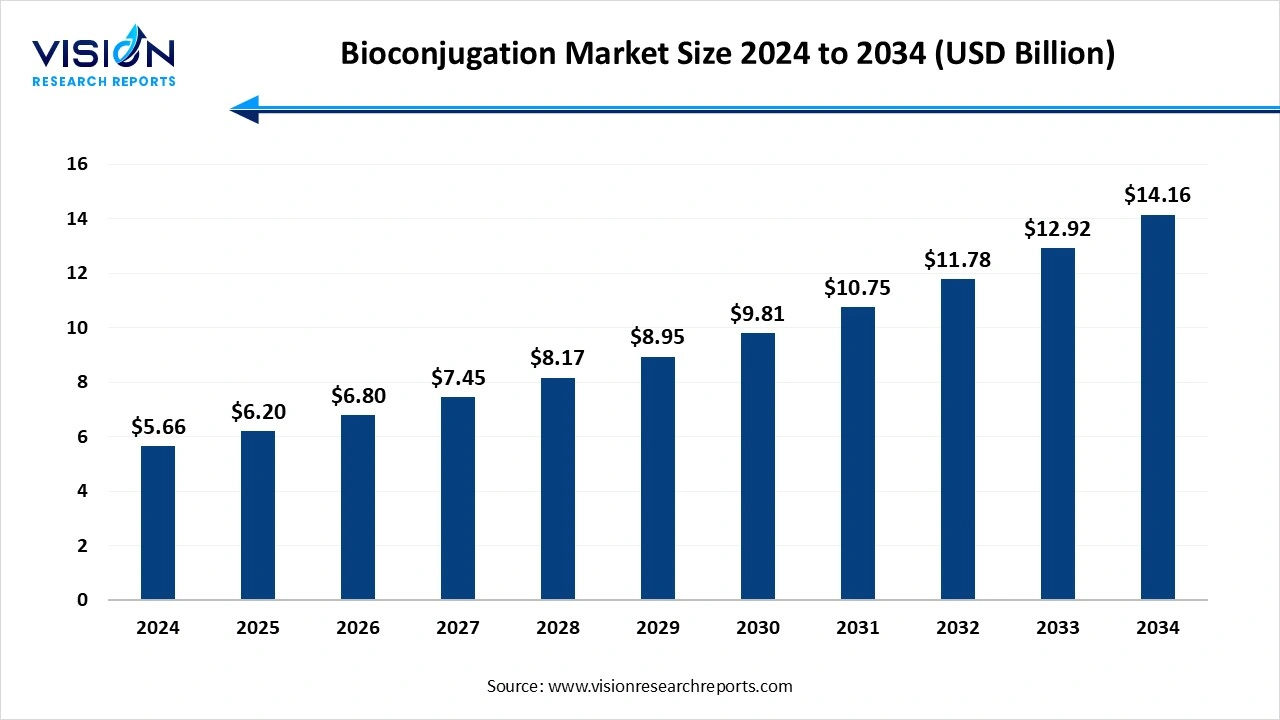

The global bioconjugation market size was surpassed at USD 5.66 billion in 2024 and is expected to hit around USD 14.16 billion by 2034, growing at a CAGR of 9.60% from 2025 to 2034.

The bioconjugation market is experiencing robust growth, driven by increasing demand for targeted therapeutics, advancements in drug delivery systems, and expanding applications in diagnostics and biotechnology research. Bioconjugation, the chemical strategy that links biomolecules such as antibodies, peptides, or nucleic acids with drugs or imaging agents, plays a crucial role in the development of antibody-drug conjugates (ADCs), biosensors, and molecular diagnostics. Growing investments in personalized medicine and the rising prevalence of chronic diseases are further fueling market expansion.

One of the primary growth drivers of the bioconjugation market is the increasing demand for precision medicine and targeted drug delivery. As the global healthcare industry shifts toward more personalized treatment approaches, the need for bioconjugation technologies has surged. These techniques enable the precise attachment of therapeutic agents to biological molecules, improving the efficacy and reducing the side effects of treatments, particularly in oncology. The rise in antibody-drug conjugates (ADCs) and the success of several FDA-approved bioconjugated drugs have further validated the commercial and clinical potential of this technology, attracting significant investment from pharmaceutical and biotechnology companies.

Another key factor fueling market growth is the rapid advancement in bioconjugation chemistries and labeling techniques. Innovations such as click chemistry, enzyme-mediated conjugation, and site-specific bioconjugation have improved the stability, efficiency, and reproducibility of these processes. Additionally, the growing use of bioconjugates in diagnostics, such as biosensors and imaging agents, is expanding their application beyond therapeutics.

