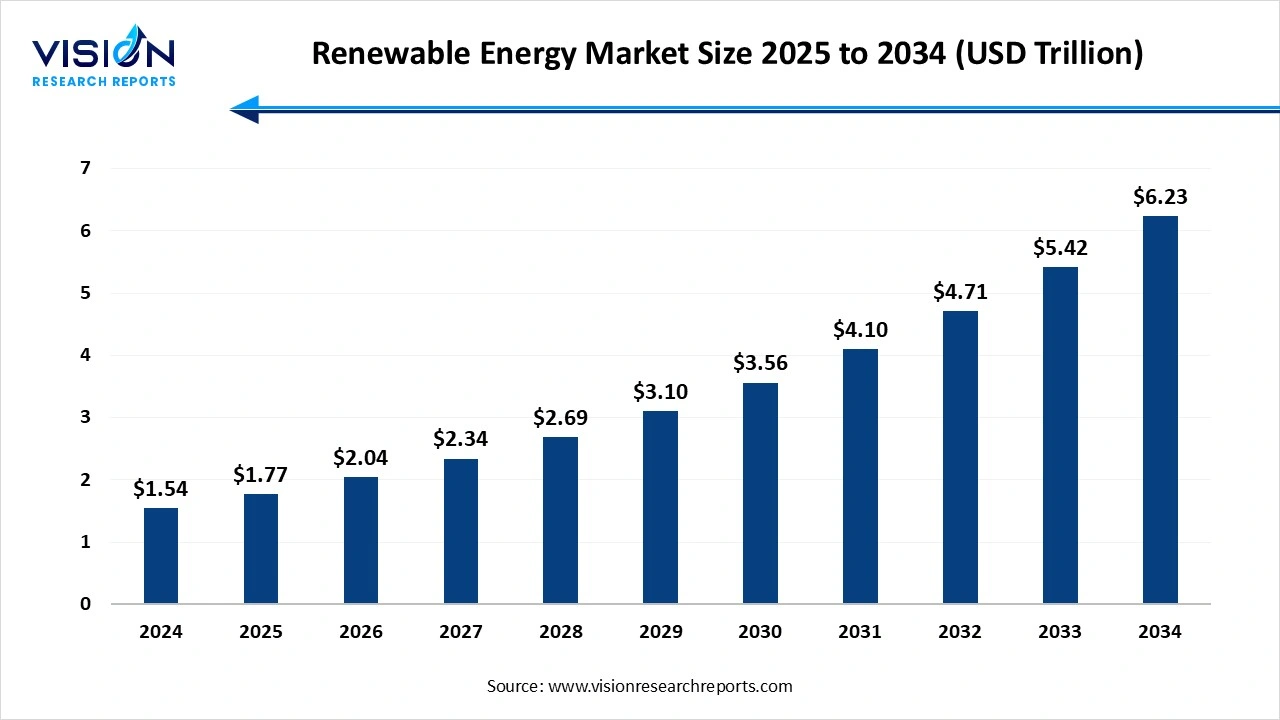

The global renewable energy market size was estimated at around USD 1.54 trillion in 2024 and it is projected to hit around USD 6.23 trillion by 2034, growing at a CAGR of 15% from 2025 to 2034. The market growth is driven by increasing global emphasis on decarbonization, supportive government policies, and rising investments in clean energy infrastructure, the renewable energy market is witnessing robust growth.

The global renewable energy market has witnessed remarkable growth in recent years, driven by increasing concerns over climate change, rising demand for sustainable energy sources, and supportive government policies. Renewable energy technologies such as wind, solar, hydro, and bioenergy are rapidly replacing conventional fossil fuels due to their lower environmental impact and long-term cost benefits. Advancements in grid infrastructure, energy storage, and digital technologies have further accelerated the integration of renewables into national energy systems. In addition, international agreements like the Paris Climate Accord have prompted countries to set ambitious carbon neutrality goals, boosting investments in clean energy infrastructure.

