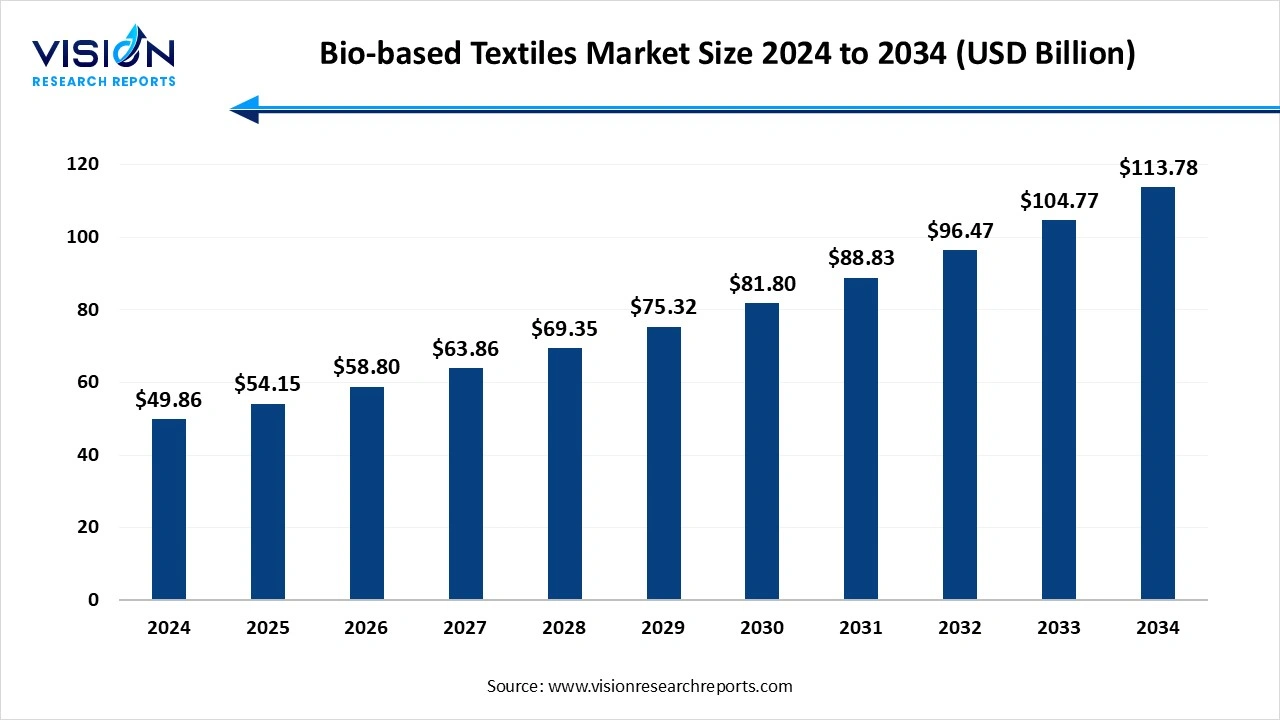

The global bio-based textiles market size was reached at around USD 49.86 billion in 2024 and it is projected to hit around USD 113.78

billion by 2034, growing at a CAGR of 8.60% from 2025 to 2034.

The bio-based textiles market is witnessing significant growth as consumers and industries increasingly prioritize sustainability and environmental responsibility. These textiles, derived from renewable natural sources such as plants, algae, and other organic materials, offer an eco-friendly alternative to conventional synthetic fabrics made from petroleum-based products. The rising awareness about the environmental impact of traditional textile production, coupled with stringent regulations on carbon emissions and waste management, has propelled the demand for bio-based textiles across various sectors including fashion, home textile, and technical textile. Innovations in fiber technology and processing methods are further enhancing the quality, durability, and affordability of bio-based fabrics, making them more attractive to manufacturers and consumers alike.

The growth of the bio-based textiles market is primarily driven by increasing consumer awareness and demand for sustainable and eco-friendly products. As environmental concerns such as pollution, resource depletion, and carbon emissions gain more attention globally, both consumers and businesses are seeking alternatives to conventional synthetic textiles that rely heavily on fossil fuels. Bio-based textiles, made from renewable natural fibers like organic cotton, hemp, bamboo, and cellulose-based fibers, offer a greener solution that reduces the environmental footprint of textile production.