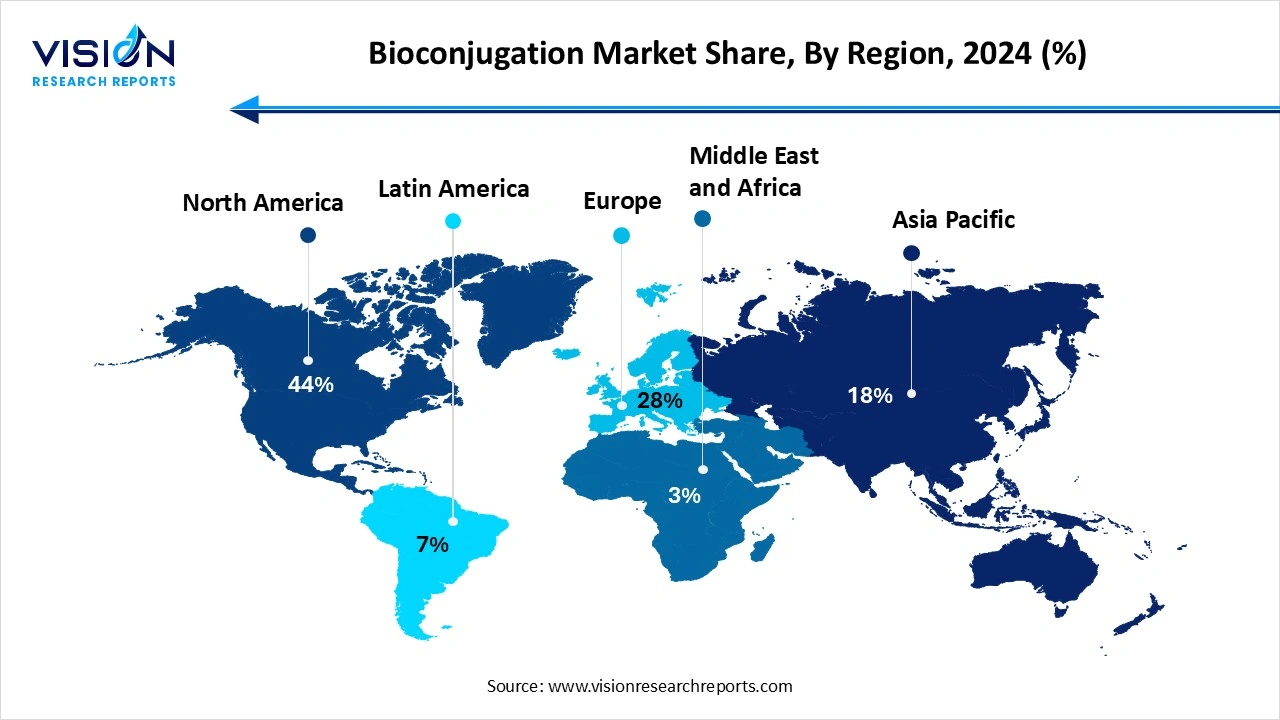

North America led the bioconjugation market, capturing the largest revenue share of 44% in 2024. This dominance was fueled by substantial investments in research and development, a mature biopharmaceutical industry, and growing demand for bioconjugation services. The region's stronghold is further reinforced by the presence of leading pharmaceutical and biotech companies that are at the forefront of innovations in antibody-drug conjugates (ADCs), gene therapies, and precision medicine. Supportive regulatory policies and robust government funding have also played a pivotal role in driving market growth.

The bioconjugation market in the Asia Pacific region is projected to experience the fastest growth, with a CAGR of 11.53% from 2025 to 2034. This expansion is propelled by increased healthcare investments, the growth of biotechnology and pharmaceutical industries, and rising demand for targeted therapies. Enhanced R&D efforts, government support, and the emergence of new biopharma companies are driving advancements in antibody-drug conjugates (ADCs) and precision medicine. Furthermore, the region’s growing manufacturing capabilities and wider adoption of bioconjugation technologies in drug development and diagnostics are further boosting market growth.

The bioconjugation market in the Asia Pacific region is projected to experience the fastest growth, with a CAGR of 11.53% from 2025 to 2034. This expansion is propelled by increased healthcare investments, the growth of biotechnology and pharmaceutical industries, and rising demand for targeted therapies. Enhanced R&D efforts, government support, and the emergence of new biopharma companies are driving advancements in antibody-drug conjugates (ADCs) and precision medicine. Furthermore, the region’s growing manufacturing capabilities and wider adoption of bioconjugation technologies in drug development and diagnostics are further boosting market growth.

