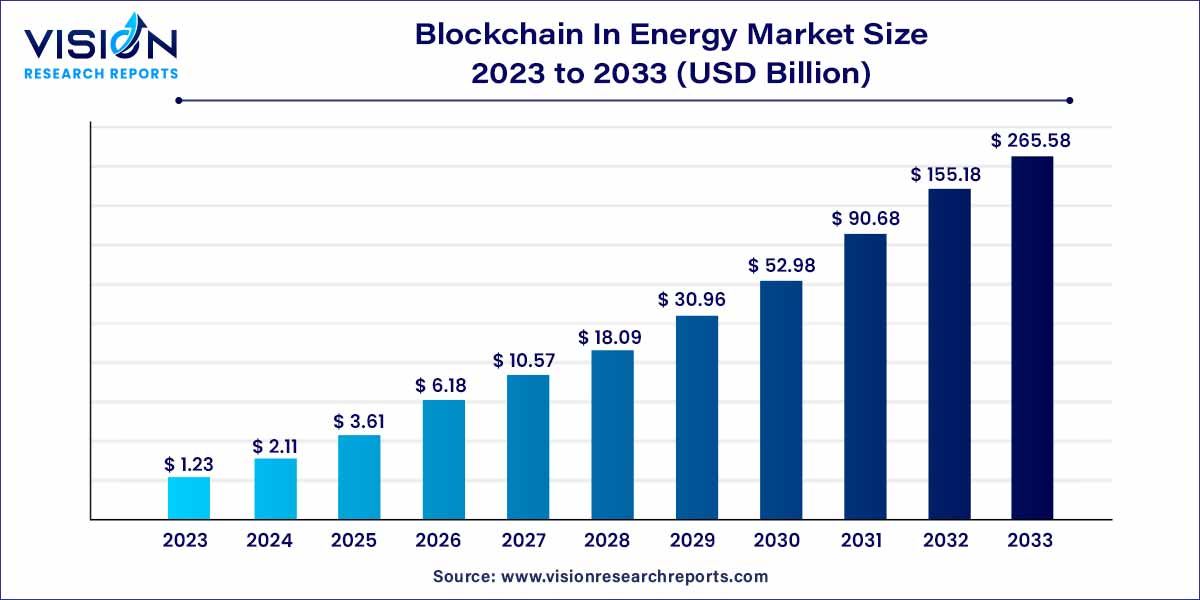

The global blockchain in energy market size was estimated at around USD 1.23 billion in 2023 and it is projected to hit around USD 265.58 billion by 2033, growing at a CAGR of 71.14% from 2024 to 2033. The blockchain in energy market is driven by an improved grid management is facilitated by blockchain, tokenization for trading opportunities, enhanced transparency and traceability, and smart contracts automation.

Blockchain technology has emerged as a transformative force within the energy sector, promising increased efficiency, transparency, and security. The traditional energy landscape faces challenges such as centralized control, data silos, and complex transaction processes. Blockchain offers a decentralized and immutable ledger, addressing these challenges and unlocking new possibilities for the industry.

The growth of the blockchain in energy market is propelled by a confluence of key factors driving transformative change within the industry. Firstly, the decentralization enabled by blockchain technology empowers a shift towards peer-to-peer transactions, reducing reliance on intermediaries and enhancing operational efficiency. The automation capabilities of smart contracts play a pivotal role, expediting processes such as energy trading and settlements while mitigating the risks of errors and disputes. Transparency and traceability, facilitated by blockchain, provide real-time access to data throughout the energy supply chain, fostering trust and accountability. Additionally, the optimization of renewable energy integration through better grid management enhances overall system flexibility and stability. Tokenization of energy assets opens up novel avenues for trading on decentralized platforms, fostering market growth. The inherent cybersecurity features of blockchain ensure data integrity, addressing critical concerns in the energy sector. Lastly, the technology's ability to facilitate regulatory compliance by offering transparent and auditable transactions further contributes to the positive trajectory of the blockchain in energy market. As stakeholders increasingly recognize these advantages, the market is poised for sustained expansion and innovation.

| Report Coverage | Details |

| Growth rate from 2024 to 2033 | CAGR of 71.14% |

| Market Size in 2023 | USD 1.23 billion |

| Revenue Forecast by 2033 | USD 265.58 billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Categorized by type, the blockchain in energy market is divided into private and public segments. In 2022, the public segment dominated the market, holding the largest share. The ascendancy of the public blockchain segment can be attributed to factors like decentralized architecture, the capability to enhance platform awareness, and greater usability. The private sector is poised for substantial expansion in the upcoming years, presenting growth prospects for the public segment throughout the forecast period.

In terms of components, the market is categorized into platforms and services, with the services segment dominating the market share in 2023. Globally, numerous businesses are emphasizing collaboration with various blockchain companies to integrate blockchain operations, including grid management, energy trading, and supply chain management. Additionally, blockchain services offer enhanced power management and efficiency to consumers. Notably, an encrypted database integrates energy consumption information seamlessly with stable and real-time updates.

In terms of application, the blockchain in energy market is segmented into sustainability attribution, electric vehicles, grid transactions, energy financing, peer-to-peer transactions, and others. The largest market share in 2023 was held by the peer-to-peer transaction segment. Blockchain technology finds efficient application in various aspects of smart grids, particularly in the realm of peer-to-peer energy trading. The notable advantages of this application include the improvement of system resiliency, reduction in transaction costs, assurance of privacy, and enhancement of system security. Consequently, these factors are anticipated to create growth opportunities for the peer-to-peer transaction segment throughout the forecast period.

