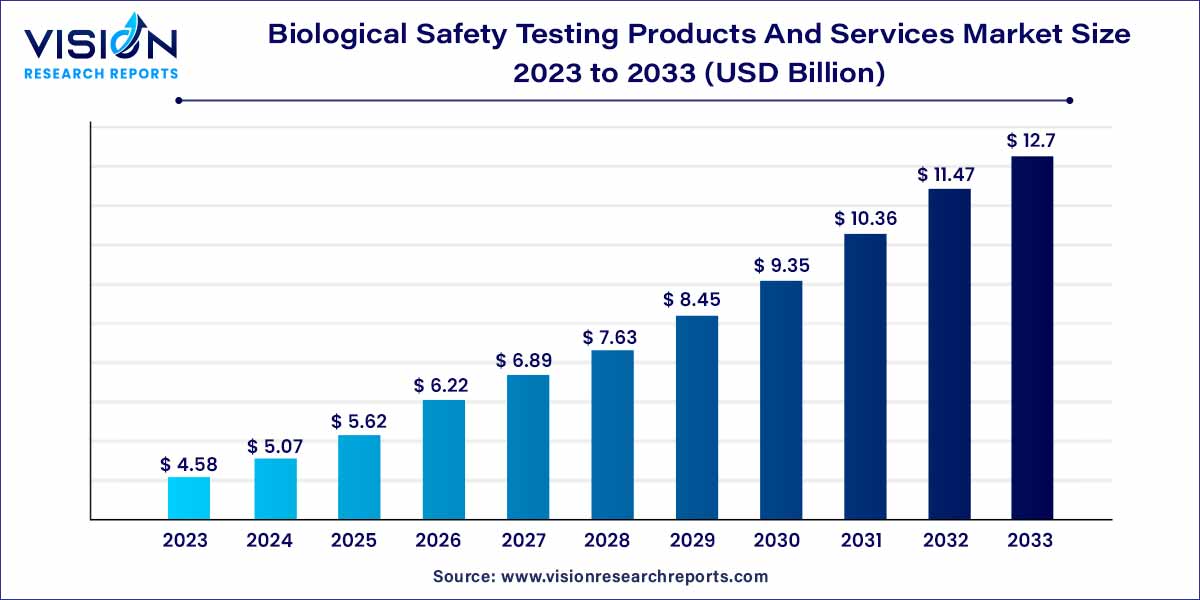

The global biological safety testing products and services market size was estimated at around USD 4.58 billion in 2023 and it is projected to hit around USD 12.7 billion by 2033, growing at a CAGR of 10.74% from 2024 to 2033. The biological safety testing products and services market plays a pivotal role in ensuring the safety, quality, and regulatory compliance of a wide array of healthcare products. This sector encompasses a diverse range of testing solutions specifically designed for pharmaceuticals, biologics, medical devices, and other related products. This overview provides a snapshot of the key components, market dynamics, and factors influencing the landscape of Biological Safety Testing.

The growth of the biological safety testing products and services market is propelled by several key factors. Firstly, the increasing stringency of regulatory frameworks, particularly from agencies such as the FDA and EMA, necessitates rigorous safety testing, driving the demand for advanced testing products and services. Secondly, advancements in testing technologies, including next-generation sequencing and cell-based assays, contribute to the market's growth by enhancing the accuracy and efficiency of safety assessments. Thirdly, the rising prevalence of infectious diseases and global health challenges accentuates the importance of reliable and efficient biological safety testing in pharmaceutical and biopharmaceutical development. Moreover, the industry's response to these challenges through research and development efforts fosters innovation, creating new opportunities for market expansion. Overall, the convergence of regulatory compliance, technological progress, and the imperative for heightened safety standards collectively underpin the growth trajectory of the biological safety testing products and services market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 10.74% |

| Market Revenue by 2033 | USD 12.7 billion |

| Revenue Share of North America in 2023 | 36% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The reagents and kits accounted for the largest market share of 41% in 2023. Reagents & Kits and Instruments. The domain of Reagents & Kits encompasses an array of essential tools designed to facilitate precise and thorough safety assessments in various healthcare product developments. These reagents and kits play a pivotal role in microbial testing, endotoxin testing, bioburden testing, and other crucial aspects of safety evaluation. Their significance lies in their ability to provide accurate results, ensuring the absence of harmful microorganisms and contaminants in pharmaceuticals, biologics, and medical devices.

The instruments segment is expected to grow at fastest growth rate during the forecast period. These instruments are designed to streamline and optimize testing methodologies, incorporating advanced technologies such as next-generation sequencing and rapid microbial detection methods. The instruments contribute to the efficiency and reliability of safety assessments, catering to the evolving needs of the pharmaceutical and biopharmaceutical industries. As the demand for sophisticated testing solutions continues to rise, the market for biological safety testing instruments remains at the forefront of technological innovation, providing essential tools for accurate and timely safety evaluations.