The consumables segment held the largest share of market revenue in 2024, accounting for 46%. The Global Bioconjugation Market for products and services, particularly in the segment of consumables and services, is experiencing notable growth due to the increasing demand for advanced biotechnological applications across pharmaceuticals, diagnostics, and research laboratories. Consumables within this market encompass a wide range of reagents, kits, linkers, crosslinkers, and other chemical compounds that facilitate the conjugation of biomolecules such as antibodies, proteins, peptides, and nucleic acids. These consumables are critical in enabling high-efficiency labeling, detection, and modification processes, which are essential in therapeutic and diagnostic applications.

The services segment is projected to experience the highest compound annual growth rate (CAGR) of 11.74% between 2025 and 2034. These services are often offered by specialized contract research organizations (CROs) and biotechnology firms that provide customized conjugation solutions tailored to client-specific research or clinical needs. These include antibody-drug conjugate (ADC) development, oligonucleotide conjugation, and protein labeling, among others. As pharmaceutical companies increasingly outsource complex bioconjugation tasks to service providers to optimize timelines and cost-efficiency, the service segment is poised for substantial expansion.

By biomolecule type, the antibodies segment held the largest share of market revenue in 2024. The global bioconjugation market, particularly in the context of biomolecules such as antibodies and oligonucleotides, is experiencing significant growth due to advancements in biopharmaceutical research and an increasing demand for targeted therapies. Bioconjugation involving antibodies plays a crucial role in the development of antibody-drug conjugates (ADCs), which combine the specificity of monoclonal antibodies with the potent cytotoxic effects of small-molecule drugs. This fusion enhances the therapeutic index of drugs used in oncology and other chronic diseases by targeting diseased cells while sparing healthy tissues.

The oligonucleotides segment is projected to experience the highest compound annual growth rate (CAGR) from 2025 to 2034. Conjugating oligonucleotides with peptides, lipids, or other molecules enhances their stability, cellular uptake, and target specificity. This has led to the development of innovative therapeutic platforms such as antisense oligonucleotides (ASOs), small interfering RNAs (siRNAs), and aptamers, which hold promise in treating genetic and rare diseases.

By technique, the chemical conjugation segment dominated the market in 2024, capturing the largest revenue share of 43%. Chemical conjugation remains a foundational method within the field, offering a variety of strategies for covalently linking biomolecules such as proteins, peptides, nucleic acids, and small molecules. This method relies on functional group compatibility and selectivity, with commonly used chemistries including amide bond formation, maleimide-thiol coupling, and carbodiimide-mediated reactions. These reactions enable the formation of stable bioconjugates that are essential in applications like antibody-drug conjugates (ADCs), diagnostic imaging, and targeted drug delivery systems.

The click chemistry segment is anticipated to register the fastest CAGR between 2025 and 2034. Characterized by its high yield, specificity, and bioorthogonality, click chemistry enables the formation of bioconjugates under mild conditions without interfering with biological systems. The copper-catalyzed azide-alkyne cycloaddition (CuAAC) and strain-promoted azide-alkyne cycloaddition (SPAAC) are among the most widely adopted click reactions. These methodologies have been particularly beneficial in developing targeted therapeutics and advanced diagnostics due to their reliability and efficiency in complex biological environments.

By application, the therapeutics segment held the leading position in 2024, accounting for the largest revenue share of 58%. In therapeutic applications, bioconjugation plays a crucial role in the development of targeted drug delivery systems. It enables the precise attachment of therapeutic agents to specific biomolecules such as antibodies, peptides, or small molecules, enhancing the efficacy and specificity of treatments. This approach is especially valuable in oncology, where antibody-drug conjugates (ADCs) have emerged as a powerful tool to deliver cytotoxic agents directly to cancer cells while minimizing harm to healthy tissues.

The diagnostics segment is projected to achieve the fastest CAGR from 2025 to 2034 It allows for the stable linking of detection molecules, such as fluorescent dyes or radioactive isotopes, to antibodies or other targeting ligands. This capability enhances the accuracy of diagnostic tests used in clinical and research settings, enabling early disease detection and monitoring. Techniques such as enzyme-linked immunosorbent assays (ELISAs), immunohistochemistry (IHC), and molecular imaging rely heavily on bioconjugation technologies. These methods are widely used for identifying biomarkers associated with cancer, cardiovascular diseases, neurological disorders, and infectious conditions.