One of the primary growth drivers of the renewable energy market is the increasing global focus on reducing greenhouse gas emissions and combating climate change. Governments worldwide are implementing strict environmental regulations and offering incentives such as tax credits, feed-in tariffs, and subsidies to promote the adoption of clean energy sources. International commitments, including the Paris Agreement and net-zero targets, have accelerated the shift from fossil fuels to renewable alternatives..

Another significant factor contributing to the market’s growth is technological advancement. Innovations in energy storage, smart grids, and digital monitoring systems have enhanced the efficiency, reliability, and scalability of renewable energy solutions. The integration of artificial intelligence and IoT in energy management has enabled better demand forecasting and real-time system optimization.

One of the major challenges in the renewable energy market is the intermittent and variable nature of renewable power sources like solar and wind. Since these energy sources are dependent on weather conditions and time of day, they cannot guarantee a consistent power supply without adequate storage solutions. This intermittency creates grid management issues and requires advanced infrastructure for balancing energy supply and demand. In many regions, the lack of reliable and cost-effective energy storage systems remains a barrier to the widespread integration of renewables into the power grid.

Another significant challenge is the high upfront capital investment required for developing renewable energy infrastructure. Although operational costs are low, the initial setup covering land acquisition, technology installation, and grid connectivity can be prohibitively expensive, especially for developing countries.

