (CROs). Countries such as China, India, South Korea, Australia, and Japan have become major hubs for clinical research, owing to advancements in healthcare infrastructure, rising investments in R&D, and government support to streamline clinical trial processes. Moreover, the region’s high disease burden and increasing demand for novel therapeutics have made it an attractive destination for multinational pharmaceutical and biotechnology companies.

One of the primary growth factors driving the Asia Pacific clinical trials market is the region’s large, genetically diverse population, which enables faster and more comprehensive patient recruitment across various therapeutic areas. This diversity enhances the quality of clinical data and accelerates timelines, making Asia Pacific highly attractive for global pharmaceutical and biotechnology firms. Additionally, the relatively lower operational costs compared to Western markets offer significant economic advantages, especially for early-phase and large-scale trials.

Another significant driver is the rapid expansion of healthcare infrastructure and the increasing adoption of digital health technologies across the region. The rise of advanced medical institutions, well-equipped research facilities, and experienced investigators enhances the region’s capability to conduct high-quality clinical research. Furthermore, the growing incidence of chronic diseases, coupled with rising healthcare awareness and improved access to medical care, fuels the demand for innovative therapeutics and clinical studies.

Despite its promising growth, the Asia Pacific clinical trials market faces several key challenges that can impact its scalability and global competitiveness. One of the primary concerns is the regulatory heterogeneity across countries in the region. Each nation operates under different regulatory bodies with varying timelines, documentation requirements, and approval processes, which can delay trial initiation and increase administrative burdens. This lack of standardization often creates complexities for multinational sponsors attempting to conduct multi-country trials.

Another significant challenge is the shortage of adequately trained professionals and infrastructure disparities between urban and rural areas. While major metropolitan centers in countries like China, India, and South Korea have advanced clinical research facilities, many regions still lack the infrastructure necessary for high-quality trial conduct. Ensuring data integrity, maintaining Good Clinical Practice (GCP) standards, and improving patient retention in such areas remain ongoing concerns.

The phase III segment held the largest revenue share in the Asia Pacific clinical trials industry, accounting for 54% of the market in 2024. The Asia Pacific clinical trials market, Phase III trials represent a significant portion of overall research activity, as they are crucial for confirming the efficacy and monitoring the adverse reactions of new therapeutic interventions in large patient populations. These late-stage trials are essential for obtaining regulatory approvals and market authorization, and they often involve thousands of participants across multiple geographic locations. The Asia Pacific region offers a highly favorable environment for Phase III trials due to its cost advantages, robust patient recruitment capabilities, and the presence of globally accredited clinical research facilities.

The phase I segment is expected to register the highest compound annual growth rate during the forecast period. In the Asia Pacific region, there has been a notable increase in Phase I activity as drug developers seek to capitalize on the region’s cost efficiencies and regulatory agility. Countries like Australia and Singapore are emerging as leading destinations for Phase I trials due to their streamlined ethics and regulatory approval processes, high-quality medical infrastructure, and favorable research environments. These early-phase trials often involve healthy volunteers or small patient cohorts and are critical in determining optimal dosing parameters before advancing to later stages.

The based on the study design segment, interventional trials accounted for the largest market share in 2024. These trials involve the active assignment of participants to specific interventions, such as new drugs, surgical procedures, or medical devices, in order to assess their safety and efficacy. The region has become a favored destination for interventional studies due to its cost-effective infrastructure, rapid patient recruitment capabilities, and supportive regulatory environments in countries like China, India, and South Korea. Pharmaceutical and biotechnology companies increasingly rely on interventional trials in Asia Pacific to expedite the drug development process, particularly in therapeutic areas such as oncology, cardiology, and infectious diseases.

The observational trials segment is projected to experience the fastest compound annual growth rate over the forecast period. These studies do not involve the administration of experimental treatments; instead, they observe participants in a naturalistic setting without altering their routine medical care. The expansion of electronic health records, patient registries, and mobile health technologies has significantly enhanced the feasibility of conducting large-scale observational studies across diverse populations. Government health agencies and academic institutions in the region are increasingly sponsoring observational research to inform public health strategies and healthcare policy development.

Based on the indication segment, the oncology segment accounted for the largest share of the market in 2024. This rise is largely attributed to the increasing prevalence of chronic autoimmune conditions such as rheumatoid arthritis, psoriasis, inflammatory bowel disease (IBD), and systemic lupus erythematosus across the region. With a growing aging population, lifestyle changes, and heightened awareness about immune-related disorders, demand for novel therapies and targeted treatment options has escalated.

The autoimmune/inflammation segment is expected to record the second highest compound annual growth rate during the forecast period. Countries like Japan, South Korea, and China are actively investing in immunology research, while the availability of treatment-naïve patient populations and cost advantages continues to draw international sponsors. Additionally, partnerships between global biopharma companies and regional Contract Research Organizations (CROs) are streamlining trial operations, accelerating development timelines for therapies targeting autoimmune and inflammatory diseases.

The based on the service segment, the laboratory services segment captured the largest market share in 2024. These services encompass a broad range of activities, including biomarker analysis, pharmacokinetics and pharmacodynamics testing, genetic and molecular profiling, and safety parameter assessments. As clinical trials become increasingly complex and data-driven, the demand for advanced laboratory services has grown substantially across the region. Countries like India, China, and Singapore have developed strong laboratory networks with state-of-the-art facilities and adherence to international quality standards, making them attractive destinations for clinical sample analysis.

The patient recruitment segment is projected to witness the fastest compound annual growth rate over the forecast period. In the Asia Pacific region, patient recruitment services are gaining importance due to the large and ethnically diverse population, which provides access to a wide range of disease profiles and treatment-naïve subjects. Effective patient recruitment strategies, including digital outreach, community engagement, and the use of electronic health records, are helping sponsors overcome one of the most persistent challenges in clinical research. However, variability in patient awareness, cultural attitudes towards trials, and healthcare accessibility can create barriers, making professional recruitment services essential. Specialized agencies and CROs operating in the region are leveraging local expertise, multilingual support, and data-driven targeting techniques to identify and enroll eligible participants efficiently.

The sponsor segment, pharmaceutical and biopharmaceutical companies accounted for the largest market share in 2024. These sponsors are increasingly turning to the region to conduct early- and late-phase trials due to its large patient populations, lower operational costs, and high-quality infrastructure available in countries such as China, India, South Korea, and Australia. The strategic advantages offered by the region, including expedited regulatory pathways, strong presence of experienced investigators, and established networks of clinical research organizations (CROs), have made it an attractive hub for global sponsors.

The medical device companies segment is expected to register the second highest compound annual growth rate during the forecast period. The region’s aging population, expanding healthcare infrastructure, and growing awareness of advanced medical technologies have created a fertile environment for device trials. These companies are investing in clinical studies to demonstrate safety, efficacy, and usability of new devices under real-world conditions. Regulatory agencies in countries like Japan and Australia have implemented frameworks that support timely approvals and post-market surveillance, encouraging device manufacturers to initiate more studies locally.

By Phase

By Study Design

By Indication

By Indication by Study Design

By Service

By Sponsor

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others