The pharmaceutical and biotechnology companies segment dominated the market in 2024, capturing the largest revenue share of 48%. These organizations are heavily investing in bioconjugation technologies to enhance the efficacy, specificity, and safety profiles of novel therapeutics, particularly in oncology and autoimmune diseases. Bioconjugation allows for the strategic linking of bioactive molecules to carriers such as antibodies, nanoparticles, or polymers, offering enhanced control over pharmacokinetics and biodistribution. As pharmaceutical and biotech firms strive to expand their biologics portfolios, bioconjugation has emerged as a key enabler of innovation, supporting the development of next-generation biologics and biosimilars.

Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) also represent a vital segment in the bioconjugation market, serving as strategic partners to pharmaceutical and biotech firms. These entities provide a wide range of services from early-stage research to large-scale production, enabling faster and more cost-effective development of complex biologics. The rise in outsourcing trends, driven by the need for specialized expertise and advanced infrastructure, has significantly fueled the adoption of bioconjugation techniques within CROs and CMOs. Their capabilities in process development, analytical testing, and regulatory compliance allow clients to accelerate time-to-market while ensuring quality and scalability.

By Product & Services

By Biomolecule Type

By Technique

By Application

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Bioconjugation Market

5.1. COVID-19 Landscape: Bioconjugation Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Bioconjugation Market, By Product & Services

8.1. Bioconjugation Market, by Product & Services

8.1.1. Consumables

8.1.1.1. Market Revenue and Forecast

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast

8.1.3. Service

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Bioconjugation Market, By Biomolecule Type

9.1. Bioconjugation Market, by Biomolecule Type

9.1.1. Antibodies

9.1.1.1. Market Revenue and Forecast

9.1.2. Proteins

9.1.2.1. Market Revenue and Forecast

9.1.3. Peptides

9.1.3.1. Market Revenue and Forecast

9.1.4. Oligonucleotides

9.1.4.1. Market Revenue and Forecast

9.1.5. Other Biomolecules

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global Bioconjugation Market, By Technique

10.1Bioconjugation Market, by Technique Mode

10.1.1. Chemical Conjugation

10.1.1.1. Market Revenue and Forecast

10.1.2.1. Market Click Chemistry

10.1.2.1. Market Revenue and Forecast

10.1.3. Photoreactive Crosslinking

10.1.3.1. Market Revenue and Forecast

10.1.4. Other Techniques

10.1.4.1. Market Revenue and Forecast

Chapter 11. Global Bioconjugation Market, By Application

11.1. Bioconjugation Market, by Application Size

11.1.1. Therapeutics

11.1.1.1. Market Revenue and Forecast

11.1.2. Research & Development

11.1.2.1. Market Revenue and Forecast

11.1.3. Diagnostics

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Bioconjugation Market, By End Use

12.1. Bioconjugation Market, by End Use

12.1.1. Pharmaceutical & Biotechnology Companies

12.1.1.1. Market Revenue and Forecast

12.1.2. CROs & CMOs

12.1.2.1. Market Revenue and Forecast

12.1.3. Academic & Research Institutes

12.1.3.1. Market Revenue and Forecast

12.1.4. Hospitals, Clinical & Diagnostic Laboratories

12.1.4.1. Market Revenue and Forecast

12.1.5.1. Market Revenue and Forecast

Chapter 13. Global Bioconjugation Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product & Services