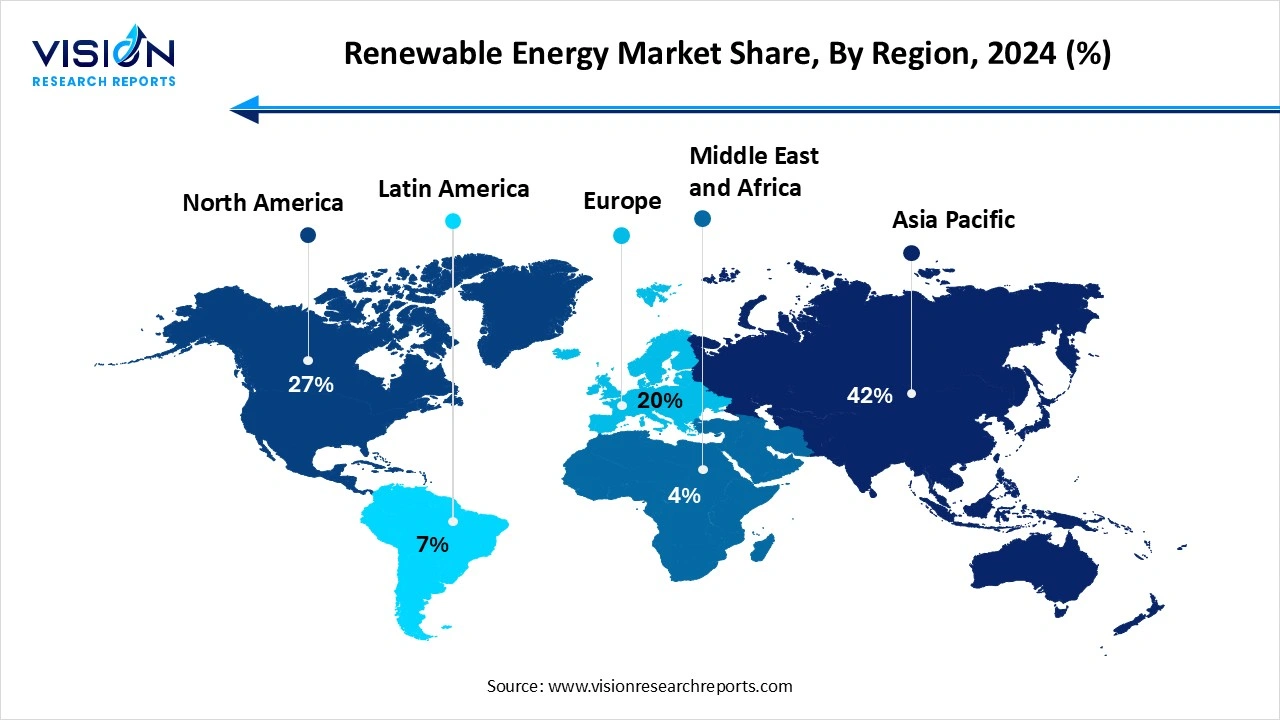

The Asia Pacific region held the market with highest share of 42% in 2024, Remains at the forefront of the global renewable energy market, fueled by rapid capacity expansion, robust government policies, and substantial investments in solar, wind, hydropower, and biomass initiatives. Countries such as China and India have invested heavily in solar and wind projects, supported by large-scale government initiatives, technological advancements, and growing private sector participation. China, in particular, dominates the global solar manufacturing landscape and continues to lead in installed renewable energy capacity.

North America led by the United States and Canada is experiencing substantial growth due to favorable tax incentives, renewable portfolio standards, and rising corporate investments in clean energy. The U.S. Inflation Reduction Act has particularly accelerated renewable energy development across the country.

North America led by the United States and Canada is experiencing substantial growth due to favorable tax incentives, renewable portfolio standards, and rising corporate investments in clean energy. The U.S. Inflation Reduction Act has particularly accelerated renewable energy development across the country.

The solar sub-segment led the product category within the renewable energy market, capturing a revenue share of 24% in 2024. The widespread adoption of solar photovoltaic (PV) technology, driven by declining equipment costs, enhanced efficiency, and favorable government policies, has significantly accelerated the deployment of solar power systems across residential, commercial, and utility-scale applications. Technological innovations such as bifacial modules, perovskite solar cells, and floating solar farms have further enhanced the performance and adaptability of solar solutions in diverse geographic and climatic conditions.

The Within the solar power category, sub-segments such as rooftop solar, ground-mounted systems, and off-grid solar solutions are gaining traction worldwide. Rooftop solar, in particular, has witnessed increasing demand from residential and commercial sectors due to its potential to reduce electricity bills and support decentralized energy generation. Ground-mounted utility-scale solar farms continue to contribute significantly to national energy targets, especially in countries with high solar irradiance.

The industrial sub-segment accounted for the highest revenue share of 62% in 2024. The industrial sector represents one of the most significant applications in the global renewable energy market, as manufacturers and large-scale operations increasingly turn to clean energy sources to reduce operational costs and meet sustainability targets. Renewable energy is being integrated into industrial processes such as heating, cooling, and machinery operations, helping reduce reliance on fossil fuels and minimizing carbon footprints. Many industries are also adopting on-site renewable installations, such as solar rooftops and biomass systems, to ensure energy security and regulatory compliance.

The energy sector, renewable sources are playing an essential role in reshaping the global power generation landscape. Utilities are transitioning from traditional coal and gas plants to renewable-based energy portfolios to meet national clean energy goals and reduce greenhouse gas emissions. Solar, wind, hydro, and other renewable technologies are now central to energy generation, supported by advancements in smart grid infrastructure and energy storage systems that enable more stable and efficient electricity delivery.

By Product

By Application

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Renewable Energy Market

5.1. COVID-19 Landscape: Renewable Energy r Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Renewable Energy Market, By Product

8.1. Renewable Energy Market, by Product, 2024-2033

8.1.1. Hydropower

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Wind

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Solar

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Bioenergy

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Renewable Energy Market, By Application

9.1. Renewable Energy Market, by Application, 2024-2033

9.1.1. Industrial

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commercial

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Residential

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Pharmaceutical Water Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. NextEra Energy, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Iberdrola, S.A.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Orsted A/S

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Enel S.p.A.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Vestas Wind Systems A/S

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Siemens Gamesa Renewable Energy, S.A.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Canadian Solar Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. First Solar, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. General Electric

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Brookfield Renewable Partners L.P.

11.10. Nexus Pharmaceuticals

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others