Technological advancements and innovation in fiber processing and textile manufacturing also play a crucial role in accelerating the market growth. Improvements in bio-fiber extraction, blending techniques, and finishing processes have enhanced the durability, comfort, and aesthetic appeal of bio-based textiles, making them competitive with traditional materials.

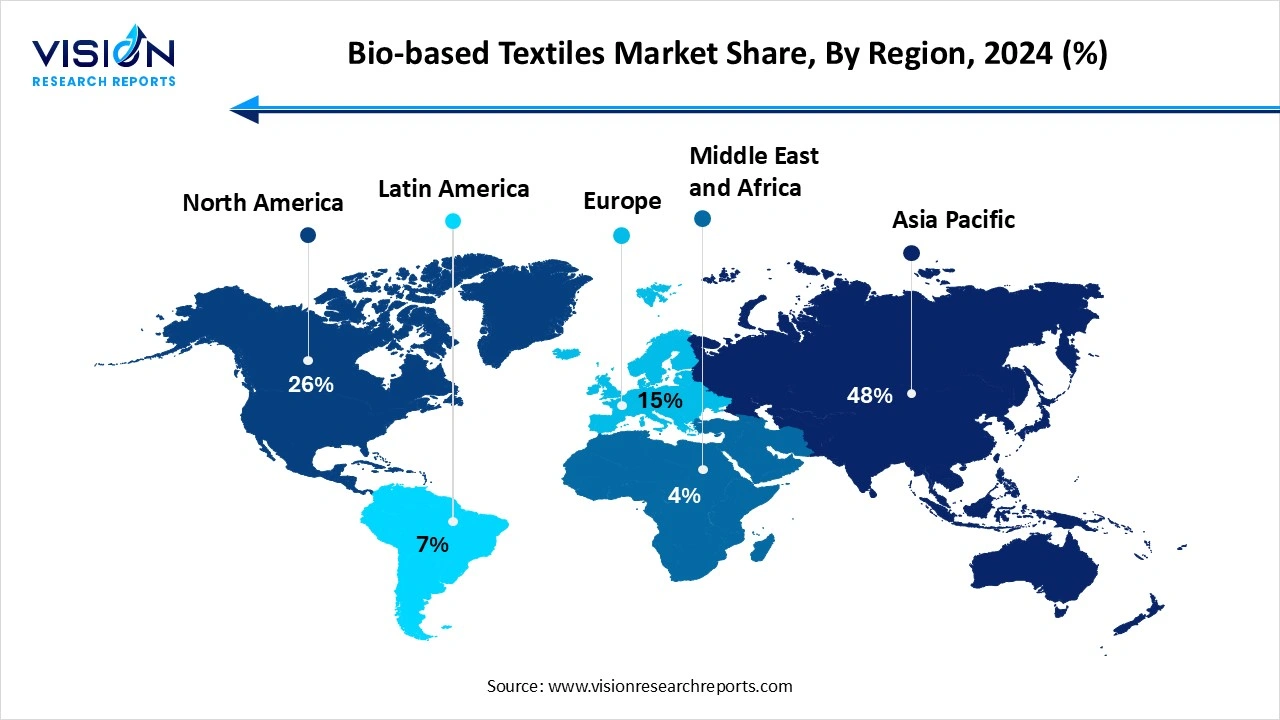

The Asia Pacific region led the bio-based textiles market, capturing the largest revenue share of 48% in 2024. This dominance is fueled by its extensive textile manufacturing infrastructure, rich agricultural resources, and a rising emphasis on sustainability. Key countries such as India, China, and Japan are spearheading bio-based textile production, bolstered by supportive government policies and increasing demand from environmentally conscious consumers. The region's advantage lies in its affordable labor and readily available raw materials, which facilitate the large-scale production of plant-based fibers like organic cotton and bamboo. Moreover, a wave of innovation and collaboration between startups and established manufacturers is driving further growth, reinforcing Asia Pacific’s position as a global leader in the bio-based textiles market.