Categorized by end use, the blockchain in energy market is divided into power and oil & gas, with the power segment holding the largest market share in 2023. The substantial growth in this segment is attributed to the efficient control that blockchain technology provides over distributed energy sources. Additionally, blockchain technology offers a comprehensive perspective on energy usage, allowing for the monitoring of energy consumption. This capability empowers businesses to make well-informed decisions based on the data insights derived from the blockchain technology.

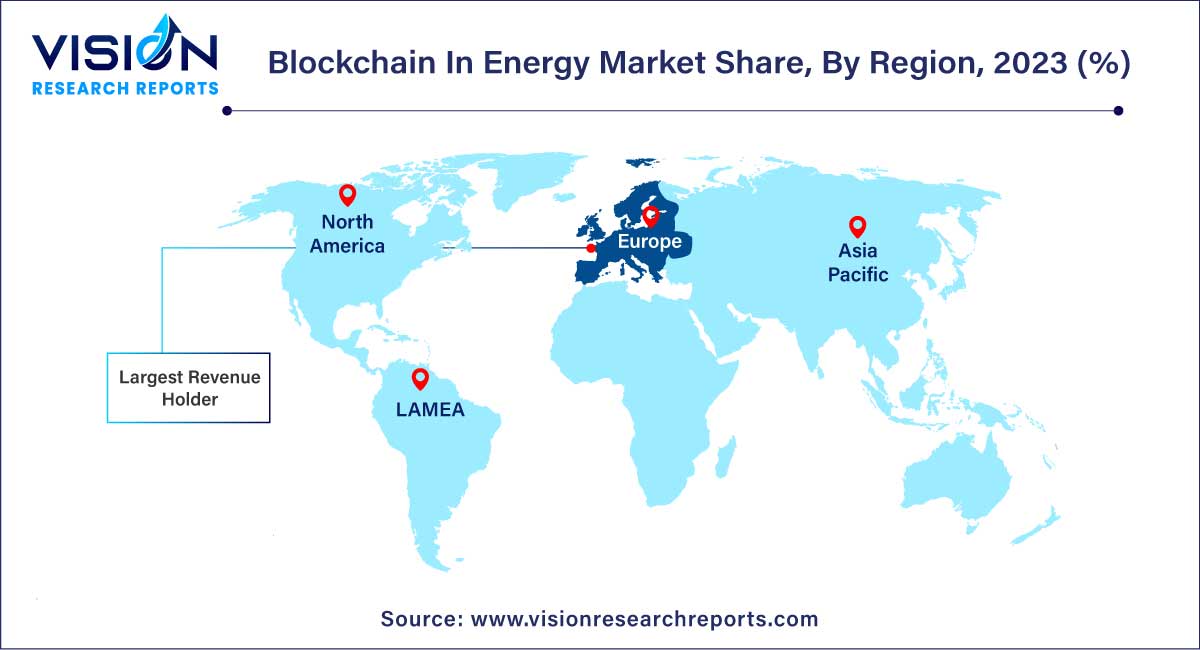

The European region emerged as the dominant force in the blockchain in energy market in 2023. The growth in the regional market is credited to the evolving emphasis on addressing the growing complexity of power supply through the adoption of smart grids. Additionally, increased investments from energy businesses and expanding funding activities are poised to bolster the industry's overall outlook.

Furthermore, government incentives promoting the adoption of renewable energy for increased product installations, coupled with favorable regulatory rules and policies facilitating technology adoption, are anticipated to propel the growth of the regional market throughout the forecast period.

By Type

By Component

By Application

By End-Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Blockchain in Energy Market

5.1. COVID-19 Landscape: Blockchain in Energy Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Blockchain in Energy Market, By Type

8.1. Blockchain in Energy Market, by Type, 2024-2033

8.1.1. Private

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Public

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Blockchain in Energy Market, By Component

9.1. Blockchain in Energy Market, by Component, 2024-2033

9.1.1. Platforms

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Services

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Blockchain in Energy Market, By Application

10.1. Blockchain in Energy Market, by Application, 2024-2033

10.1.1. Sustainability Attribution

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Electric Vehicles

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Grid Transactions

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Energy Financing

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Peer-To-Peer Transactions

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Blockchain in Energy Market, By End-Use

11.1. Blockchain in Energy Market, by End-Use, 2024-2033

11.1.1. Power

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Oil & Gas

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Blockchain in Energy Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Component (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Component (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Component (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.2. Market Revenue and Forecast, by Component (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Component (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Component (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Component (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Component (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.2. Market Revenue and Forecast, by Component (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Component (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Component (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Component (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Component (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.2. Market Revenue and Forecast, by Component (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Component (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Component (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Component (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Component (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.2. Market Revenue and Forecast, by Component (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Component (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-Use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Component (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-Use (2021-2033)

Chapter 13. Company Profiles

13.1. BigchainDB GmbH

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Deloitte Touche Tohmatsu Limited

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Microsoft Corporation

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. IBM Corporation

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Accenture plc

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Oracle Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. SAP SE

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Infosys Limited

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others