13.1.2. Market Revenue and Forecast, by Biomolecule

13.1.3. Market Revenue and Forecast, by Technique Mode

13.1.4. Market Revenue and Forecast, by Application Size

13.1.5. Market Revenue and Forecast, by End Use

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product & Services

13.1.6.2. Market Revenue and Forecast, by Biomolecule

13.1.6.3. Market Revenue and Forecast, by Technique

13.1.6.4. Market Revenue and Forecast, by Application

13.1.7. Market Revenue and Forecast, by End Use

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product & Services

13.1.8.2. Market Revenue and Forecast, by Biomolecule

13.1.8.3. Market Revenue and Forecast, by Technique

13.1.8.4. Market Revenue and Forecast, by Application

13.1.8.5. Market Revenue and Forecast, by End Use

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product & Services

13.2.2. Market Revenue and Forecast, by Biomolecule

13.2.3. Market Revenue and Forecast, by Technique

13.2.4. Market Revenue and Forecast, by Application

13.2.5. Market Revenue and Forecast, by End Use

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product & Services

13.2.6.2. Market Revenue and Forecast, by Biomolecule

13.2.6.3. Market Revenue and Forecast, by Technique

13.2.7. Market Revenue and Forecast, by Application

13.2.8. Market Revenue and Forecast, by End Use

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product & Services

13.2.9.2. Market Revenue and Forecast, by Biomolecule

13.2.9.3. Market Revenue and Forecast, by Technique

13.2.10. Market Revenue and Forecast, by Application

13.2.11. Market Revenue and Forecast, by End Use

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product & Services

13.2.12.2. Market Revenue and Forecast, by Biomolecule

13.2.12.3. Market Revenue and Forecast, by Technique

13.2.12.4. Market Revenue and Forecast, by Application

13.2.13. Market Revenue and Forecast, by End Use

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product & Services

13.2.14.2. Market Revenue and Forecast, by Biomolecule

13.2.14.3. Market Revenue and Forecast, by Technique

13.2.14.4. Market Revenue and Forecast, by Application

13.2.15. Market Revenue and Forecast, by End Use

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product & Services

13.3.2. Market Revenue and Forecast, by Biomolecule

13.3.3. Market Revenue and Forecast, by Technique

13.3.4. Market Revenue and Forecast, by Application

13.3.5. Market Revenue and Forecast, by End Use

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product & Services

13.3.6.2. Market Revenue and Forecast, by Biomolecule

13.3.6.3. Market Revenue and Forecast, by Technique

13.3.6.4. Market Revenue and Forecast, by Application

13.3.7. Market Revenue and Forecast, by End Use

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product & Services

13.3.8.2. Market Revenue and Forecast, by Biomolecule

13.3.8.3. Market Revenue and Forecast, by Technique

13.3.8.4. Market Revenue and Forecast, by Application

13.3.9. Market Revenue and Forecast, by End Use

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product & Services

13.3.10.2. Market Revenue and Forecast, by Biomolecule

13.3.10.3. Market Revenue and Forecast, by Technique

13.3.10.4. Market Revenue and Forecast, by Application

13.3.10.5. Market Revenue and Forecast, by End Use

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product & Services

13.3.11.2. Market Revenue and Forecast, by Biomolecule

13.3.11.3. Market Revenue and Forecast, by Technique

13.3.11.4. Market Revenue and Forecast, by Application

13.3.11.5. Market Revenue and Forecast, by End Use

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product & Services

13.4.2. Market Revenue and Forecast, by Biomolecule

13.4.3. Market Revenue and Forecast, by Technique

13.4.4. Market Revenue and Forecast, by Application

13.4.5. Market Revenue and Forecast, by End Use

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product & Services

13.4.6.2. Market Revenue and Forecast, by Biomolecule

13.4.6.3. Market Revenue and Forecast, by Technique

13.4.6.4. Market Revenue and Forecast, by Application

13.4.7. Market Revenue and Forecast, by End Use

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product & Services

13.4.8.2. Market Revenue and Forecast, by Biomolecule

13.4.8.3. Market Revenue and Forecast, by Technique

13.4.8.4. Market Revenue and Forecast, by Application

13.4.9. Market Revenue and Forecast, by End Use

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product & Services

13.4.10.2. Market Revenue and Forecast, by Biomolecule

13.4.10.3. Market Revenue and Forecast, by Technique

13.4.10.4. Market Revenue and Forecast, by Application

13.4.10.5. Market Revenue and Forecast, by End Use

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product & Services

13.4.11.2. Market Revenue and Forecast, by Biomolecule

13.4.11.3. Market Revenue and Forecast, by Technique

13.4.11.4. Market Revenue and Forecast, by Application

13.4.11.5. Market Revenue and Forecast, by End Use

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product & Services

13.5.2. Market Revenue and Forecast, by Biomolecule

13.5.3. Market Revenue and Forecast, by Technique

13.5.4. Market Revenue and Forecast, by Application

13.5.5. Market Revenue and Forecast, by End Use

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product & Services

13.5.6.2. Market Revenue and Forecast, by Biomolecule

13.5.6.3. Market Revenue and Forecast, by Technique

13.5.6.4. Market Revenue and Forecast, by Application

13.5.7. Market Revenue and Forecast, by End Use

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product & Services

13.5.8.2. Market Revenue and Forecast, by Biomolecule

13.5.8.3. Market Revenue and Forecast, by Technique

13.5.8.4. Market Revenue and Forecast, by Application

13.5.8.5. Market Revenue and Forecast, by End Use

Chapter 14. Company Profiles

14.1. Thermo Fisher Scientific, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Merck KGaA (MilliporeSigma)

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. F. Hoffmann-La Roche Ltd.

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Seagen Inc.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Bio-Rad Laboratories, Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Abcam plc

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Genentech, Inc. (Roche Group)

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Abzena plc

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Lonza Group AG

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Sartorius AG

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others