Europe’s bio-based textiles market is robust and environmentally forward-thinking, driven by strict regulations and strong consumer commitment to sustainable living. Initiatives like the EU Green Deal and Circular Economy Action Plan are compelling textile producers to embrace bio-based materials and minimize their environmental footprint. Renowned for quality and sustainability, European fashion brands are swiftly shifting toward organic and biodegradable fabrics. The region also leads in circular fashion efforts, promoting reuse, recycling, and responsible sourcing.

Europe’s bio-based textiles market is robust and environmentally forward-thinking, driven by strict regulations and strong consumer commitment to sustainable living. Initiatives like the EU Green Deal and Circular Economy Action Plan are compelling textile producers to embrace bio-based materials and minimize their environmental footprint. Renowned for quality and sustainability, European fashion brands are swiftly shifting toward organic and biodegradable fabrics. The region also leads in circular fashion efforts, promoting reuse, recycling, and responsible sourcing.

The plant-based segment dominated the market in 2024, capturing the largest revenue share of 64% in 2024. Plant-based textiles constitute the largest segment and include fibers derived from natural sources such as cotton, hemp, flax, bamboo, and other cellulose-rich plants. These materials are valued for their biodegradability, renewability, and lower environmental footprint compared to synthetic fibers. The cultivation and processing of these plants into fibers have seen technological advancements that enhance fiber quality and performance, making plant-based textiles increasingly competitive in both apparel and home furnishing applications.

The microbial/bioengineered textiles segment is projected to register the highest CAGR over the forecast period. These textiles are produced using microorganisms such as bacteria, fungi, and algae, or through bioengineering techniques that manipulate biological systems to create fibers with unique properties. Examples include bacterial cellulose, mycelium-based materials, and biofabricated spider silk. These textiles offer potential benefits such as customizable strength, flexibility, and biodegradability, which open new possibilities for sustainable textile production.

The apparel segment accounted for the highest revenue share of 52% in the market in 2024. The global bio-based textiles market finds significant application in the apparel sector, where sustainability and eco-conscious consumer preferences are driving the adoption of natural and bio-derived fibers. Apparel manufacturers are increasingly incorporating bio-based textiles such as organic cotton, bamboo, hemp, and innovative bioengineered fibers into their collections to meet growing demand for environmentally friendly clothing. These textiles offer advantages including biodegradability, breathability, and comfort, making them ideal for a wide range of garments from casual wear to high-performance activewear.

The home textiles segment is projected to register the highest CAGR over the forecast period. Products such as curtains, upholstery, bed linens, towels, and rugs increasingly utilize bio-based fibers due to their natural origin, softness, and hypoallergenic properties. Consumers are gravitating towards sustainable home textile options that combine comfort with reduced environmental impact. The demand for durable yet eco-friendly materials in interior design and furnishings has encouraged manufacturers to innovate with bio-based textiles that meet both aesthetic and functional requirements.

By Source Material

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bio-based Textiles Market

5.1. COVID-19 Landscape: Bio-based Textiles Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Bio-based Textiles Market, By Source Material

8.1. Bio-based Textiles Market, by Source Material

8.1.1. Plant-Based

8.1.1.1. Market Revenue and Forecast

8.1.2. Animal-Based

8.1.2.1. Market Revenue and Forecast

8.1.3. Microbial/Bioengineered

8.1.3.1. Market Revenue and Forecast

8.1.4. Others

8.1.4.1. Market Revenue and Forecast

Chapter 9. Bio-based Textiles Market, By Application

9.1. Bio-based Textiles Market, by Application

9.1.1. Apparel

9.1.1.1. Market Revenue and Forecast

9.1.2. Home Textiles

9.1.2.1. Market Revenue and Forecast

9.1.3. Industrial Textiles

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Bio-based Textiles Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Source Material

10.1.2. Market Revenue and Forecast, by Application

Chapter 11. Company Profiles

11.1. Lenzing AG

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. DuPont de Nemours, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Fulgar S.p.A.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. GreenYarn Textile Solutions Pvt. Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. NatureWorks LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ecovative Design, LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. AlgiKnit

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Hemp Fortex Group

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Toray Industries, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Spinnova Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others