The vaccine and therapeutics segment held the largest share of 24% in 2023. Within this domain, the emphasis lies on ensuring the safety and efficacy of vaccines and therapeutic agents. Rigorous safety testing becomes imperative to verify the absence of microbial contaminants, endotoxins, and other potential risks in these products. As the demand for vaccines and therapeutic innovations continues to grow globally, the Biological Safety Testing Products and Services play an instrumental role in upholding the integrity of these crucial healthcare interventions.

The gene therapy segment is predicted to grow at the fastest CAGR during the forecast period. The market application extends to the burgeoning field of Gene Therapy. With advancements in genetic medicine gaining momentum, the safety assessment of gene therapy products becomes paramount. Biological Safety Testing facilitates the identification and mitigation of risks associated with gene therapy, ensuring the delivery of safe and effective treatments. The complexities inherent in gene therapy formulations necessitate specialized testing protocols, making biological safety testing a cornerstone in the development of gene-based therapeutic solutions. As the field of gene therapy expands, the market for Biological Safety Testing Products and Services assumes a pivotal role in supporting the safety and success of these groundbreaking medical advancements.

Endotoxin tests dominated the global market with the largest market share of 22% in 2023. Endotoxin testing stands as a critical pillar in ensuring the safety of pharmaceuticals, biologics, and medical devices by detecting the presence of bacterial endotoxins. These tests are indispensable in verifying that healthcare products are free from potentially harmful components, thereby upholding the stringent regulatory standards set forth by health authorities. The precision and reliability of Endotoxin Tests contribute significantly to the overall safety assurance in the development and production of a wide array of healthcare interventions.

The bioburden tests segment is expected to grow at fastest growth rate over the forecast period. Bioburden Tests play a crucial role in assessing the microbial load in raw materials and finished products. These tests provide insights into the quantity and types of microorganisms present, aiding in the identification of potential contamination risks. By establishing microbial control measures, Bioburden Tests contribute to the overall safety and quality of pharmaceuticals and medical devices. The meticulous evaluation of bioburden ensures that healthcare products meet the necessary standards, aligning with the industry's commitment to delivering safe and effective interventions to patients worldwide.

North America region dominated the market with the largest market share of 36% in 2023. In North America, a prominent market presence is driven by a robust healthcare infrastructure and stringent regulatory standards. The region, led by the United States, is a focal point for advanced technological innovations and a stronghold for industry leaders committed to delivering cutting-edge safety testing solutions.

The Asia Pacific market is anticipated to grow at a significant CAGR over the forecast period. The Asia-Pacific region emerges as a burgeoning market, driven by the rapid expansion of the pharmaceutical and biotechnology sectors. With increasing investments in healthcare infrastructure, particularly in countries like China and India, the demand for Biological Safety Testing Products and Services is on the rise. This region represents a significant growth opportunity for market players, as it becomes a focal point for research and development activities and manufacturing operations.

By Product

By Application

By Test Type

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Biological Safety Testing Products And Services Market

5.1. COVID-19 Landscape: Biological Safety Testing Products And Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Biological Safety Testing Products And Services Market, By Product

8.1. Biological Safety Testing Products And Services Market, by Product, 2024-2033

8.1.1 Reagents & Kits

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Instruments

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Services

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Biological Safety Testing Products And Services Market, By Application

9.1. Biological Safety Testing Products And Services Market, by Application, 2024-2033

9.1.1. Vaccines & Therapeutics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Vaccines

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Monoclonal Antibodies

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Recombinant Protein

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Blood & Blood-based Products

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Gene Therapy

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Tissue & Tissue-based Products

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Stem Cell

9.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Biological Safety Testing Products And Services Market, By Test Type

10.1. Biological Safety Testing Products And Services Market, by Test Type, 2024-2033

10.1.1. Endotoxin Tests

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Sterility Tests

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cell Line Authentication & Characterization Tests

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Bioburden Tests

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Adventitious Agent Detection Tests

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Residual Host Contamination Detection Tests

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.7. Others

10.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Biological Safety Testing Products And Services Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Test Type (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Test Type (2021-2033)

Chapter 12. Company Profiles

12.1. Charles River Laboratories.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. BSL Bioservice, Merck KGaA (MilliporeSigma).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Samsung Biologics.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Sartorius AG.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Eurofins Scientific.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. SGS Société Générale de Surveillance SA

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Thermo Fisher Scientific Inc..

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. BIOMÉRIEUX

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Lonza.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others